AAC Technologies (2018-hk): Heading Towards January High

AAC Technologies (2018-hk), a manufacturer of miniaturized acoustic components, has rebounded more than 60% from March low, exceeding our previous forecast made in June.

In fact, the Nasdaq Composite Index has reached another record high on Monday, with tech stocks surging higher. AAC Technologies is a major iPhone components supplier, it should benefit from a strong performance in Apple's share price and optimism on economic reopening.

HSBC pointed out that the company's 2Q lens module shipments are expected to rebound to 154 million units from 68 million units in 1Q and sees 2Q net income growing 7% on year to 360 million yuan.

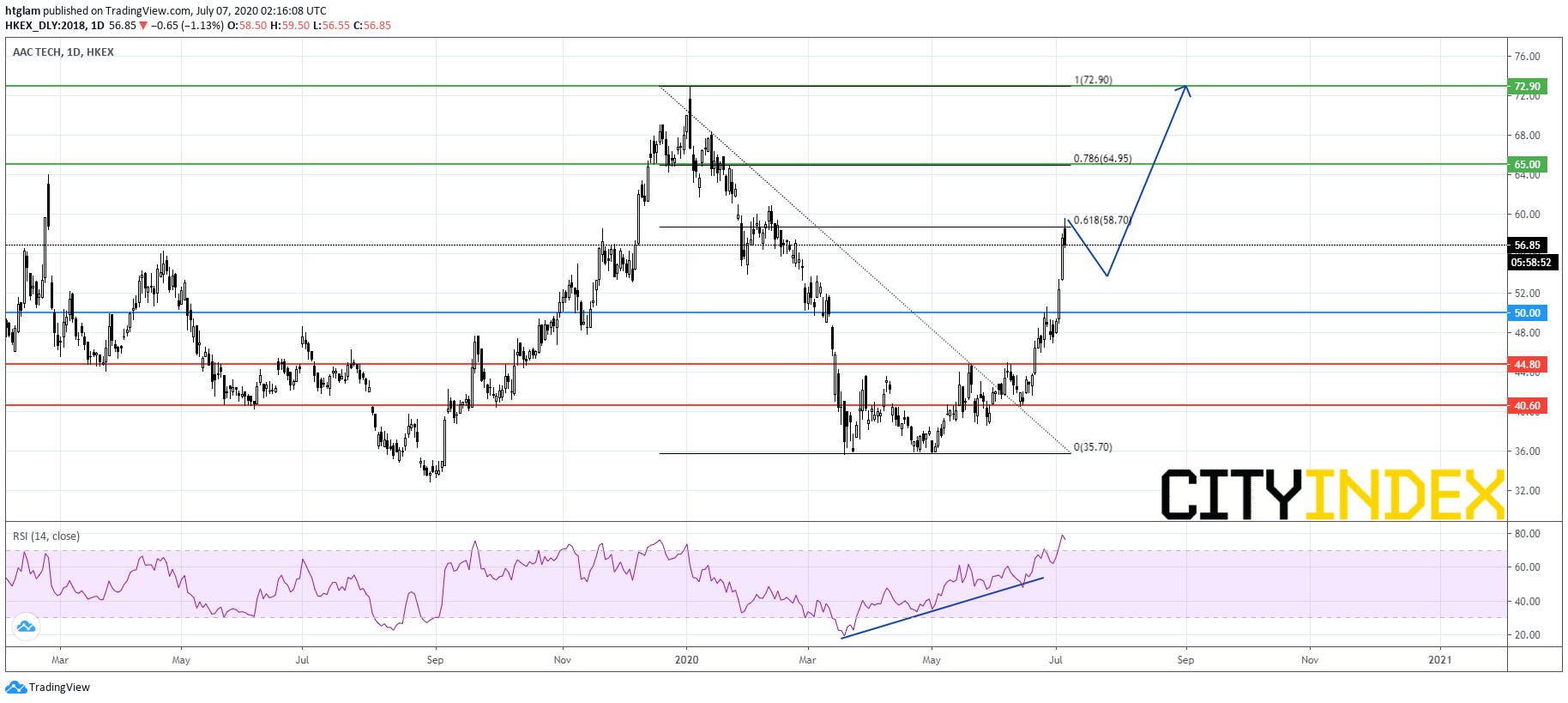

From a technical point of view, AAC Technologies has accelerated to the upside after breaking above a 3-month consolidation range as shown on the daily chart. Currently, it is challenging the 61.8% Fibonacci retracement resistance of the decline in 1Q. Bullish investors might consider $50.00 as the nearest support level, with prices trending to test the next resistances at $65.00 and $72.90. Alternatively, losing $50.00 would signal a loss of momentum and may trigger a pull-back to the next support at $44.80.