EU indices still down this morning | TA focus on Sika

Yesterday, European stocks ended in negative territory. The Stoxx Europe 600 Index declined 0.52%, Germany's DAX 30 dropped 0.35%, France's CAC 40 slipped 0.23%, and the U.K.'s FTSE 100 was down 0.51%.

EUROPE ADVANCE/DECLINE

62% of STOXX 600 constituents traded lower or unchanged yesterday.

43% of the shares trade above their 20D MA vs 47% Monday (above the 20D moving average).

54% of the shares trade above their 200D MA vs 55% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 0.08pt to 26.9, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Industrial

3mths relative low: Telecom., Energy

Europe Best 3 sectors

utilities, technology, industrial goods & services

Europe worst 3 sectors

banks, energy, insurance

INTEREST RATE

The 10yr Bund yield was unchanged to -0.53% (below its 20D MA). The 2yr-10yr yield spread rose 1bp to -17bps (above its 20D MA).

ECONOMIC DATA

GE 07:00: Aug Import Prices YoY, exp.: -4.6%

GE 07:00: Aug Import Prices MoM, exp.: 0.3%

GE 07:00: Aug Unemployment Rate Harmonised, exp.: 4.4%

GE 07:00: Aug Retail Sales MoM, exp.: -0.9%

GE 07:00: Aug Retail Sales YoY, exp.: 4.2%

UK 07:00: Q2 Current Account, exp.: £-21.1B

UK 07:00: Q2 Business Investment QoQ final, exp.: -0.3%

UK 07:00: Q2 Business Investment YoY final, exp.: 0.8%

UK 07:00: Q2 GDP Growth Rate QoQ final, exp.: -2.2%

UK 07:00: Q2 GDP Growth Rate YoY final, exp.: -1.7%

UK 07:00: Sep Nationwide Housing Prices YoY, exp.: 3.7%

UK 07:00: Sep Nationwide Housing Prices MoM, exp.: 2%

FR 07:45: Aug Household Consumption MoM, exp.: 0.5%

FR 07:45: Aug PPI MoM, exp.: 0.4%

FR 07:45: Sep Inflation Rate MoM Prel, exp.: -0.1%

FR 07:45: Sep Harmonised Inflation Rate YoY Prel, exp.: 0.2%

FR 07:45: Sep Harmonised Inflation Rate MoM Prel, exp.: -0.1%

FR 07:45: Sep Inflation Rate YoY Prel, exp.: 0.2%

EC 08:20: ECB President Lagarde speech

GE 08:55: Sep Unemployment chg, exp.: -9K

GE 08:55: Sep Unemployment Rate, exp.: 6.4%

UK 09:30: BoE FPC Meeting

UK 09:30: BoE Haldane speech

GE 10:40: 5-Year Bobl auction, exp.: -0.69%

GE 12:30: Bundesbank Wuermeling speech

EC 15:00: ECB Lane speech

MORNING TRADING

In Asian trading hours, EUR/USD eased to 1.1733 and GBP/USD retreated to 1.2845. USD/JPY slipped to 105.59. This morning, official data showed that Japan's industrial production grew 1.7% on month in August (+1.4% expected) and retail sales rose 4.6% (+2.0% expected). AUD/USD fell to 0.7113. Earlier today, China's official Manufacturing PMI rose to a 6-month high of 51.5 in September (51.3 expected) from 51.0 in August and Non-manufacturing PMI climbed to the highest level since November 2013 at 55.9 (54.7 expected) from 55.2. On the other hand, China's Caixin Manufacturing PMI slipped to 53.0 in September (53.1 expected) from 53.1 in August.

Spot gold dropped to $1,890 an ounce.

#UK - IRELAND#

Compass Group, a contract foodservice company, reported that 4Q organic revenue decline is expected to be narrowed to -38% from -45% in 3Q, and full-year organic revenue is estimated to be down 19%. The company added that it "is now at breakeven at a trading level".

William Hill, a bookmaker, and American resorts operator Caesars Entertainment announced that they have reached agreement on the terms of a recommended cash acquisition of 272p per William Hill's share, valuing the company at approximately 2.9 billion pounds.

QinetiQ Group, a defence technology company, issued a trading update: "The Board has decided to pay an additional dividend of 4.4p per share, representing the deferred final dividend from FY20. This results in a total dividend for the year ended 31 March 2020 of 6.6p per share. (...) We anticipate full year order intake to be strong, ahead of the prior year, and we expect high single digit percentage revenue growth compared to last year (low single digit growth on an organic basis)."

Rio Tinto, a giant mining group, was downgraded to "hold" from "buy" at Societe Generale.

#FRANCE#

Bouygues, an industrial group, said it intends to sell 11 million shares of Alstom, lowering its stake in the company to about 9.7% from around 14.5%.

#ITALY#

Mediobanca, an Italian investment bank, had considered acquiring Generali's 3.2 billion euros private banking and wealth management unit, reported Bloomberg citing people familiar with the matter.

#SWITZERLAND#

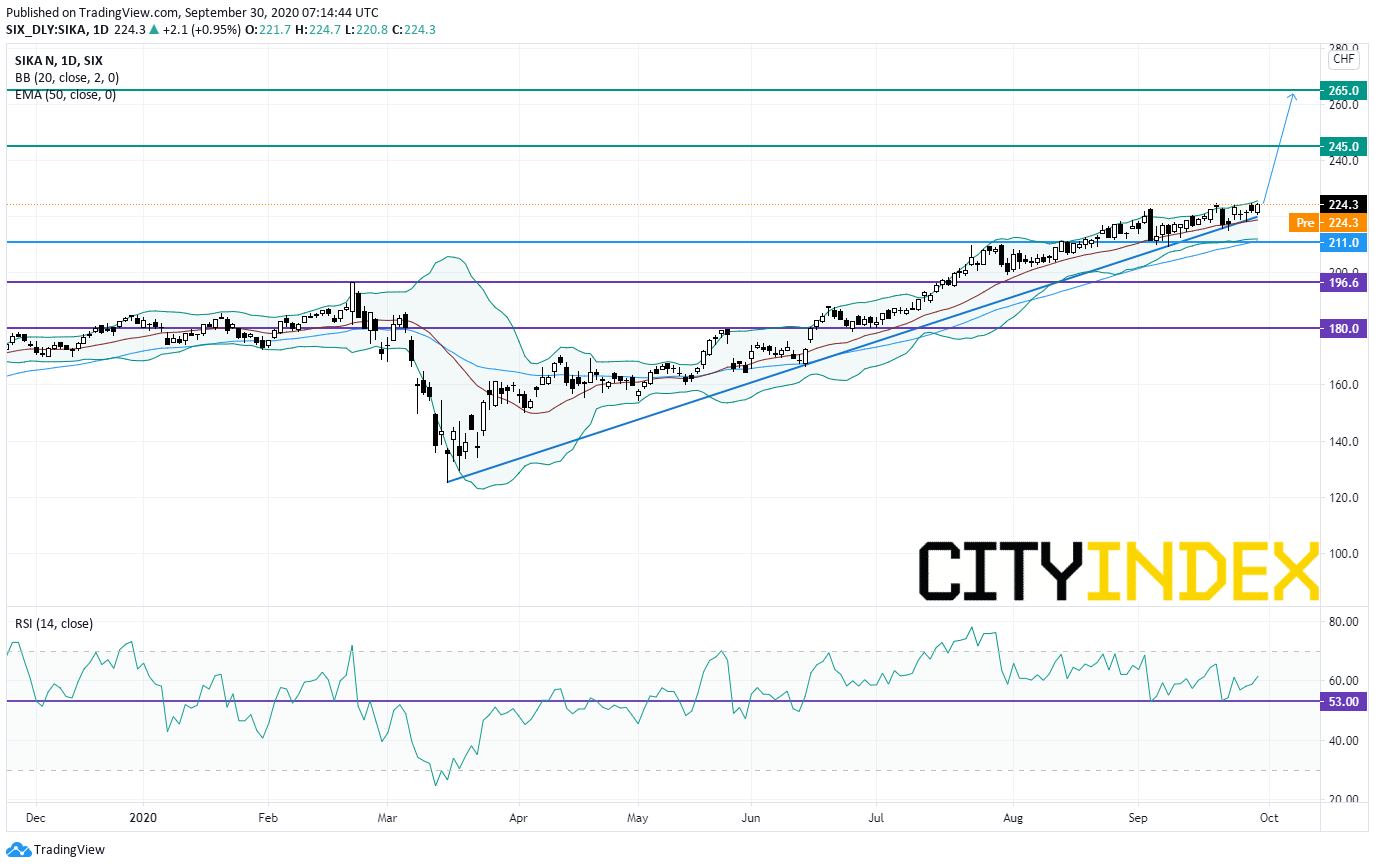

Sika, a specialty chemical company, confirmed its target of growing 6% - 8% a year in local currencies until 2023 and is aiming for a higher EBIT margin of 15% - 18% from 2021 onwards.

From a daily point of view, the share is supported by a rising trend line drawn since March. Furthermore, the exponential 50-period moving average plays a support role, while the Relative Strength Index is on the upside, above the key support at 53%. Above the horizontal support at 211CHF, targets are set at 245CHF and 265CHF in extension.

Source: TradingView, GAIN Capital