The Nikkei has switched from being the underdog to being the strongest performer against its peers this past three months. Since breaking out of a basing pattern in August, its managed to rally over 11% and outperform the S&P500, STOXX and CSI300.

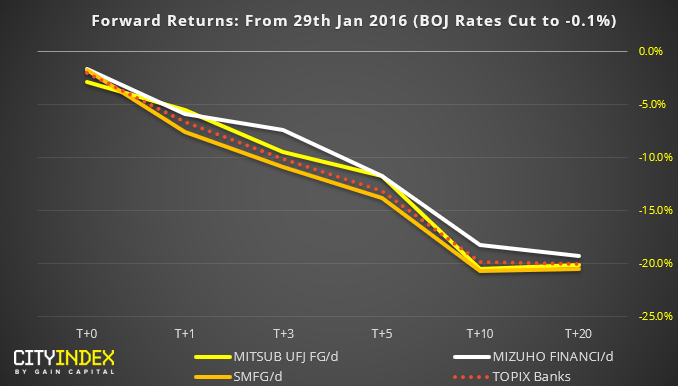

Yet whilst the daily trend structure remains firmly bullish, price action appears stretched, so could be in the need of a correction. Besides, if BOJ’s last rate cut is anything to go by, we could find the Nikkei (and particularly banking stocks) under pressure if they decide to go further into negative territory tomorrow.

For today’s video we check out key levels on the Nikkei 225.

Related markets:

iShares MSCI Japan CFD/DFT

Japan 25 CFD/DFT

Baillie Gifford Japan CFD/DFT

Related Analysis:

FTSE: The Long And Short Of It | FTSE, AVST, BA, GRG

S&P500: Long and Short of It | S&P, Starbucks, Assurance