US Futures rising ahead of Fed, watch GOOGL, BA, GE, F, SBUX, HAS

Later today, the U.S. government will report first-quarter GDP growth (an annualized rate of -4.0% on quarter expected). The Federal Reserve is expected to keep its benchmark interest rate unchanged at 0.00%-0.25%. March pending home sales are also due to be released today (-13.6% expected).

European indices are flat. Rating agency Fitch downgraded Italy's rating to "BBB-" from "BBB+" with a stable outlook, saying "the downgrade reflects the significant impact of the global Covid-19 pandemic on Italy's economy and the sovereign's fiscal position." The European Commission has posted the eurozone's April Economic Confidence Index at 67.0 (vs 74.7 expected). The European Central Bank has reported the eurozone's M3 money supply in March at +7.5% (vs +5.5% on year expected). The German Federal Statistical Office will release April CPI (+0.7% on year expected) later today.

Asian indices closed in the green. Earlier today, official data showed that Australia's 1Q CPI rose 2.2% on year (+1.9% expected).

WTI Crude Oil Futures are rebounding. The American Petroleum Institute (API) reported that U.S. crude oil stockpile built 9.98 million barrels for week ended April 24. Later today, The U.S. Energy Information Administration (EIA) will release crude oil inventories data for last week.

Gold fell 1.76 dollar (-0.1%) to 1706.03 dollars but remains at high levels on economic fears.

On the currencies side, the US dollar is still consolidating ahead of central bank meetings. EUR/USD rose 28pips to 1.0848 while USD/JPY declined 40pips to 106.47.

US Equity Snapshot

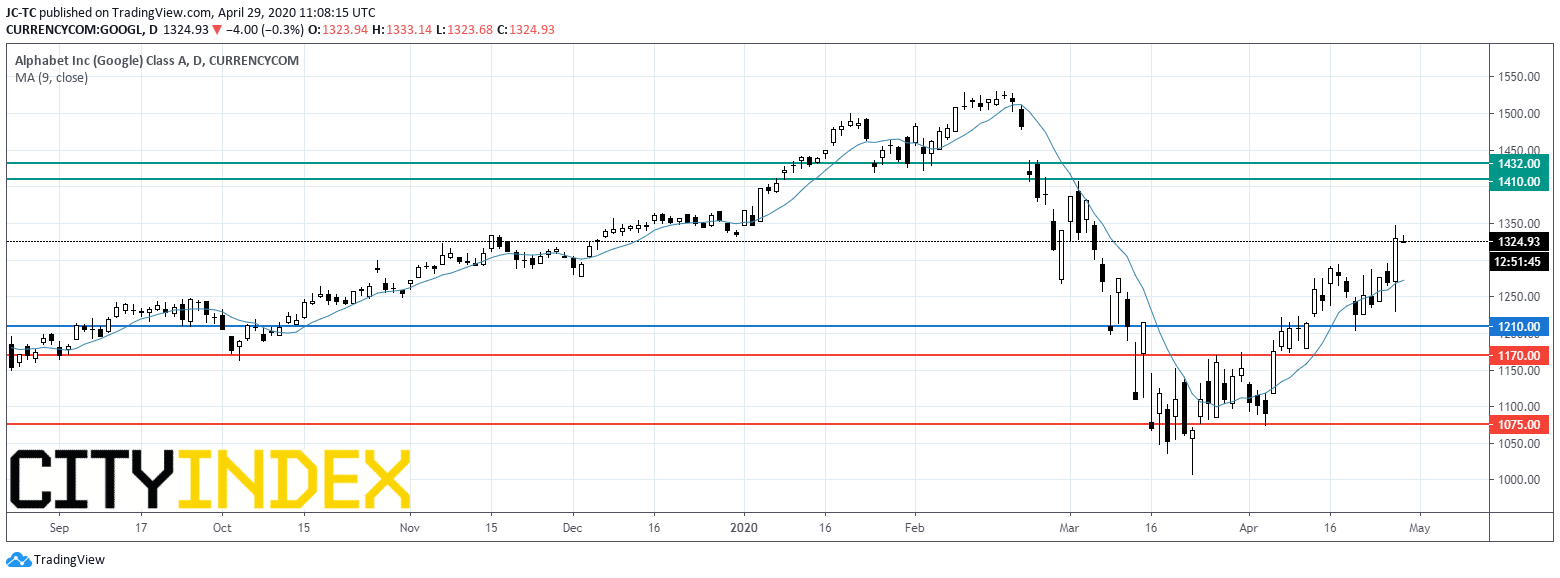

Alphabet (GOOGL), Google's holding company, jumped after hours after posting first quarter sales up 13% to 41.16 billion dollars, exceeding estimates. Adjusted EPS was down to 9.87 dollars from 10.81 dollars a year earlier, shy of forecasts.

Boeing (BA), the aircraft maker, posted first quarter LPS of 1.70 dollar vs adjusted EPS of 3.16 dollars a year earlier. Sales were down 26% to 16.91 billion dollars. Both figures missed forecasts. Free cash flow was negative 4.73 billion dollars from positive 2.29 billion dollars, but beat estimates. The company said it "is taking several actions that include reducing commercial airplane production rates" to "align the business for the new market reality". Boeing also targets a 10% cut in staff.

General Electric (GE), the conglomerate, unveiled first quarter adjusted EPS down to 0.05 dollar, below estimates, from 0.14 dollar a year earlier. Total revenue was down 8% to 20.52 billion dollars. Sales at Aviation division slipped 13% to 6.89 billion dollars. The company expects that financial results will decline sequentially in second quarter.

Ford (F), the carmaker, announced first quarter adjusted LPS of 0.23 dollar, worse than expected, vs an EPS of 0.44 dollar a year ago, on sales down 15% to 34.3 billion dollars, below forecasts. The company expects second quarter adjusted EBIT loss of more than 5.0 billion dollars, widening from 0.6 billion dollars in the first quarter, "as year-over-year industry volumes decline significantly in every region".

Starbucks (SBUX), the global specialty coffee chain, reported second quarter adjusted EPS down to 0.32 dollar, below estimates, from 0.60 dollar a year ago, on sales down to 6.0 billion dollars, better than anticipated, down from 6.3 billion dollars a year earlier.

Hasbro (HAS), the global toy and game company, announced it withdraws its full year guidance.

TradingView, GAIN Capital