A Sector View Shows Popularity of Portfolio Diversification

A quick look at FTSE 350 stock sector performance for London listed stocks testifies the popularity of investors to diversify their portfolio holdings away from […]

A quick look at FTSE 350 stock sector performance for London listed stocks testifies the popularity of investors to diversify their portfolio holdings away from […]

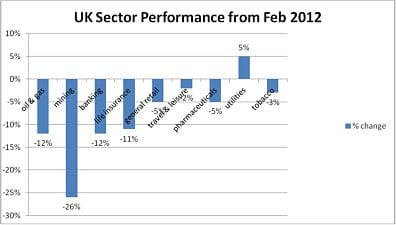

A quick look at FTSE 350 stock sector performance for London listed stocks testifies the popularity of investors to diversify their portfolio holdings away from risk on associated stocks such as the miners and banks towards typical defensive safe haven sectors such as tobacco and utility stocks as the eurozone crisis escalates.

In uncertain times, investors typically diversify their stock holdings out of the riskier asset classes such as miners, banks and oil sectors. This is because in difficult times, these sectors are typically harder hit. That diversification typically see’s slightly higher demand for ‘defensive’ sectors such as pharmaceutical, tobacco and utility stocks, where demand for these types of products and services typically remain high, regardless of underlying economic conditions. So from the chart above, it would appear that this trend remains fairly consistent, with defensive stock sectors outperforming a 8% loss in the FTSE 100 and FTSE mid 250 Index for the same period (February highs to today).

Indeed, a standout performer is the FTSE 350 Gas Water and Multi-Utilities Index, where stocks such as Severn Trent and United Utilities reside. This sector has broadly outperformed all sector peers, rallying 5% despite the general stock decline seen across Europe.

So whilst spread bettors and CFD traders can take advantage of falling prices by short selling via our platform, for those clients who lack the appetite to go short, there remains the argument for portfolio diversification to limit the net downside bearish equity moves typically represent at times of market uncertainty.

You can follow me on Twitter via @Josh_Cityindex