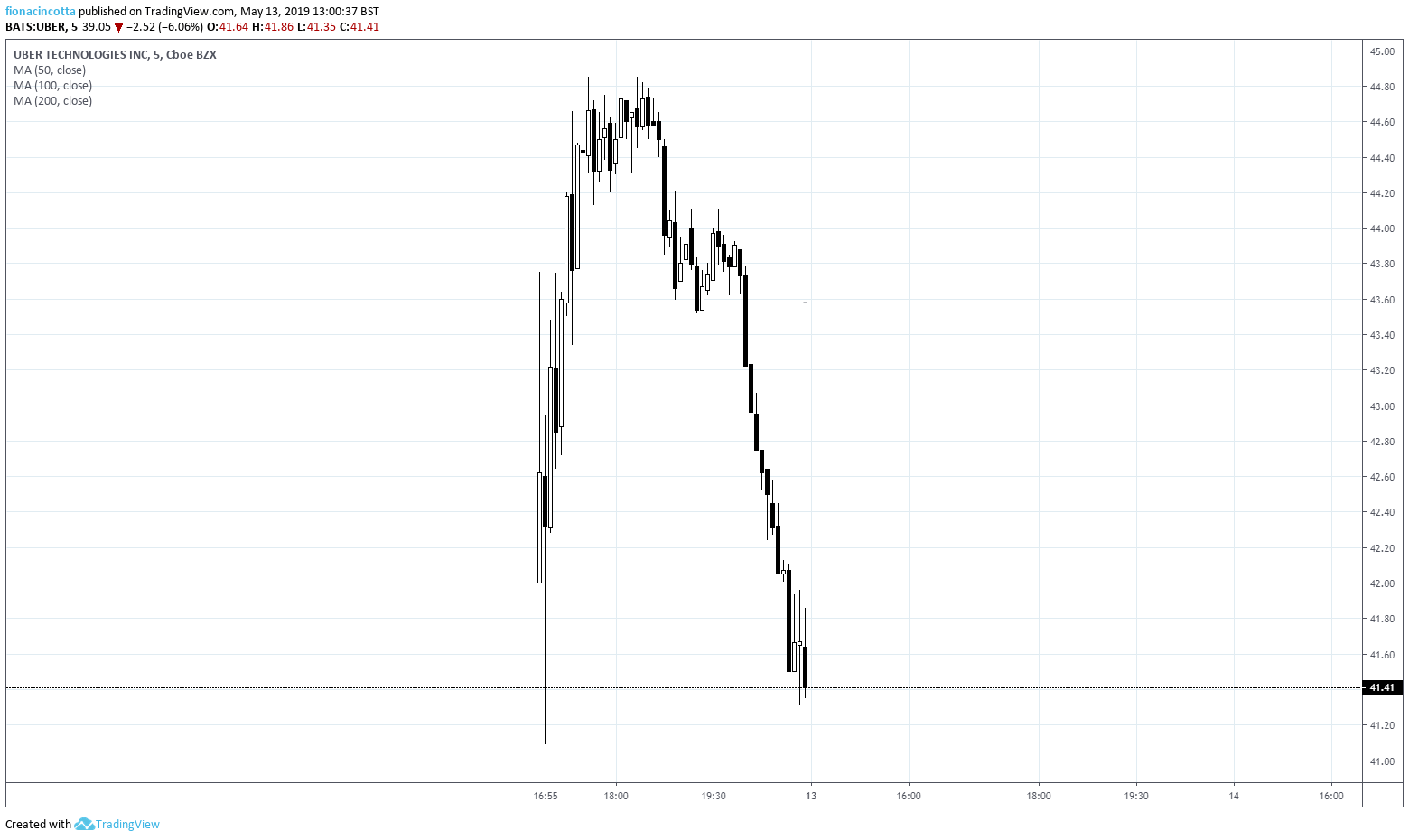

UBER had a tough first day of trading as a listed public company and its second looks like it could be another rough ride. UBER’S initial public offering price was $45. Rather than popping higher, the firm trended lower across the session closing almost 8% below its IPO price. This put the value of UBER at $76.5 billion, barely above the $76 billion that private investors pegged to it in August last year.

Few large-scale IPO’s have stumbled so badly out of the gate. Facebook, Alibaba even Lyft, they all rose on their first day. To put it into context, since 2000, only 18 firms valued at over $1 billion and listed on US exchanges have opened below their IPO price.

Conditions were far from ideal for an IPO – the broader market was already in a bad place last week after Trump reignited US – Sino trade tensions with the threat of a trade tariff increase on $200 billion of Chinese imports. A threat which was put into action on Friday the day of UBER’s IPO and trade tariffs were hiked to 25% from 10%. Risk aversion dominated across the week and looks set to continue this week.

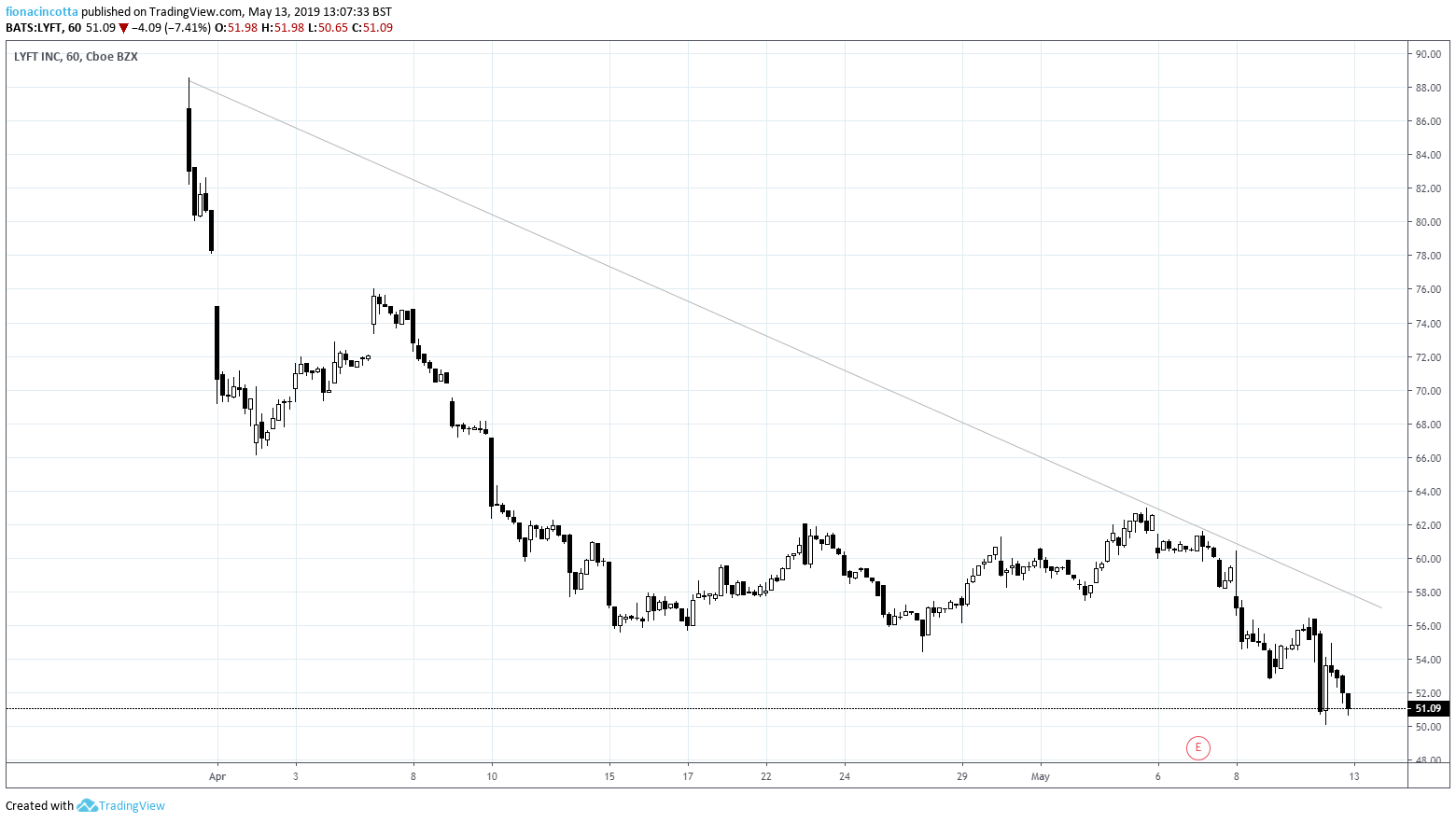

Lyft’s losses

Adding to the bad climate for a hail riding IPO, Lyft, UBER’s main rival reported eye watering losses of $1.1 billion in Q1. Both Lyft and UBER have been running at hefty losses for the past few years, which is a concern for investors. The road to profitability for Lyft and UBER is far from clear. In fact, investors are still weighing up whether these are functional businesses or just hail riding services funded by angels.

What does UBER’s IPO tell us?

Few large-scale IPO’s have stumbled so badly out of the gate. Facebook, Alibaba even Lyft, they all rose on their first day. To put it into context, since 2000, only 18 firms valued at over $1 billion and listed on US exchanges have opened below their IPO price.

Unfavourable broader market conditions

Conditions were far from ideal for an IPO – the broader market was already in a bad place last week after Trump reignited US – Sino trade tensions with the threat of a trade tariff increase on $200 billion of Chinese imports. A threat which was put into action on Friday the day of UBER’s IPO and trade tariffs were hiked to 25% from 10%. Risk aversion dominated across the week and looks set to continue this week.

Lyft’s losses

Adding to the bad climate for a hail riding IPO, Lyft, UBER’s main rival reported eye watering losses of $1.1 billion in Q1. Both Lyft and UBER have been running at hefty losses for the past few years, which is a concern for investors. The road to profitability for Lyft and UBER is far from clear. In fact, investors are still weighing up whether these are functional businesses or just hail riding services funded by angels.

What does UBER’s IPO tell us?

These are still very early days for UBER as a publicly listed company. We tend to see high levels of volatility in a stock around its IPO. What investors reaction to the IPO does tell us is that fast growing but unprofitable firms may not be looking as attractive to investors as they have in the past. This could be valuable knowledge as we look ahead to more tech companies moving towards going public. We expect there to be more caution in the IPO market going forward. Investors are not prepared to swallow the growth at all costs mantra of Silicon Valley.

UBER LYFT

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM