US Futures rising, watch BA, CAT, TWTR

The S&P 500 Futures continue to climb as investors believe the coronavirus has passed its peak in major economies.

European indices are on the upside as governments of France, Italy and Spain said they are preparing to loosen coronavirus restrictions. U.K. Prime Minister Boris Johnson has returned to work today after suffering from the coronavirus.

Asian indices closed on a jump. The Bank of Japan announced that it will purchase necessary amount of Japanese government bonds with no limit, compared with a previous target of 80 trillion yen, while keeping its benchmark rate at -0.1% unchanged.

WTI Crude Oil Futures are back to the downside. The number of U.S. oil rigs counts plunged further to the lowest level since July 2016 at 378 on April 24 from 438 a week ago, according to Baker Hughes.

USD/JPY fell 37pips to 107.14 on increasing BoJ stimulus.

US Equity Snapshot

Boeing (BA), the aircraft manufacturer, announced that it has terminated the agreement with Brazilian aerospace conglomerate Embraer to establish a joint venture. Embraer said Boeing "has manufactured false claims as a pretext to seek to avoid its commitments to close the transaction and pay Embraer the 4.2 billion dollars purchase price", adding it " will pursue all remedies against Boeing for the damages".

Caterpillar (CAT), the world's largest manufacturer of heavy equipment for multiple industries, was downgraded to "underweight" from "equal-weight" at Morgan Stanley.

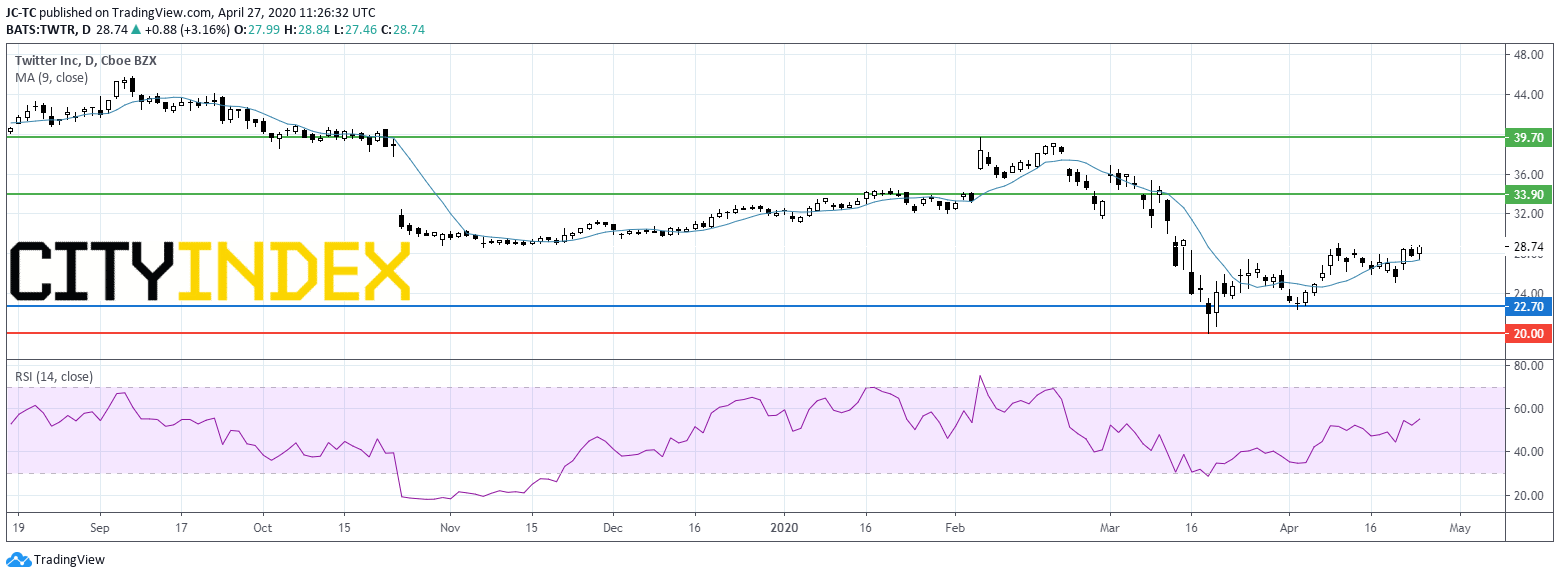

Twitter (TWTR), the social network, was upgraded to "neutral" from "underperform" at Mizuho Securities.

Later today, the Federal Reserve Bank of Dallas will release its Manufacturing Activity Index for April (-88.0 expected).

European indices are on the upside as governments of France, Italy and Spain said they are preparing to loosen coronavirus restrictions. U.K. Prime Minister Boris Johnson has returned to work today after suffering from the coronavirus.

Asian indices closed on a jump. The Bank of Japan announced that it will purchase necessary amount of Japanese government bonds with no limit, compared with a previous target of 80 trillion yen, while keeping its benchmark rate at -0.1% unchanged.

WTI Crude Oil Futures are back to the downside. The number of U.S. oil rigs counts plunged further to the lowest level since July 2016 at 378 on April 24 from 438 a week ago, according to Baker Hughes.

Gold fell 13.04 dollars (-0.75%) to 1716.56 as hopes of lockdown easing measures improved market sentiment.

For same reasons, the US Dollar is losing some ground, EUR/USD rose 19pips to 1.0842 while GBP/USD gained 67pips to 1.2434.

USD/JPY fell 37pips to 107.14 on increasing BoJ stimulus.

US Equity Snapshot

Boeing (BA), the aircraft manufacturer, announced that it has terminated the agreement with Brazilian aerospace conglomerate Embraer to establish a joint venture. Embraer said Boeing "has manufactured false claims as a pretext to seek to avoid its commitments to close the transaction and pay Embraer the 4.2 billion dollars purchase price", adding it " will pursue all remedies against Boeing for the damages".

Caterpillar (CAT), the world's largest manufacturer of heavy equipment for multiple industries, was downgraded to "underweight" from "equal-weight" at Morgan Stanley.

Twitter (TWTR), the social network, was upgraded to "neutral" from "underperform" at Mizuho Securities.

Source : TradingView, GAIN Capital

Latest market news

Yesterday 11:23 PM

Yesterday 10:19 PM

Yesterday 08:00 PM

Yesterday 04:54 PM

Yesterday 01:15 PM