On Monday, the U.S. Commerce Department announced a rule allowing U.S. tech firms to work with Huawei in international 5G standards-development activities, which appears to be rare move as the U.S. has been targeting the Chinese giant for some time.

AAC Technologies (2018-hk), a manufacturer of miniaturized acoustic components, was one of the most suffered tech company during the U.S.-China trade war. Despite persistent pessimism, its share price shows signs of stability over the past few months.

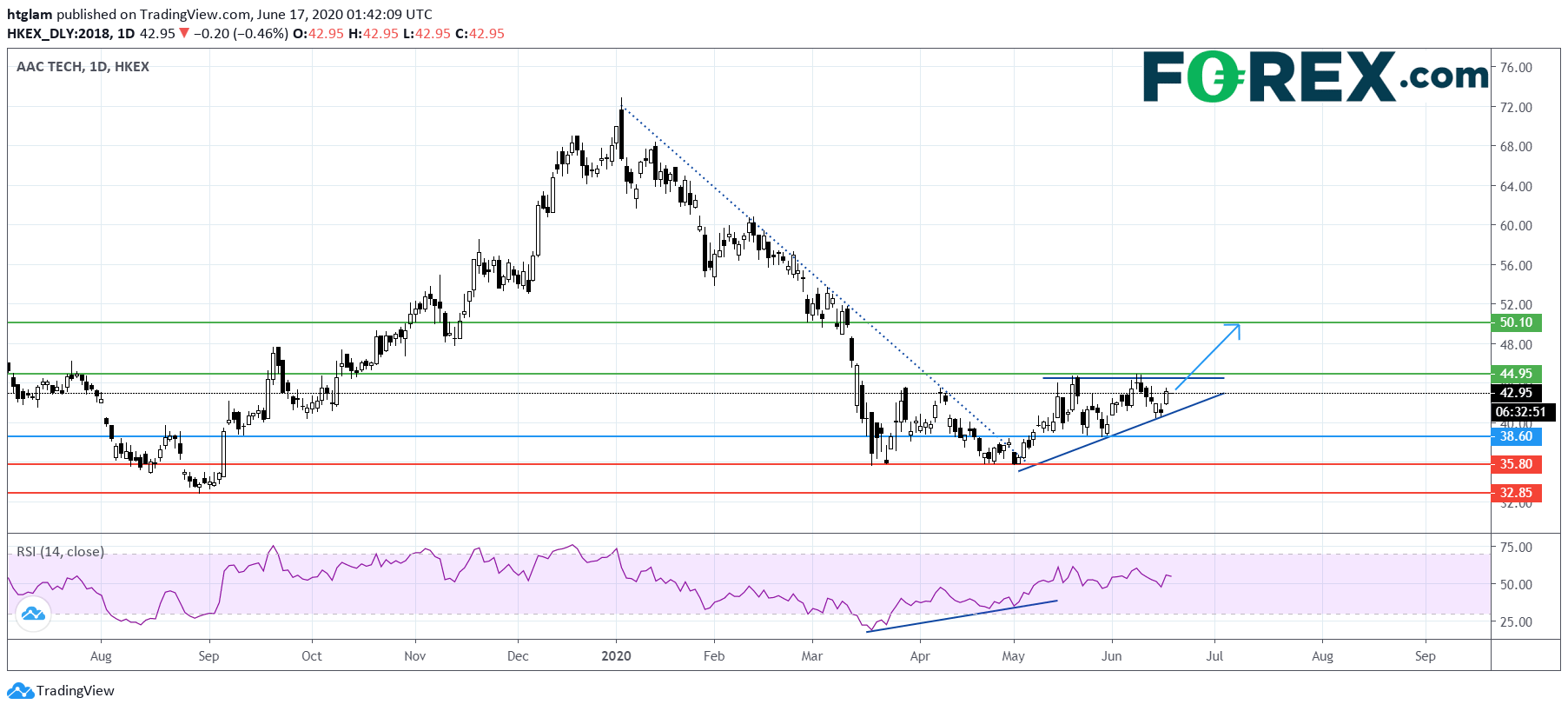

From a technical point of view, AAC Technologies has potentially formed a double-bottom pattern as shown on the daily chart. It has broken above a bearish trend line drawn from January and is now trading within a bullish ascending triangle. Bullish investors might consider $38.60 as the nearest support, and a break above the nearest resistance at $44.95 would open a path to the next resistance at $50.10. Alternatively, a break below $38.60 may suggest that the next support at $35.80 is exposed.