EU indices still under pressure | TA focus on BASF

Yesterday, European stocks remained under pressure. The Stoxx Europe 600 Index fell 0.95%, Germany's DAX 30 lost 0.93%, France's CAC 40 tumbled 1.77%, and the U.K.'s FTSE 100 was down 1.09%.

EUROPE ADVANCE/DECLINE

76% of STOXX 600 constituents traded lower or unchanged yesterday.

17% of the shares trade above their 20D MA vs 26% Monday (below the 20D moving average).

50% of the shares trade above their 200D MA vs 52% Monday (below the 20D moving average).

The Euro Stoxx 50 Volatility index added 0.98pt to 32.74, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Pers. & House. Goods, Utilities

3mths relative low: Insurance, Energy

Europe Best 3 sectors

health care, technology, personal & household goods

automobiles & parts, banks, insurance

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.58% (below its 20D MA). The 2yr-10yr yield spread rose 2bps to -16bps (above its 20D MA).

ECONOMIC DATA

FR 08:45: Oct Consumer Confidence, exp.: 95

GE 11:40: 10-Year Bund auction, exp.: -0.51%

MORNING TRADING

In Asian trading hours, EUR/USD extended its decline to 1.1777 and GBP/USD slipped to 1.3035. USD/JPY remained subdued at 104.30. AUD/USD rebounded to 0.7138. Earlier today, official data showed that Australia's 3Q CPI grew 0.7% on year (+0.6% expected).

Spot gold edged down to $1,906 an ounce.

#UK - IRELAND#

Next, a retailer, posted a 3Q trading statement: "Full price sales in the third quarter were better than we anticipated and were up +2.8% against last year. Total sales (including markdown sales) were up +1.4%. Full year profit before tax, based on our new central sales scenario, is now forecast at £365m, £65m higher than the central scenario given in September."

Land Securities, a commercial property group, announce the appointment of Vanessa Simms, currently CFO of Grainger, as its next CFO.

#GERMANY#

Deutsche Bank, a banking group, announced that it swung to a net profit of 182 million euros from a net loss of 942 million euros in the prior-year period and net revenue rose 13% on year to 5.94 billion euros. Provision for credit losses increased 56% from the prior-year quarter, but reduced from 761 million euros in the prior quarter. The bank said it expects investment bank revenue, which jumped 43% on year to 2.37 billion euros in 3Q, to be significantly higher for the full year 2020 compared to the prior year.

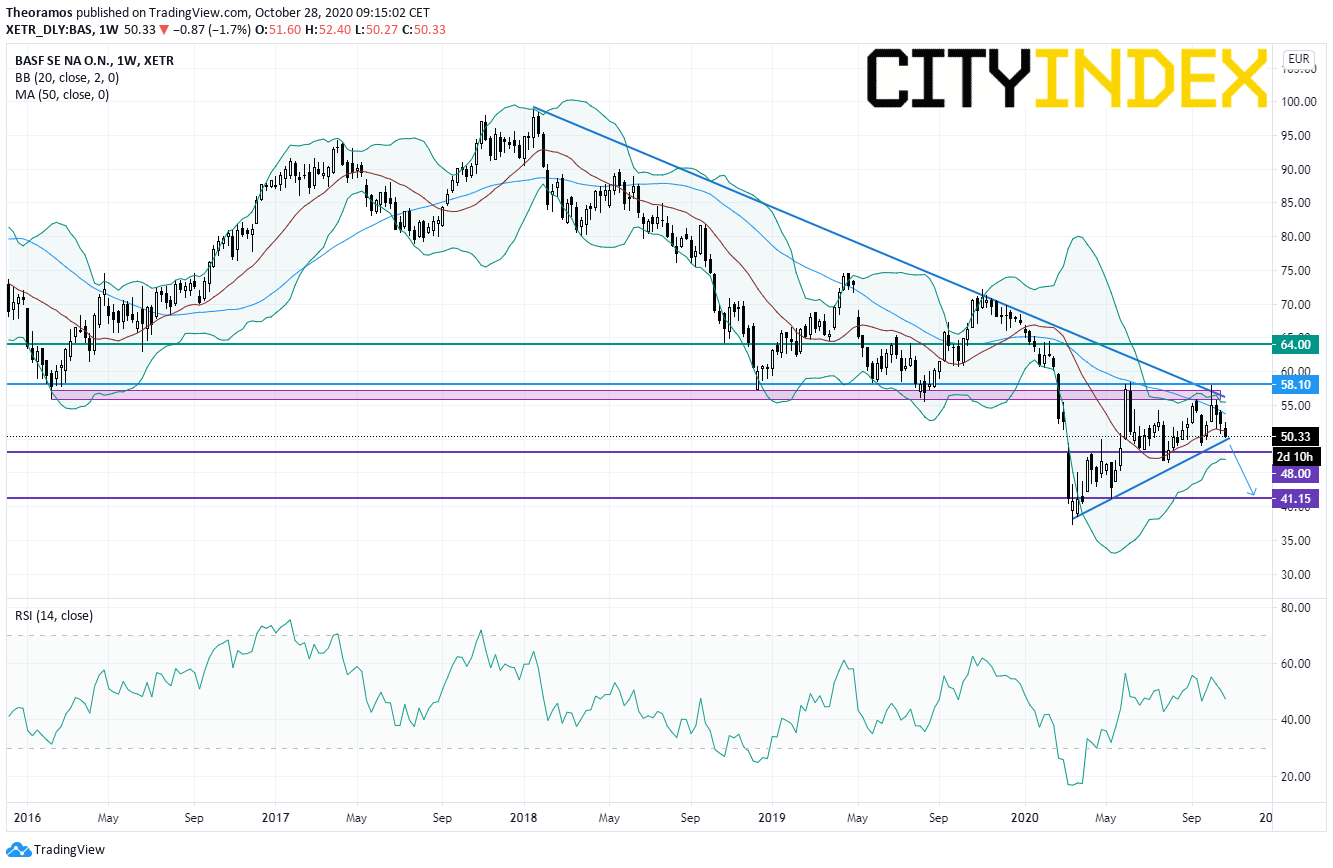

BASF, a multinational chemical company, reported that 3Q adjusted EPS declined 33% on year to 0.60 euro per share and adjusted EBIT dropped 45% to 581 million euros on revenue of 13.81 billion euros, down 5%. Regarding full-year outlook, the company sees an adjusted EBIT of between 3.0 - 3.3 billion euros and revenue is expected to be between 57 - 58 billion euros.

Source: TradingView, GAIN Capital

#FRANCE#

Peugeot, an automobile group, reported that 3Q revenue fell 0.8% on year to 15.45 billion euros, while automotive division revenue grew 1.2% to 11.96 billion euros.

Carrefour, a hypermarket chain, posted 3Q revenue increased 8.4% on year on a like-for-like basis (-2.5% reported) to 19.69 billion euros, "best performance in at least 20 years".

LVMH, a French luxury goods conglomerate, is negotiating with Tiffany Co over the contested takeover, where Tiffany is seeking to lower the price to 132 dollars per share from 135 dollars per share originally.

#BENELUX#

Heineken, a Dutch brewing company, announced that 3Q organic beer volume fell 1.9% on year (-2.1% reported) and 9-month organic beer volume was down 8.1% (-8.3% reported).

#DENMARK#

Danske Bank, a Danish bank, has raised its full-year net profit guidance to 4.0 - 4.5 billion Danish krone from 3.0 billion Danish krone previously and expects 3Q net profit to be around 2.1 billion Danish krone. The bank said: "The upward revision is based on generally improved developments in the financial markets, continually good progress in the underlying business as well as lower costs."

Carlsberg, a Danish brewer, announced that 3Q revenue fell 6.8% on year (-2.1% organic growth) to 17.26 billion Danish krone while sales volume grew 2.4% (+2.4% organic growth). The company has lifted its full-year organic operating profit forecast to a decline of mid-single-digit percentage from a decline of high-single-digit percentage previously.