Central Bank action has been much more spontaneous is recent weeks, but that doesn’t mean that we won’t be watching the ECB’s monthly meeting closely. However, with lockdown starting to ease across the bloc will wee see further action from the ECB?

Recent action

So far the ECB’s virus response has been modest, particularly when compared to the Fed. We don’t expect Christine Lagarde to follow the Fed’s lead and throw everything including the kitchen sink at the coronvirus crisis, although we do expect some action for the ECB, now seen as the “only game in town”.

So far the ECB’s virus response has been modest, particularly when compared to the Fed. We don’t expect Christine Lagarde to follow the Fed’s lead and throw everything including the kitchen sink at the coronvirus crisis, although we do expect some action for the ECB, now seen as the “only game in town”.

The central bank has already stepped in with a €750 billion bond buying programme, (Pandemic Emergency Purchase Programme PEPP) which includes purchasing sovereign bonds. Rates were already at rock bottom, limiting the ECB’s firepower.

Whilst the worst in terms of covid-19 infections is behind us evidence of the severity of the economic fallout is just emerging. Just last week, Christine Lagarde warned of an economic contraction in the region of 15% for the bloc this year. The GDP reading preceding his meeting will give some clues as to the size of the initial hit to the economy. It will make for grim reading.

Despite the PEPP intervention, the borrowing costs of southern European governments have jumped recently reflecting concerns surrounding the ability of those countries to service the debt taken on to fight the coronavirus crisis and the economic slump that it has caused.

Christine Lagarde will almost certainly keep pressurising governments across the bloc for more ambitious fiscal support, so far this has been slow and insufficient. After the EU leaders failed to agree coronavirus recovery fund, the ball is back in the ECB’s court.

Fallen angels

An additional €500 billion in asset purchases or even a doubling of the current programme are very real possibilities. The central bank could also look to buy up junk bonds or opt for cheaper bank loans. Most likely will be an expansion of the PEPP to include fallen angel bonds, bonds which have recently lost their investment grade.

Expectations for action are riding high. Failure by the ECB to act could hit the Euro hard.

An additional €500 billion in asset purchases or even a doubling of the current programme are very real possibilities. The central bank could also look to buy up junk bonds or opt for cheaper bank loans. Most likely will be an expansion of the PEPP to include fallen angel bonds, bonds which have recently lost their investment grade.

Expectations for action are riding high. Failure by the ECB to act could hit the Euro hard.

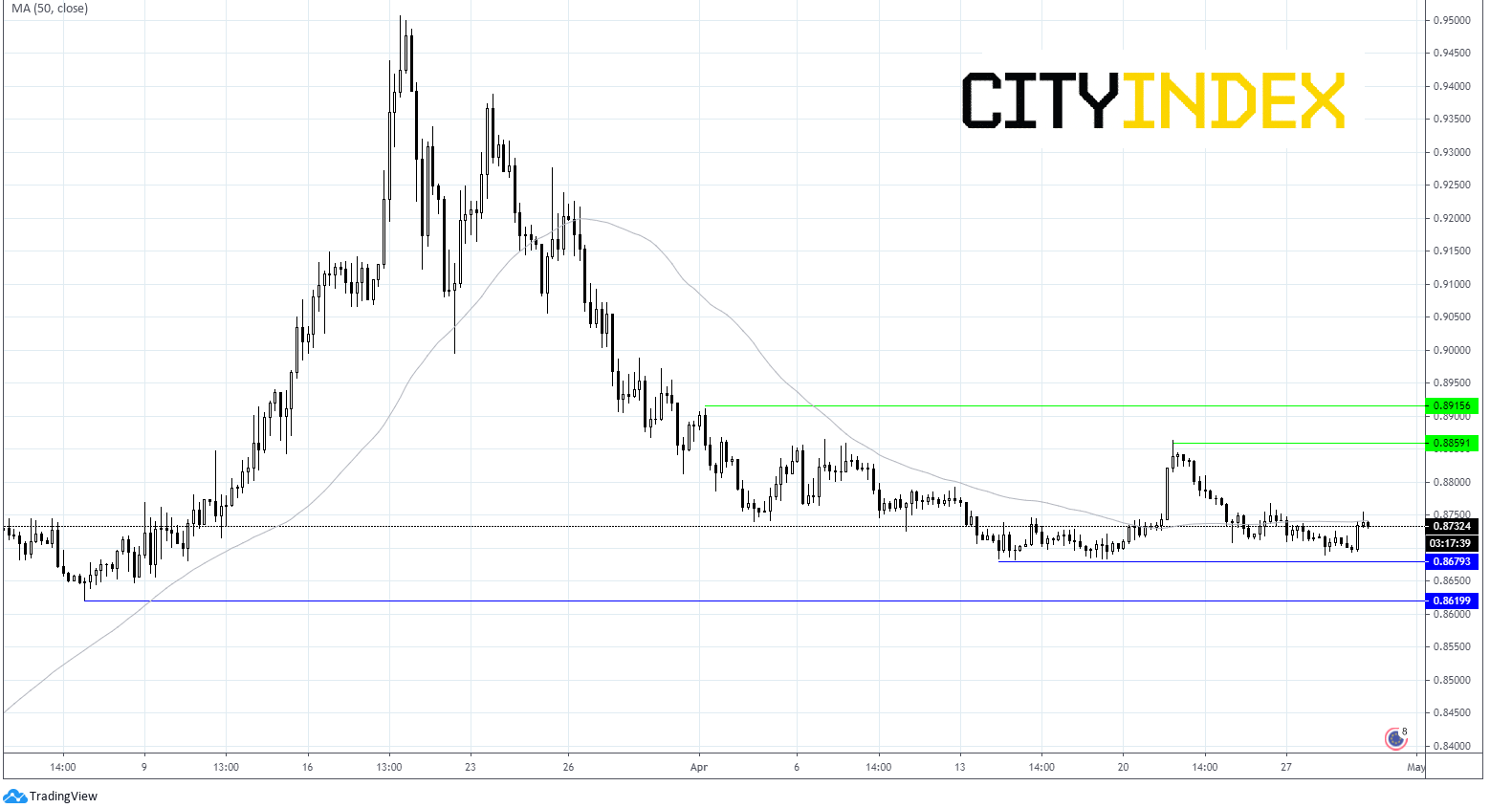

EUR/GBP levels to watch:

After dropping sharply from March highs EUR/GBP traded with a mild negative bias across April. The pair has just slipped through its 50 sma on 4 hr chart at 0.8741.

Immediate support can be seen at 0.8680 (support since mid April) and breakthrough here could open the door to 0.8620 (low March 5th)

Resistance can be seen at 0.8863 (high 21st April) prior to 0.8915 (high 5th April)

.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM