A couple of key catalysts behind the move. The first being evidence that the health of President Trump is on the improve after his positive coronavirus test last week. Footage of President Trump giving two thumbs up on his way into the White House had me thinking about a tweet I sent last Friday.

If President Trump who is in the high-risk bracket due to his age and weight, can beat the virus, it gives his flagging re-election hopes a massive boost. In theory, it also brings the world much closer to a treatment for the virus, tested, and proved on none other than the POTUS. This would surely be supportive of the next leg higher in the reflation/equities trade.

Also supporting the rally in U.S. equities, the odds of a fiscal stimulus deal ahead of November have improved from about 20% to 50% after discussions between House Speaker Pelosi and Treasury Secretary Mnuchin. Discussions are set to continue today.

Finally, a stronger than expected U.S. nonmanufacturing ISM print overnight, including a 50+ employment reading. The only concern being the stronger ISM number did prompt a sharp move higher in both nominal and real long-end yields.

Low real yields have been one of the anchors of market trends in past months, including higher U.S growth stocks, higher gold, and a lower U.S. dollar. Should the rally in yields continue it would at some point be expected to present a challenge to existing trends.

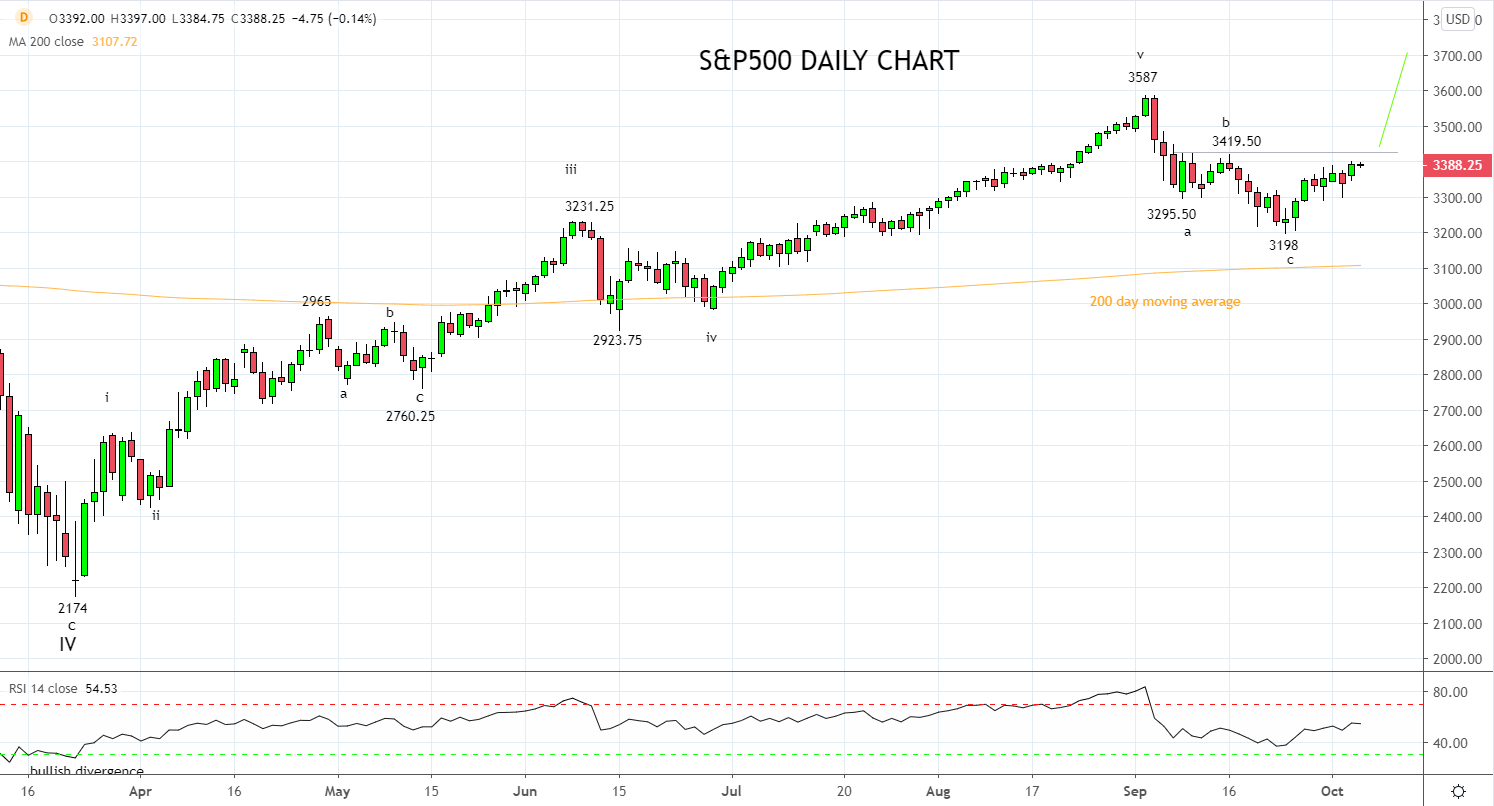

Technically, the three-wave corrective pullback in the S&P500 during September from its 3587 high, combined with the rally/close back above resistance at 3330 last week, provided initial evidence the S&P500 put in place a tradable low at the recent 3198 low print and that the uptrend has resumed.

However further confirmation is required in the form of a break and daily close above key resistance 3420/30 area. Should this occur it would open the way for a retest and break of the 3587 high.

Keeping in mind, a break and close below 3198 would warn that a deeper pullback towards 3130/00 is underway.

Source Tradingview. The figures stated areas of the 6th of October 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation