As noted by the RBA in their June meeting minutes released earlier this week, the AUDUSD and the S&P500 are moving in tandem under the existing correlation regime.

”Movements of the Australian dollar over the course of this year had been closely correlated with global equity prices”.

The loss of 228,000 jobs in Australia was worse than forecast but not outside the range of economists’ expectations posted in the lead-up. A key concern is that 142,000 people left the workforce during May resulting in a fall in the participation rate that limited the rise in the unemployment rate to 7.1%.

If the participation rate had held steady at 63.6%, the unemployment rate would have risen above 8%. Furthermore, without the government's Jobseeker program that doesn’t require people to look for a job, the unemployment rate would have been well over 10%.

There is some good news in all this. Firstly the Jobkeeper program is working as designed. The second is that following the economies partial re-open in Mid-May, employment will increase in the months ahead. Thirdly, the softer data has taken some further heat out of the AUDUSD and appears to cement the idea of some consolidation between .7050 and .6680 as discussed in yesterday's note.

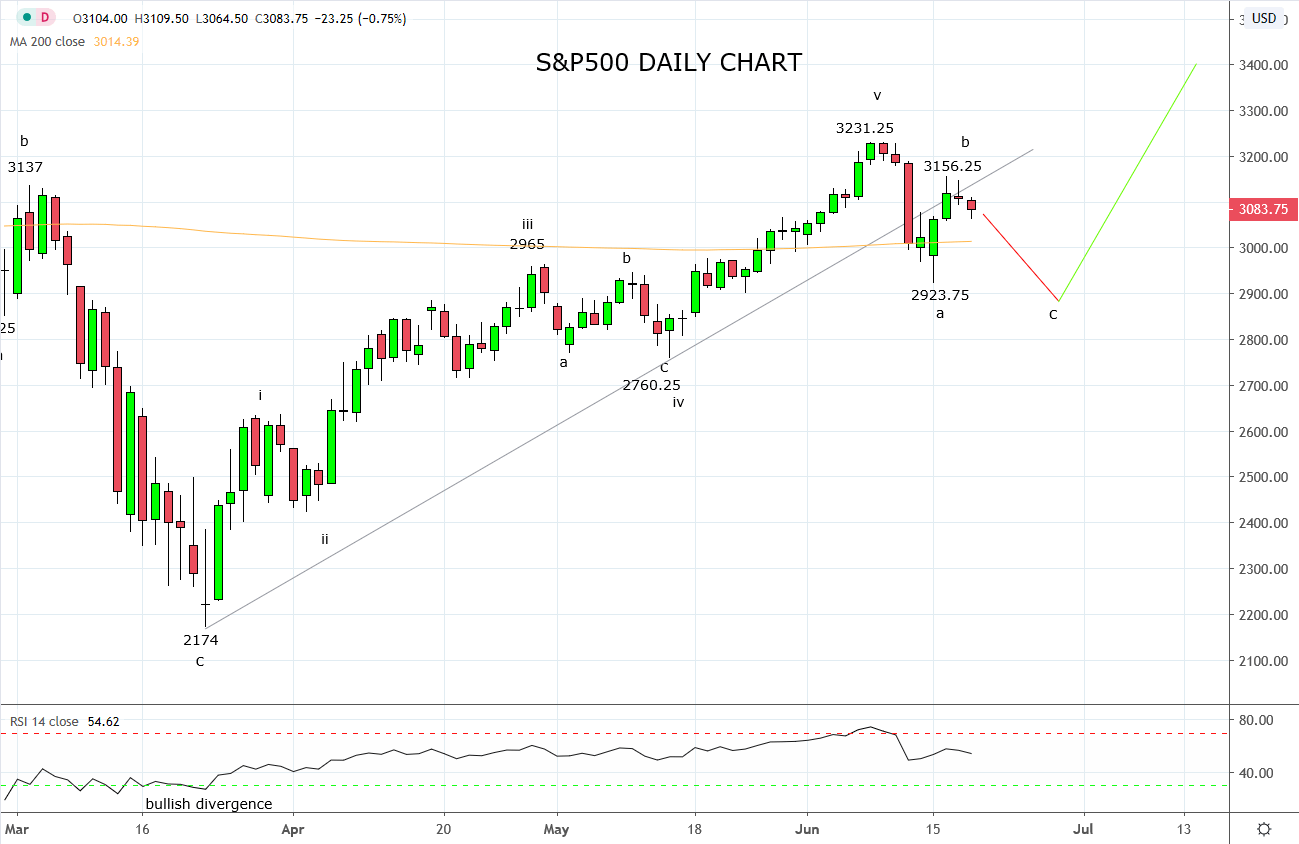

Turning now to the S&P500. The spike in volatility following last week’s FOMC meeting provided another reminder as to why I tread warily after FOMC meetings. Despite breaking the uptrend support at 3070/60 I had thought might hold, the view remains that the sell off from the 3231.25 high is corrective/counter-trend rather than a reversal lower.

Narrowing the focus, should the S&P500 trade below Mondays 2923.75 low during the current episode of weakness, it is likely to find support between 2850/30 which encapsulates the 38.2% Fibonacci retracement and wave equality target.

It is in this region I will be looking for a base to form in the shape of a bullish daily reversal candle in expectation of the uptrend resuming and a retest of the recent 3231.25 high.

Source Tradingview. The figures stated areas of the 18th of June 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation