4 Stocks Poised to Benefit with “Helicopter Money” Incoming

In yesterday’s coronavirus press conference, US President Trump promised a “big, bold” stimulus package (reportedly in the $1T+ ballpark), with Treasury Secretary Mnuchin stating that the federal government was looking at “sending checks to Americans immediately…Now, and I mean now. In the next two weeks."

President Trump went on to suggest that such checks could be larger than the $1,000 floated in the media and by other lawmakers. These measures to directly put money in the hands of US consumers would follow on comparable programs taken in Hong Kong, Macau, and Singapore last month and could lead to similar efforts be taken up in other countries in the coming weeks.

Such examples of “helicopter money” do have an historical precedent, including under the last US Republican President George W. Bush in 2008 in response to the Great Financial Crisis and in Japan in 1999, though their effectiveness in boosting the economy is still up for debate. In this case, the checks are meant more to prevent the worse effects of a sudden recession (read: allowing laid-off workers to buy food and pay their mortgages) rather than to stimulate a slow-growing economy and therefore may be more likely to achieve their aim.

In any event, this “new” policy will have a major short-term impact on the economy and markets. Amidst an ongoing de facto national quarantine, surging unemployment, and likely recession, it’s unlikely that Americans will rush out en masse to use the funds on a new car, vacation, or other discretionary purchase; instead, the biggest boost will likely be to consumer staple companies that supply the goods and services that consumers can’t possibly live without. In other words, some of the biggest “winners” in recent weeks are poised to build on their gains.

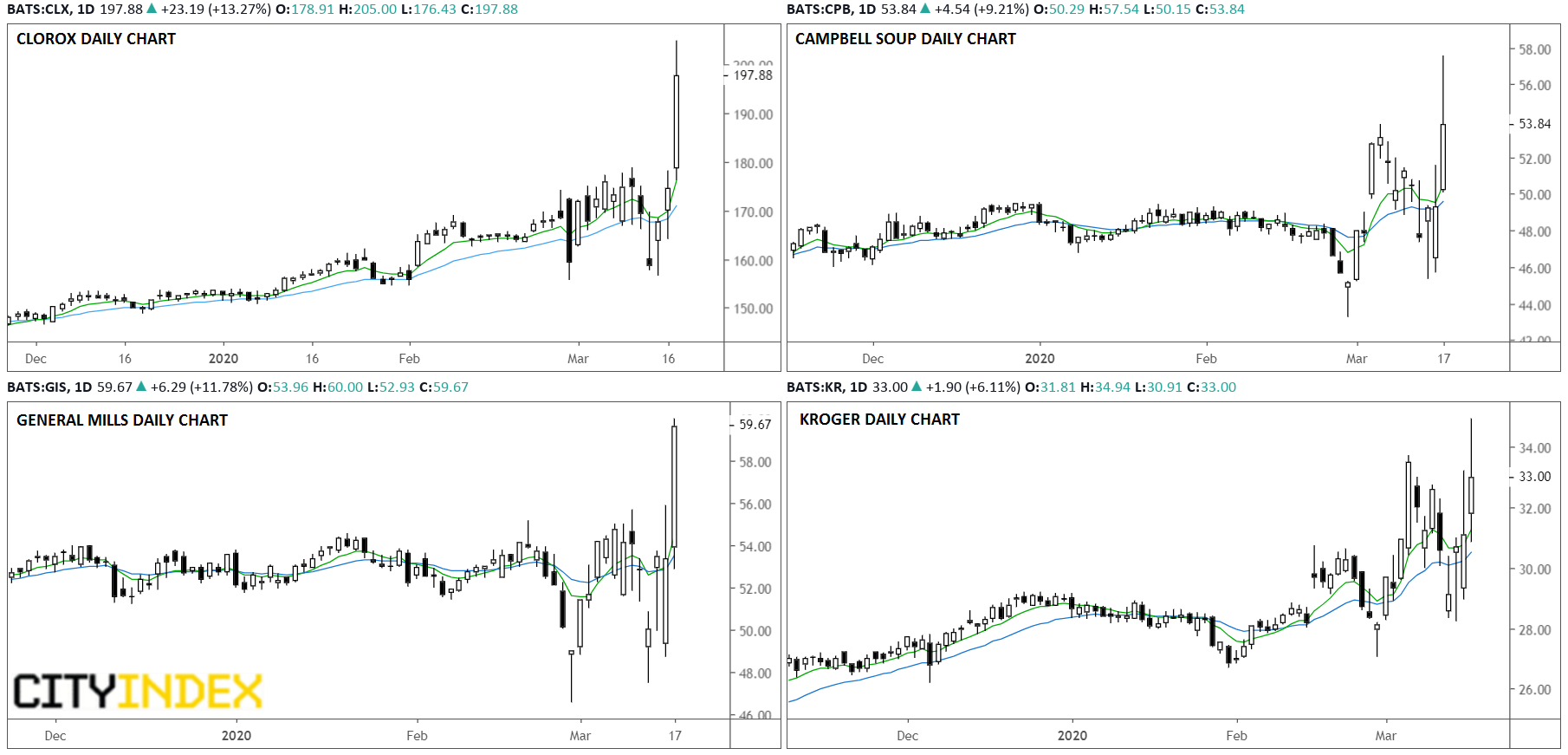

Despite the big selloff in recent weeks, several consumer staple stocks bucked the bearish trend to hit new 52-week highs yesterday, including Clorox (CLX), Campbell Soup (CPB), General Mills (GIS), Kroger (KR). Each of these defensive companies are beneficiaries of the de facto global quarantine and as long as the current state of affairs lasts, they are poised to outperform the broader markets:

Source: TradingView, GAIN Capital

In times of crisis, investors focus on the safe return of their capital, rather than maximizing the return on their capital. Amidst the biggest economic and market crisis in at least a decade, it may make sense to focus long positions in the companies churning out staples like disinfectants and basic foods!