US Futures losing some ground, watch COST, CRM, JWN, DELL, ULTA

The S&P 500 futures remain under pressure after they erased gains to close in the red yesterday, as President Donald Trump announced plans to hold a press conference on China. Beijing has just passed a controversial national security law which is widely expected to erode Hong Kong's autonomy.

Later today, Wholesale Inventories (-0.7% on month in April expected), Personal Income (-6.0% on month expected), Personal Spending (-12.8% on month expected), Market News International's Chicago Purchasing Managers Index (40.0 in May expected) and the University of Michigan's Consumer Sentiment Index (74.0 in May expected) will be reported.

European indices are under pressure. The European Commission has posted May CPI at -0.1% (vs +0.1% on year expected). The European Central Bank has reported the eurozone's M3 money supply in April at +8.3% (vs +8.2% on year expected). The German Federal Statistical Office has reported April retail sales at -5.3% (vs -12.0% on month expected). France's INSEE has released final readings of 1Q GDP at -5.3% (vs -5.4% on year expected) and May CPI at +0.2% (vs +0.3% on year expected).

Asian indices closed in the red. This morning, official data showed that Japan's industrial production declined 9.1% on month in April (-5.7% expected), and retail sales fell 9.6% (-6.9% expected). Meanwhile, jobless rate edged up to 2.6% in April (2.7% expected) from 2.5% in March.

WTI Crude Oil Futures remain under pressure despite a build of 7.9 million barrels in U.S. crude-oil stockpiles last week as reported by the Energy Information Administration.

Gold gains ground while the US dollar is still consolidating before Donald Trump press conference.

Gold rose 10.15$ (+0.59%) to 1728.48 dollars. The EUR/USD rose 63pips to 1.114 while the GBP/USD gained 26pips to 1.2347.

US Equity Snapshot

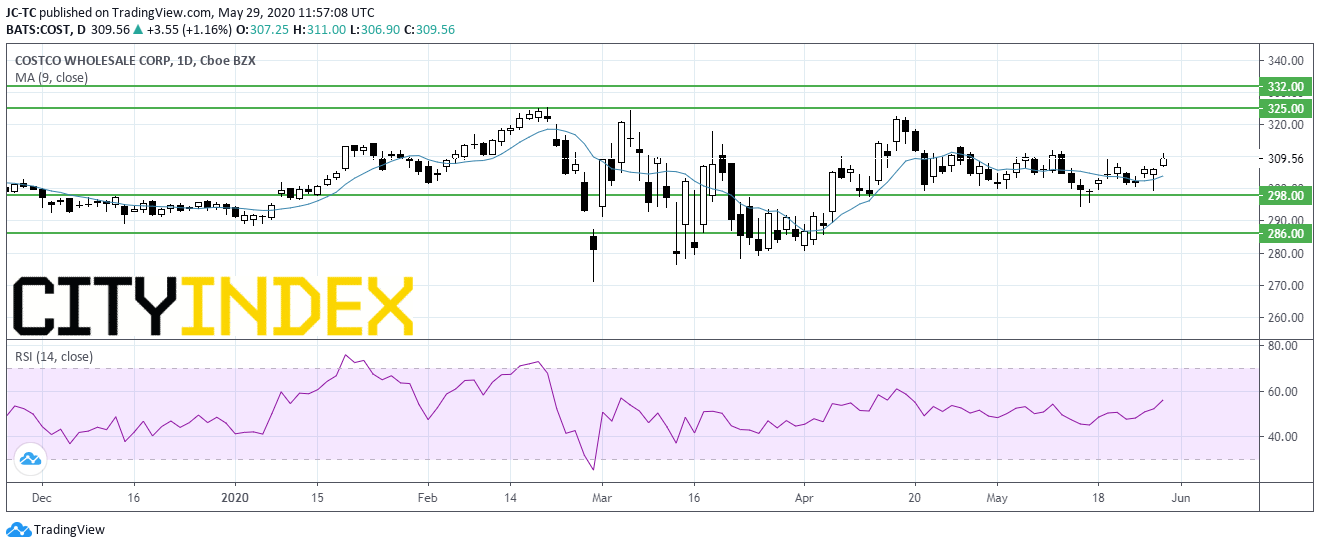

Costco Wholesale (COST), an operator of a chain of warehouse stores, reported third quarter EPS of 1.89 dollar, lower than expected, flat year on year, on sales of 37.3 billion dollars, slightly above the consensus, up from 34.7 billion dollars in the year before.

Salesforce.com (CRM), a developer of business software, cut its full year guidance. The company now expects full year sales to be around 20 billion dollars vs a previous forecast of 21-21.1 billion dollars. The company also sees a full year LPS of 0.06 to 0.04 dollar vs an earlier outlook of breaking even or a 0.01 dollar EPS. Separately, Salesforce.com revealed first quarter adjusted EPS of 0.70 dollar, just above estimates, down from 0.93 dollar a year ago, on sales of 4.9 billion dollars, just above consensus, up from 3.7 billion dollars in the previous year.

Nordstrom (JWN), the North American fashion retailer, disclosed first quarter LPS of 3.33 dollars, worse than expected, down from an EPS of 0.23 dollar a year ago on sales of 2.0 billion dollars, below forecasts, down from 3.3 billion dollars in the prior year. Company's CEO Erik Nordstrom, said that "we have sufficient liquidity to successfully execute our strategy in 2020 and over the longer term."

Dell Technologies (DELL), a computer technology company, jumped in extended trading after posting better than expected quarterly earnings.

Ulta Beauty (ULTA), an operator of a chain of beauty retailers, announced first quarter LPS of 1.39 dollar, significantly missing estimates, down from an EPS of 3.26 dollars a year ago, on sales of 1.2 billion dollars, as expected, down from 1.7 billion dollars a year earlier.

Later today, Wholesale Inventories (-0.7% on month in April expected), Personal Income (-6.0% on month expected), Personal Spending (-12.8% on month expected), Market News International's Chicago Purchasing Managers Index (40.0 in May expected) and the University of Michigan's Consumer Sentiment Index (74.0 in May expected) will be reported.

European indices are under pressure. The European Commission has posted May CPI at -0.1% (vs +0.1% on year expected). The European Central Bank has reported the eurozone's M3 money supply in April at +8.3% (vs +8.2% on year expected). The German Federal Statistical Office has reported April retail sales at -5.3% (vs -12.0% on month expected). France's INSEE has released final readings of 1Q GDP at -5.3% (vs -5.4% on year expected) and May CPI at +0.2% (vs +0.3% on year expected).

Asian indices closed in the red. This morning, official data showed that Japan's industrial production declined 9.1% on month in April (-5.7% expected), and retail sales fell 9.6% (-6.9% expected). Meanwhile, jobless rate edged up to 2.6% in April (2.7% expected) from 2.5% in March.

WTI Crude Oil Futures remain under pressure despite a build of 7.9 million barrels in U.S. crude-oil stockpiles last week as reported by the Energy Information Administration.

Gold gains ground while the US dollar is still consolidating before Donald Trump press conference.

Gold rose 10.15$ (+0.59%) to 1728.48 dollars. The EUR/USD rose 63pips to 1.114 while the GBP/USD gained 26pips to 1.2347.

US Equity Snapshot

Costco Wholesale (COST), an operator of a chain of warehouse stores, reported third quarter EPS of 1.89 dollar, lower than expected, flat year on year, on sales of 37.3 billion dollars, slightly above the consensus, up from 34.7 billion dollars in the year before.

Salesforce.com (CRM), a developer of business software, cut its full year guidance. The company now expects full year sales to be around 20 billion dollars vs a previous forecast of 21-21.1 billion dollars. The company also sees a full year LPS of 0.06 to 0.04 dollar vs an earlier outlook of breaking even or a 0.01 dollar EPS. Separately, Salesforce.com revealed first quarter adjusted EPS of 0.70 dollar, just above estimates, down from 0.93 dollar a year ago, on sales of 4.9 billion dollars, just above consensus, up from 3.7 billion dollars in the previous year.

Nordstrom (JWN), the North American fashion retailer, disclosed first quarter LPS of 3.33 dollars, worse than expected, down from an EPS of 0.23 dollar a year ago on sales of 2.0 billion dollars, below forecasts, down from 3.3 billion dollars in the prior year. Company's CEO Erik Nordstrom, said that "we have sufficient liquidity to successfully execute our strategy in 2020 and over the longer term."

Dell Technologies (DELL), a computer technology company, jumped in extended trading after posting better than expected quarterly earnings.

Ulta Beauty (ULTA), an operator of a chain of beauty retailers, announced first quarter LPS of 1.39 dollar, significantly missing estimates, down from an EPS of 3.26 dollars a year ago, on sales of 1.2 billion dollars, as expected, down from 1.7 billion dollars a year earlier.

Source : TradingVIEW, Gain Capital

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM