US Futures green, watch MU, AAPL, BA, WFC

Due later today the Conference Board will publish June Consumer Confidence Index. SP/Case-Shiller will report 20-City Composite Home Price Index for April. The Market News International will release June Chicago PMI.

European indices are relatively flat. On the statistical front, U.K. GDP declined 2.2% in the first quarter according to the latest estimate after remaining stable in the previous quarter. It was expected to decline by 2.0%. The Euro-zone year-on-year inflation was released in line with expectations at 0.8%, after 0.9% in April.

Asian indices ended higher. Japan's industrial production declined 8.4% on month in May (-5.7% expected), while jobless rate rose to 2.9% (2.8% expected) from 2.6% in April. China's official Manufacturing PMI edged up to 50.9 in June (50.5 expected) from 50.6 in May and Non-manufacturing PMI climbed to 54.4 (53.6 expected) from 53.6.

WTI Crude Oil futures eased during Asian session. China's crude oil imports rose to a record level at 11.3M b/d in May, according to the government. Later today, API will release the change of U.S. oil stockpile data for June 26.

Gold remains firms near 8-year high and is on track for its strongest quarterly increase in four years on COVID-19 fears.

Gold fell 2.78 dollars (-0.16%) to 1770.04.

Risk currencies consolidate as investors wait for fresh coronavirus data in the US.

EUR/USD fell 34pips to 1.1208 while GBP/USD declined also 34pips to 1.2264.

US Equity Snapshot

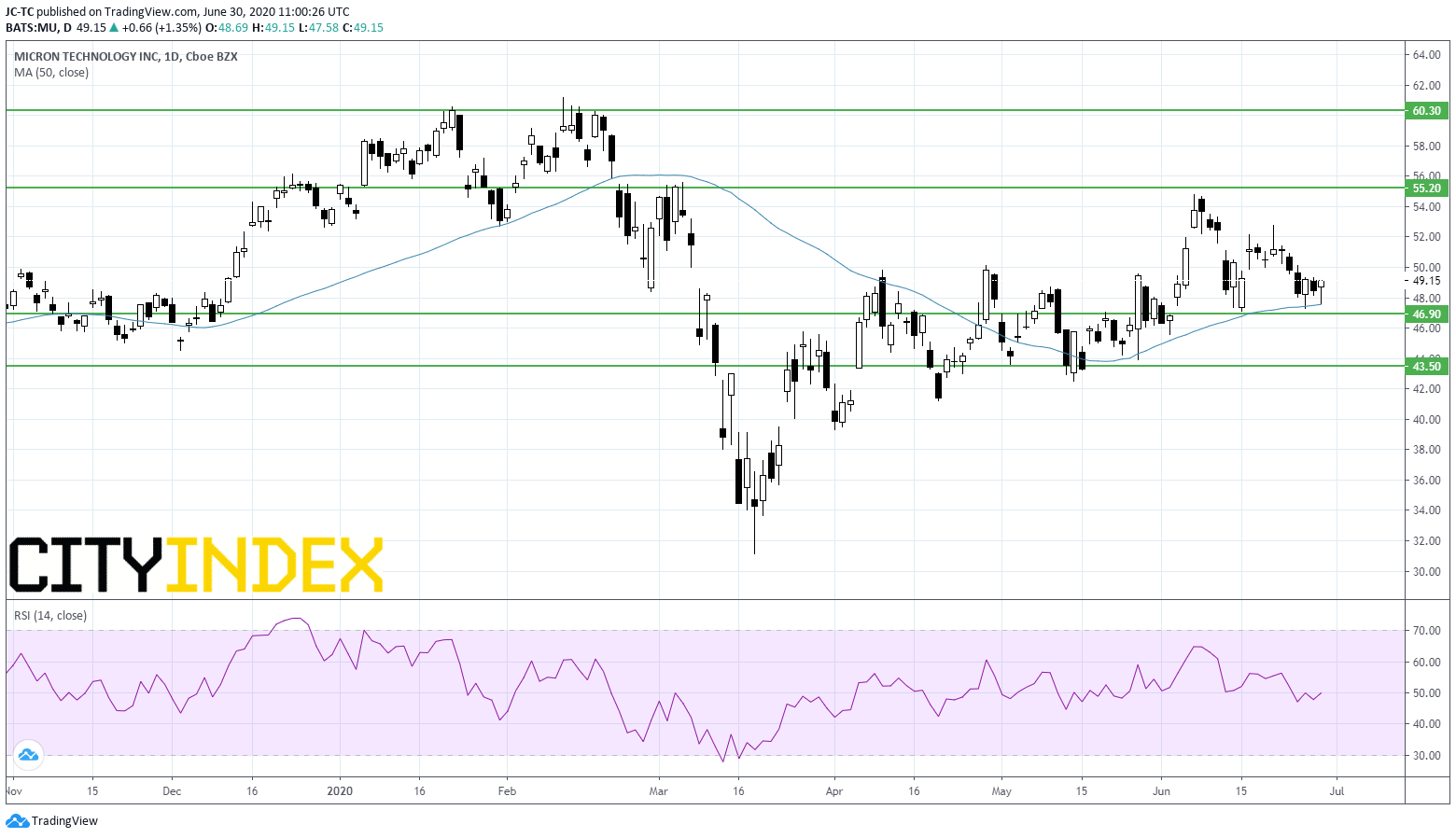

Micron Technology (MU), a manufacturer of memory chips, reported third quarter adjusted EPS of 0.82 dollar, beating estimates, down from 1.05 dollar a year ago, on adjusted revenue of 5.4 billion dollars, just above the consensus, up from 4.8 billion dollars a year earlier.

Apple's (AAPL) 5G iPhone shipments might reach 15-20 million units in 2020 vs a previous estimate of 30-40 million units, according to Digitimes.

Boeing (BA): Norwegian Air Shuttle, the airline company, canceled orders regarding 97 Boeing jets, including 92 737 MAX.

Wells Fargo (WFC), a banking group, announced that its third quarter dividend is expected to be reduced from the current level of 0.51 dollar per share, citing the results of the Federal Reserve's instructions regarding capital distributions. On the other hand, Goldman Sachs (GS), Bank of America (BAC), Morgan Stanley (MS), JPMorgan (JPM) and Citigroup (C) will maintain their current dividend level.

Uber Technologies (UBER), a ride-hailing company, is in discussions regarding a 2.6 billion dollars acquisition of American food delivery company Postmates, reported Dow Jones.

Source : TradingVIEW, Gain Capital