U.S Futures try to rebound - Watch PINS, TIF, F, SPOT, CMCSA

The S&P 500 Futures are posting a tentative rebound after they encountered another selloff yesterday. Investors were deeply worried that the surge in coronavirus cases world-wide, particularly in Europe and the U.S., would lead to further lockdown measures.

Later today, the U.S. Commerce Department will report 3Q annualized GDP (+32.0% on quarter expected). The Labor Department will release initial jobless claims in the week ending October 24 (0.77 million expected). The National Association of Realtors will post September pending home sales (+3.0% on month expected).

European indices are mixed. The German Federal Statistical Office has posted October jobless rate at 6.2% (vs 6.3% expected). The Bank of England has released the number of mortgage approvals for September at 91,500 (vs 76,100 expected). The European Commission has reported the Eurozone’s October Economic Confidence Index at 90.9 (vs 89.6 expected) and Consumer Confidence at -15.5, vs -13.9 in September. Later today, the European Central Bank will announce its interest rates decision (deposit facility rate unchanged at -0.50% expected).

Asian indices closed in dispersed order as the Australian ASX faced a drop when the Chinese indices closed in the green. The Japanese Nikkei ended in the red. The Bank of Japan kept its benchmark rate unchanged at -0.10% and maintained 10-year government bond yield target at about 0%. BOJ downgraded Japan's 2020 GDP growth forecast to -5.5% from -4.7% previously and core CPI forecast was lowered to -0.6% from -0.5%. Meanwhile, official data showed that Japan's retail sales slipped 0.1% on month in September (+1.0% expected).

WTI Crude Oil futures remain under pressure. The U.S. Energy Information Administration (EIA) reported that U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) rose by 4.32M barrels, the highest increase since July.

On the US economic data front, the Mortgage Bankers Association's Mortgage Applications rose 1.7% for the week ending October 23rd, compared to -0.6% in the previous week. Finally, Wholesale Inventories fell 0.1% on month in the September preliminary reading (+0.4% expected), compared to a revised +0.3% in the August final reading.

The dollar index rose 0.26pt to 93.661.

U.S. Equity Snapshot

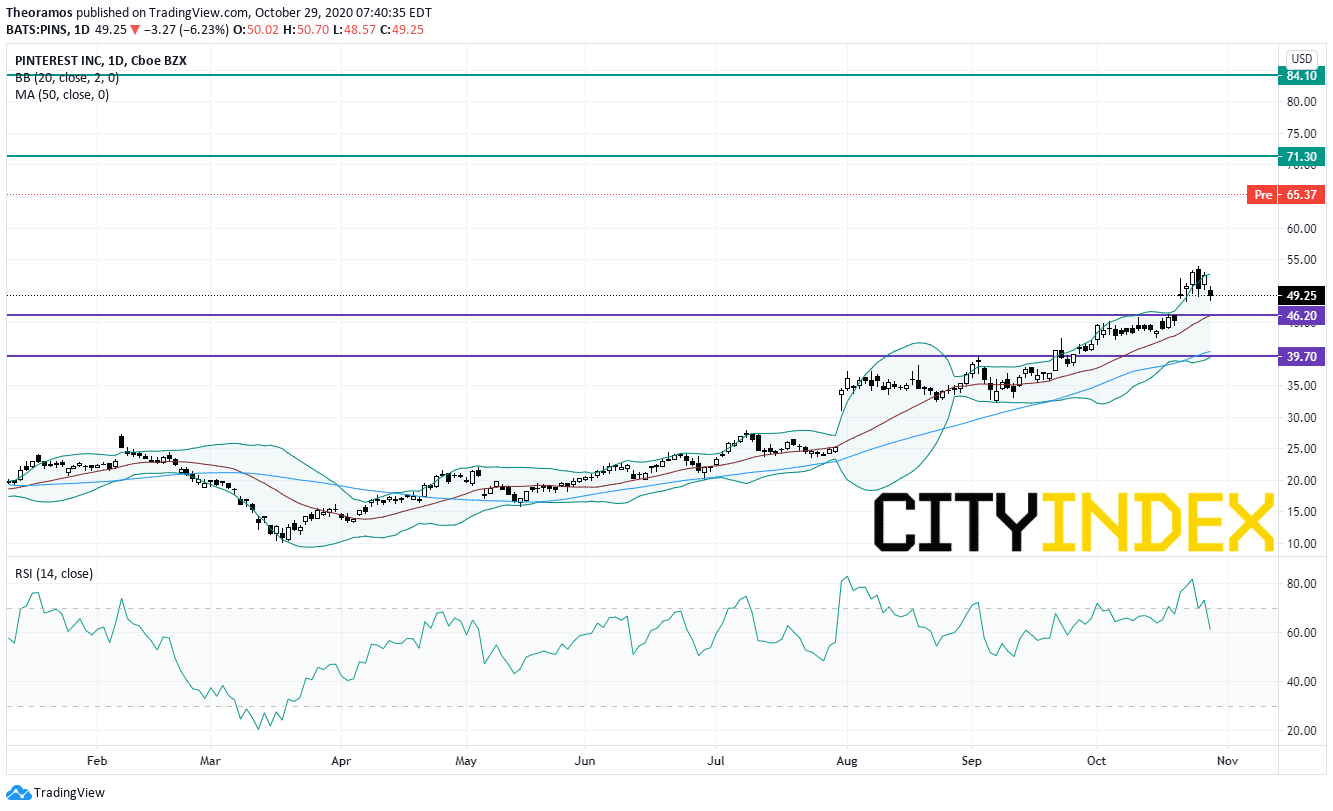

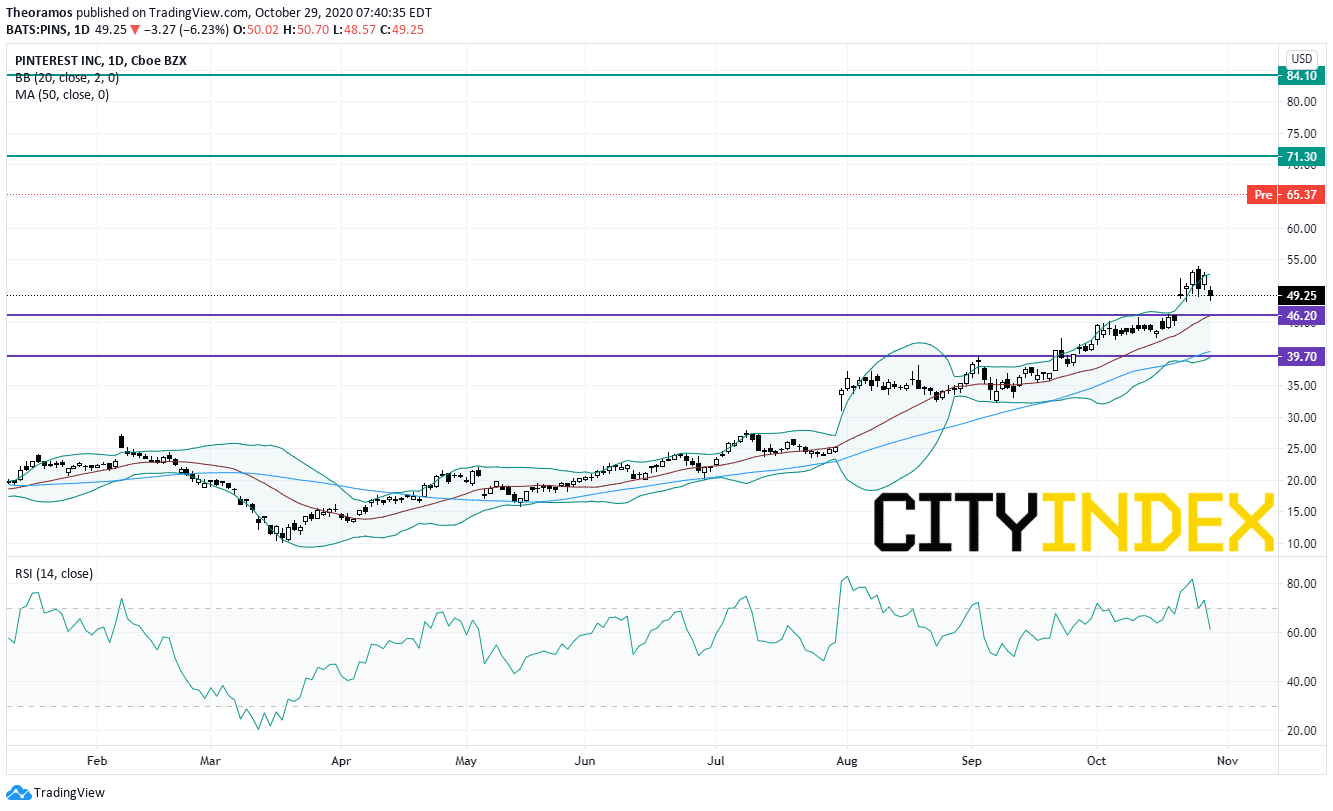

Pinterest (PINS), the social media, surged in extended trading after reporting quarterly adjusted EPS and sales that smashed estimates. Following that release, Facebook (FB) and Twitter (TWTR) also gained ground post market.

Source: TradingView, GAIN Capital

Tiffany (TIF), the jeweler, and LVMH, the world’s leading luxury products group, "have concluded an agreement modifying certain terms of their initial agreement to reflect a purchase price of 131.50 dollars in cash and to reduce closing conditionality. Other key terms of the Merger Agreement remain unchanged. Tiffany and LVMH have also agreed to settle their pending litigation in the Delaware Chancery Court. The merger is expected to close in early 2021, subject to Tiffany shareholder approval and customary closing conditions."

Ford Motor (F), the automobile manufacturer, disclosed third quarter adjusted EPS of 0.65 dollar, significantly above forecasts, up from 0.34 dollar a year ago, on revenue of 34.7 billion dollars, higher than expected, up from 33.9 billion dollars a year earlier.

Spotify (SPOT), the music streaming specialist, is losing ground before hours as quarterly earnings missed estimates.

Comcast (CMCSA), the media company, gains ground before hours as quarterly adjusted EPS beat estimates.

Visa (V), the credit card company, posted fourth quarter adjusted EPS of 1.12 dollar, ahead of estimates, down from 1.47 dollar a year ago, on net income of 2.1 billion dollars, down from 3.0 billion dollars in the year before.

DuPont (DD), a diversified specialty chemicals company, posted quarterly earnings above estimates and raised its full year guidance.

Gilead Sciences (GILD), a biopharmaceutical company focused on infectious diseases, edged lower in extended trading after releasing full year guidance that missed estimates. Separately, the company reported quarterly earnings above expectations.

Amgen (AMGN), the biotech, reported quarterly earnings above estimates and boosted its full year guidance.

eBay (EBAY), the global electronic commerce platform, dived after hours as quarterly active users fell short of expectations.

Later today, the U.S. Commerce Department will report 3Q annualized GDP (+32.0% on quarter expected). The Labor Department will release initial jobless claims in the week ending October 24 (0.77 million expected). The National Association of Realtors will post September pending home sales (+3.0% on month expected).

European indices are mixed. The German Federal Statistical Office has posted October jobless rate at 6.2% (vs 6.3% expected). The Bank of England has released the number of mortgage approvals for September at 91,500 (vs 76,100 expected). The European Commission has reported the Eurozone’s October Economic Confidence Index at 90.9 (vs 89.6 expected) and Consumer Confidence at -15.5, vs -13.9 in September. Later today, the European Central Bank will announce its interest rates decision (deposit facility rate unchanged at -0.50% expected).

Asian indices closed in dispersed order as the Australian ASX faced a drop when the Chinese indices closed in the green. The Japanese Nikkei ended in the red. The Bank of Japan kept its benchmark rate unchanged at -0.10% and maintained 10-year government bond yield target at about 0%. BOJ downgraded Japan's 2020 GDP growth forecast to -5.5% from -4.7% previously and core CPI forecast was lowered to -0.6% from -0.5%. Meanwhile, official data showed that Japan's retail sales slipped 0.1% on month in September (+1.0% expected).

WTI Crude Oil futures remain under pressure. The U.S. Energy Information Administration (EIA) reported that U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) rose by 4.32M barrels, the highest increase since July.

U.S indices closed down on Wednesday, pressured by Transportation (-4.86%), Software & Services (-4.47%) and Media (-4.45%) sectors.

Approximately 65% of stocks in the S&P 500 Index were trading above their 200-day moving average and 30% were trading above their 20-day moving average. The VIX Index jumped 6.93pts (+20.78%) to 40.28, while Gold dropped $31.23 (-1.64%) to $1876.77, and WTI Crude Oil fell $2.23 (-5.64%) to $37.34 at the close.On the US economic data front, the Mortgage Bankers Association's Mortgage Applications rose 1.7% for the week ending October 23rd, compared to -0.6% in the previous week. Finally, Wholesale Inventories fell 0.1% on month in the September preliminary reading (+0.4% expected), compared to a revised +0.3% in the August final reading.

Gold consolidates as the U.S dollar remains firm on U.S election and economic uncertainties.

Gold fell 0.6 dollar (-0.03%) to 1876.59 dollars.The dollar index rose 0.26pt to 93.661.

U.S. Equity Snapshot

Pinterest (PINS), the social media, surged in extended trading after reporting quarterly adjusted EPS and sales that smashed estimates. Following that release, Facebook (FB) and Twitter (TWTR) also gained ground post market.

Source: TradingView, GAIN Capital

Tiffany (TIF), the jeweler, and LVMH, the world’s leading luxury products group, "have concluded an agreement modifying certain terms of their initial agreement to reflect a purchase price of 131.50 dollars in cash and to reduce closing conditionality. Other key terms of the Merger Agreement remain unchanged. Tiffany and LVMH have also agreed to settle their pending litigation in the Delaware Chancery Court. The merger is expected to close in early 2021, subject to Tiffany shareholder approval and customary closing conditions."

Ford Motor (F), the automobile manufacturer, disclosed third quarter adjusted EPS of 0.65 dollar, significantly above forecasts, up from 0.34 dollar a year ago, on revenue of 34.7 billion dollars, higher than expected, up from 33.9 billion dollars a year earlier.

Spotify (SPOT), the music streaming specialist, is losing ground before hours as quarterly earnings missed estimates.

Comcast (CMCSA), the media company, gains ground before hours as quarterly adjusted EPS beat estimates.

Visa (V), the credit card company, posted fourth quarter adjusted EPS of 1.12 dollar, ahead of estimates, down from 1.47 dollar a year ago, on net income of 2.1 billion dollars, down from 3.0 billion dollars in the year before.

DuPont (DD), a diversified specialty chemicals company, posted quarterly earnings above estimates and raised its full year guidance.

Gilead Sciences (GILD), a biopharmaceutical company focused on infectious diseases, edged lower in extended trading after releasing full year guidance that missed estimates. Separately, the company reported quarterly earnings above expectations.

Amgen (AMGN), the biotech, reported quarterly earnings above estimates and boosted its full year guidance.

eBay (EBAY), the global electronic commerce platform, dived after hours as quarterly active users fell short of expectations.