Playing a key part in our thinking the risk asset complex absorbed a lot of bad news during the second half of June. As we noted, if a market can’t go down and stay down on negative news flow it often indicates the path of least resistance is higher.

The stunning 5.7% rally in Chinese equities yesterday along with a sharp fall in USDCNH, confirmed we were on the right track and was soon followed by broad-based selling of the U.S. dollar against G10 currencies.

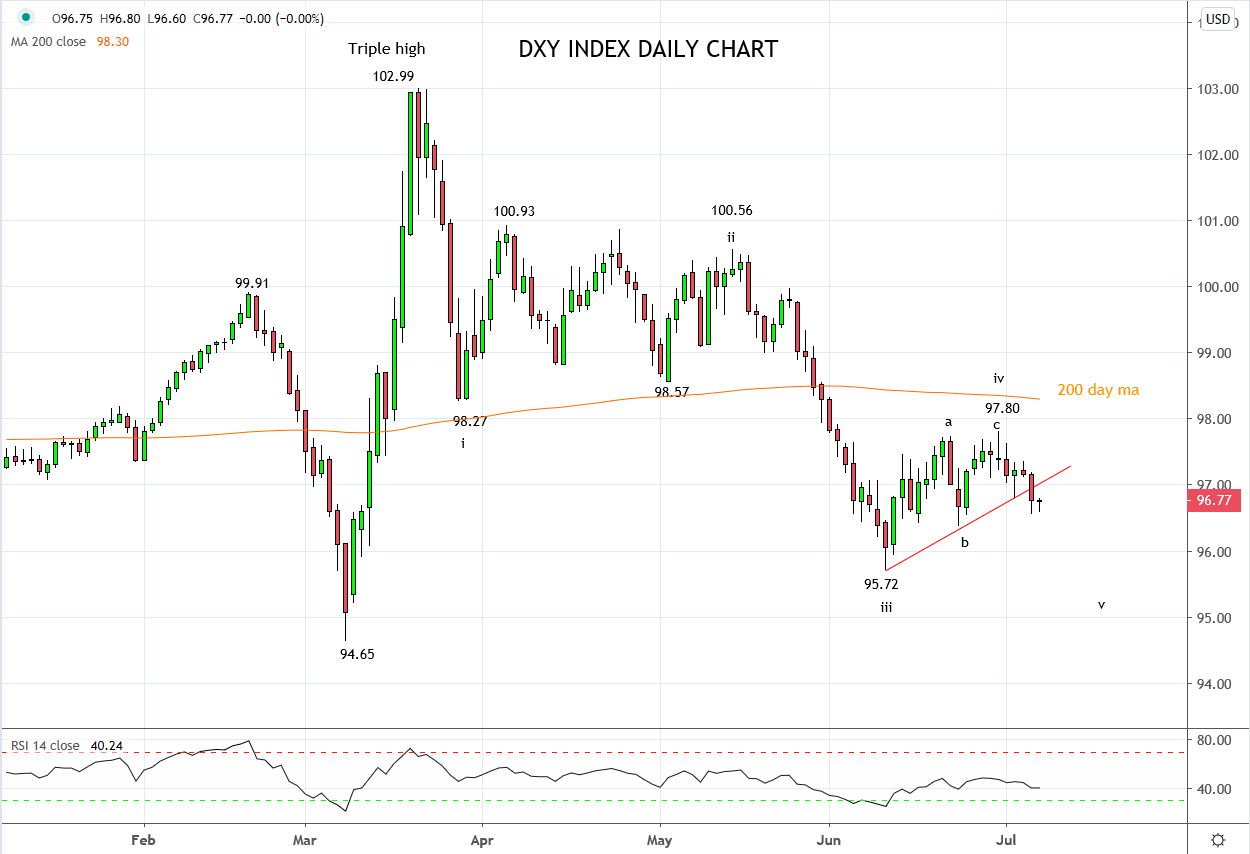

Ironically last week, according to the IMM positioning data, the market reduced its U.S dollar short position, mainly against the EURUSD, the currency with the biggest weighting in the DXY index. A need to re-enter U.S. dollar shorts yesterday is likely to have helped the DXY close below its short term uptrend as viewed in the chart below.

Whether the DXY can continue its descent from here and in lieu of any Tier 1 U.S. data in the coming days will be dependent on broader risk sentiment. It will also be dependent on the EURUSD breaking above the 1.1350/55 resistance zone and USDCNH breaking below the big psychological 7.00 support zone.

Technically, the decline in the DXY index, from the Mid-May 100.56 high displays impulsive characteristics. The subsequent bounce from the June 95.72 low unfolded in a three-wave “abc” type correction, falling short of the preferred 98.20/40 sell zone.

Providing the DXY remains below the short term resistance coming from the broken uptrend 97.00 area our preference remains for the DXY to retest and break below the 10th of June 95.72 low. A break/close below the 96.40/30 support area would provide confirmation the next leg lower has commenced.

Source Tradingview. The figures stated areas of the 7th of July 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation