NZD/USD: narrowing New Zealand's annual trade deficit

This morning, official data showed that New Zealand recorded in May an annual trade deficit of 1.33 billion New Zealand dollars, the lowest since 2014. On a monthly basis, New Zealand posted a trade surplus of 1.25 billion New Zealand dollars in May (1.29 billion New Zealand dollars expected), where exports totaled 5.39 billion New Zealand dollars (5.40 billion New Zealand dollars expected).

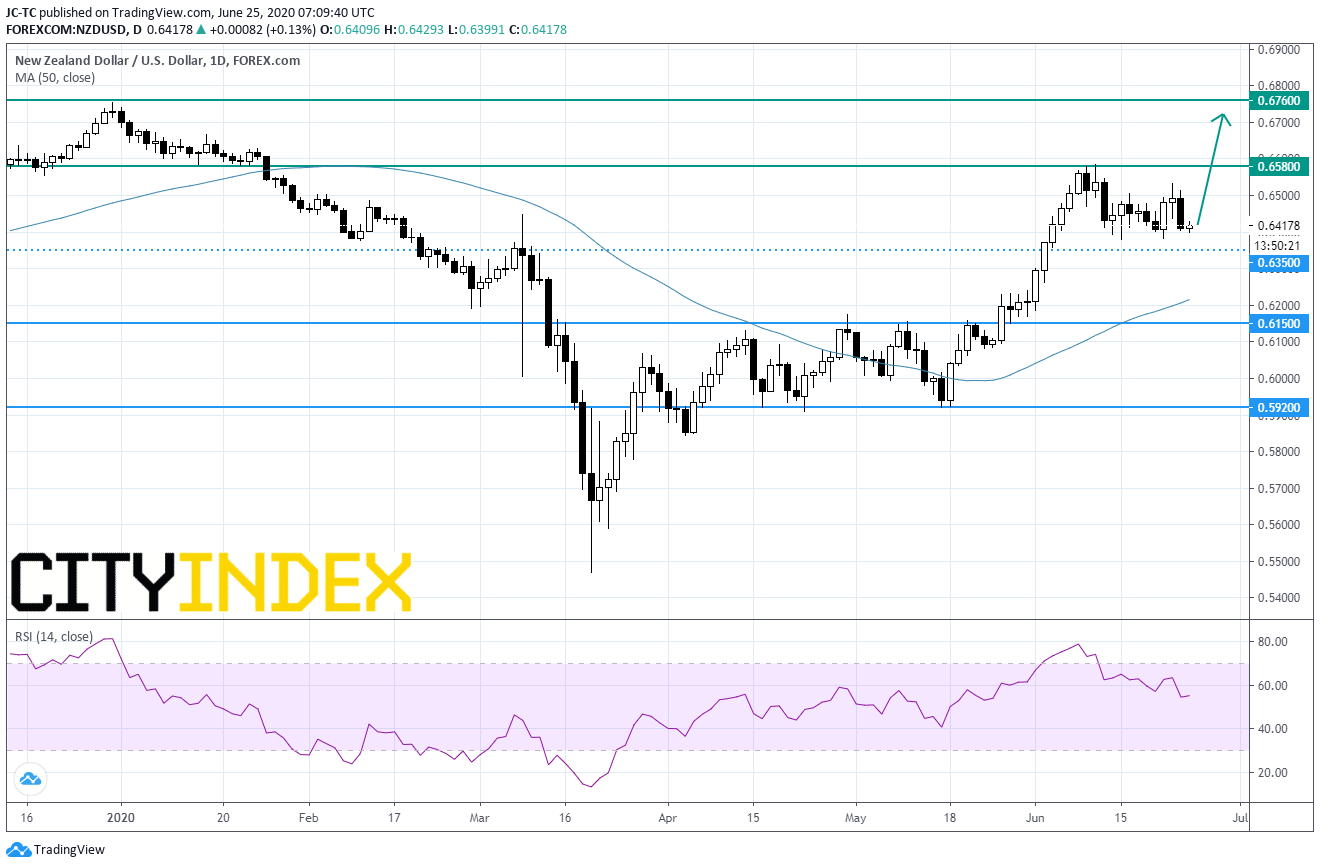

From a technical point of view, on a daily chart, the pair consolidates above former resistance at 0.6350 and stands above its 50-day moving average (in blue). The daily RSI remains within its buying area. Readers may therefore consider the potential for further advance above support at 0.6150 (overlap). The nearest resistance would be set at 0.6580 (June high) and a second one would be set at 0.6760 (December high) in extension.

From a technical point of view, on a daily chart, the pair consolidates above former resistance at 0.6350 and stands above its 50-day moving average (in blue). The daily RSI remains within its buying area. Readers may therefore consider the potential for further advance above support at 0.6150 (overlap). The nearest resistance would be set at 0.6580 (June high) and a second one would be set at 0.6760 (December high) in extension.

Source : TradingVIEW, Gain Capital

Latest market news

Yesterday 10:40 PM

Yesterday 04:00 PM