US Futures gaining ground - Watch AMZN, AAPL, MRNA, SLB, BIIB, HAS

The S&P 500 Futures are rebounding after they sank further on Friday. Escalating tensions between the U.S. and China started to drag the feet of market bulls.

Later today, the U.S. Commerce Department will report Durable Goods Orders for June (preliminary readings). July Dallas Fed Manufacturing Index is also expected.

European indices are posting a rebound. Germany's IFO Business Climate Index at 90.5 (vs 89.3 expected) and Expectations Index at 97.0 (vs 93.4 expected) for July were released. The European Central Bank has reported M3 Money Supply growth in June at +9.2% (vs +9.3% on year expected).

Asian indices closed mixed as Beijing ordered the U.S. consulate in Chengdu city to close in retaliation against the U.S. which shut the Chinese consulate in Houston.

WTI Crude Oil futures are under pressure. The number of U.S. rigs dropped to 251 for the week ended 24 from 253, while the amount of rigs in Canada increased to 42 from 32, according to Baker Hughes.

Gold climbed to an all-time high while the US dollar index fell to a two-year low on US-China tensions and COVID-19 fears.

Gold rose 39.93 dollars (+2.1%) to 1941.95 dollars.

The dollar index fell 0.63pt to 93.805.

U.S. Equity Snapshot

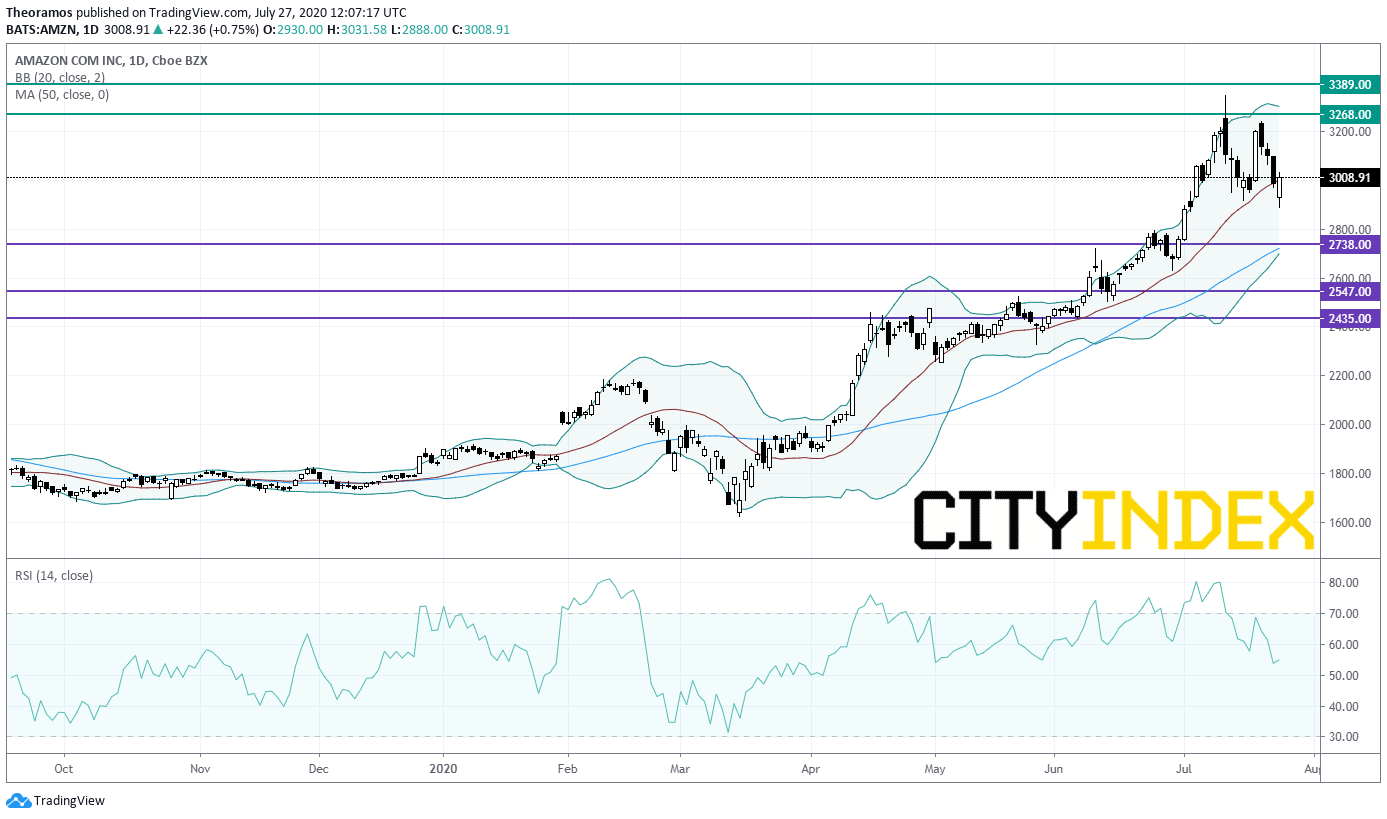

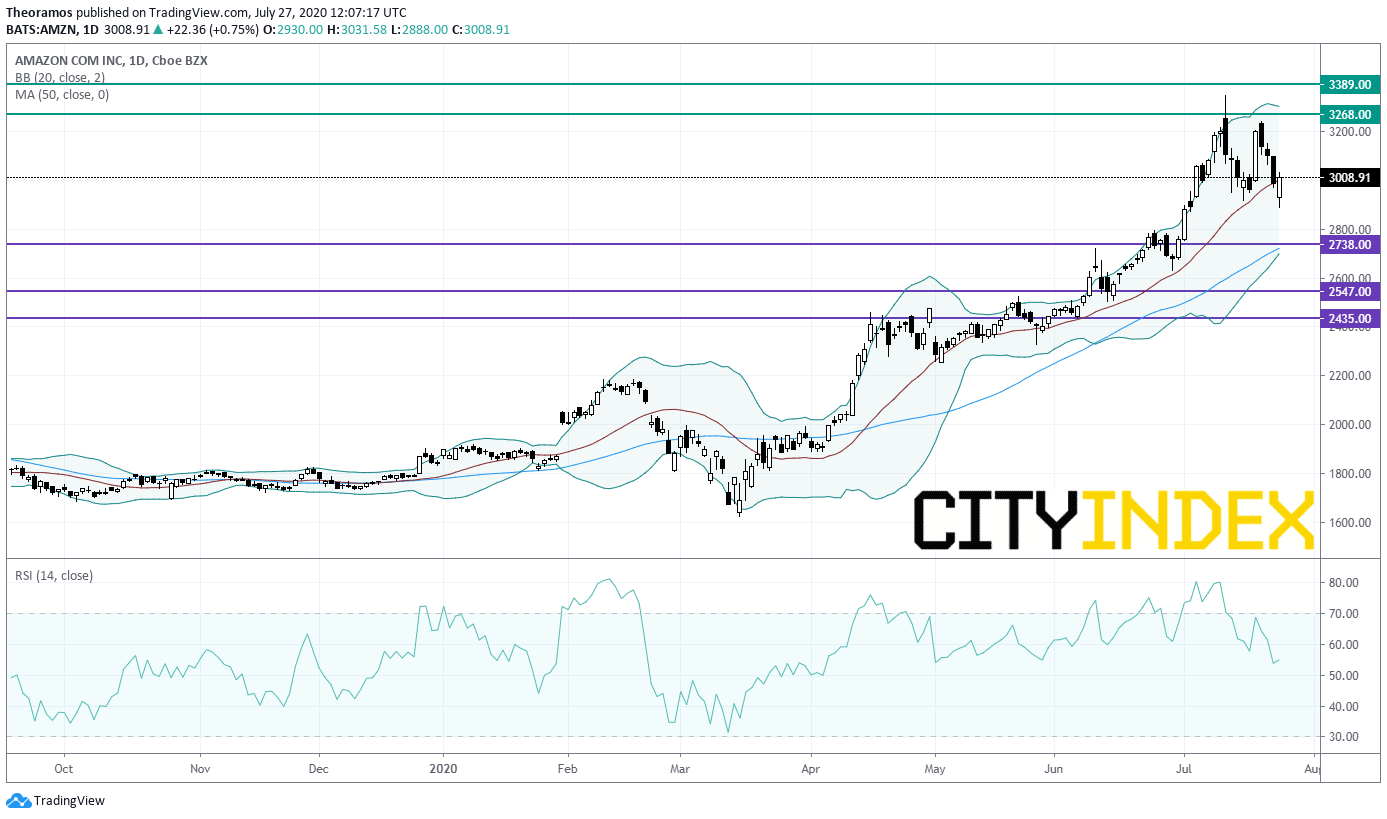

Amazon.com's (AMZN), the e-commerce giant, price target was raised to 3,600 dollars from 2,800 dollars at Telsey, and to 3,600 dollars from 3,000 dollars at Wells Fargo. Separately, according to Reuters, the company plans to add 1,000 jobs in Ireland over two years, bringing total workforce in the country to 5,000.

Later today, the U.S. Commerce Department will report Durable Goods Orders for June (preliminary readings). July Dallas Fed Manufacturing Index is also expected.

European indices are posting a rebound. Germany's IFO Business Climate Index at 90.5 (vs 89.3 expected) and Expectations Index at 97.0 (vs 93.4 expected) for July were released. The European Central Bank has reported M3 Money Supply growth in June at +9.2% (vs +9.3% on year expected).

Asian indices closed mixed as Beijing ordered the U.S. consulate in Chengdu city to close in retaliation against the U.S. which shut the Chinese consulate in Houston.

WTI Crude Oil futures are under pressure. The number of U.S. rigs dropped to 251 for the week ended 24 from 253, while the amount of rigs in Canada increased to 42 from 32, according to Baker Hughes.

Gold climbed to an all-time high while the US dollar index fell to a two-year low on US-China tensions and COVID-19 fears.

Gold rose 39.93 dollars (+2.1%) to 1941.95 dollars.

The dollar index fell 0.63pt to 93.805.

U.S. Equity Snapshot

Amazon.com's (AMZN), the e-commerce giant, price target was raised to 3,600 dollars from 2,800 dollars at Telsey, and to 3,600 dollars from 3,000 dollars at Wells Fargo. Separately, according to Reuters, the company plans to add 1,000 jobs in Ireland over two years, bringing total workforce in the country to 5,000.

Source: TradingView, Gain Capital

Apple's (AAPL), the tech giant, price target was raised to 425 dollars from 365 dollars at JPMorgan.

Moderna (MRNA), the biotech, "announced that the Phase 3 study of its mRNA vaccine candidate (mRNA-1273) against COVID-19 has begun." The company expects to enroll 30,000 participants in the US.

Schlumberger (SLB), the world's largest supplier of oil and gas products and services, was upgraded to "buy" from "neutral" at Citigroup. Target price was raised to 26 dollars from 20 dollars.

Biogen (BIIB), a pharmaceutical company, was upgraded to "overweight" from "underweight" at Morgan Stanley.

Hasbro (HAS), the toy maker, is losing ground before hours after posting quarterly results that missed estimates.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM