EU indices mixed | TA focus on Thyssenkrupp

INDICES

Yesterday, European stocks were broadly lower. The Stoxx Europe 600 Index dropped 0.8%, Germany's DAX 30 lost 0.7%, France's CAC 40 slid 0.6% and the U.K.'s FTSE 100 was down 0.8%.

EUROPE ADVANCE/DECLINE

77% of STOXX 600 constituents traded lower or unchanged yesterday.

63% of the shares trade above their 20D MA vs 73% Wednesday (above the 20D moving average).

54% of the shares trade above their 200D MA vs 55% Wednesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 1.56pt to 23.56, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Industrial

3mths relative low: Healthcare

Europe Best 3 sectors

travel & leisure, media, personal & household good

Europe worst 3 sectors

basic resources, real estate, health care

INTEREST RATE

The 10yr Bund yield rose 2bps to -0.42% (above its 20D MA). The 2yr-10yr yield spread fell 2bps to -25bps (below its 20D MA).

ECONOMIC DATA

GE 07:00: Jul Import Prices YoY, exp.: -5.1%

GE 07:00: Jul Import Prices MoM, exp.: 0.6%

GE 07:00: Sep GfK Consumer Confidence, exp.: -30%

FR 07:45: Jul Household Consumption MoM, exp.: 9%

FR 07:45: Q2 GDP Growth Rate QoQ final, exp.: -5.9%

FR 07:45: Aug Inflation Rate MoM Prel, exp.: 0.4%

FR 07:45: Aug Harmonised Inflation Rate MoM Prel, exp.: 0.4%

FR 07:45: Aug Harmonised Inflation Rate YoY Prel, exp.: 0.9%

FR 07:45: Jul PPI MoM, exp.: 0.7%

FR 07:45: Aug Inflation Rate YoY Prel, exp.: 0.8%

EC 10:00: Aug Consumer Confidence final, exp.: -15

EC 10:00: Aug Consumer Inflation expectations, exp.: 17.5

EC 10:00: Aug Economic Sentiment, exp.: 82.3

EC 10:00: Aug Industrial Sentiment, exp.: -16.2

EC 10:00: Aug Services Sentiment, exp.: -26.1

UK 14:05: BoE Gov Bailey speech

MORNING TRADING

In Asian trading hours, EUR/USD bounced to 1.1831 and GBP/USD climbed to 1.3224. USD/JPY rose further to 106.81 before facing a drop as Japanese Prime Minister Shinzo Abe plans to resign due to health reasons, according to NHK.

Spot gold rebounded to $1,934 an ounce.

#UK - IRELAND#

Essentra, a supplier of plastic and fibre products, posted 1H results: "HY 2020 revenue decreased 11.5% (-11.7% at constant exchange) to £448.4m. On a LFL basis, revenue decreased 8.5%. (...) On an adjusted basis, operating profit was down 40.0% (-40.0% at constant FX) at £29.0m. (...) On an adjusted basis, net income of £17.2m was down 48.0% (48.4% at constant FX) and adjusted basic earnings per share decreased by 48.3% (48.5% at constant FX) to 6.2p."

#GERMANY#

Bayer's, a pharmaceutical group, 11 billion dollars U.S. settlement deal risks partial collapse, as U.S. District Judge Vince Chhabria said he is concerned the company has "manipulated" the settlement process since announcing its plan in June to resolve 125,000 cases related to its weedkillers, according to Bloomberg. The judge will revisit in a month whether to keep the litigation on hold for settlement talks to continue or to let more trials proceed.

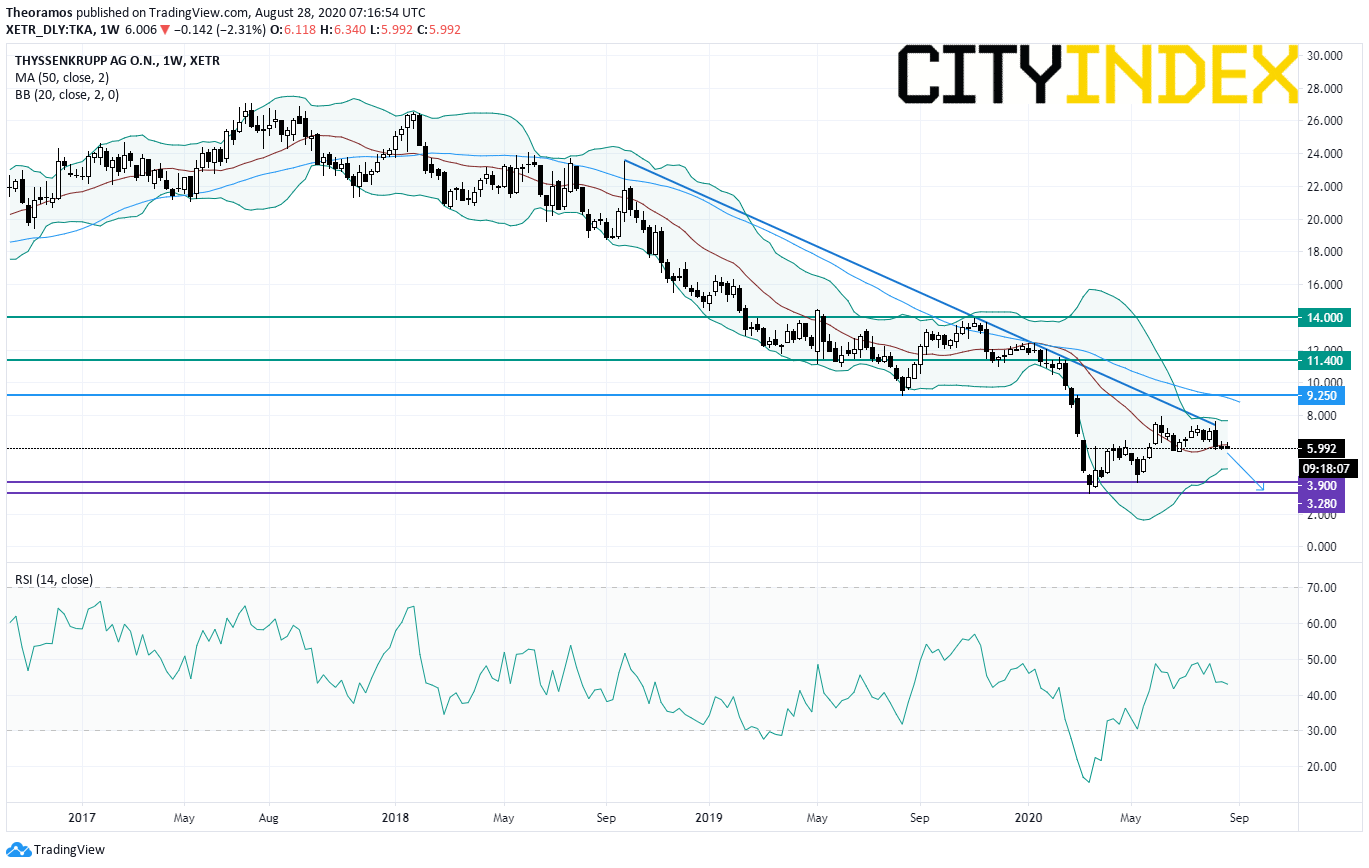

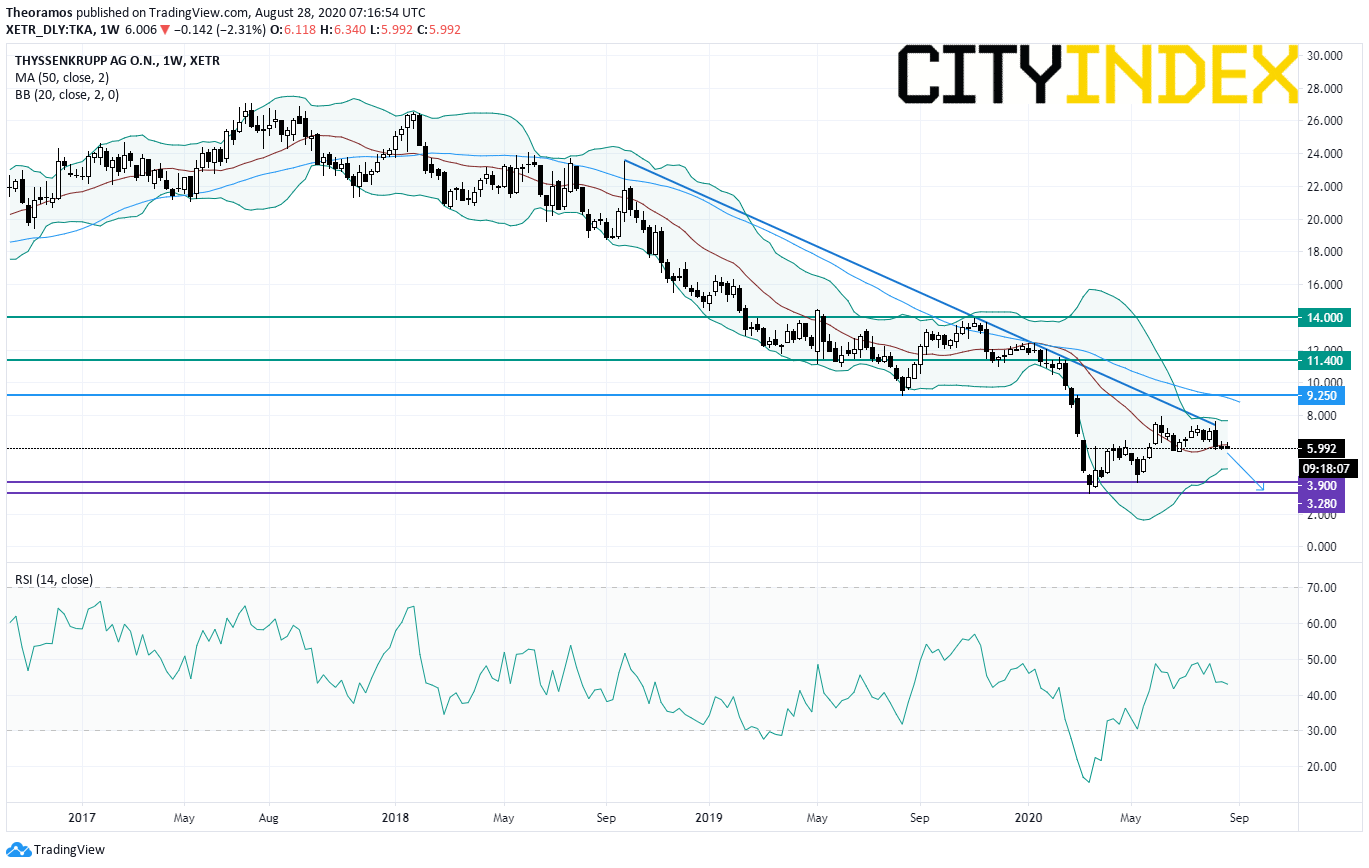

Thyssenkrupp, an industrial engineering group, was downgraded to "underweight" from "equalweight" at Morgan Stanley.

From a weekly point of view, the share is capped by a bearish trend line drawn since September 2018. Furthermore the 50 DMA is playing a resistance role above the stock. Below the overlap area at 9.25E look for the horizontal resistance at 3.9E and 3.28E in extension.

Source: GAIN Capital, TradingView

Fraport, an airport operator, was downgraded to "hold" from "buy" at Deutsche Bank.

#ITALY#

Prysmian, a manufacturer of electric power transmission and telecommunications cables, was upgraded to "overweight" from "neutral" at JPMorgan.

EX-DIVIDEND

Deutsche Post: E1.15, Fresenius Medical Care: E1.2

Yesterday, European stocks were broadly lower. The Stoxx Europe 600 Index dropped 0.8%, Germany's DAX 30 lost 0.7%, France's CAC 40 slid 0.6% and the U.K.'s FTSE 100 was down 0.8%.

EUROPE ADVANCE/DECLINE

77% of STOXX 600 constituents traded lower or unchanged yesterday.

63% of the shares trade above their 20D MA vs 73% Wednesday (above the 20D moving average).

54% of the shares trade above their 200D MA vs 55% Wednesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 1.56pt to 23.56, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Industrial

3mths relative low: Healthcare

Europe Best 3 sectors

travel & leisure, media, personal & household good

Europe worst 3 sectors

basic resources, real estate, health care

INTEREST RATE

The 10yr Bund yield rose 2bps to -0.42% (above its 20D MA). The 2yr-10yr yield spread fell 2bps to -25bps (below its 20D MA).

ECONOMIC DATA

GE 07:00: Jul Import Prices YoY, exp.: -5.1%

GE 07:00: Jul Import Prices MoM, exp.: 0.6%

GE 07:00: Sep GfK Consumer Confidence, exp.: -30%

FR 07:45: Jul Household Consumption MoM, exp.: 9%

FR 07:45: Q2 GDP Growth Rate QoQ final, exp.: -5.9%

FR 07:45: Aug Inflation Rate MoM Prel, exp.: 0.4%

FR 07:45: Aug Harmonised Inflation Rate MoM Prel, exp.: 0.4%

FR 07:45: Aug Harmonised Inflation Rate YoY Prel, exp.: 0.9%

FR 07:45: Jul PPI MoM, exp.: 0.7%

FR 07:45: Aug Inflation Rate YoY Prel, exp.: 0.8%

EC 10:00: Aug Consumer Confidence final, exp.: -15

EC 10:00: Aug Consumer Inflation expectations, exp.: 17.5

EC 10:00: Aug Economic Sentiment, exp.: 82.3

EC 10:00: Aug Industrial Sentiment, exp.: -16.2

EC 10:00: Aug Services Sentiment, exp.: -26.1

UK 14:05: BoE Gov Bailey speech

MORNING TRADING

In Asian trading hours, EUR/USD bounced to 1.1831 and GBP/USD climbed to 1.3224. USD/JPY rose further to 106.81 before facing a drop as Japanese Prime Minister Shinzo Abe plans to resign due to health reasons, according to NHK.

Spot gold rebounded to $1,934 an ounce.

#UK - IRELAND#

Essentra, a supplier of plastic and fibre products, posted 1H results: "HY 2020 revenue decreased 11.5% (-11.7% at constant exchange) to £448.4m. On a LFL basis, revenue decreased 8.5%. (...) On an adjusted basis, operating profit was down 40.0% (-40.0% at constant FX) at £29.0m. (...) On an adjusted basis, net income of £17.2m was down 48.0% (48.4% at constant FX) and adjusted basic earnings per share decreased by 48.3% (48.5% at constant FX) to 6.2p."

#GERMANY#

Bayer's, a pharmaceutical group, 11 billion dollars U.S. settlement deal risks partial collapse, as U.S. District Judge Vince Chhabria said he is concerned the company has "manipulated" the settlement process since announcing its plan in June to resolve 125,000 cases related to its weedkillers, according to Bloomberg. The judge will revisit in a month whether to keep the litigation on hold for settlement talks to continue or to let more trials proceed.

Thyssenkrupp, an industrial engineering group, was downgraded to "underweight" from "equalweight" at Morgan Stanley.

From a weekly point of view, the share is capped by a bearish trend line drawn since September 2018. Furthermore the 50 DMA is playing a resistance role above the stock. Below the overlap area at 9.25E look for the horizontal resistance at 3.9E and 3.28E in extension.

Source: GAIN Capital, TradingView

Fraport, an airport operator, was downgraded to "hold" from "buy" at Deutsche Bank.

#ITALY#

Prysmian, a manufacturer of electric power transmission and telecommunications cables, was upgraded to "overweight" from "neutral" at JPMorgan.

EX-DIVIDEND

Deutsche Post: E1.15, Fresenius Medical Care: E1.2

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM