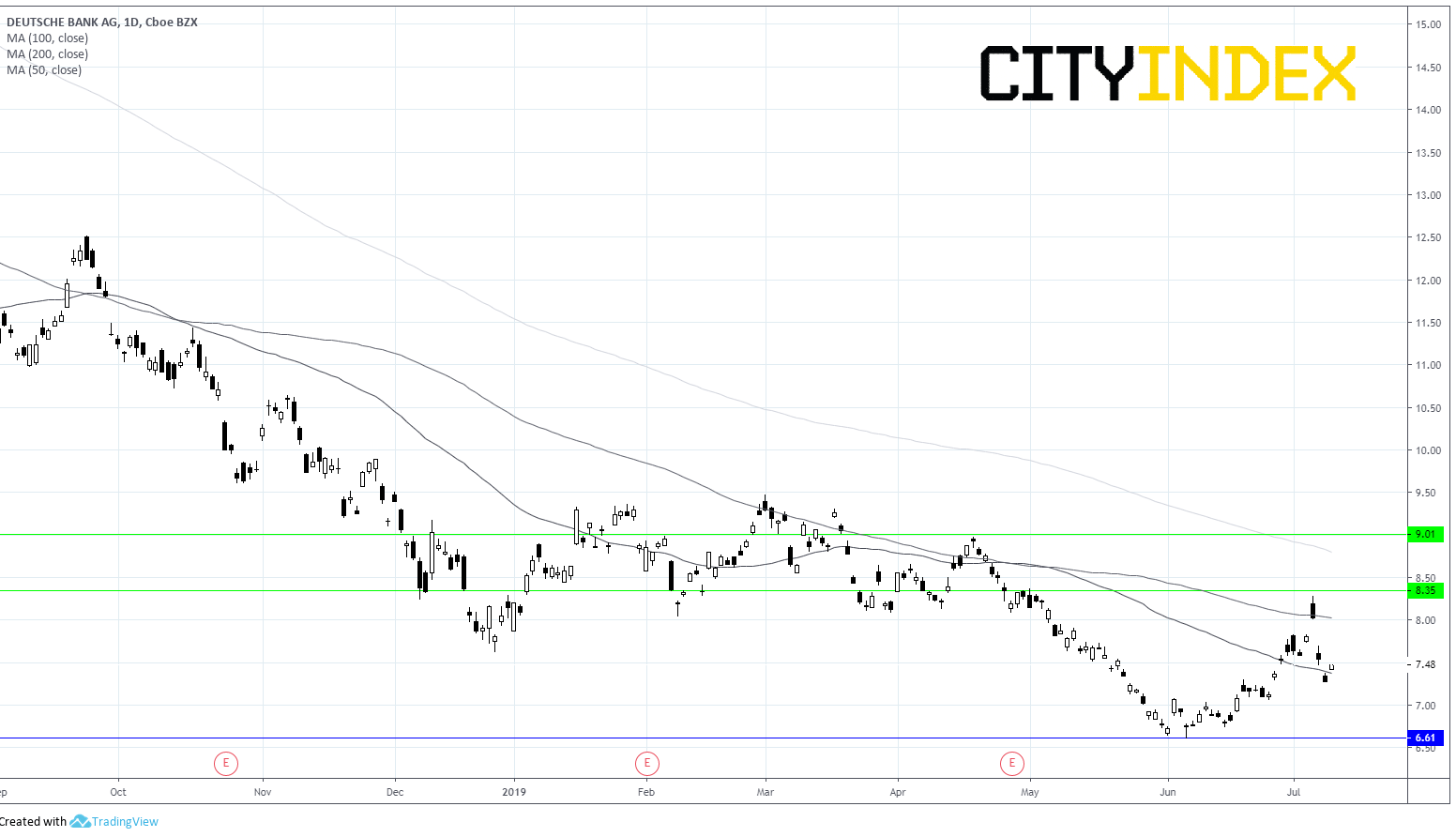

The German multinational investment bank started slashing jobs on Monday, as part of a restructuring plan which will see 18,000 jobs lost (20%) from the global workforce by 2022. Investors have responded by selling out of the stock. The share price, already hovering around its all time low, took another hit falling from $8 at the close on Friday to Tuesday’s closing price of $7.28.

Different this time?

Deutsche Bank has been dabbling in the restructuring game for some time without much success. However, this restructuring plan or “restart” as it has been dubbed, appears to be more dramatic and more serious than previous attempts. After 5 restructurings in 4 years, this one is going much further.

Deutsche Bank will shrink its trading business with an unprecedented withdrawal from equities, a loss-making business for the bank. Fixed income will also be scaled back and then there’s the 18,000 job slaying as well. The move away from hedge fund clients towards corporate clients should mean more stable earnings and a more evenly spread business.

Other notable moves as part of the plan include slimming down the balance sheet and focusing on cutting costs. Whilst some operations will be handed to France’s BNP Paribas, the rest will be sold off leaving Deutsche Bank vulnerable if it can’t get the price it needs.

Challenging climate

The climate is not easy right now, Deutsche is grappling with years of low interest rates, high regulatory costs and of course $18 billion in fines. Interest rates have been low since the financial crisis and that has hit profit margins. The Fed is standing ready to cut rates again which will do little to help the big banks, particularly if the central bank is looking at more than one rate cut going forward.

To buy or not to buy?

This is an ambitious plan and Deutsche Bank faces many pitfalls along the way. Clients could just prefer to walk. Investors will want a clearer understanding of how revenue of the core business is expected to grow 2% per year.

The share price been hit hard but this could present a good opportunity to buy in. Whilst it is clear that Deutsche Bank will never return to its former glory, there could still be some upside for a patient trader. Shares are up 2.8% in pre-market trading.