So far today, the Japanese yen is the strongest of the major currencies, but zooming out a bit, it’s actually the weakest major currency over the last month, losing more than 4% of its value against the US dollar.

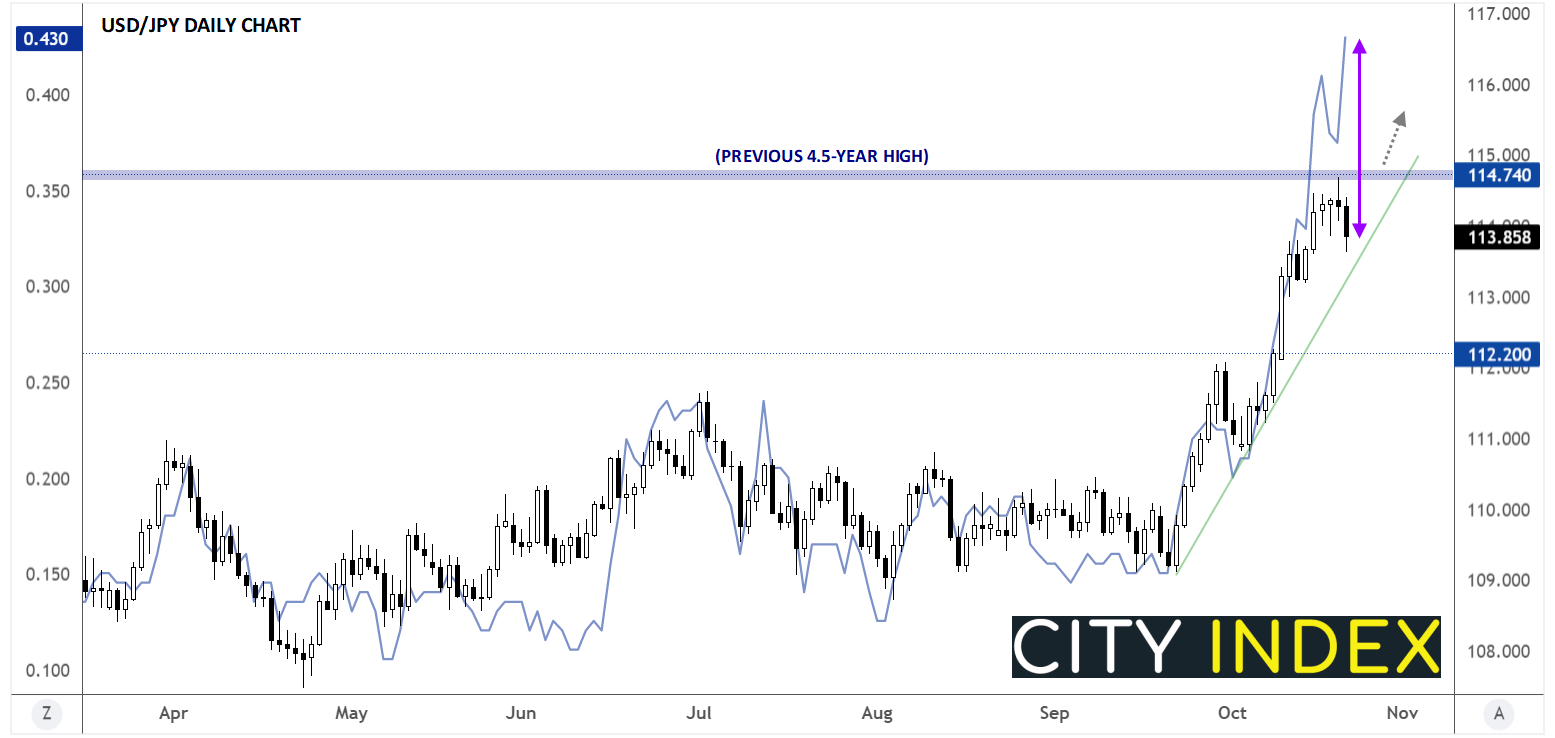

In fact, USD/JPY tested its highest level in more than 4.5 years near 114.70 yesterday, marking a 550+ pip rally in the pair less than a month. While this widely-watched resistance level certainly marks a logical area for bulls to take profits after a big rally, there are (at least) four reasons that USD/JPY could continue to rally through resistance to new highs:

1) Auto exports are still restrained

Due heavily to the ongoing semiconductor shortage, exports of Japan’s vaunted automobile brands (Toyota, Honda, Daihatsu, Nissan, Suzuki, Mazda, Mitsubishi, Subaru, Isuzu, etc) are running well below full capacity. Yesterday’s trade balance report showed that auto shipments have been nearly cut in half from last year (-40%), and with the chip shortage proving more durable than many analysts had expected, this dynamic may continue to weigh on the yen moving forward.

2) Global risk appetite has returned

While both the US dollar and Japanese yen are seen as “safe haven” currencies, the US is in a better position to benefit from a resurgence in global growth given its entrepreneurial culture, fast-growing early stage companies, and long-term demographics. With global investor risk appetite returning (see major indices and cryptocurrencies testing record highs while global bond yields surge – more on that below), traders are shifting from allocating to the Japanese yen to the US dollar at the margin.

3) Retail positioning remains surprisingly bearish on USD/JPY

Generally speaking, retail traders tend to be trend followers, benefitting from prolonged trends but occasionally getting “caught offside” when trends change. Accordingly, some sophisticated traders watch for extremely lopsided retail positioning as a signal that an established trend may be more vulnerable to a reversal.

In the case of USD/JPY, our internal data shows that a surprisingly low 29% of outstanding StoneX retail volume is long USD/JPY; stated another way, less than half of our volume is betting on the uptrend continuing from here, hardly a sign of excessive long positioning and a potential contrarian indicator that the trend could extend further before eventually reversing.

4) USD/JPY hasn’t been “keeping up” with the market’s aggressive bets on US interest rate hikes

From a fundamental perspective, interest rates are arguably the most important driver of currency values, and despite the impressive rally in USD/JPY over the last month, the pair hasn’t been “keeping up” with surging expectations for interest rate increases from the Fed in 2022.

The chart below shows the performance of USD/JPY over the last six months against the difference in 30-day Fed Funds futures in December 2021 and December 2022. Put simply, this measures how many basis points of interest rate increases traders are expecting between December of this year (or effectively the current level, as no one expects the Fed to raise interest rates in the next 6 weeks) and December of next year. At 43bps (left scale), traders have already “priced in” a full 0.25% interest rate increase from the Fed next year and about 75% odds (18/25bps) of a second interest rate increase by the end of next year:

Source: TradingView, StoneX

The tight correlation between these two market-based indicators over the last half-year is clear, but USD/JPY has been lagging the rapid rise in US interest rate hike expectations so far this week. To the extent that interest rates drive currency values, this gap could close and point to a potential rally to fresh 4.5-year highs above 115.00 in the coming days.

Of course, a bearish trader could just as easily outline 4 (or more!) reasons that the USD/JPY rally could reverse in the coming days, so it’s important to use stop losses on any trade and practice good risk management with any trade, but as long as USD/JPY remains above its short-term bullish trend line (currently around 113.35), the path of least resistance remains to the topside, even despite key resistance at 114.70.

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade