Before the election, a Democratic win was widely anticipated and thought to be bullish for U.S. equities. A contested election, a split congress, or a Trump re-election was likely to be a headwind for equities.

The first inkling that the pre-election playbook might be ignored, was a rally in U.S. equity futures as Trump became the betting market's favourite after voting put him ahead in the key state of Florida.

Since then equity markets have continued to rally on the prospect of a Joe Biden Presidency and a split Congress, a scenario previously also thought to be negative for equity markets. However a change of heart towards this appears to have taken place for the following reasons.

- A split Congress will make tax increases, the unwinding of Trumps' tax cuts, and potential unfriendly legislation on tech companies more difficult to implement.

- Trade policy, a source of significant uncertainty under the Trump administration is the domain of the White House. A Biden Presidency is likely to use less tariffs and quotas and less protective measures are in general supportive of growth and stocks.

- The likelihood of a contested election is fading along with the prospects of success for Trump's legal measures designed to influence the election outcome.

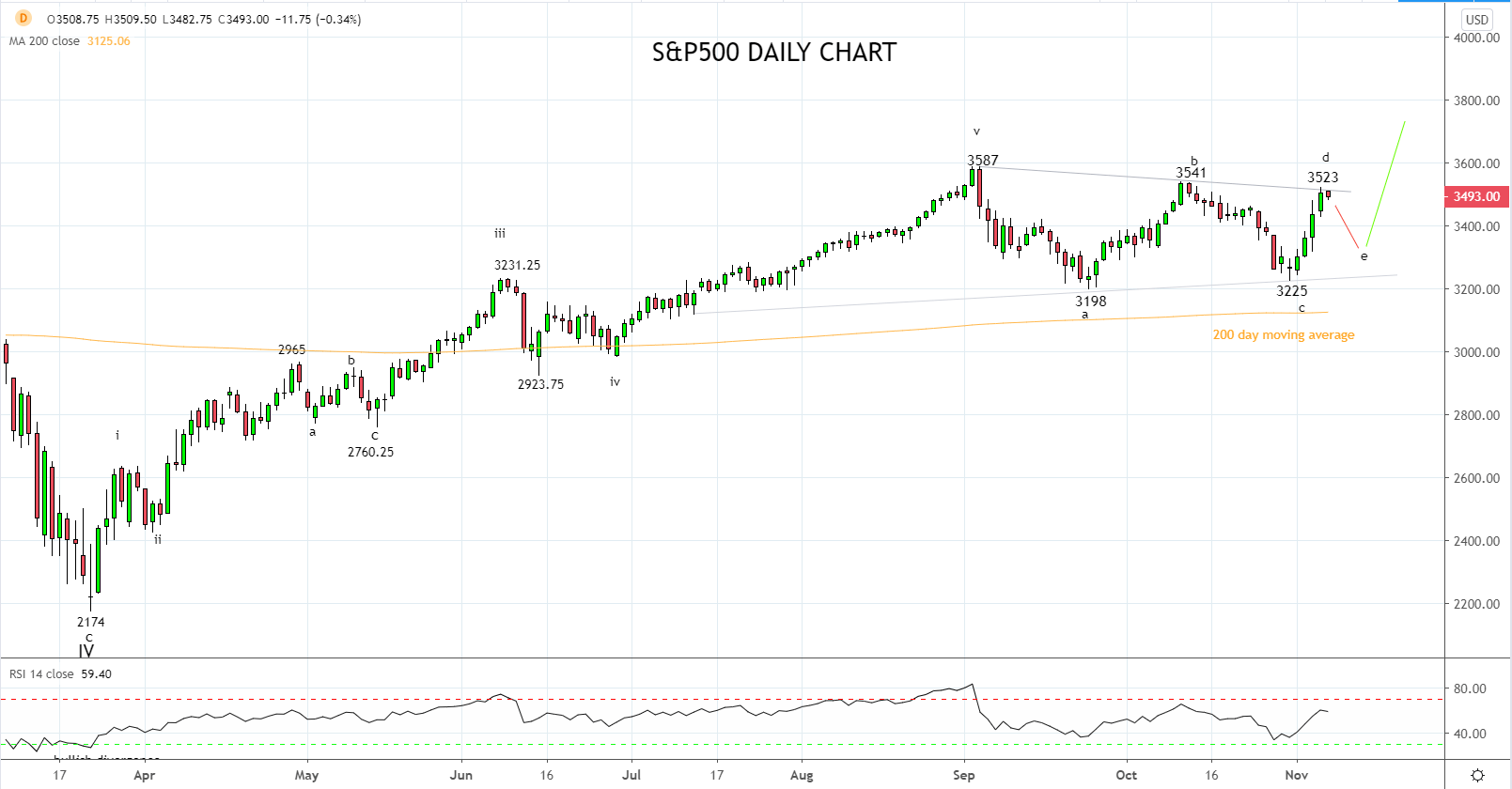

Whether there are any further twists in the 2020 Presidential election remains to be seen. However what is becoming more likely after this week’s rally back above 3420 is the idea that the S&P500 completed a medium term corrective low point at the September 24th, 3198 low, from the 3587 high.

To confirm the uptrend has truly returned, a sustained break above trend line resistance 3510/20 area is required and this would reduce the possibility of a final dip back towards 3300 to complete a contracting “abcde” triangular correction.

Source Tradingview. The figures stated areas of the 6th of November 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation