US Futures slightly up - Watch BRK/B, MSFT, WMT, BYND

The S&P 500 Futures remain on the upside after they closed higher on Friday.

Later today, the Dallas Federal Reserve will post its Manufacturing Outlook Index for August (-2 expected).

European indices are on the upside. Later today, the German Federal Statistical Office will report August CPI (+0.1% on year expected).

Asian indices closed in the red except the Japanese Nikkei. This morning, official data showed that Japan's industrial production grew 8.0% on month in July (+5.0% expected), while retail sales slid 3.3% (-2.5% expected). China's official Manufacturing PMI slipped 51.0 in August (51.1 expected) from 51.2 in July, while Non-manufacturing PMI rose to 55.2 (54.1 expected) from 54.2.

WTI Crude Oil futures are bullish. The total number of rigs in the U.S. was unchanged at 254 as of August 28 as compared with the prior week, while rigs in Canada fell to 54 from 56, according to Baker Hughes.

Gold gains ground as ths US dollar remains weak on Fed policy.

Gold rose 1.55 dollar (+0.08%) to 1966.38 dollars while the the dollar index fell 0.19pt to 92.184.

U.S. Equity Snapshot

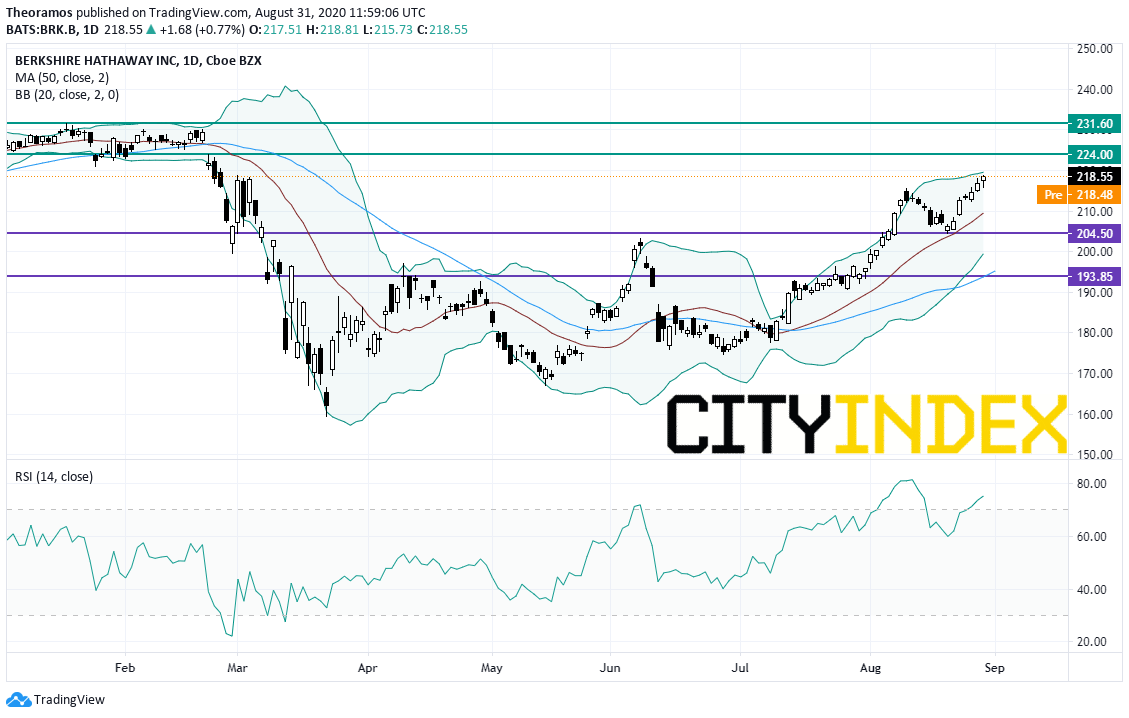

Berkshire Hathaway (BRK/B), the investment firm owned by Warren Buffet, acquired stakes in five Japanese trading companies, valued at more than 6 billion dollars.

Beyond Meat (BYND), a producer of plant-based meat substitutes, was upgraded to "neutral" from "sell" at Citi.

Later today, the Dallas Federal Reserve will post its Manufacturing Outlook Index for August (-2 expected).

European indices are on the upside. Later today, the German Federal Statistical Office will report August CPI (+0.1% on year expected).

Asian indices closed in the red except the Japanese Nikkei. This morning, official data showed that Japan's industrial production grew 8.0% on month in July (+5.0% expected), while retail sales slid 3.3% (-2.5% expected). China's official Manufacturing PMI slipped 51.0 in August (51.1 expected) from 51.2 in July, while Non-manufacturing PMI rose to 55.2 (54.1 expected) from 54.2.

WTI Crude Oil futures are bullish. The total number of rigs in the U.S. was unchanged at 254 as of August 28 as compared with the prior week, while rigs in Canada fell to 54 from 56, according to Baker Hughes.

Gold gains ground as ths US dollar remains weak on Fed policy.

Gold rose 1.55 dollar (+0.08%) to 1966.38 dollars while the the dollar index fell 0.19pt to 92.184.

U.S. Equity Snapshot

Berkshire Hathaway (BRK/B), the investment firm owned by Warren Buffet, acquired stakes in five Japanese trading companies, valued at more than 6 billion dollars.

Source: TradingView, GAIN Capital

Beyond Meat (BYND), a producer of plant-based meat substitutes, was upgraded to "neutral" from "sell" at Citi.

Latest market news

Today 08:33 AM