Primark owner ABF is expected to update the market today. The update comes just over 2 weeks after British government eased lockdown restrictions and stores reopened, albeit with strict social distancing measures in place. The 2-meter rule is also set to be reduced further this weekend, meaning that stores will be allowed more shoppers to enter at anyone time which is good news for business.

Investors will look forward to knowing the extent of the damage from the lockdown and how initial trading has been faring. A combination of the UK heading for its worst recession in 300 years, combined with consumers tired of being locked up for 3 months means price will be more important than ever for consumers as they hit the shops.

With this in mind, Primark’s accessible pricing means that it is well positioned coming out of lockdown to attract those keen to start buying non-essential items after a 3-month hiatus without breaking the bank.

The groups’ strong financial position, liquidity and solvency has also meant that the firm is expected to emerge from the coronavirus pandemic in a reasonable condition, although its lack of an online presence will have held it back.

With no online presence and fears of a second wave of coronavirus growing, the prospect of closing stores again, could weigh on the share price and limit gains and even see the share price drop sharply, should localised lockdown be implemented on a widening scale.

The pandemic raises questions over Primark’s store only strategy and its absence of an online store. The recent lockdown and possibility over future lock downs raises the question whether Primark will look to increase its online presence a move which would be particularly useful if lock down and localised lockdowns become more common.

Chart thoughts

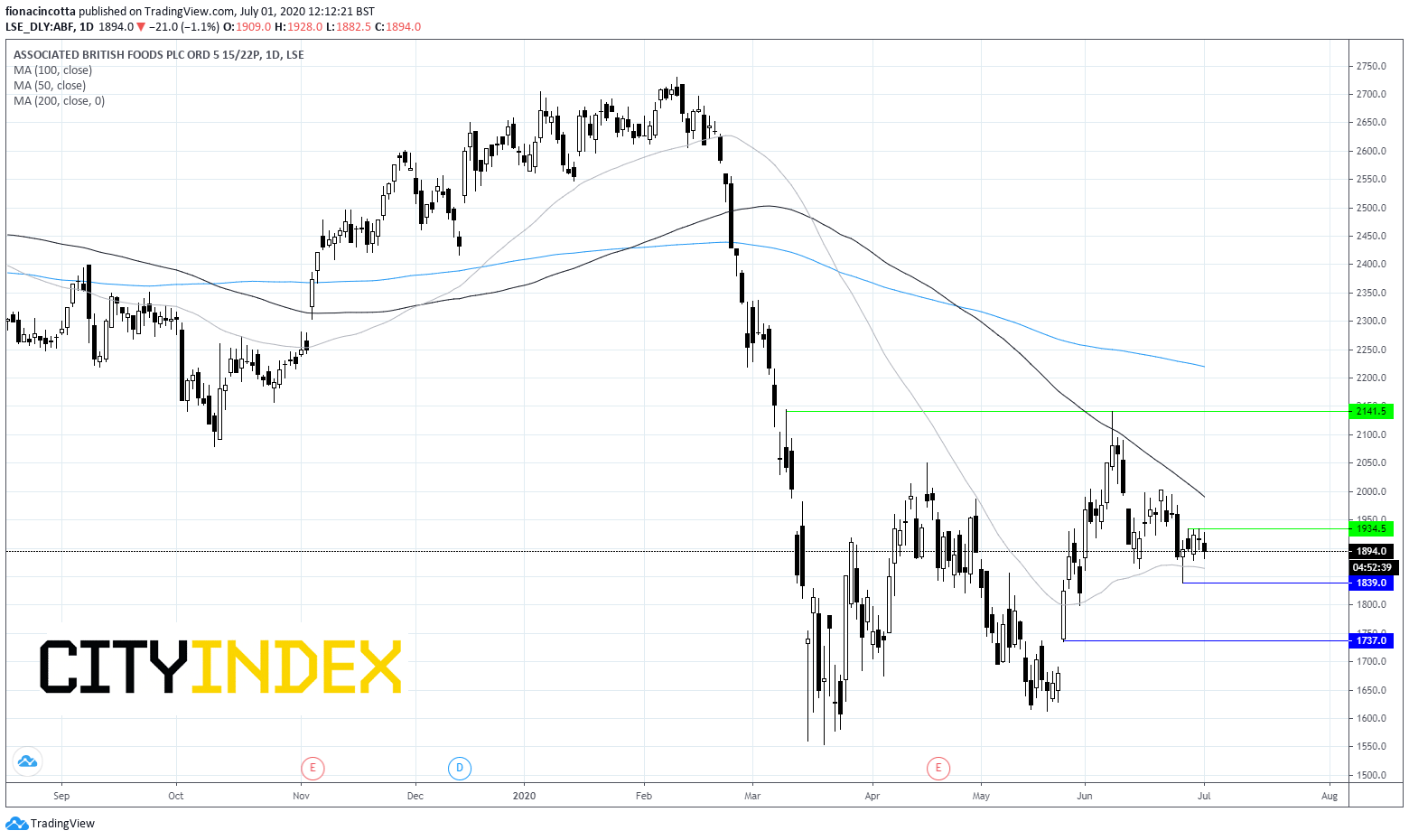

Primark is trding down -20% year to date. It trades above its 50 day sma, a support which has held since the beginning of June. The stock continues to trade below its 100 day sma a level which offers strong resistance at around 2000p. This is a level which the stock has failed to trade over since 10th June.

A break above 2000p could open the door to resistance at 2140p (June high).

On the flip side, a breakthrough the 50 sma around 1865p could open the door to 1840p (June low) prior to 1740p (low 26th May)

Latest market news

Today 08:15 AM

Today 05:45 AM

Yesterday 11:09 PM

Yesterday 11:01 PM