EU indices under pressure | TA focus on Nestle

INDICES

Yesterday, European stocks closed mixed. The Stoxx Europe 600 Index was little changed, Germany's DAX 30 edged down 0.10%, while France's CAC 40 gained 0.60%, and the U.K.'s FTSE 100 closed flat.

EUROPE ADVANCE/DECLINE

42% of STOXX 600 constituents traded lower or unchanged yesterday.

47% of the shares trade above their 20D MA vs 47% Tuesday (below the 20D moving average).

50% of the shares trade above their 200D MA vs 49% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.17pt to 24.23, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Utilities

3mths relative low: Energy

Europe Best 3 sectors

real estate, retail, food & beverage

Europe worst 3 sectors

automobiles & parts, banks, chemicals

INTEREST RATE

The 10yr Bund yield fell 4bps to -0.49% (below its 20D MA). The 2yr-10yr yield spread fell 0bp to -18bps (above its 20D MA).

ECONOMIC DATA

GE 07:00: Jun Unemployment Rate Harmonised, exp.: 3.9%

UK 07:00: Jul Nationwide Housing Prices YoY

UK 07:00: Jul Nationwide Housing Prices MoM

FR 07:45: Jun PPI MoM

GE 08:55: Jul Unemployment chg, exp.: 69K

GE 08:55: Jul Unemployment Rate, exp.: 6.4%

EC 09:00: ECB Economic Bulletin

GE 09:00: Q2 GDP Growth Rate YoY Flash

GE 09:00: Q2 GDP Growth Rate QoQ Flash

UK 09:00: Jun Car Production YoY

EC 10:00: Jul Consumer Inflation expectations, exp.: 21.6

EC 10:00: Jul Consumer Confidence final

EC 10:00: Jul Economic Sentiment, exp.: 75.7

EC 10:00: Jul Industrial Sentiment

EC 10:00: Jul Services Sentiment

EC 10:00: Jun Unemployment Rate, exp.: 7.4%

GE 13:00: Jul Harmonised Inflation Rate MoM Prel, exp.: 0.7%

GE 13:00: Jul Harmonised Inflation Rate YoY Prel, exp.: 0.8%

GE 13:00: Jul Inflation Rate MoM Prel, exp.: 0.6%

GE 13:00: Jul Inflation Rate YoY Prel, exp.: 0.9%

MORNING TRADING

In Asian trading hours, the U.S. dollar continued show weakness against other major currencies. EUR/USD remained at elevated levels around 1.1780, and GBP/USD was still buoyed around 1.2990. USD/JPY kept wavering around the key 105.00 level. Japanese official data showed that retail sales growth (June) was +13.1% on month and -1.2% on year, better than expected. AUD/USD was well supported above 0.7160. Official data showed that the number of building approvals in Australia dropped 4.9% on month in June, worse than expected.

Spot gold traded slightly lower at $1,964 an ounce.

#UK - IRELAND#

Lloyds Banking Group, a British bank, posted a 2Q pretax loss of 676 million pounds (worse than expected) citing a 2.4 billion-pound charge for bad loans.

Standard Chartered, a British bank, reported that 2Q underlying profit before tax slumped 40% on year to 733 million dollars, citing a surge in credit impairments to 611 million dollars.

Royal Dutch Shell, an oil producer, posted 2Q adjusted profit at 638 million dollars, compared to a loss of 664 million dollars expected. The Company proposed maintaining 2Q dividend at 16 cents per share.

BAE Systems, a defence contractor, announced 1H results: "Revenue increased to 9.2 billion pounds (2019 8.7 billion pounds), up 5% on a constant currency basis (...) Operating profit was 808 million pounds (2019 896 million pounds), down 10% on last year, (...) Underlying earnings per share for the period decreased by 15% to 18.7 pence (...) The Board has declared an interim dividend of 13.8 pence in respect of the year ended 31 December 2019 (...) the Board has also declared an interim dividend of 9.4p in respect of the half-year ended 30 June 2020."

#GERMANY#

Volkswagen, a car maker, reported that it swung to a 1H pretax loss of 1.40 billion euros from a profit of 9.60 billion in the prior-year period on sales of 96.10 billion euros, down 23.2% on year. The Company proposed lowering ordinary share dividend to 4.80 euros per share from 6.50 euros in the prior year.

Fresenius SE, a global health care group, posted 2Q net income down 13% on year to 411 million euros and EBIT before special items were flat at 1.12 billion euros.

Fresenius Medical Care, which offers kidney dialysis services, announced that 2Q net income rose 38% on year to 351 million euros and EBIT were up 26% to 656 million euros on revenue of 4.56 billion euros, up 5%.

Linde: 2Q results expected

#FRANCE#

Airbus Group, an airplane maker, reported that it swung to a 2Q net loss of 1.44 billion euros from a net income of 1.16 billion euros in the prior-year period, with revenue slumping 55% to 8.32 billion euros. 2Q EBIT Adjusted ran into a loss of 1.23 billion euros compared to a profit of 1.98 billion euros a year earlier. The Company's CEO said: "The impact of the COVID-19 pandemic on our financials is now very visible in the second quarter, with H1 commercial aircraft deliveries halving compared to a year ago."

Veolia Environnement, which operates utility and public transportation business, swung into a 1H net loss of 138 million euros from a net income of 331 million euros in the prior-year period, on revenue of 12.41 billion euros, down 6.8% on year.

#SPAIN#

BBVA, a Spanish bank, posted a 2Q net income of 636 million euros, compared to a net loss of 50 million euros in the prior-year period. The Bank made provisions of 1.6 billion euros including those worth 644 million euros related to COVID-19.

Telefonica, a Spanish telecoms giant, reported that 2Q OIBDA were down 25.3% on year to 3.32 billon euros on revenue of 10.30 billion euros, down 15.0%.

#BENELUX#

Anheuser-Busch InBev, the world's largest brewer, announced that 2Q net income slumped to 351 million dollars from 2.48 billion dollars in the prior-year period. The Company pointed out an business writedown of 2.5 billion dollars due to the coronavirus pandemic.

#ITALY#

Generali, an Italian insurance firm, reported that 1H net income plunged 57% on year to 774 million euros, citing impairments of 226 million euros.

#SWITZERLAND#

Credit Suisse, the second largest bank in Switzerland, reported that 2Q net income increased 24% on year to 1.16 Swiss francs. Provisions for credit impairments grew to 296 million Swiss francs from 25 million Swiss francs in the prior-year period. Meanwhile, it announced some strategic chances saying it would create a global investment bank.

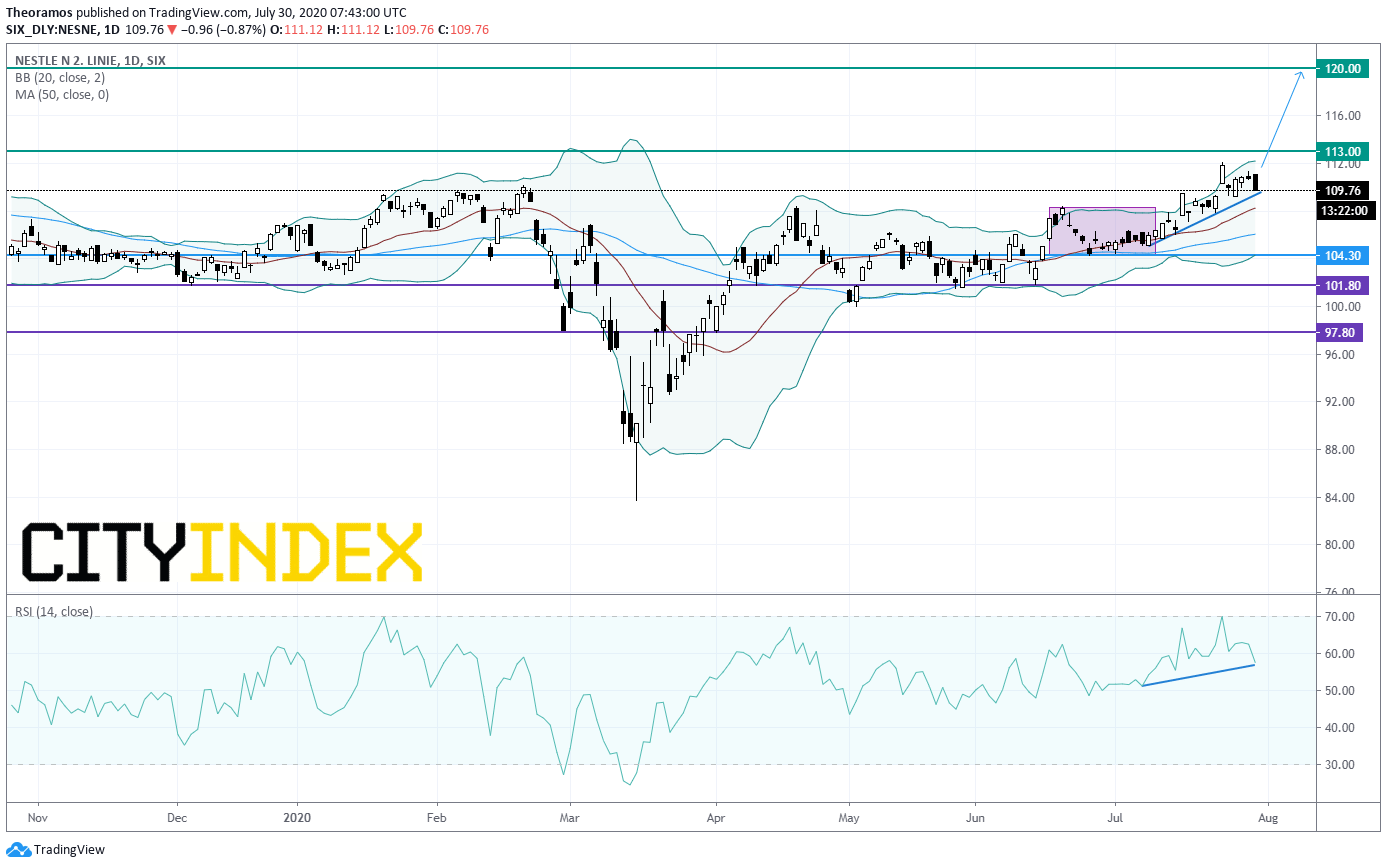

Nestle, a Swiss giant food producer, announced that 1H net income rose 18.3% on year to 5.90 billion Swiss francs (Earnings per share +22.2% to 2.06 Swiss francs) on sales of 41.15 billion Swiss francs, down 9.5% (+2.8% organic growth). Looking into 2020 the Company said it expects full-year organic sales growth between 2% and 3%.

From a daily point of view, prices are supported by a rising trend line drawn since July, after a short term consolidation period mid-June. Moreover, the RSI remains above the 50%. Above 104.3CHF look for the September resistance at 113CHF, and then 120CHF in extension. Alternatively, a break below 104.3CHF would call for a consolidation to 101.80CHF.

Source: GAIN Capital, TradingView

LafargeHolcim, a building material producer, reported that 1H net income slumped 65.7% on year to 347 million Swiss francs on revenue of 10.69 billion Swiss francs, down 10.8%.

Yesterday, European stocks closed mixed. The Stoxx Europe 600 Index was little changed, Germany's DAX 30 edged down 0.10%, while France's CAC 40 gained 0.60%, and the U.K.'s FTSE 100 closed flat.

EUROPE ADVANCE/DECLINE

42% of STOXX 600 constituents traded lower or unchanged yesterday.

47% of the shares trade above their 20D MA vs 47% Tuesday (below the 20D moving average).

50% of the shares trade above their 200D MA vs 49% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.17pt to 24.23, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Utilities

3mths relative low: Energy

Europe Best 3 sectors

real estate, retail, food & beverage

Europe worst 3 sectors

automobiles & parts, banks, chemicals

INTEREST RATE

The 10yr Bund yield fell 4bps to -0.49% (below its 20D MA). The 2yr-10yr yield spread fell 0bp to -18bps (above its 20D MA).

ECONOMIC DATA

GE 07:00: Jun Unemployment Rate Harmonised, exp.: 3.9%

UK 07:00: Jul Nationwide Housing Prices YoY

UK 07:00: Jul Nationwide Housing Prices MoM

FR 07:45: Jun PPI MoM

GE 08:55: Jul Unemployment chg, exp.: 69K

GE 08:55: Jul Unemployment Rate, exp.: 6.4%

EC 09:00: ECB Economic Bulletin

GE 09:00: Q2 GDP Growth Rate YoY Flash

GE 09:00: Q2 GDP Growth Rate QoQ Flash

UK 09:00: Jun Car Production YoY

EC 10:00: Jul Consumer Inflation expectations, exp.: 21.6

EC 10:00: Jul Consumer Confidence final

EC 10:00: Jul Economic Sentiment, exp.: 75.7

EC 10:00: Jul Industrial Sentiment

EC 10:00: Jul Services Sentiment

EC 10:00: Jun Unemployment Rate, exp.: 7.4%

GE 13:00: Jul Harmonised Inflation Rate MoM Prel, exp.: 0.7%

GE 13:00: Jul Harmonised Inflation Rate YoY Prel, exp.: 0.8%

GE 13:00: Jul Inflation Rate MoM Prel, exp.: 0.6%

GE 13:00: Jul Inflation Rate YoY Prel, exp.: 0.9%

MORNING TRADING

In Asian trading hours, the U.S. dollar continued show weakness against other major currencies. EUR/USD remained at elevated levels around 1.1780, and GBP/USD was still buoyed around 1.2990. USD/JPY kept wavering around the key 105.00 level. Japanese official data showed that retail sales growth (June) was +13.1% on month and -1.2% on year, better than expected. AUD/USD was well supported above 0.7160. Official data showed that the number of building approvals in Australia dropped 4.9% on month in June, worse than expected.

Spot gold traded slightly lower at $1,964 an ounce.

#UK - IRELAND#

Lloyds Banking Group, a British bank, posted a 2Q pretax loss of 676 million pounds (worse than expected) citing a 2.4 billion-pound charge for bad loans.

Standard Chartered, a British bank, reported that 2Q underlying profit before tax slumped 40% on year to 733 million dollars, citing a surge in credit impairments to 611 million dollars.

Royal Dutch Shell, an oil producer, posted 2Q adjusted profit at 638 million dollars, compared to a loss of 664 million dollars expected. The Company proposed maintaining 2Q dividend at 16 cents per share.

BAE Systems, a defence contractor, announced 1H results: "Revenue increased to 9.2 billion pounds (2019 8.7 billion pounds), up 5% on a constant currency basis (...) Operating profit was 808 million pounds (2019 896 million pounds), down 10% on last year, (...) Underlying earnings per share for the period decreased by 15% to 18.7 pence (...) The Board has declared an interim dividend of 13.8 pence in respect of the year ended 31 December 2019 (...) the Board has also declared an interim dividend of 9.4p in respect of the half-year ended 30 June 2020."

#GERMANY#

Volkswagen, a car maker, reported that it swung to a 1H pretax loss of 1.40 billion euros from a profit of 9.60 billion in the prior-year period on sales of 96.10 billion euros, down 23.2% on year. The Company proposed lowering ordinary share dividend to 4.80 euros per share from 6.50 euros in the prior year.

Fresenius SE, a global health care group, posted 2Q net income down 13% on year to 411 million euros and EBIT before special items were flat at 1.12 billion euros.

Fresenius Medical Care, which offers kidney dialysis services, announced that 2Q net income rose 38% on year to 351 million euros and EBIT were up 26% to 656 million euros on revenue of 4.56 billion euros, up 5%.

Linde: 2Q results expected

#FRANCE#

Airbus Group, an airplane maker, reported that it swung to a 2Q net loss of 1.44 billion euros from a net income of 1.16 billion euros in the prior-year period, with revenue slumping 55% to 8.32 billion euros. 2Q EBIT Adjusted ran into a loss of 1.23 billion euros compared to a profit of 1.98 billion euros a year earlier. The Company's CEO said: "The impact of the COVID-19 pandemic on our financials is now very visible in the second quarter, with H1 commercial aircraft deliveries halving compared to a year ago."

Veolia Environnement, which operates utility and public transportation business, swung into a 1H net loss of 138 million euros from a net income of 331 million euros in the prior-year period, on revenue of 12.41 billion euros, down 6.8% on year.

#SPAIN#

BBVA, a Spanish bank, posted a 2Q net income of 636 million euros, compared to a net loss of 50 million euros in the prior-year period. The Bank made provisions of 1.6 billion euros including those worth 644 million euros related to COVID-19.

Telefonica, a Spanish telecoms giant, reported that 2Q OIBDA were down 25.3% on year to 3.32 billon euros on revenue of 10.30 billion euros, down 15.0%.

#BENELUX#

Anheuser-Busch InBev, the world's largest brewer, announced that 2Q net income slumped to 351 million dollars from 2.48 billion dollars in the prior-year period. The Company pointed out an business writedown of 2.5 billion dollars due to the coronavirus pandemic.

#ITALY#

Generali, an Italian insurance firm, reported that 1H net income plunged 57% on year to 774 million euros, citing impairments of 226 million euros.

#SWITZERLAND#

Credit Suisse, the second largest bank in Switzerland, reported that 2Q net income increased 24% on year to 1.16 Swiss francs. Provisions for credit impairments grew to 296 million Swiss francs from 25 million Swiss francs in the prior-year period. Meanwhile, it announced some strategic chances saying it would create a global investment bank.

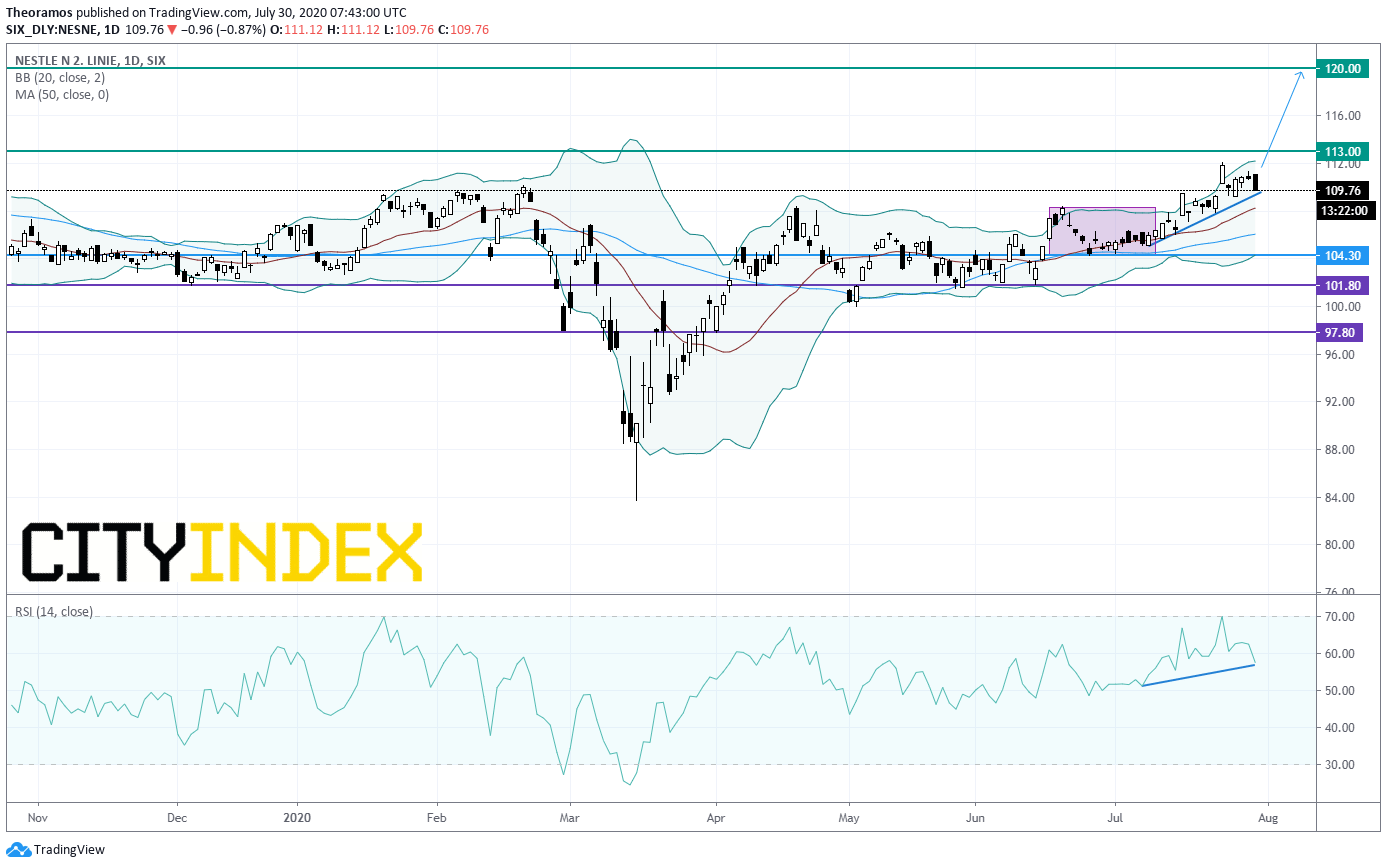

Nestle, a Swiss giant food producer, announced that 1H net income rose 18.3% on year to 5.90 billion Swiss francs (Earnings per share +22.2% to 2.06 Swiss francs) on sales of 41.15 billion Swiss francs, down 9.5% (+2.8% organic growth). Looking into 2020 the Company said it expects full-year organic sales growth between 2% and 3%.

From a daily point of view, prices are supported by a rising trend line drawn since July, after a short term consolidation period mid-June. Moreover, the RSI remains above the 50%. Above 104.3CHF look for the September resistance at 113CHF, and then 120CHF in extension. Alternatively, a break below 104.3CHF would call for a consolidation to 101.80CHF.

Source: GAIN Capital, TradingView

LafargeHolcim, a building material producer, reported that 1H net income slumped 65.7% on year to 347 million Swiss francs on revenue of 10.69 billion Swiss francs, down 10.8%.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM