Gyrations in equity market have continued overnight as the S&P 500 rallied +6%, recovering exactly half of its losses from the previous session on details of a substantial U.S. fiscal spending package.

The proposed $1.2 trillion stimulus package is equivalent to approximately 5.5% of U.S. GDP and exceeds considerably the earlier rumours of an $850bn package. Notably, the proposed package will include direct payments to individuals and business at the end of April ($250bn), to be followed by another direct payment four weeks later ($500bn) assuming there is no de-escalation in the Covid-19 pandemic.

The prospect of such a large dose of stimulus working in tandem with the recent easing measures announced by Central Banks should ease fears of a deep and protracted Covid-19 recession. In due course, it should suppress some of the recent volatility and ensure a return to more normal trading conditions. Based on this reasoning, I would like to update our view on gold.

In our past two Week Ahead videos, we have warned about the downside risks in gold. Partially this was due to the extended long position that was vulnerable as funds were forced to cut positions to remain within risk limits and to return money to investors.

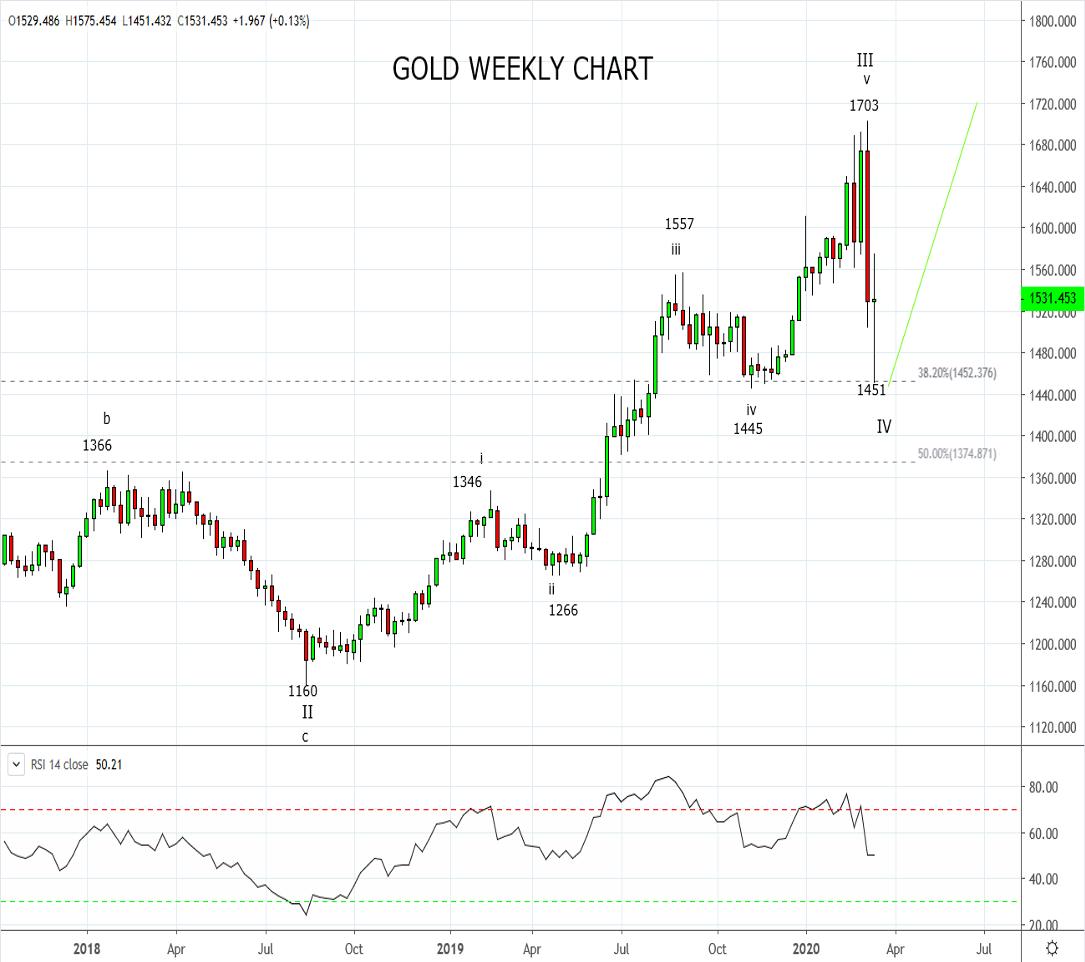

It also lent heavily on technical analysis. After a strong run higher in recent months, we were looking for gold to commence a retracement which we said in last week’s video at around the 9-minute mark

“could come back to the $1445 region, quite easily…and that would not dent the bigger picture uptrend.”

After this weeks pullback to the $1451 low that neatly tagged the 38.2% Fibonacci retracement of the rally from the $1046 low from 2015 to the $1703 high from two weeks ago and with positioning much cleaner after the recent flush AND with more fiscal and easing reasons than previously, we feel gold is well placed to recover lost ground.

Providing gold remains above this week's $1450 low, a break and close above $1560 would be initial confirmation the uptrend in gold has returned, targeting a move towards $1800.

Source Tradingview. The figures stated areas of the 18th of March 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation