Tesla’s week went from bad to worse – is a turnaround on the cards?

After tumbling 4.8% on Monday, Tesla’s losses kept stacking up on Tuesday, as the EV maker’s share price plunged a further 12%. The 2 day rout, marked the worst sell off in Tesla in 14 months, with $199 billion wiped off the companies value.

What’s been driving the losses?

Monday’s selloff was sparked by Elon Musk’s twitter poll when the majority urged Musk to sell a 10% stake in Tesla. News that Elon Musk’s brother Kimbal Musk sold $100 million worth of Tesla shares prior to that poll added to the bearish tone surrounding the stock.

Meanwhile, a tweet by famed short seller Michael Burry suggested that Musk was considering selling the stock to cover personal loans he had taken out, collateralized by Tesla stock.

Additional selling pressure came from China car sales data which revealed that Tesla sold 54,391 China made vehicles in October, down 3% from September. Furthermore Tesla’s China made vehicles for export surged to over 40,000 from 3.5k the previous month, again highlighting weakness in the key market.

A history of TeslaAnd the gains?

But this is only half the picture, its worth noting that Tesla share price has been on a tear prior to this week. In the space of three weeks Tesla share price skyrocketed 35% taking it to the all time high of $1243..

The catalyst for that surge higher had been impressive Q3 expectation beating results and an order from Hertz for 100,000 cars, a deal which Musk later tweeted hadn’t been signed. The share price rallied 12% on the day of the Hertz announcement, significantly more than what the deal was worth.

Even with this latest pull back the stock is still up over 40% this year and remains within the elusive $1 trillion club.

Volatile stock & client positioning

Given Tesla’s relatively limited free float, combined with Elon Musk’s tweeting habits, Tesla is an infamously volatile stock. This latest pullback could be considered a technical move in a stock that was very bought.

In fact, out clients at City Index have turned more bullish on the stock. Two weeks ago, 90% of our clients trading Tesla where short, now 59% are long.

Tesla technical analysis

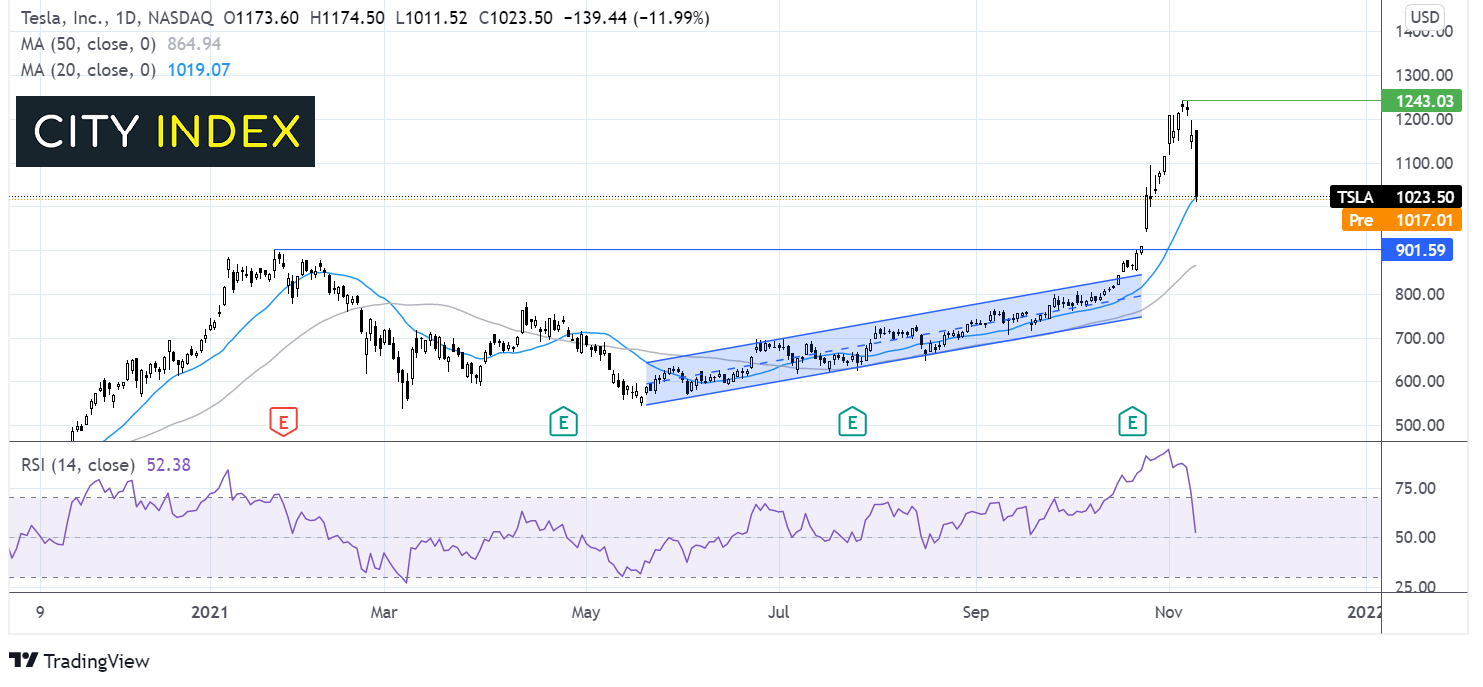

Tesla broke out of its 4-month rising channel on October 21, surging higher and running into resistance at $1242 all time high. The RSI was firmly in overbought territory. This week’s selloff has brought the RSI back towards 50 but still above 50. A move below 50 could suggest that more loses are on the cards.

The price is testing the 20 sma which also sits at around $1000 a key psychological level and could prove a tough nut to crack. A break below here could see the price look towards $900 the January high.

However, should the 20 sma hold Tesla could start to build back towards 1243 and new highs.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.