EU indices flat ahead of ECB meeting | TA focus on BT Group

INDICES

Yesterday, European stocks ended deep in the red. The Stoxx Europe 600 Index slumped 2.95%, Germany's DAX 30 plunged 4.17%, France's CAC 40 tumbled 3.37%, and the U.K.'s FTSE 100 sank 2.55%.

EUROPE ADVANCE/DECLINE

97% of STOXX 600 constituents traded lower or unchanged yesterday.

7% of the shares trade above their 20D MA vs 17% Tuesday (below the 20D moving average).

43% of the shares trade above their 200D MA vs 50% Tuesday (below the 20D moving average).

The Euro Stoxx 50 Volatility index added 5.52pts to 38.26, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Media

3mths relative low: none

Europe Best 3 sectors

technology, energy, real estate

Europe worst 3 sectors

media, travel & leisure, insurance

INTEREST RATE

The 10yr Bund yield fell 4bps to -0.62% (below its 20D MA). The 2yr-10yr yield spread fell 0bp to -16bps (above its 20D MA).

ECONOMIC DATA

GE 08:00: Sep Unemployment Rate Harmonised, exp.: 4.4%

UK 08:00: Oct Nationwide Housing Prices YoY, exp.: 5%

UK 08:00: Oct Nationwide Housing Prices MoM, exp.: 0.9%

GE 09:55: Oct Unemployment Rate, exp.: 6.3%

GE 09:55: Oct Unemployment chg, exp.: -8K

UK 10:00: Sep Car Production YoY, exp.: -44.6%

UK 10:30: Sep Net Lending to Individuals MoM, exp.: £3.4B

UK 10:30: Sep BoE Consumer Credit, exp.: £0.3B

UK 10:30: Sep Mortgage Approvals, exp.: 84.7K

UK 10:30: Sep Mortgage Lending, exp.: £3.1B

EC 11:00: Oct Consumer Confidence final, exp.: -13.9

EC 11:00: Oct Consumer Inflation expectations, exp.: 12.5

EC 11:00: Oct Economic Sentiment, exp.: 91.1

EC 11:00: Oct Industrial Sentiment, exp.: -11.1

EC 11:00: Oct Services Sentiment, exp.: -11.1

EC 13:45: ECB Interest Rate Decision, exp.: 0%

EC 13:45: Deposit Facility Rate, exp.: -0.5%

EC 13:45: Marginal Lending Rate, exp.: 0.25%

GE 14:00: Oct Harmonised Inflation Rate YoY Prel, exp.: -0.4%

GE 14:00: Oct Harmonised Inflation Rate MoM Prel, exp.: -0.4%

GE 14:00: Oct Inflation Rate MoM Prel, exp.: -0.2%

GE 14:00: Oct Inflation Rate YoY Prel, exp.: -0.2%

EC 14:30: ECB Press Conference

MORNING TRADING

In Asian trading hours, EUR/USD edged up to 1.1753 and GBP/USD bounced to 1.2998. USD/JPY rebounded to 104.45. Earlier today, the Bank of Japan kept its benchmark rate unchanged at -0.10% and maintained 10-year government bond yield target at about 0%. BOJ downgraded Japan's 2020 GDP growth forecast to -5.5% from -4.7% previously and core CPI forecast was lowered to -0.6% from -0.5%. Meanwhile, official data showed that Japan's retail sales slipped 0.1% on month in September (+1.0% expected).

Spot gold climbed to $1,880 an ounce.

#UK - IRELAND#

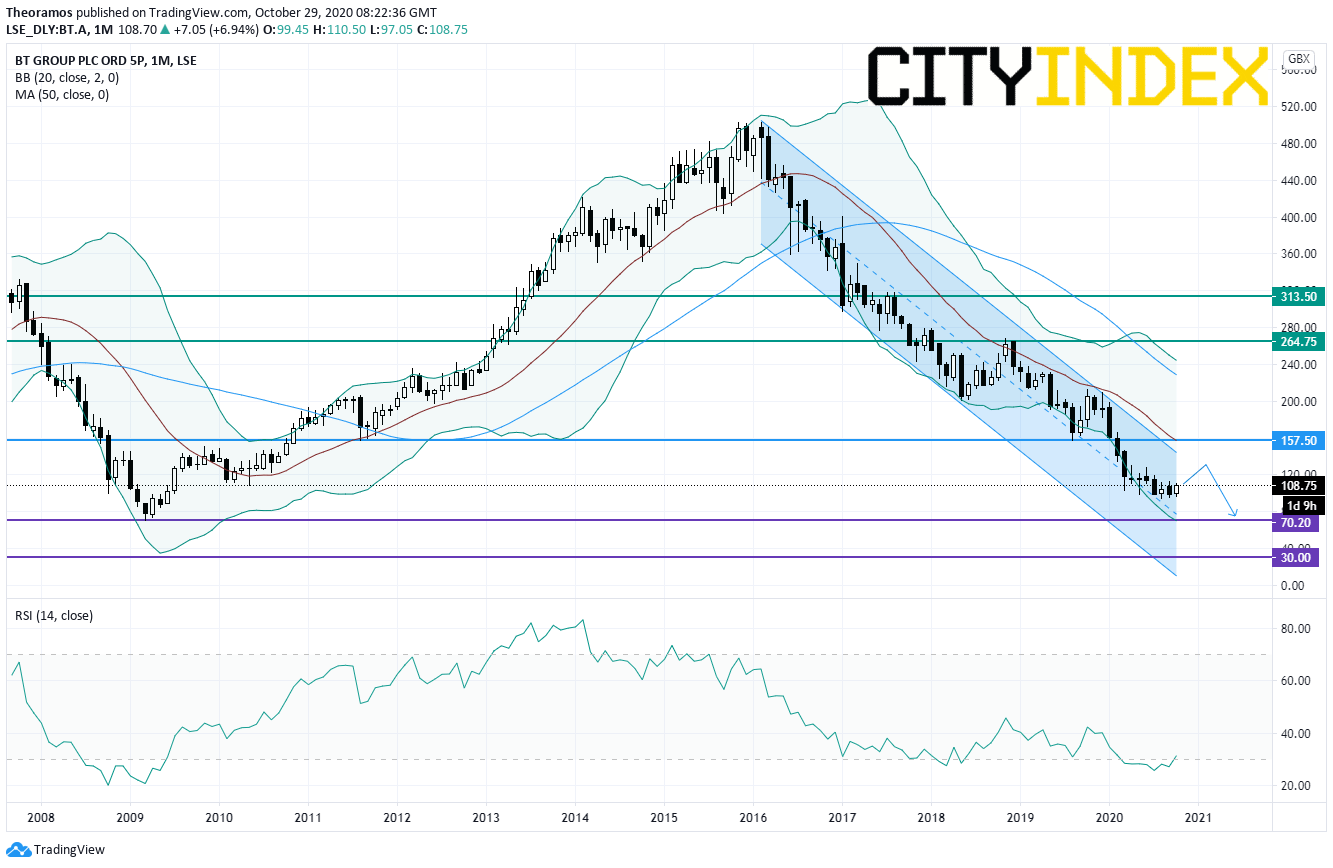

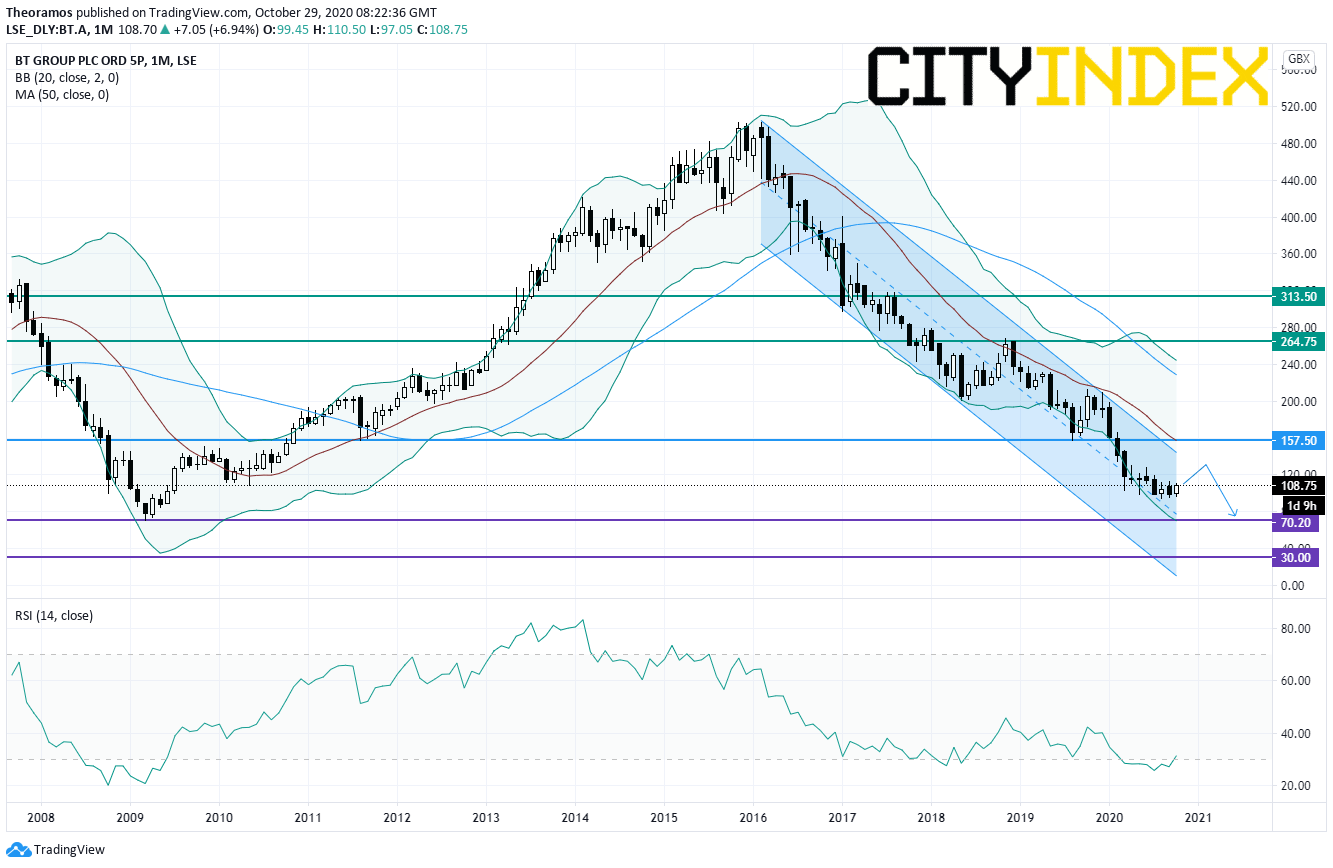

BT Group, a telecommunications group, posted 1H profit before tax declined 20% on year to 1.06 billion pounds and adjusted EBITDA fell 5% to 3.72 billion pounds on revenue of 10.59 billion pounds, down 8%. The company said it has raised the lower end of the full-year adjusted EBITDA outlook range to 7.3 billion pounds (range 7.3 - 7.5 billion pounds).

From a technical point of view, the stock price is trading within a declining channel in place since February 2016. Furthermore, the 20- simple MMA currently at 156.92p maintains the price under pressure. Below the horizontal resistance at 157.5p, targets are set at the previous all-time low of 2009 at 70.2p and 30p in extension. Alternatively, a push above the upper boundary of the channel would call for a rebound towards the horizontal resistance at 264.75p and 313.50p.

#GERMANY#

Volkswagen, an automobile group, announced that 3Q net income declined 31.8% on year to 2.58 billion euros and adjusted operating profit dropped 33.9% to 3.18 billion euros on revenue of 59.36 billion euros, down 3.4%. The company said it expects revenue to "fall significantly below the previous year's level in 2020", while adjusted operating result is expected to be in positive territory.

Deutsche Boerse, a stock exchange operator, posted 3Q adjusted net income slid 11% on year to 253 million euros and adjusted EBIT dropped 10% to 369 million euros on net revenue of 708 million euros, down 4%. The company confirmed its full-year adjusted net income guidance of 1.20 billion euros.

#FRANCE#

Sanofi, a pharmaceutical giant, announced that 3Q business EPS grew 0.5% on year (+8.8% at constant exchange rates) to 1.83 euros on net sales of 9.48 billion euros, down 0.2% (+5.7% at constant exchange rates). The company said it now expects 2020 business EPS to grow 7% - 8% at constant exchange rates, compared with 6% - 7% previously.

Airbus, an aircraft manufacturer, reported that it swung to a 3Q net loss of 767 million euros from a net profit of 989 million euros in the prior-year period and adjusted EBIT dropped 49% on year to 820 million euros on revenue of 11.21 billion euros, down 27%. 9-month free cash flow (before M&A and customer financing) totaled -11,80 billion euros and the company said it "targets at least breakeven free cash flow before M&A and customer financing in the fourth quarter of 2020".

LVMH, a French luxury goods conglomerate, will pay a lowered price of 131.50 dollars per share, compared with 135.00 dollars per share originally, to acquire Tiffany, as the U.S. jeweler's board has approved the proposal, reported Bloomberg citing people familiar with the matter.

#SPAIN#

Telefonica, a Spanish telecommunications company, reported that 3Q net loss totaled 160 million euros and OIBDA fell 2.8% to 2.67 billion euros, citing 785 million euros impairment related to its Argentine unit. Revenue was down 12.1% to 10.46 billion euros.

#BENELUX#

AB InBev, a multinational drink and brewing company, reported that 3Q underlying net income slid 14.4% on year to 1.60 billion dollars and normalized EBITDA dropped 7.5% to 4.89 billion dollars on revenue of 12.82 billion dollars, down 2.7% (+4.0% organic growth). The company decided to forgo the interim 2020 dividend payment.

Adyen, a Dutch payment company, posted 3Q EBITDA rose 24% on year to 101 million euros on net revenue of 169 million euros, up 25%.

#SWITZERLAND#

Credit Suisse, a banking group, announced that 3Q net income dropped 38% on year to 546 million Swiss franc on net revenue of 5.20 billion Swiss franc, down 2%. The bank added: "We are pleased that we are proposing the payout of the second tranche of our 2019 dividend and that we continue to accrue a 5% higher 2020 dividend for our shareholders. Furthermore, we intend to resume our share buyback program in January 2021 with a target repurchase of up to CHF1.5 billion of shares and a minimum of at least CHF 1.0 billion for the full year."

#SCANDINAVIA#

Nokia, a Finnish telecommunications group, reported that 3Q adjusted EPS was flat on year at 0.05 euro while adjusted operating profit grew 2% to 486 million euros on net sales of 5.29 billion euros, down 7% (-3% at constant currency). The company said it now expects full-year adjusted EPS of 0.20 - 0.26 euro, compared with previous forecast of 0.20 - 0.30 euro.

Equinor, a Norwegian energy company, posted 3Q adjusted net income slumped 75% on year to 271 million dollars and net operating loss widened to 2.02 billion dollars from 469 million dollars in the prior-year period. The company reported net impairments of 2.93 billion dollars, "mainly due to reduced future price assumptions".

EX-DIVIDEND

Essity: SEK6.25, Inditex: E0.2835

Yesterday, European stocks ended deep in the red. The Stoxx Europe 600 Index slumped 2.95%, Germany's DAX 30 plunged 4.17%, France's CAC 40 tumbled 3.37%, and the U.K.'s FTSE 100 sank 2.55%.

EUROPE ADVANCE/DECLINE

97% of STOXX 600 constituents traded lower or unchanged yesterday.

7% of the shares trade above their 20D MA vs 17% Tuesday (below the 20D moving average).

43% of the shares trade above their 200D MA vs 50% Tuesday (below the 20D moving average).

The Euro Stoxx 50 Volatility index added 5.52pts to 38.26, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Media

3mths relative low: none

Europe Best 3 sectors

technology, energy, real estate

Europe worst 3 sectors

media, travel & leisure, insurance

INTEREST RATE

The 10yr Bund yield fell 4bps to -0.62% (below its 20D MA). The 2yr-10yr yield spread fell 0bp to -16bps (above its 20D MA).

ECONOMIC DATA

GE 08:00: Sep Unemployment Rate Harmonised, exp.: 4.4%

UK 08:00: Oct Nationwide Housing Prices YoY, exp.: 5%

UK 08:00: Oct Nationwide Housing Prices MoM, exp.: 0.9%

GE 09:55: Oct Unemployment Rate, exp.: 6.3%

GE 09:55: Oct Unemployment chg, exp.: -8K

UK 10:00: Sep Car Production YoY, exp.: -44.6%

UK 10:30: Sep Net Lending to Individuals MoM, exp.: £3.4B

UK 10:30: Sep BoE Consumer Credit, exp.: £0.3B

UK 10:30: Sep Mortgage Approvals, exp.: 84.7K

UK 10:30: Sep Mortgage Lending, exp.: £3.1B

EC 11:00: Oct Consumer Confidence final, exp.: -13.9

EC 11:00: Oct Consumer Inflation expectations, exp.: 12.5

EC 11:00: Oct Economic Sentiment, exp.: 91.1

EC 11:00: Oct Industrial Sentiment, exp.: -11.1

EC 11:00: Oct Services Sentiment, exp.: -11.1

EC 13:45: ECB Interest Rate Decision, exp.: 0%

EC 13:45: Deposit Facility Rate, exp.: -0.5%

EC 13:45: Marginal Lending Rate, exp.: 0.25%

GE 14:00: Oct Harmonised Inflation Rate YoY Prel, exp.: -0.4%

GE 14:00: Oct Harmonised Inflation Rate MoM Prel, exp.: -0.4%

GE 14:00: Oct Inflation Rate MoM Prel, exp.: -0.2%

GE 14:00: Oct Inflation Rate YoY Prel, exp.: -0.2%

EC 14:30: ECB Press Conference

MORNING TRADING

In Asian trading hours, EUR/USD edged up to 1.1753 and GBP/USD bounced to 1.2998. USD/JPY rebounded to 104.45. Earlier today, the Bank of Japan kept its benchmark rate unchanged at -0.10% and maintained 10-year government bond yield target at about 0%. BOJ downgraded Japan's 2020 GDP growth forecast to -5.5% from -4.7% previously and core CPI forecast was lowered to -0.6% from -0.5%. Meanwhile, official data showed that Japan's retail sales slipped 0.1% on month in September (+1.0% expected).

Spot gold climbed to $1,880 an ounce.

#UK - IRELAND#

Standard Chartered, a banking group, announced that 3Q net income declined 50% on year to 428 million dollars and operating income fell 12% to 3.52 billion dollars. Credit impairment rose to 353 million dollars from 279 million dollars in the prior-year period, but down from 611 million dollars in the prior quarter. The bank stated: "Given our strong capital position the Board will consider at that time resuming shareholder returns, subject to consultation with our regulators."

Royal Dutch Shell, a giant oil producer, posted 3Q adjusted profit slumped 80% on year to 955 million dollars, "reflecting lower realised prices for oil and LNG as well as lower realised refining margins and production volumes compared with the third quarter 2019. EPS was down 92% to 0.06 dollar. The company proposed a dividend of 0.1665 dollar per share (0.16 dollar per share in 2Q and 0.47 dollar per share in the prior-year quarter).BT Group, a telecommunications group, posted 1H profit before tax declined 20% on year to 1.06 billion pounds and adjusted EBITDA fell 5% to 3.72 billion pounds on revenue of 10.59 billion pounds, down 8%. The company said it has raised the lower end of the full-year adjusted EBITDA outlook range to 7.3 billion pounds (range 7.3 - 7.5 billion pounds).

From a technical point of view, the stock price is trading within a declining channel in place since February 2016. Furthermore, the 20- simple MMA currently at 156.92p maintains the price under pressure. Below the horizontal resistance at 157.5p, targets are set at the previous all-time low of 2009 at 70.2p and 30p in extension. Alternatively, a push above the upper boundary of the channel would call for a rebound towards the horizontal resistance at 264.75p and 313.50p.

Source: TradingView, GAIN Capital

WPP, an advertising and public relations company, issued a 3Q trading update: "Revenue in the third quarter was down 9.8% at £3.0 billion. On a constant currency basis, revenue was down 5.9% year-on-year. (...) Excluding the impact of acquisitions and disposals, like-for-like growth was -7.6%."#GERMANY#

Volkswagen, an automobile group, announced that 3Q net income declined 31.8% on year to 2.58 billion euros and adjusted operating profit dropped 33.9% to 3.18 billion euros on revenue of 59.36 billion euros, down 3.4%. The company said it expects revenue to "fall significantly below the previous year's level in 2020", while adjusted operating result is expected to be in positive territory.

Deutsche Boerse, a stock exchange operator, posted 3Q adjusted net income slid 11% on year to 253 million euros and adjusted EBIT dropped 10% to 369 million euros on net revenue of 708 million euros, down 4%. The company confirmed its full-year adjusted net income guidance of 1.20 billion euros.

#FRANCE#

Sanofi, a pharmaceutical giant, announced that 3Q business EPS grew 0.5% on year (+8.8% at constant exchange rates) to 1.83 euros on net sales of 9.48 billion euros, down 0.2% (+5.7% at constant exchange rates). The company said it now expects 2020 business EPS to grow 7% - 8% at constant exchange rates, compared with 6% - 7% previously.

Airbus, an aircraft manufacturer, reported that it swung to a 3Q net loss of 767 million euros from a net profit of 989 million euros in the prior-year period and adjusted EBIT dropped 49% on year to 820 million euros on revenue of 11.21 billion euros, down 27%. 9-month free cash flow (before M&A and customer financing) totaled -11,80 billion euros and the company said it "targets at least breakeven free cash flow before M&A and customer financing in the fourth quarter of 2020".

LVMH, a French luxury goods conglomerate, will pay a lowered price of 131.50 dollars per share, compared with 135.00 dollars per share originally, to acquire Tiffany, as the U.S. jeweler's board has approved the proposal, reported Bloomberg citing people familiar with the matter.

#SPAIN#

Telefonica, a Spanish telecommunications company, reported that 3Q net loss totaled 160 million euros and OIBDA fell 2.8% to 2.67 billion euros, citing 785 million euros impairment related to its Argentine unit. Revenue was down 12.1% to 10.46 billion euros.

#BENELUX#

AB InBev, a multinational drink and brewing company, reported that 3Q underlying net income slid 14.4% on year to 1.60 billion dollars and normalized EBITDA dropped 7.5% to 4.89 billion dollars on revenue of 12.82 billion dollars, down 2.7% (+4.0% organic growth). The company decided to forgo the interim 2020 dividend payment.

Adyen, a Dutch payment company, posted 3Q EBITDA rose 24% on year to 101 million euros on net revenue of 169 million euros, up 25%.

#SWITZERLAND#

Credit Suisse, a banking group, announced that 3Q net income dropped 38% on year to 546 million Swiss franc on net revenue of 5.20 billion Swiss franc, down 2%. The bank added: "We are pleased that we are proposing the payout of the second tranche of our 2019 dividend and that we continue to accrue a 5% higher 2020 dividend for our shareholders. Furthermore, we intend to resume our share buyback program in January 2021 with a target repurchase of up to CHF1.5 billion of shares and a minimum of at least CHF 1.0 billion for the full year."

#SCANDINAVIA#

Nokia, a Finnish telecommunications group, reported that 3Q adjusted EPS was flat on year at 0.05 euro while adjusted operating profit grew 2% to 486 million euros on net sales of 5.29 billion euros, down 7% (-3% at constant currency). The company said it now expects full-year adjusted EPS of 0.20 - 0.26 euro, compared with previous forecast of 0.20 - 0.30 euro.

Equinor, a Norwegian energy company, posted 3Q adjusted net income slumped 75% on year to 271 million dollars and net operating loss widened to 2.02 billion dollars from 469 million dollars in the prior-year period. The company reported net impairments of 2.93 billion dollars, "mainly due to reduced future price assumptions".

EX-DIVIDEND

Essity: SEK6.25, Inditex: E0.2835

Latest market news

Yesterday 10:36 PM

Yesterday 05:36 PM

Yesterday 05:00 PM

Yesterday 01:31 PM

Yesterday 12:26 PM