Pinduoduo shares: the basics

Pinduoduo shares are listed on the NASDAQ under the ticker PDD. The Chinese agricultural e-commerce company went public in July 2018, offering 85.6 million American depositary shares at $19 each. At open, the price jumped nearly 40% up to $26.5.

As of March 23 2021, Pinduoduo shares were trading at $137.15, giving the company a market capitalisation of over $168 billion. Its 52-week high is $212.60, and its low is $32.66 – giving an insight into the volatility surrounding the company’s share price.

Let’s take a look at Pinduoduo as a company, before diving into where the stock price could go in the future and how you can trade Pinduoduo shares.

Looking for something specific? Navigate the article using these links:

- How does Pinduoduo work?

- How does Pinduoduo make money?

- What is Pinduoduo’s business model?

- What is Pinduoduo’s revenue?

- Who are Pinduoduo’s competitors?

- Pinduoduo vs Alibaba

- Pinduoduo market share

- Who founded Pinduoduo?

- Pinduoduo stock forecast

- How to trade Pinduoduo stock

How does Pinduoduo work?

Pinduoduo works by enabling users to buy directly from manufacturers through its mobile app. The company has essentially gamified the entire process of shopping, as users have to shop in teams to earn discounts.

Each user will create a list of their desired purchases, and if other people are interested, they’d form a team to help secure a discount by buying in bulk. So, while an individual might be able to purchase something for ¥540 (about $5), they could join in with other buyers and only pay ¥270 (about $2.50).

Pinduoduo works in much the same way as social media, to the extent that some postings are said to have gone ‘viral’. Users can share unique codes to their social media followers to get more teammates on board and get even bigger discounts. Pinduoduo is even integrated with WeChat – China’s multipurpose messaging, social media and payment app owned by Tencent.

It’s unlikely that Pinduoduo would be as popular without WeChat, as a large portion of the company’s users come from the app. The close relationship would also explain why Tencent holds an 18.5% stake in PDD shares.

How does Pinduoduo make money?

Pinduoduo makes money from what it calls ‘online marketplace services’, which accounts for the majority of its revenue. This is essentially the commission PDD takes from sales on its platform as well as any advertising it runs.

Another way Pinduoduo makes money is by selling user data on to manufacturers. While most other e-commerce platforms use data insights to create their own private labels, Pinduoduo just packages up consumer insights and preferences to help them create a more targeted offering.

What is Pinduoduo’s business model?

Pinduoduo’s business model is customer-to-manufacturer. It cuts out the third-party intermediaries that are usually involved in the distribution chain of products. The main involvement Pinduoduo has in sales is its role in security – it blocks out any suspicious links to keep the platform open but controlled.

Farm produce is the largest product category on the app, which has made it popular in more rural communities.

For customers, the Pinduoduo business model means they get better prices by bulk buying with other users. And for manufacturers, they get more control over their prices and can balance out their supply more efficiently, making sure that they don’t create any unnecessary waste.

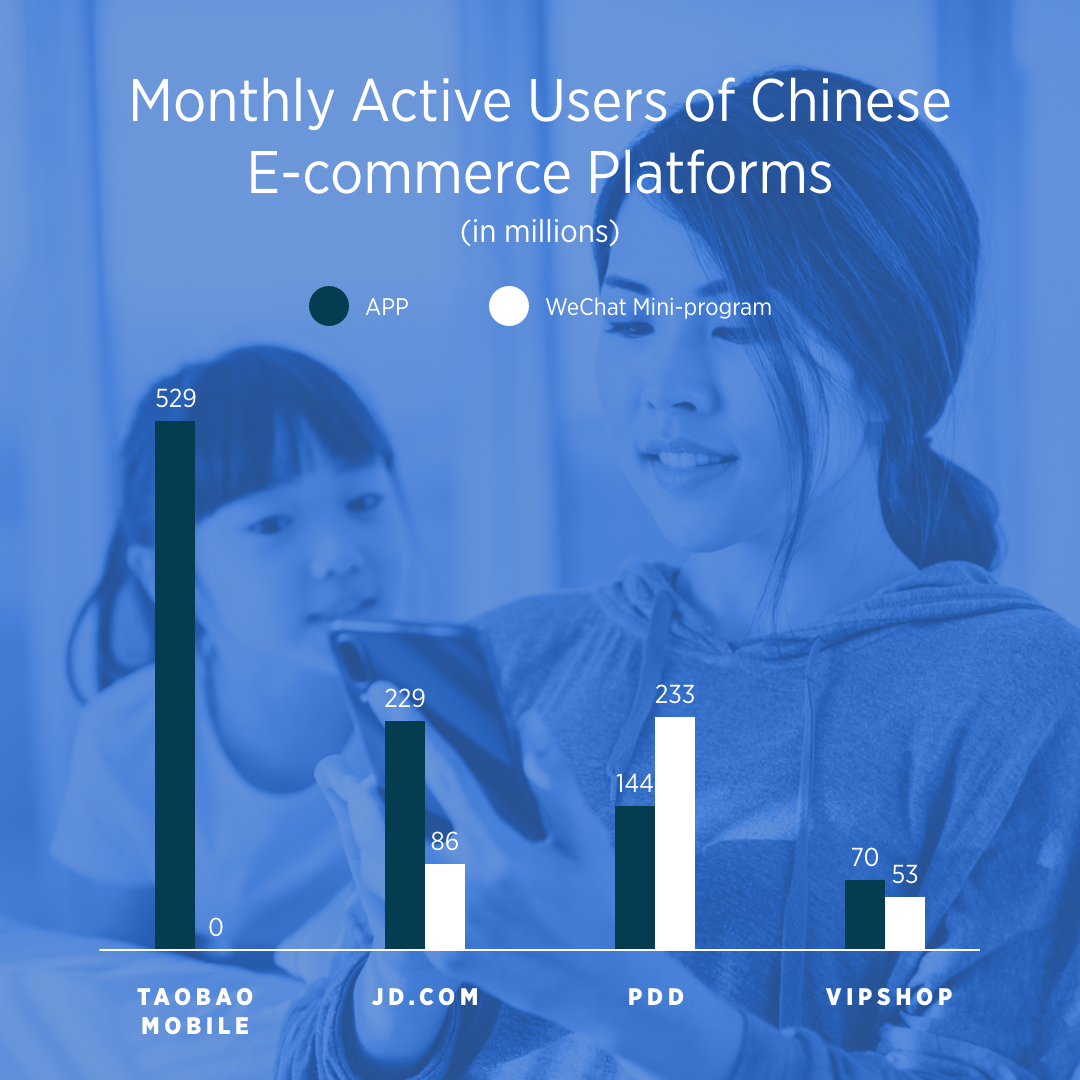

Pinduoduo’s social shopping model also means that so far, it’s had to spend very little on marketing. With over 366 million monthly users all sharing links with their friends and family, it’s unsurprising Pinduoduo has rapidly grown to become the second-most-used e-commerce site in China.

Recently, Pinduoduo has increased investment in R&D, marketing and hiring. For example, PDD announced $7 billion in funds going toward creating new infrastructure to perfect its online retail services – particularly regarding agricultural products.

Pinduoduo has also started trialling artificially-intelligent farms and training farmers in tech. This has earned the company points with the Chinese government, which has plans to boost the rural economy.

What is Pinduoduo’s revenue?

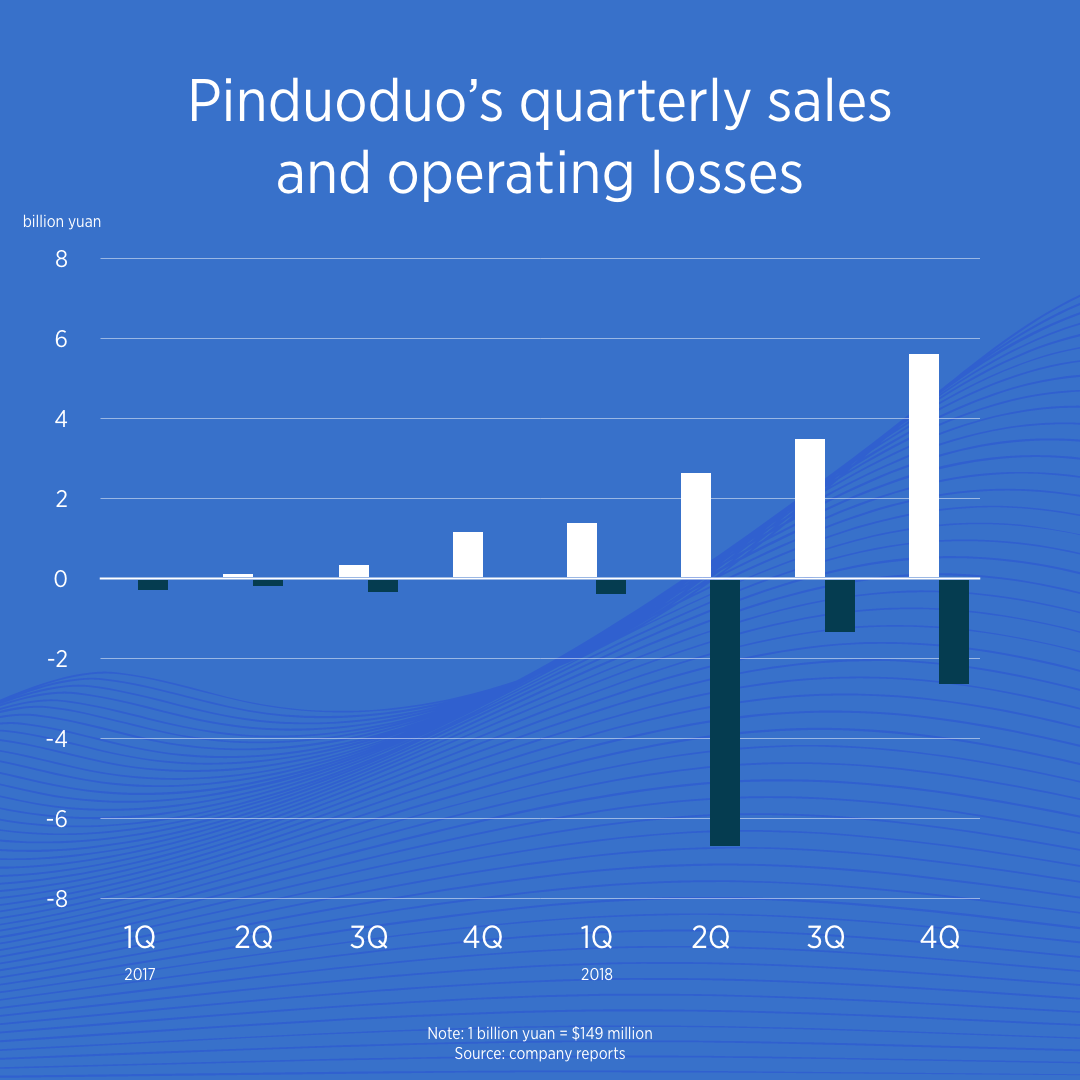

Pinduoduo’s revenue was RM 26.5 billion in its Q4 earnings reported on March 17 2021. This represented an increase of 146% year-on-year, beating the consensus forecast by 38%.

However, due to its increasing investments and focus on growth over profits, Pinduoduo is still operating at a loss. It did report that its net loss for the three months to December 2020 had fallen to RMB 1.38 billion, from RMB 1.75 billion a year ago.

It’s worth pointing out that Pinduoduo isn’t the only Chinese start-up that has focused on growth over profits. For example, South Korean e-commerce company Coupang also has the strategy of gaining market dominance first and breaking even second.

While Pinduoduo makes less money than its notable competitors Alibaba and JD.com, its revenue is growing faster in percentage terms. While Pinduoduo’s revenue increased by 146%, on the same quarter, Alibaba’s revenue was up 38% - however, Alibaba brought in 161.45 billion yuan or $23.19 billion, nearly 15 times as much as PDD.

Who are Pinduoduo’s competitors?

Pinduoduo has had a lot of competitors springing up out of the woodwork in an attempt to copy its social shopping business model. While most of them are small non-starters, the most notable mimic is Alibaba.

There is no mainstream customer-to-manufacturer app of the sort outside of China, but as Pinduoduo grows in popularity, it’s likely we could see more like-minded companies springing up.

Until Pinduoduo decides to expand into other territories, this wouldn’t impact the company’s market share. But CEO Lei Chen did note that management hopes ‘Pinduoduo can one day become the largest grocer in the world’, so the move abroad might not be far off.

Pinduoduo vs Alibaba

In April 2020, Alibaba announced that its e-commerce arm Taobao would be launching a new consumer-to-manufacturer app that would provide low prices to consumers. The app, called Taobao Special Offer Edition, would enable group purchases to get bulk discounts.

Largely, the two companies have different audiences, so they might not impact each other much. Pinduoduo operates in smaller, rural areas, while Alibaba is focused on more developed areas.

While Pinduoduo hasn’t made plans to move into Alibaba’s higher-end market, it has notably signed big brands such as Nike and Omega to their platform, which could lead to wider adoption in cities.

Pinduoduo market share

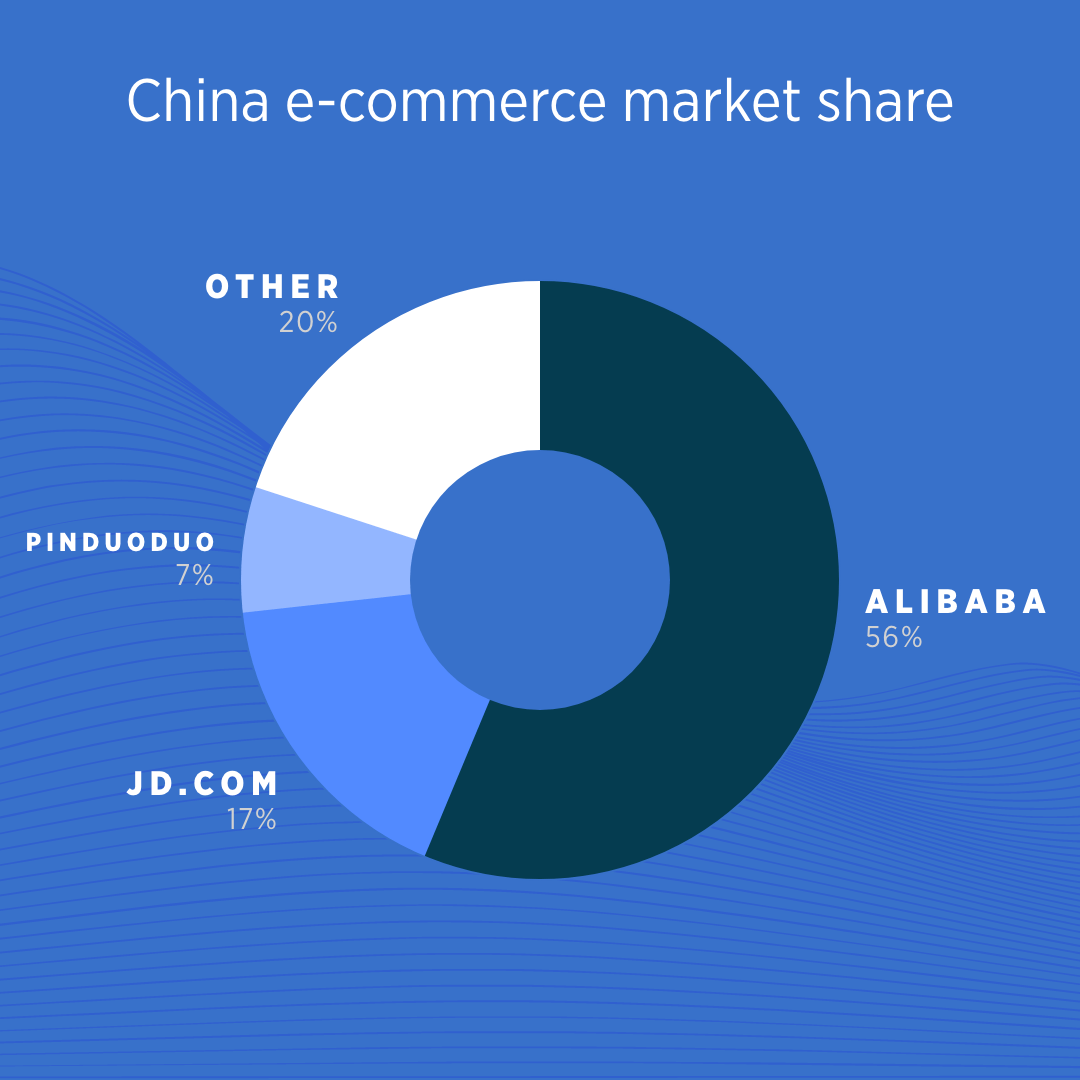

Pinduoduo is currently the third-largest e-commerce site in China, with a market share of 7.3%. It lags behind JD.com (17%) and Alibaba (56%).

Pinduoduo has a long way to go to catch up to the likes of Alibaba, but for the first time, it’s surpassed the giant in terms of active annual users.

Who founded Pinduoduo?

Pinduoduo was founded by Chinese billionaire Colin Huang and Chen Lei in 2015.

In March 2021, Huang stepped down from the board and relinquished his special voting rights. In a statement the company said that Huang will still focus on longer-term initiatives, including research in food and life sciences. Huang is also known to own at least three other companies, which all own shares in Pinduoduo.

Chen Lei has assumed the role of chairman and continues to serve as CEO, a role he took on when Huang stepped down in 2020.

Pinduoduo stock forecast

As Pinduoduo grows, so does the interest in its stock. Although it’s remained a relative unknown outside of China, its comparison to Alibaba has boosted the company’s profile internationally.

While Pinduoduo operates at a loss, most of the interest in its shares comes from its growth potential and sales. The company is seen to have struck the perfect balance between the growing consumer demand for quality products and the need for low prices amid economic uncertainty.

However, Pinduoduo has big aspirations of selling $145 billion worth of agricultural products per year by 2025. As its volume has already doubled in 2020, this target could be achievable. Once it reaches such big numbers, it’s likely its share price will boost in the long-term. And if the company does decide to expand into other territories, who knows what potential it would unlock.

The main threat Pinduoduo will face over the coming years is growing competition in the customer-to-manufacturer space. Any lessening of Pinduoduo’s market share would have a huge impact on its bottom line and share price.

How to trade Pinduoduo

You can Pinduoduo with City Index using spread bets or CFDs, with spreads from 0.1%. Follow these easy steps to start trading opportunities with UK stocks.

- Open a City Index account, or log in if you’re already a customer

- Search ‘Pinduoduo’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place your trade and monitor the market