EU indices up | TA focus on Deutsche Lufthansa

INDICES

Friday, European stocks were broadly lower. The Stoxx Europe 600 Index lost 0.5%, Germany's DAX 30 dropped 0.5%, France's CAC 40 fell 0.3% and the U.K.'s FTSE 100 was down 0.6%.

EUROPE ADVANCE/DECLINE

67% of STOXX 600 constituents traded lower or unchanged Friday.

57% of the shares trade above their 20D MA vs 63% Thursday (above the 20D moving average).

53% of the shares trade above their 200D MA vs 54% Thursday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 1.6pt to 25.16, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: Healthcare

Europe Best 3 sectors

banks, basic resources, insurance

Europe worst 3 sectors

food & beverage, health care, telecommunications

INTEREST RATE

The 10yr Bund yield rose 1bp to -0.41% (above its 20D MA). The 2yr-10yr yield spread fell 1bp to -26bps (below its 20D MA).

ECONOMIC DATA

UK : Late Summer Bank Holiday

GE 13:00: Aug Harmonised Inflation Rate MoM Prel, exp.: -0.5%

GE 13:00: Aug Harmonised Inflation Rate YoY Prel, exp.: 0%

GE 13:00: Aug Inflation Rate MoM Prel, exp.: -0.5%

GE 13:00: Aug Inflation Rate YoY Prel, exp.: -0.1%

FR 14:00: 12-Mth BTF auction, exp.: -0.58%

FR 14:00: 3-Mth BTF auction, exp.: -0.57%

FR 14:00: 6-Mth BTF auction, exp.: -0.61%

MORNING TRADING

In Asian trading hours, EUR/USD held gains at 1.1912 and GBP/USD was firm at 1.3352. USD/JPY rose to 105.45. This morning, official data showed that Japan's industrial production grew 8.0% on month in July (+5.0% expected), while retail sales slid 3.3% (-2.5% expected), AUD/USD was little changed at 0.7366. Earlier today, China's official Manufacturing PMI slipped 51.0 in August (51.1 expected) from 51.2 in July, while Non-manufacturing PMI rose to 55.2 (54.1 expected) from 54.2.

Spot gold climbed to $1,970 an ounce.

#GERMANY#

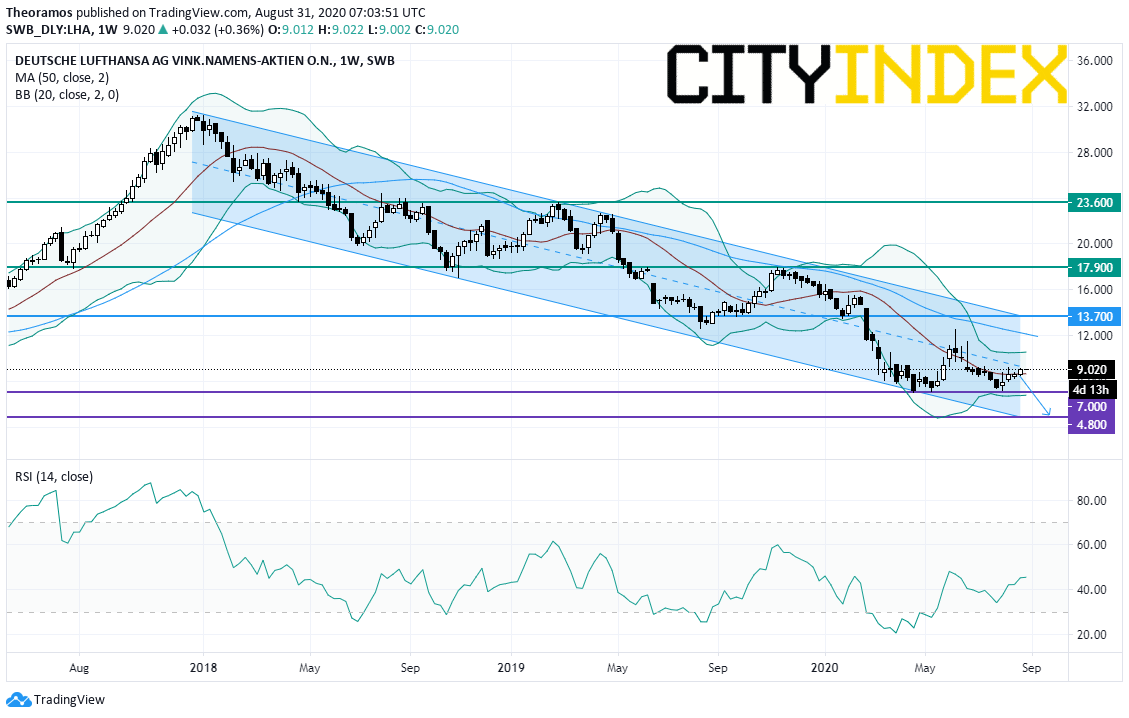

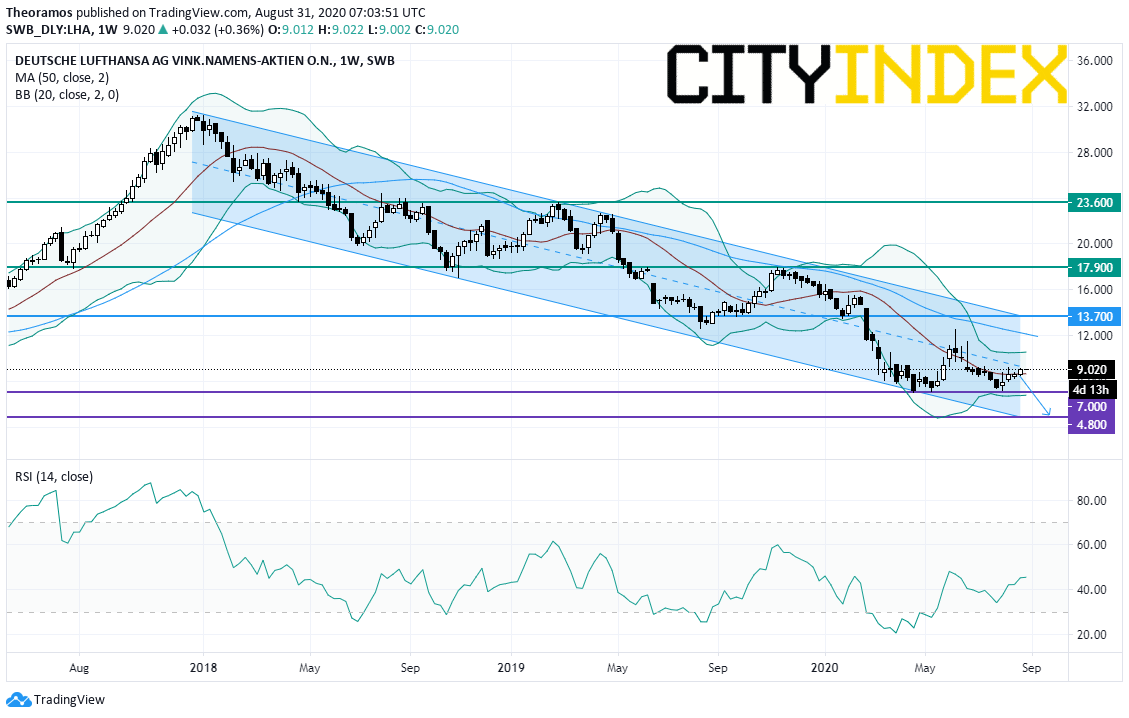

Deutsche Lufthansa, an airline group, is considering a further 20,000 jobs cut, according to newspaper NZZ am Sonntag.

From a weekly point of view, the stock price remains stuck within a declining channel drawn since December 2017. Below the upper boundary of the channel at 13.7E, look for the horizontal target at 7E and a new all-time low set at 4.8E in extension. Alternatively, a break above 13.7E would trigger a reversal up trend towards 17.9E and 23.6E in extension.

Source: GAIN Capital, TradingView

#FRANCE#

Veolia, a resource management company, announced that it has made an offer to acquire the 29.9% stake in Suez hold by Engie for 15.50 euros per share in cash, representing about 2.9 billion euros and a 50% premium on the Suez share price on July 30. The company said: "If it is accepted by Engie, Veolia intends, following the acquisition of the 29.9% of Suez shares, to file a voluntary tender offer for the remaining Suez shares."

Natixis, a corporate and investment bank which holds a 50.01% stake in H2O Asset Management, the temporary suspension of eight of H2O Asset Management's funds has no financial impact on the bank. It said: "H2O Asset Management (H2O AM) has announced the temporary suspension of eight of its funds1 for an estimated period of four weeks with the aim of sidepocketing holdings of private securities and reestablishing liquidity for investors in the portion of the funds invested in liquid assets."

Sanofi, a pharmaceutical company, is on the right track to develop coronavirus vaccine based on recent data, according to CEO Paul Hudson cited by Reuters.

#BENELUX#

Philips, a health technology company, said it has received notice from the U.S. Department of Health and Human Services (HHS) of the partial termination of the April 2020 contract to deliver 43,000 bundled EV300 ventilator configurations to HHS through December 2020. The company added: "The reduction in our ventilator deliveries to HHS will obviously impact Philips' financial performance, but we continue to expect to return to growth and improved profitability in the second half of the year, starting in the third quarter. For the full year 2020, we now expect to deliver modest comparable sales growth with an Adjusted EBITA margin of around the level of last year (previously aimed for an improvement)."

EX-DIVIDEND

Fresenius SE: E0.84

Friday, European stocks were broadly lower. The Stoxx Europe 600 Index lost 0.5%, Germany's DAX 30 dropped 0.5%, France's CAC 40 fell 0.3% and the U.K.'s FTSE 100 was down 0.6%.

EUROPE ADVANCE/DECLINE

67% of STOXX 600 constituents traded lower or unchanged Friday.

57% of the shares trade above their 20D MA vs 63% Thursday (above the 20D moving average).

53% of the shares trade above their 200D MA vs 54% Thursday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 1.6pt to 25.16, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: Healthcare

Europe Best 3 sectors

banks, basic resources, insurance

Europe worst 3 sectors

food & beverage, health care, telecommunications

INTEREST RATE

The 10yr Bund yield rose 1bp to -0.41% (above its 20D MA). The 2yr-10yr yield spread fell 1bp to -26bps (below its 20D MA).

ECONOMIC DATA

UK : Late Summer Bank Holiday

GE 13:00: Aug Harmonised Inflation Rate MoM Prel, exp.: -0.5%

GE 13:00: Aug Harmonised Inflation Rate YoY Prel, exp.: 0%

GE 13:00: Aug Inflation Rate MoM Prel, exp.: -0.5%

GE 13:00: Aug Inflation Rate YoY Prel, exp.: -0.1%

FR 14:00: 12-Mth BTF auction, exp.: -0.58%

FR 14:00: 3-Mth BTF auction, exp.: -0.57%

FR 14:00: 6-Mth BTF auction, exp.: -0.61%

MORNING TRADING

In Asian trading hours, EUR/USD held gains at 1.1912 and GBP/USD was firm at 1.3352. USD/JPY rose to 105.45. This morning, official data showed that Japan's industrial production grew 8.0% on month in July (+5.0% expected), while retail sales slid 3.3% (-2.5% expected), AUD/USD was little changed at 0.7366. Earlier today, China's official Manufacturing PMI slipped 51.0 in August (51.1 expected) from 51.2 in July, while Non-manufacturing PMI rose to 55.2 (54.1 expected) from 54.2.

Spot gold climbed to $1,970 an ounce.

#GERMANY#

Deutsche Lufthansa, an airline group, is considering a further 20,000 jobs cut, according to newspaper NZZ am Sonntag.

From a weekly point of view, the stock price remains stuck within a declining channel drawn since December 2017. Below the upper boundary of the channel at 13.7E, look for the horizontal target at 7E and a new all-time low set at 4.8E in extension. Alternatively, a break above 13.7E would trigger a reversal up trend towards 17.9E and 23.6E in extension.

Source: GAIN Capital, TradingView

#FRANCE#

Veolia, a resource management company, announced that it has made an offer to acquire the 29.9% stake in Suez hold by Engie for 15.50 euros per share in cash, representing about 2.9 billion euros and a 50% premium on the Suez share price on July 30. The company said: "If it is accepted by Engie, Veolia intends, following the acquisition of the 29.9% of Suez shares, to file a voluntary tender offer for the remaining Suez shares."

Natixis, a corporate and investment bank which holds a 50.01% stake in H2O Asset Management, the temporary suspension of eight of H2O Asset Management's funds has no financial impact on the bank. It said: "H2O Asset Management (H2O AM) has announced the temporary suspension of eight of its funds1 for an estimated period of four weeks with the aim of sidepocketing holdings of private securities and reestablishing liquidity for investors in the portion of the funds invested in liquid assets."

Sanofi, a pharmaceutical company, is on the right track to develop coronavirus vaccine based on recent data, according to CEO Paul Hudson cited by Reuters.

#BENELUX#

Philips, a health technology company, said it has received notice from the U.S. Department of Health and Human Services (HHS) of the partial termination of the April 2020 contract to deliver 43,000 bundled EV300 ventilator configurations to HHS through December 2020. The company added: "The reduction in our ventilator deliveries to HHS will obviously impact Philips' financial performance, but we continue to expect to return to growth and improved profitability in the second half of the year, starting in the third quarter. For the full year 2020, we now expect to deliver modest comparable sales growth with an Adjusted EBITA margin of around the level of last year (previously aimed for an improvement)."

EX-DIVIDEND

Fresenius SE: E0.84

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM