US Futures turning down - Watch PFE, MMM, MCD, RTX, TSLA

Later today, the Conference Board's Consumer Confidence Index will be published (a fall to 94.5 in July is expected). The July Richmond Federal Manufacturing Index will also be reported (expected at 5.0).

European indices are facing a consolidation on fears of a second Covid-19 wave as German Robert-Koch Institute warned that latest infection trend is "very worrying".

Asian indices closed on mixed notes. Hong Kong HSI and Chinese CSI were up when Japanese Nikkei and Australian ASX faced a consolidation.

WTI Crude Oil futures remain on the upside. Later today, API would release the change of U.S. oil stockpile data for July 24 (vs 7.544M barrel expected).

Gold consolidates after reaching an all-time high while the US dollar tries to rebound as investors await the outlook from the Fed and the passage of a US fiscal package.

Gold fell 16.58 dollars (-0.85%) to 1925.67 dollars.

EUR/USD declined 16pips to 1.1736 while the GBP/USD fell 3pips to 1.2879.

U.S. Equity Snapshot

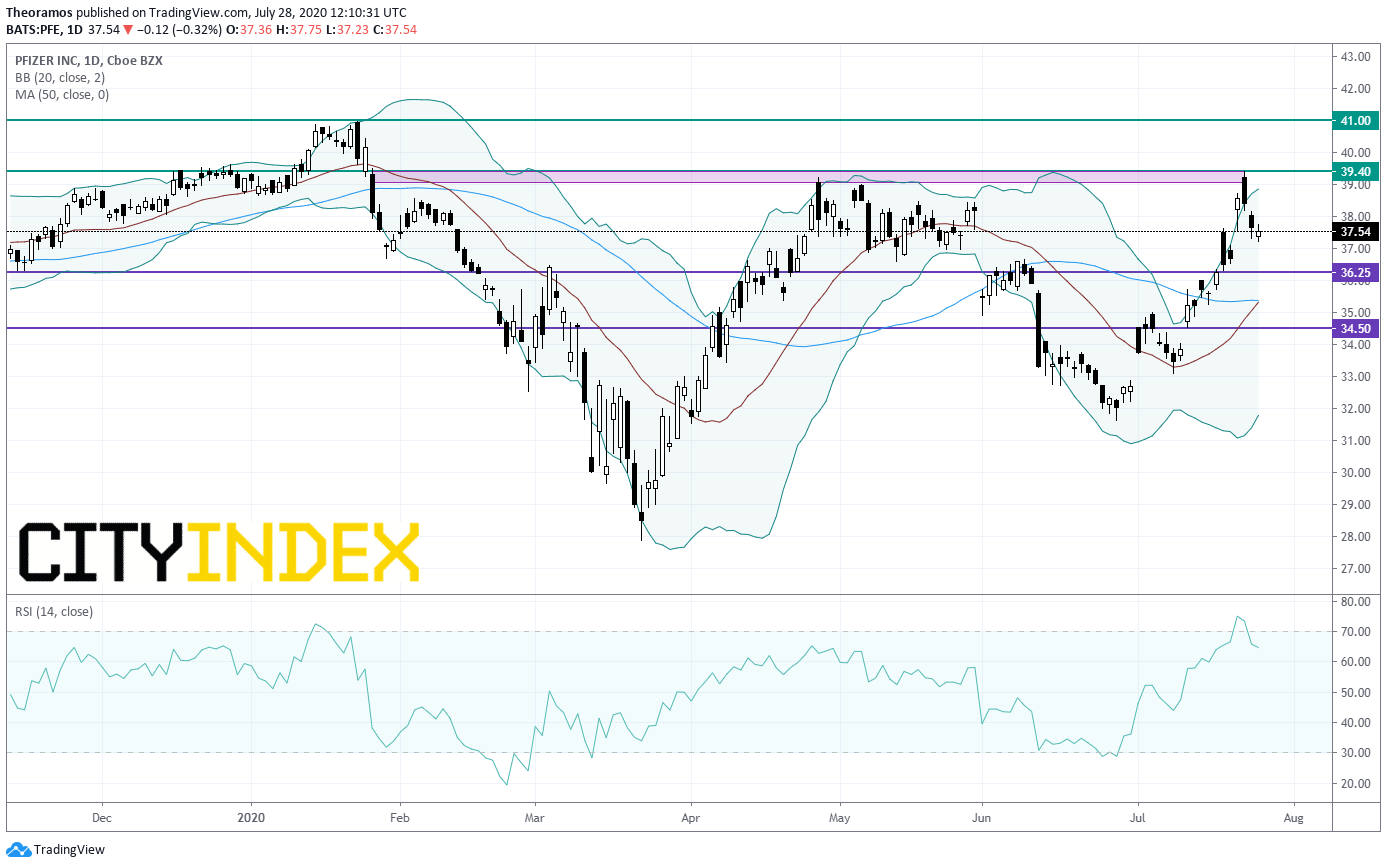

Pfizer (PFE), the pharma giant, posted second quarter adjusted EPS of 0.78 dollar vs 0.80 dollar a year earlier, on sales down 11% to 11.80 billion dollars. Both figures beat estimates. The company raised its FY guidance both for adjusted EPS and sales.

Source: TradingView, Gain Capital

3M (MMM), a diversified multinational conglomerate, reported second quarter adjusted EPS down 16.4% to 1.78 dollar, on sales down 12.2% to 7.2 billion dollars. Both figures missed estimates.

McDonald's (MCD), the global fast-food restaurant chain, is losing ground before hours as second quarter comparable sales and adjusted EPS missed estimates.

Raytheon (RTX), a technology and innovation leader specializing in defense, civil government and cybersecurity solutions, is gaining ground before hours after posting quarterly earnings that beat estimates.

Tesla (TSLA), the electric-vehicle maker, was downgraded to "underperform" from "market perform" at Bernstein.

F5 Networks (FFIV), a provider of Internet networking traffic products, lost ground after hours as fourth quarter billings and cash flow from operations missed estimates.

Universal Health Services (UHS), an owner and operator of a variety of healthcare facilities, announced second quarter adjusted EPS of 2.95 dollars, significantly exceeding forecasts, up from 2.76 dollars a year ago, on net revenue of 2.7 billion dollars, better than anticipated, down from 2.9 billion dollars a year earlier.

Cincinnati Financial (CINF), a property and casualty insurance company, posted second quarter EPS of 0.44 dollar, beating estimates, up from 0.85 dollar a year ago, on net income of 909.0 million dollars, up from 428.0 million dollars a year earlier.