U.S Futures sliding - Watch DNKN, AAPL, SNAP, PINS, HAS

The S&P 500 Futures stocks are under pressure after they closed slightly up on Friday.

Later today, the U.S. Commerce Department will report September new home sales (1.02 million units expected). The Federal Reserve Bank of Chicago will post September National Activity Index (0.60 expected). The Dallas Federal Reserve will post its Manufacturing Outlook Index for October (13.3 expected).

European indices are on the downside as COVID-19 cases are skyrocketing. German Index DAX 30 underperforms its European peers after SAP profit warning.

Germany's IFO Business Climate Index for October was released at 92.7 (vs 93.0 expected) and Expectations Index at 95.0 (vs 96.5 expected).

Asian indices closed on the downside. The Hong Kong HSI was closed for bank holiday.

WTI Crude Oil futures are facing a drop on fears of new lockdowns. The total number of rotary rigs in the U.S. rose to 287 as of October 23 from 282 in the prior week, and rigs in Canada climbed to 83 from 80, according to Baker Hughes.

Gold and the U.S dollar remain firm as COVID-19 cases surge.

Gold rose 3.05 dollars (+0.16%) to 1905.1.

The dollar index gained 0.17pt to 92.942.

U.S. Equity Snapshot

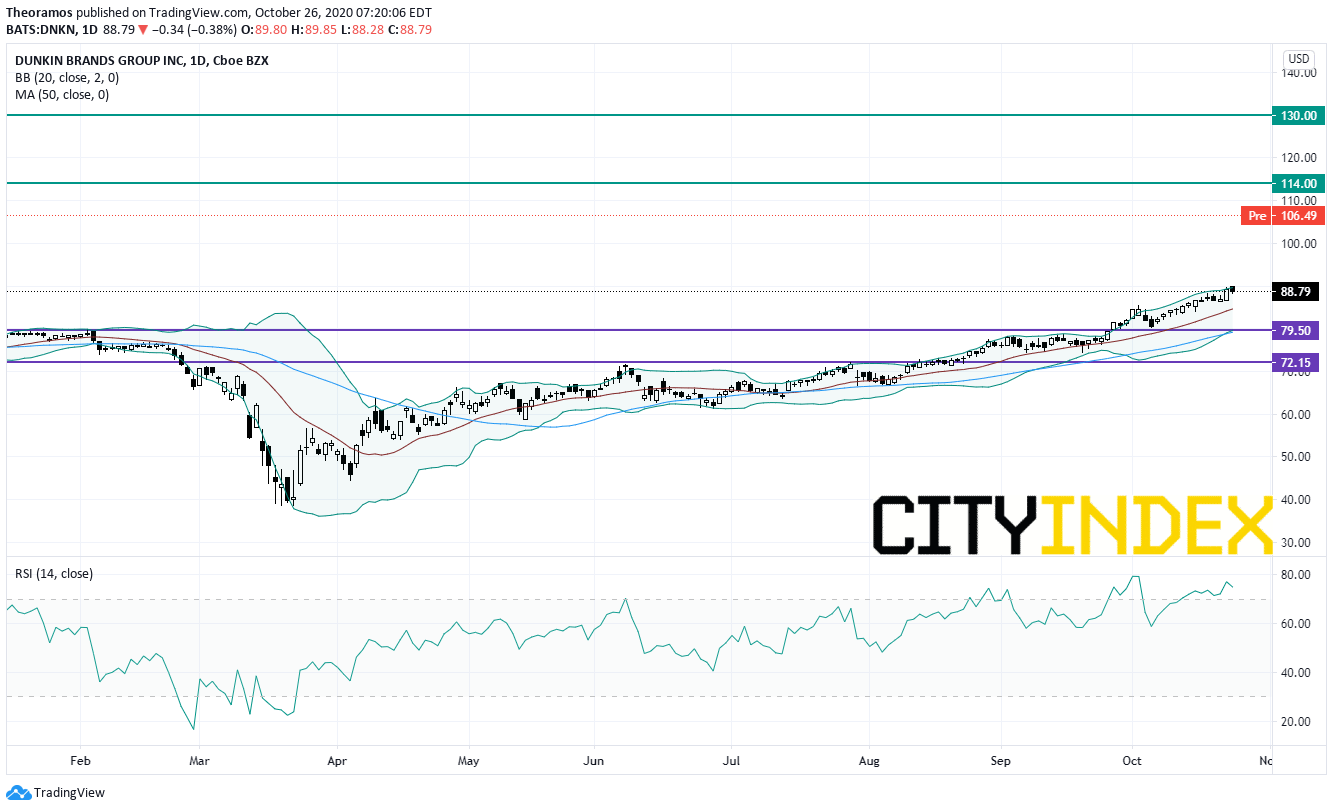

Dunkin' Brands (DNKN), the franchisor of quick service restaurants, "confirmed that it has held preliminary discussions to be acquired by Inspire Brands. There is no certainty that any agreement will be reached." According to the New York Times, Inspire would offer 106.50 dollar per Dunkin' Brands, a 20% premium over October 23rd's closing price.

Source: TradingView, GAIN Capital

Apple (AAPL), the tech giant, was upgraded to "overweight" from "neutral" at Atlantic Equities.

Snap (SNAP)'s, the social media, price target was raised to 52 dollars from 36 dollars at Guggenheim.

Pinterest (PINS)'s, the social network, price target was raised to 60 dollars from 44 dollars at KeyBanc.

Hasbro (HAS), the toy maker, is expected to gain ground as third quarter EPS and sales beat estimates.

Later today, the U.S. Commerce Department will report September new home sales (1.02 million units expected). The Federal Reserve Bank of Chicago will post September National Activity Index (0.60 expected). The Dallas Federal Reserve will post its Manufacturing Outlook Index for October (13.3 expected).

European indices are on the downside as COVID-19 cases are skyrocketing. German Index DAX 30 underperforms its European peers after SAP profit warning.

Germany's IFO Business Climate Index for October was released at 92.7 (vs 93.0 expected) and Expectations Index at 95.0 (vs 96.5 expected).

Asian indices closed on the downside. The Hong Kong HSI was closed for bank holiday.

WTI Crude Oil futures are facing a drop on fears of new lockdowns. The total number of rotary rigs in the U.S. rose to 287 as of October 23 from 282 in the prior week, and rigs in Canada climbed to 83 from 80, according to Baker Hughes.

Gold and the U.S dollar remain firm as COVID-19 cases surge.

Gold rose 3.05 dollars (+0.16%) to 1905.1.

The dollar index gained 0.17pt to 92.942.

U.S. Equity Snapshot

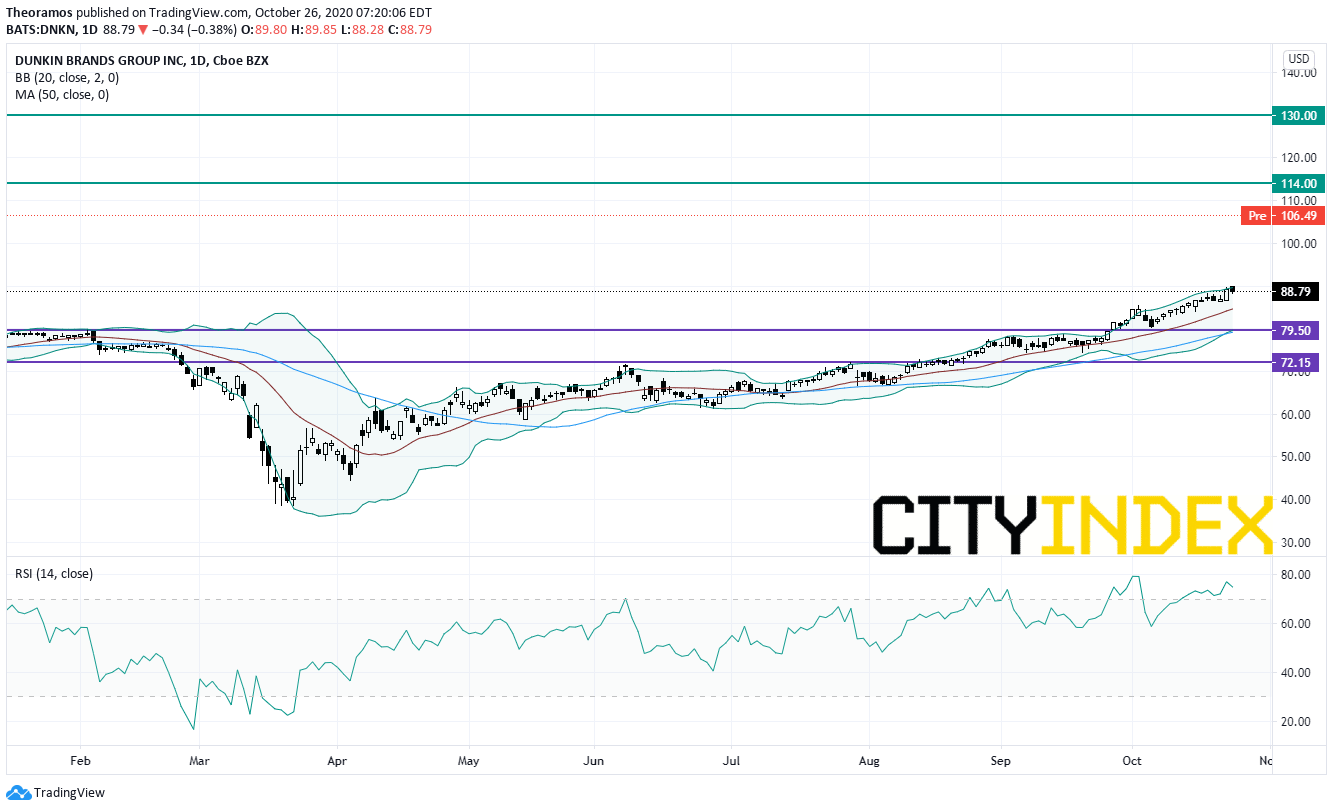

Dunkin' Brands (DNKN), the franchisor of quick service restaurants, "confirmed that it has held preliminary discussions to be acquired by Inspire Brands. There is no certainty that any agreement will be reached." According to the New York Times, Inspire would offer 106.50 dollar per Dunkin' Brands, a 20% premium over October 23rd's closing price.

Source: TradingView, GAIN Capital

Apple (AAPL), the tech giant, was upgraded to "overweight" from "neutral" at Atlantic Equities.

Snap (SNAP)'s, the social media, price target was raised to 52 dollars from 36 dollars at Guggenheim.

Pinterest (PINS)'s, the social network, price target was raised to 60 dollars from 44 dollars at KeyBanc.

Hasbro (HAS), the toy maker, is expected to gain ground as third quarter EPS and sales beat estimates.

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM