Partly explaining the S&P500’s retreat from Mondays high, and as noted in an interview on AusbizTV on Wednesday here, the arrival of a vaccine has been embedded into the road map for many investors in 2021. Keep this in mind ahead of vaccine trial results expected to be reported from Moderna in coming days.

Also dampening enthusiasm, this week a chorus of central banker governors including Jerome Powell, Christine Lagarde, Andrew Bailey, and Adrian Orr have cautioned that the arrival of a vaccine would not end the immediate challenge of low inflation and high unemployment.

Additionally, the rising infection curve in Europe and the U.S. is leading to renewed lockdown fears. Overnight Chicago announced a 30-day stay at home advisory that takes effect next week. Elsewhere, New York City is on the cusp of closing thousands of schools.

Finally, a decision by the Trump Administration to remove itself from talks on a COVID-19 relief package warns that a new fiscal package will not arrive until early in 2021, rather than in the last session of Congress due to wrap up in mid-December.

Putting all of this together, while the final destination for the S&P500 remains higher, the near term roadmap is littered with obstacles.

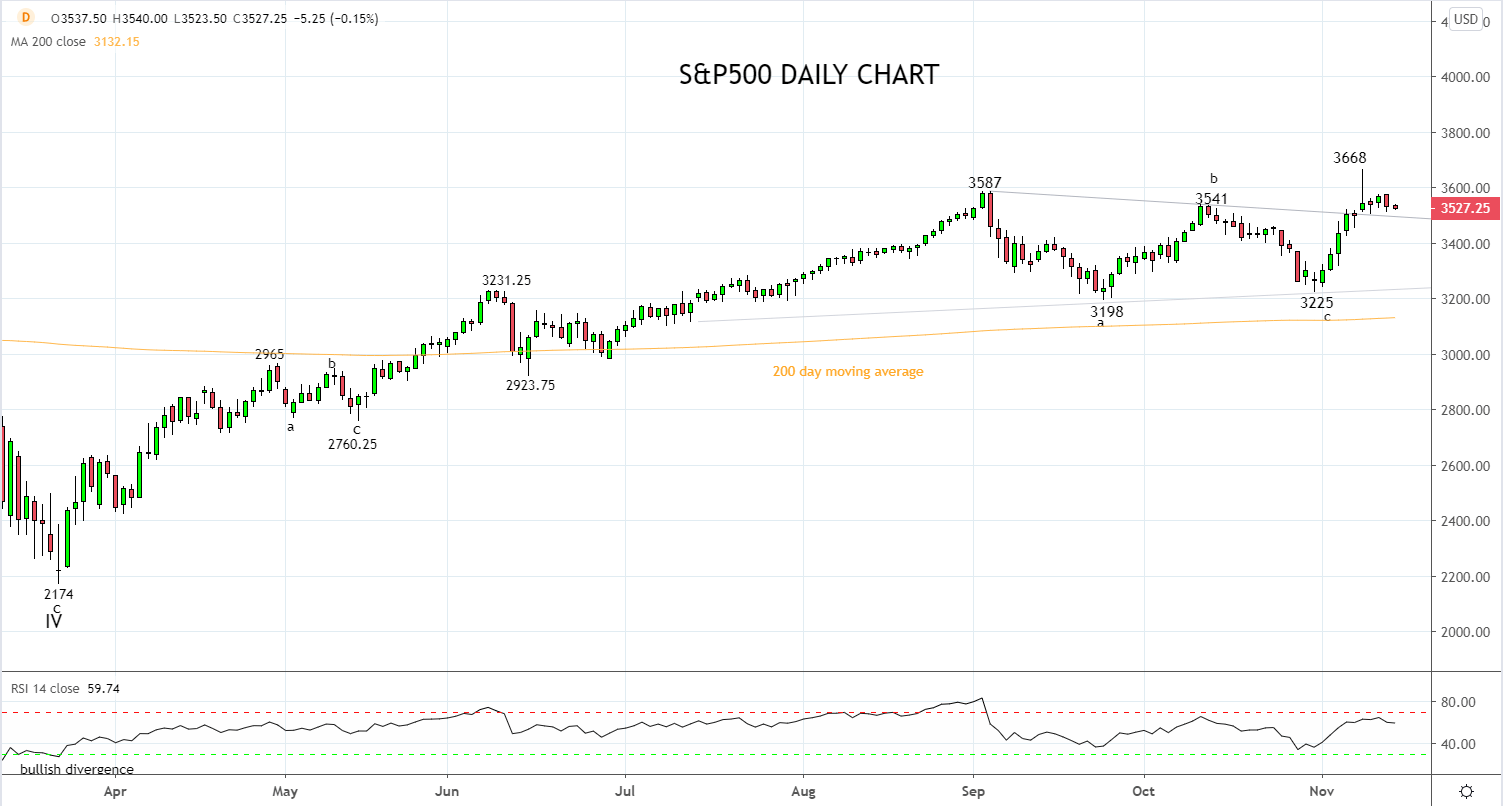

Following the break above trendline resistance 3510/20 earlier this week, the S&P500 traded to a fresh all-time high at 3668, before aggressive selling into the close created a loss of momentum daily candle on bearish RSI divergence.

To keep the upside momentum from November intact and to enable a push towards 3750 into year end, the S&P500 needs to hold above near term support at 3500 on a closing basis.

Keeping in mind, much below 3500 would warn that the S&P500 has returned to the safety of its 11 week old, 3600/3200 range.

Source Tradingview. The figures stated areas of the 13th of November 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation