ADP mixed, EUR/USD falls back to 1-week lows as bears remain in control

In an otherwise relatively quiet day for economic data, today’s highlight was the release of the US ADP Employment report for June. For the uninitiated, the release provides an update on the state of the labor market in the world’s largest economy and serves as a leading indicator for Friday’s more widely-followed Non-Farm Payrolls report.

Like much of the US economic data of late, the ADP report painted a mixed picture:

- ADP estimates that the US economy created 692k net new jobs in June

- This figure came in above the market’s expectations of 555k…

- …but below last month’s initial 978k reading…

- …which was subsequently revised down to 886k.

To summarize, the US labor market continues to grow at a healthy rate but is showing clear signs of slowing from the breakneck piece we saw over the previous couple of months. At the margin, the ADP report suggests that there could be upside risks to the 700k consensus estimate for Friday’s NFP report, but we’ll have a detailed analysis of the other leading indicators in tomorrow’s formal NFP preview report.

With inflation still running hot and the labor market recovery shifting into a lower gear, policymakers at the Federal Reserve are no doubt starting to get antsy right as they consider starting the process of normalizing monetary policy.

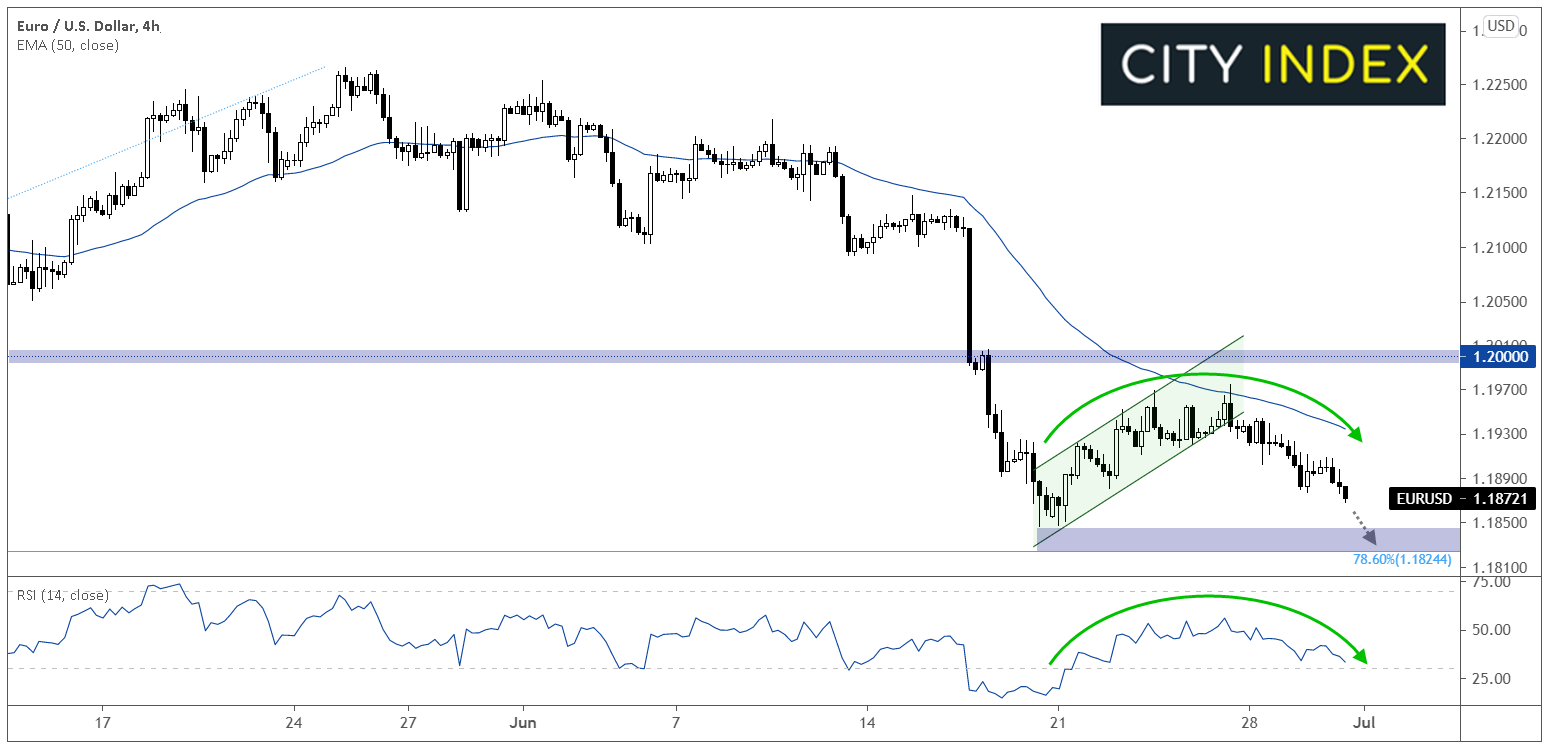

Technical view: EUR/USD

We highlighted EUR/USD last week in the context of the Core PCE report, noting that “readers can view the current pattern as a bearish flag pattern, signaling a likely resumption of the recent downtrend with potential for a drop back to 1.1850 or 1.1800 in the coming days.”

We’ve since seen rates break down as anticipated, and the world’s most widely-traded currency pair is now approaching its 3-month low at 1.1850. While EUR/USD could certainly find support at that previous support area (or around the 78.6% Fibonacci retracement of the April-May rally at 1.1825), the near-term trend still clearly favors the bears. Against that backdrop, readers may want to consider sell opportunities on bounces if NFP comes in softer than expected or even playing a breakdown below 1.1825 support if we see a strong jobs reading on Friday.

Source: StoneX, TradingView

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.