U.S Futures gaining ground - Watch AMD, AIG, MRK, PFE, CAT

The S&P 500 Futures are posting a tentative rebound after they encountered a sell-off yesterday. U.S. Treasury Secretary Steven Mnuchin and House Speaker Nancy Pelosi failed again to agree on a fiscal stimulus deal as COVID-19 cases spike in the U.S. and Europe.

Later today, the U.S. Commerce Department will post Durable Goods Orders for September (+0.5% on month expected). The Conference Board will release its Consumer Confidence Index for October (101.9 expected). The Federal Housing Finance Agency will post its house price index for August (+0.7% on month expected). S&P Case Shiller will report its house price index for August (+0.4% on month expected).

European indices are on the downside. The European Central Bank has reported September M3 money supply at +10.4% (vs +9.6% on year expected). In France, September PPI was released at +0.2% on month, vs +0.1% in August.

Asian indices closed in the red except the Chinese CSI which ended slightly positive.

WTI Crude Oil futures are posting a tentative rebound. Later today, American Petroleum Institute (API) will release the change of U.S. oil stockpile data for October 23.

US indices closed down on Monday, pressured by Energy (-3.47%), Software & Services (-2.95%) and Consumer Services (-2.64%) sectors.

Approximately 75% of stocks in the S&P 500 Index were trading above their 200-day moving average and 68% were trading above their 20-day moving average. The VIX Index jumped 4.91pts (+17.82%) to 32.46, while Gold fell $0.5 (-0.03%) to $1901.55, and WTI Crude Oil dropped $1.29 (-3.24%) to $38.56 at the close.

On the US economic data front, New Home Sales unexpectedly fell to 959K on month in September (1,025K expected), from a revised 994K in August.

Gold and U.S dollar consolidate on U.S aid and Presidential election uncertainties.

Gold rose 0.5$ (+0.03%) to 1902.58.

The dollar index fell 0.06pt to 92.981.

U.S. Equity Snapshot

Advanced Micro Devices (AMD), a designer and producer of microprocessors, announced the acquisition of Xilinx (XLNX), a designer of field-programmable gate arrays (FPGAs), in an all-stock transaction valued at 35 billion dollars.

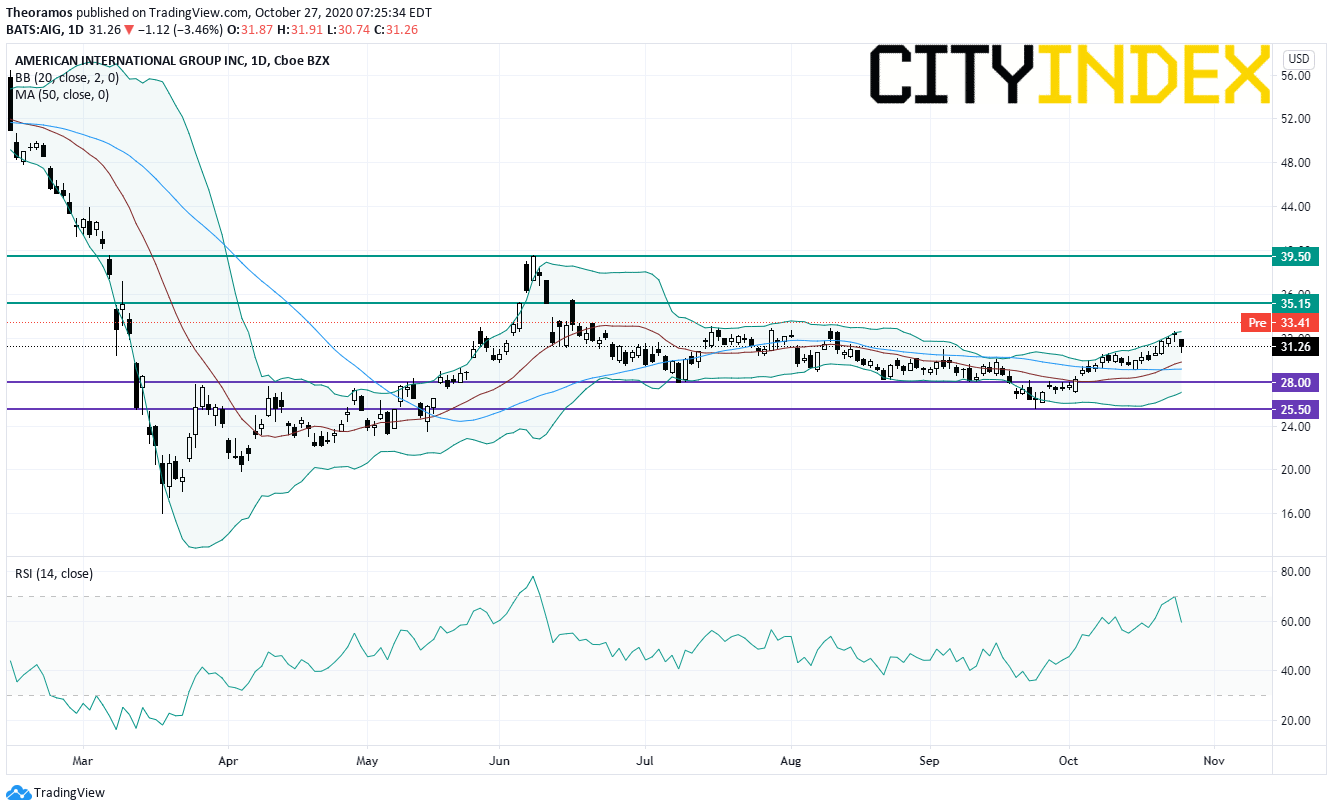

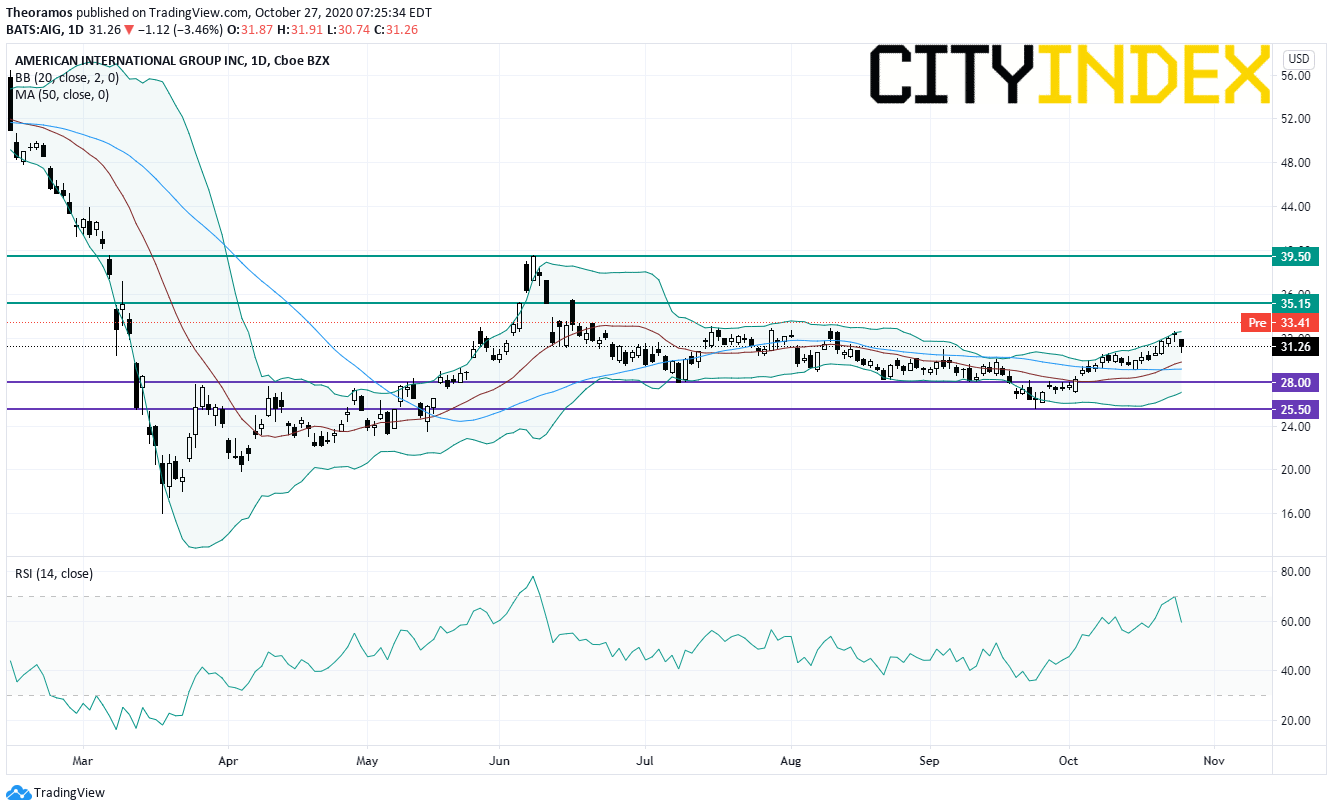

AIG (AIG), a global insurance and financial services firm, announced "its intention to separate its Life & Retirement business from AIG." Separately, "the Board of Directors has named Peter S. Zaffino Chief Executive Officer of AIG, effective March 1, 2021, in addition to his current role as President of the company." Current CEO Brian Duperreault will become Executive Chairman.

Source: TradingView, GAIN Capital

Merck & Co (MRK), the pharma giant, is slightly up before hours after reporting third quarter earnings that beat estimates and raising its full year outlook.

Pfizer (PFE), the pharma giant, is edging down as quarterly sales were slightly below estimates.

Caterpillar (CAT), the world's largest manufacturer of heavy equipment for multiple industries, is declining before hours despite posting quarterly earnings that beat estimates and forecasting a sequentially improvement in operating margin for the current quarter.

Eli Lilly (LLY), a developer and producer of pharmaceuticals, is losing some ground premarket as third quarter sales missed estimates. The company confirmed full year outlook.

3M (MMM), a diversified multinational conglomerate, is flat premarket despite posting third quarter earnings above expectations.

Twitter (TWTR)'s, the social network, price target was raised to 52 dollars from 39 dollars at JPMorgan.

Las Vegas Sands (LVS), a global operator of casino resorts, might consider the sale of its casinos in Las Vegas, according to Bloomberg.

Centene Corp (CNC), a managed-care organization focused on government-sponsored healthcare plans, posted third quarter earnings that beat estimates and raised its full year outlook.

F5 Networks (FFIV), a provider of Internet networking traffic products, reported fourth quarter adjusted EPS of 2.43 dollars, above forecasts, down from 2.59 dollars a year ago, on net revenue of 614.8 million dollars, exceeding the consensus, up from 590.4 million dollars a year earlier.

Later today, the U.S. Commerce Department will post Durable Goods Orders for September (+0.5% on month expected). The Conference Board will release its Consumer Confidence Index for October (101.9 expected). The Federal Housing Finance Agency will post its house price index for August (+0.7% on month expected). S&P Case Shiller will report its house price index for August (+0.4% on month expected).

European indices are on the downside. The European Central Bank has reported September M3 money supply at +10.4% (vs +9.6% on year expected). In France, September PPI was released at +0.2% on month, vs +0.1% in August.

Asian indices closed in the red except the Chinese CSI which ended slightly positive.

WTI Crude Oil futures are posting a tentative rebound. Later today, American Petroleum Institute (API) will release the change of U.S. oil stockpile data for October 23.

US indices closed down on Monday, pressured by Energy (-3.47%), Software & Services (-2.95%) and Consumer Services (-2.64%) sectors.

Approximately 75% of stocks in the S&P 500 Index were trading above their 200-day moving average and 68% were trading above their 20-day moving average. The VIX Index jumped 4.91pts (+17.82%) to 32.46, while Gold fell $0.5 (-0.03%) to $1901.55, and WTI Crude Oil dropped $1.29 (-3.24%) to $38.56 at the close.

On the US economic data front, New Home Sales unexpectedly fell to 959K on month in September (1,025K expected), from a revised 994K in August.

Gold and U.S dollar consolidate on U.S aid and Presidential election uncertainties.

Gold rose 0.5$ (+0.03%) to 1902.58.

The dollar index fell 0.06pt to 92.981.

Advanced Micro Devices (AMD), a designer and producer of microprocessors, announced the acquisition of Xilinx (XLNX), a designer of field-programmable gate arrays (FPGAs), in an all-stock transaction valued at 35 billion dollars.

AIG (AIG), a global insurance and financial services firm, announced "its intention to separate its Life & Retirement business from AIG." Separately, "the Board of Directors has named Peter S. Zaffino Chief Executive Officer of AIG, effective March 1, 2021, in addition to his current role as President of the company." Current CEO Brian Duperreault will become Executive Chairman.

Source: TradingView, GAIN Capital

Merck & Co (MRK), the pharma giant, is slightly up before hours after reporting third quarter earnings that beat estimates and raising its full year outlook.

Pfizer (PFE), the pharma giant, is edging down as quarterly sales were slightly below estimates.

Caterpillar (CAT), the world's largest manufacturer of heavy equipment for multiple industries, is declining before hours despite posting quarterly earnings that beat estimates and forecasting a sequentially improvement in operating margin for the current quarter.

Eli Lilly (LLY), a developer and producer of pharmaceuticals, is losing some ground premarket as third quarter sales missed estimates. The company confirmed full year outlook.

3M (MMM), a diversified multinational conglomerate, is flat premarket despite posting third quarter earnings above expectations.

Twitter (TWTR)'s, the social network, price target was raised to 52 dollars from 39 dollars at JPMorgan.

Las Vegas Sands (LVS), a global operator of casino resorts, might consider the sale of its casinos in Las Vegas, according to Bloomberg.

Centene Corp (CNC), a managed-care organization focused on government-sponsored healthcare plans, posted third quarter earnings that beat estimates and raised its full year outlook.

F5 Networks (FFIV), a provider of Internet networking traffic products, reported fourth quarter adjusted EPS of 2.43 dollars, above forecasts, down from 2.59 dollars a year ago, on net revenue of 614.8 million dollars, exceeding the consensus, up from 590.4 million dollars a year earlier.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM