US Futures mixed, watch HPQ, BA, TOL, NTAP, ADSK

US futures call for a mixed open as Dow Jones and S&P500 contracts are edging higher while Nasdaq futures are losing some ground.

For the first time since March 10, the Dow Jones Industrial Average closed above 25000 and the S&P 500 above 3000.

The Nasdaq managed to gain some ground yesterday after starting falling in early trading but some stay-at-home stocks as Amazon (-0.6%), Zoom Video (-1.2%) and Shopify (-2.3%) closed in negative territory.

The U.S. Federal Reserve expressed in its Beige Book economic report its high hopes for a swift recovery, but it also remarked that the outlook is still highly uncertain.

Later today, U.S. official data on first-quarter GDP (second reading, -4.8% on quarter annualized expected), Durable Goods Orders (preliminary reading, -19.3% on month in April expected), Initial Jobless Claims (2.1000 million for the week ended May 23 expected) will be released. The National Association of Realtors will publish pending home sales for April (-15.0% on month expected).

European indices are consolidating after a bullish gap this morning. The European Commission has posted the eurozone's May Economic Confidence Index at 67.5 (vs 70.6 expected). Consumer Confidence was confirmed at -18.8, vs -22 in April. The German Federal Statistical Office will report May CPI (+0.6% on year expected).

Asian indices closed on mixed notes. The Hong Kong HSI and the Chinese CSI were in the red whereas the Japanese Nikkei and the Australian ASX closed in the green. U.S. Secretary of State Mike Pompeo officially reported to Congress that Hong Kong is no longer autonomous from China. This will surely help to heighten tensions between the U.S. and China.

WTI Crude Oil Futures are under pressure after Russia hinted at increasing production by the end of June.

Gold gains ground while the US dollar is consolidating on deteriorating US-China relations.

Gold rose 13.2 dollars (+0.77%) to 1722.66 dollars.

EUR/USD gained 9pips to 1.1015 while GBP/USD rose 1pip to 1.2262.

US Equity Snapshot

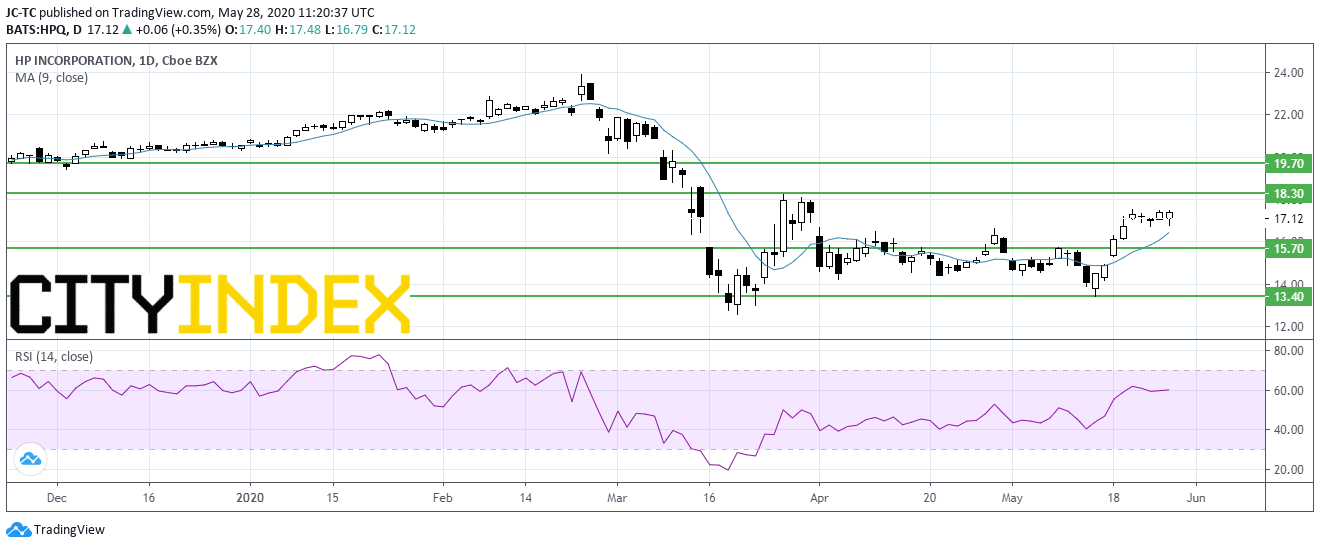

HP (HPQ), a provider of computers, printers and printer supplies, tanked after hours after saying it expects third quarter adjusted EPS between 0.39 and 0.45 dollar, below estimates. The company pulled full-year guidance.

Boeing (BA), an aircraft manufacturer, announced that it has resumed production of the 737 MAX at its Renton, Washington factory.

Toll Brothers (TOL), the home construction company, posted second quarter net income down to 75.7 million dollars, or 0.59 dollar a share, from 129.3 million dollars a year earlier, beating estimates.

NetApp (NTAP), a leading provider of data management and storage solutions, reported fourth quarter adjusted EPS of 1.19 dollar, beating estimates, down from 1.22 dollar a year ago, on net sales of 1.4 billion dollars, as expected, down from 1.6 billion dollars a year earlier. The company expects current quarter adjusted EPS to be 0.36 dollar to 0.44 dollar, below consensus.

Autodesk (ADSK), a provider of computer-aided design software, unveiled first quarter adjusted EPS of 0.85 dollar, above estimates, up from 0.45 dollar a year ago, on sales of 885.7 million dollars, better than anticipated, up from 735.5 million dollars a year earlier.

For the first time since March 10, the Dow Jones Industrial Average closed above 25000 and the S&P 500 above 3000.

The Nasdaq managed to gain some ground yesterday after starting falling in early trading but some stay-at-home stocks as Amazon (-0.6%), Zoom Video (-1.2%) and Shopify (-2.3%) closed in negative territory.

The U.S. Federal Reserve expressed in its Beige Book economic report its high hopes for a swift recovery, but it also remarked that the outlook is still highly uncertain.

Later today, U.S. official data on first-quarter GDP (second reading, -4.8% on quarter annualized expected), Durable Goods Orders (preliminary reading, -19.3% on month in April expected), Initial Jobless Claims (2.1000 million for the week ended May 23 expected) will be released. The National Association of Realtors will publish pending home sales for April (-15.0% on month expected).

European indices are consolidating after a bullish gap this morning. The European Commission has posted the eurozone's May Economic Confidence Index at 67.5 (vs 70.6 expected). Consumer Confidence was confirmed at -18.8, vs -22 in April. The German Federal Statistical Office will report May CPI (+0.6% on year expected).

Asian indices closed on mixed notes. The Hong Kong HSI and the Chinese CSI were in the red whereas the Japanese Nikkei and the Australian ASX closed in the green. U.S. Secretary of State Mike Pompeo officially reported to Congress that Hong Kong is no longer autonomous from China. This will surely help to heighten tensions between the U.S. and China.

WTI Crude Oil Futures are under pressure after Russia hinted at increasing production by the end of June.

Gold gains ground while the US dollar is consolidating on deteriorating US-China relations.

Gold rose 13.2 dollars (+0.77%) to 1722.66 dollars.

EUR/USD gained 9pips to 1.1015 while GBP/USD rose 1pip to 1.2262.

US Equity Snapshot

HP (HPQ), a provider of computers, printers and printer supplies, tanked after hours after saying it expects third quarter adjusted EPS between 0.39 and 0.45 dollar, below estimates. The company pulled full-year guidance.

Boeing (BA), an aircraft manufacturer, announced that it has resumed production of the 737 MAX at its Renton, Washington factory.

Toll Brothers (TOL), the home construction company, posted second quarter net income down to 75.7 million dollars, or 0.59 dollar a share, from 129.3 million dollars a year earlier, beating estimates.

NetApp (NTAP), a leading provider of data management and storage solutions, reported fourth quarter adjusted EPS of 1.19 dollar, beating estimates, down from 1.22 dollar a year ago, on net sales of 1.4 billion dollars, as expected, down from 1.6 billion dollars a year earlier. The company expects current quarter adjusted EPS to be 0.36 dollar to 0.44 dollar, below consensus.

Autodesk (ADSK), a provider of computer-aided design software, unveiled first quarter adjusted EPS of 0.85 dollar, above estimates, up from 0.45 dollar a year ago, on sales of 885.7 million dollars, better than anticipated, up from 735.5 million dollars a year earlier.

Source : TradingVIEW, Gain Capital

Latest market news

Today 08:18 AM

Yesterday 10:40 PM