EU indices down this morning | TA focus on Glencore

Yesterday, European stocks ended mixed. The Stoxx Europe 600 eased 0.12%, while Germany's DAX 30 gained 0.32%, and France's CAC 40 and the U.K.'s FTSE 100 were little changed.

EUROPE ADVANCE/DECLINE

56% of STOXX 600 constituents traded lower or unchanged yesterday.

7% of the shares trade above their 20D MA vs 7% Wednesday (below the 20D moving average).

43% of the shares trade above their 200D MA vs 43% Wednesday (below the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.71pt to 37.55, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Travel & Leisure

3mths relative low: Insurance

Europe Best 3 sectors

energy, utilities, insurance

Europe worst 3 sectors

automobiles & parts, retail, personal & household goods

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.63% (below its 20D MA). The 2yr-10yr yield spread fell 1bp to -17bps (above its 20D MA).

ECONOMIC DATA

FR 07:30: Q3 GDP Growth Rate QoQ Prel, exp.: -13.8%

GE 08:00: Sep Retail Sales YoY, exp.: 3.7%

GE 08:00: Sep Retail Sales MoM, exp.: 3.1%

GE 08:00: Q3 GDP Growth Rate QoQ Flash, exp.: -9.7%

GE 08:00: Q3 GDP Growth Rate YoY Flash, exp.: -11.3%

FR 08:45: Oct Harmonised Inflation Rate MoM Prel, exp.: -0.6%

FR 08:45: Oct Harmonised Inflation Rate YoY Prel, exp.: 0%

FR 08:45: Oct Inflation Rate YoY Prel, exp.: 0%

FR 08:45: Oct Inflation Rate MoM Prel, exp.: -0.5%

FR 08:45: Sep Household Consumption MoM, exp.: 2.3%

EC 10:00: ECB Mersch speech

EC 11:00: Q3 GDP Growth Rate YoY Flash, exp.: -14.7%

EC 11:00: Q3 GDP Growth Rate QoQ Flash, exp.: -11.8%

EC 11:00: Sep Unemployment Rate, exp.: 8.1%

EC 11:00: Oct Core Inflation Rate YoY Flash, exp.: 0.2%

EC 11:00: Oct Inflation Rate YoY Flash, exp.: -0.3%

EC 11:00: Oct Inflation Rate MoM Flash, exp.: 0.1%

EC 13:00: ECB Guindos speech

GE 15:30: Bundesbank Weidmann speech

MORNING TRADING

In Asian trading hours, EUR/USD rebounded to 1.1692 and GBP/USD edged up to 1.2935. USD/JPY fell to 104.43. This morning, official data showed that Japan's jobless rate was unchanged at 3.0% in September (3.1% expected), while industrial production rose 4.0% on month (+3.0% expected).

Spot gold bounced to $1,877 an ounce.

#UK - IRELAND#

IAG, an airline group, reported that 3Q adjusted loss after tax totaled 1.21 billion euros, compared with an adjusted profit after tax of 1.01 billion euros in the prior-year quarter, and adjusted operating loss amounted to 1.30 billion euros, compared with an adjusted operating profit of 1.43 billion euros in the prior-year period.

Glencore, a commodity trading and mining company, posted 3Q production report: "Own sourced copper production of 934,700 tonnes was 81,100 tonnes (8%) lower than the comparable prior period, (...) Own source zinc production of 860,100 tonnes was 50,900 tonnes (6%) higher than the comparable prior period, (...) Own sourced nickel production of 81,800 tonnes was 7,600 tonnes (9%) lower than the comparable prior period."

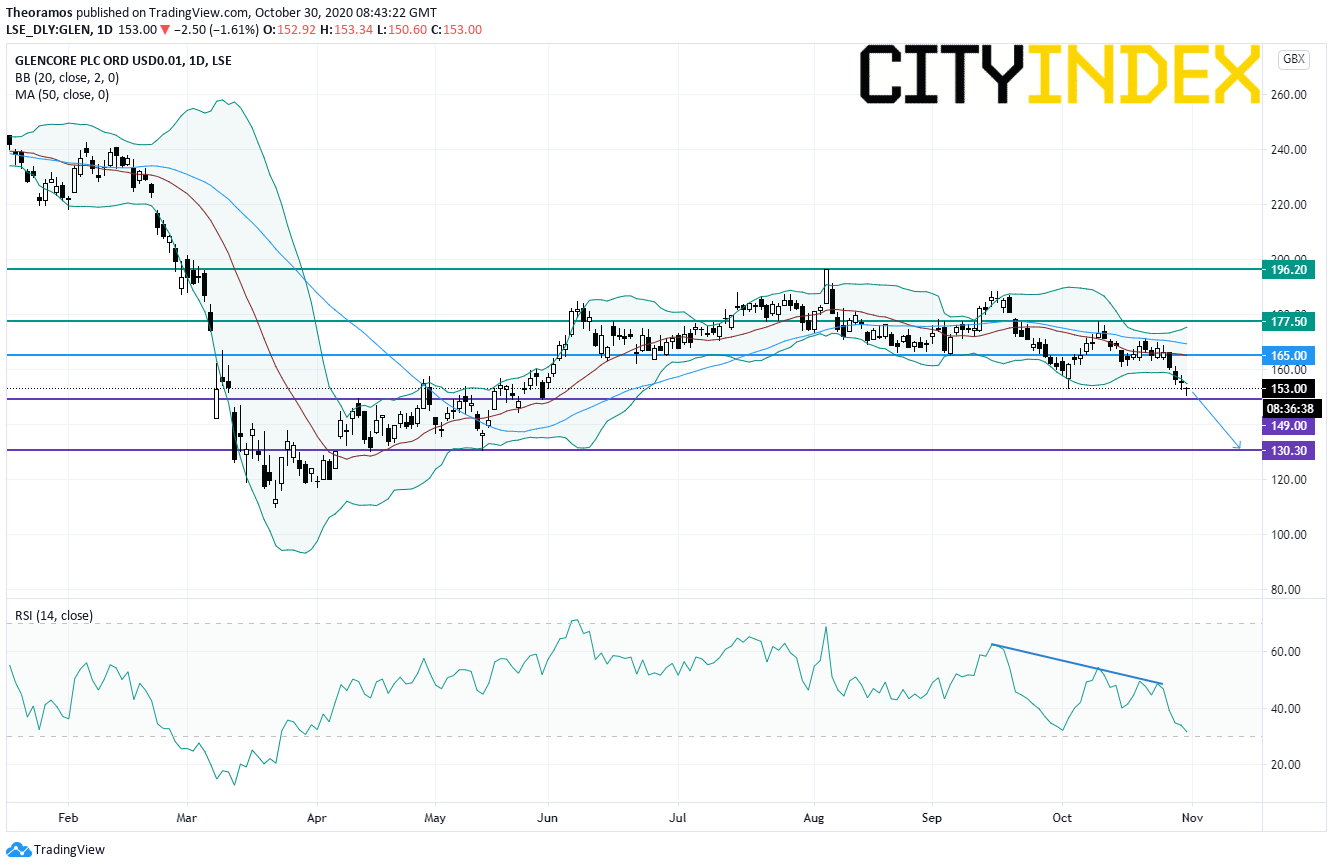

From a technical point of view, the stock is under pressure after breaking the horizontal support area at 165p. Moreover, the Relative Strength Index is capped by a short term declining trend line. Below the key level at 165p, a continuation of the down move is likely towards 149p and the bottom of May at 130.3p. Alternatively, a break above 165p would call for a reversal up trend with 177.5p as first target.

Source: TradingView, GAIN Capital

#GERMANY#

Continental, an automotive parts manufacturer, said CEO Elmar Degenhart has informed the board about his intention to resign from his position effective November 30, for reasons of immediately essential preventive health care.

#FRANCE#

Total, a giant oil producer, announced 3Q adjusted net income declined 72% on year to 848 million dollars and adjusted net operating income from business segments dropped 60% to 1.46 billion dollars.

Ubisoft, a video game company, posted 1H adjusted operating income jumped to 114 million euros from 7 million euros in the prior-year period. Revenue was up 8.5% on year to 757 million euros and net booking increased 14.2% to 755 million euros. The company has lowered its full-year net booking forecast to 2.20 - 2.35 billion euros from 2.35 - 2.65 billion euros previously and adjusted operating income guidance was narrowed to 420 - 520 million euros from 400 - 600 million euros.

#SPAIN#

BBVA, a major Spanish bank, reported that 3Q net income slid 6.9% on year to 1.14 billion euros, but up from 636 million euros in 2Q, as impairment charge reduced to 928 million from 1.57 billion euros. Net interest income dropped 10.2% on year to 4.11 billion euros.

#SWITZERLAND#

Swiss Re, an insurance group, posted a 9-month net loss of 691 million dollars, compared with a net income of 1.34 billion dollars in the prior-year period, citing a 3.00 billion dollars of COVID-19 claims and reserves. Meanwhile, net premiums earned and fee income grew 1.1% on year to 30.16 billion dollars.

#DENMARK#

Novo Nordisk, a Danish multinational pharmaceutical company, reported that 3Q net profit grew 1.0% on year to 10.30 billion Danish krone while operating profit slipped 0.1% to 12.81 billion Danish krone on net sales of 30.93 billion Danish krone, up 2.1%.