EU indices still up this morning | TA focus on Ferrexpo

INDICES

Yesterday, European stocks were broadly higher. The Stoxx Europe 600 Index jumped 1.58%, Germany's DAX 30 surged 2.36%, France's CAC 40 gained 2.28%, and the U.K.'s FTSE 100 was up 1.58%.

EUROPE ADVANCE/DECLINE

86% of STOXX 600 constituents traded higher yesterday.

74% of the shares trade above their 20D MA vs 51% Friday (below the 20D moving average).

55% of the shares trade above their 200D MA vs 51% Friday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.23pt to 23.11, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Chemicals, Construction

3mths relative low: none

Europe Best 3 sectors

energy, automobiles & parts, banks

Europe worst 3 sectors

travel & leisure, real estate, health care

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.51% (below its 20D MA). The 2yr-10yr yield spread fell 1bp to -19bps (above its 20D MA).

ECONOMIC DATA

GE 07:00: Q2 GDP Growth Rate YoY final, exp.: -2.3%

GE 07:00: Q2 GDP Growth Rate QoQ final, exp.: -2%

GE 09:00: Aug Ifo Current Conditions, exp.: 84.5

GE 09:00: Aug Ifo expectations, exp.: 97

GE 09:00: Aug Ifo Business Climate, exp.: 90.5

GE 10:40: 2-Year Schatz auction, exp.: -0.68%

UK 11:00: Aug CBI Distributive Trades, exp.: 4

MORNING TRADING

In Asian trading hours, EUR/USD climbed to 1.1806 and GBP/USD rebounded to 1.3101. USD/JPY slipped to 105.92.

Spot gold bounced to $1,934 an ounce.

#UK - IRELAND#

AstraZeneca, a pharmaceutical group, said it has initiated a phase I trial of AZD7442, "a combination of two monoclonal antibodies (mAbs) in development for the prevention and treatment of COVID-19".

Source: GAIN Capital, TradingView

#BENELUX#

GrandVision, an optical retailer, said a Dutch district court has in summary proceedings dismissed all claims made by EssilorLuxottica to receive additional documentation mainly in relation to its actions to mitigate the impact of COVID-19 on its business. The company added: "The arbitration proceedings initiated by GrandVision against EssilorLuxottica, as communicated on 30 July 2020, are proceeding as planned."

#SWEDEN#

Telia, a Swedish telecommunications group, was upgraded to "neutral" from "underweight" at JPMorgan.

Yesterday, European stocks were broadly higher. The Stoxx Europe 600 Index jumped 1.58%, Germany's DAX 30 surged 2.36%, France's CAC 40 gained 2.28%, and the U.K.'s FTSE 100 was up 1.58%.

EUROPE ADVANCE/DECLINE

86% of STOXX 600 constituents traded higher yesterday.

74% of the shares trade above their 20D MA vs 51% Friday (below the 20D moving average).

55% of the shares trade above their 200D MA vs 51% Friday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.23pt to 23.11, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Chemicals, Construction

3mths relative low: none

Europe Best 3 sectors

energy, automobiles & parts, banks

Europe worst 3 sectors

travel & leisure, real estate, health care

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.51% (below its 20D MA). The 2yr-10yr yield spread fell 1bp to -19bps (above its 20D MA).

ECONOMIC DATA

GE 07:00: Q2 GDP Growth Rate YoY final, exp.: -2.3%

GE 07:00: Q2 GDP Growth Rate QoQ final, exp.: -2%

GE 09:00: Aug Ifo Current Conditions, exp.: 84.5

GE 09:00: Aug Ifo expectations, exp.: 97

GE 09:00: Aug Ifo Business Climate, exp.: 90.5

GE 10:40: 2-Year Schatz auction, exp.: -0.68%

UK 11:00: Aug CBI Distributive Trades, exp.: 4

MORNING TRADING

In Asian trading hours, EUR/USD climbed to 1.1806 and GBP/USD rebounded to 1.3101. USD/JPY slipped to 105.92.

Spot gold bounced to $1,934 an ounce.

#UK - IRELAND#

AstraZeneca, a pharmaceutical group, said it has initiated a phase I trial of AZD7442, "a combination of two monoclonal antibodies (mAbs) in development for the prevention and treatment of COVID-19".

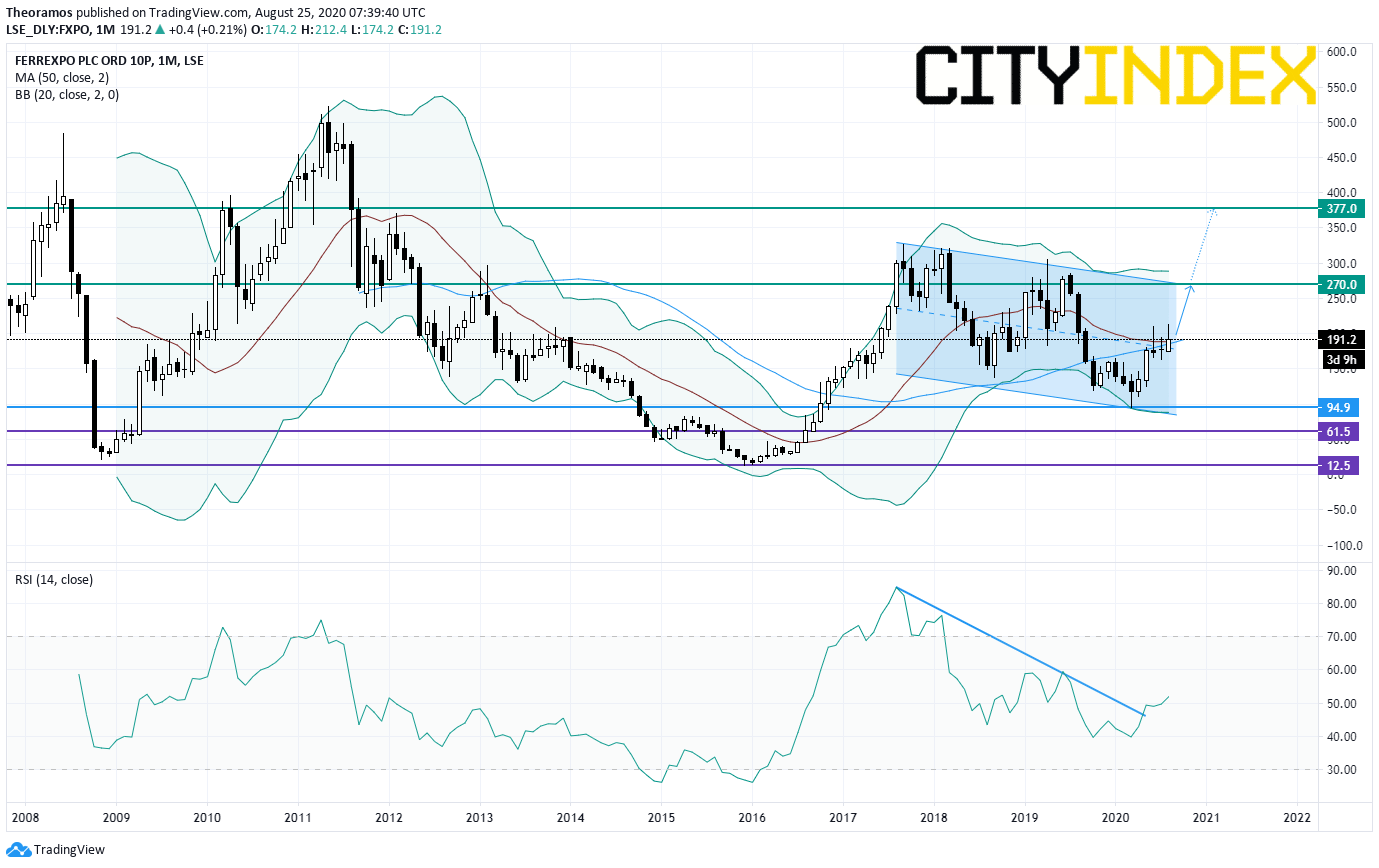

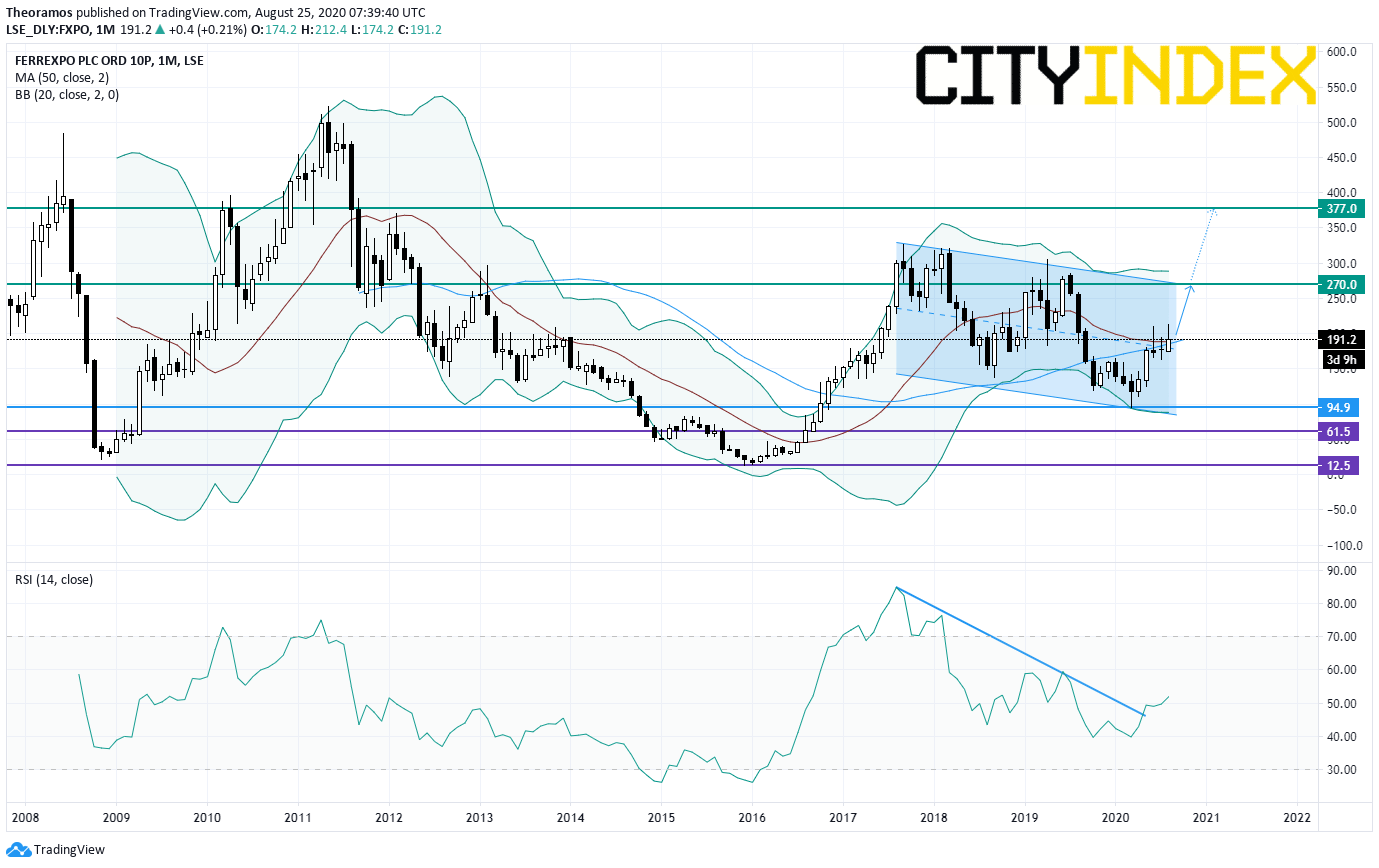

Ferrexpo, a commodity trading and mining company, announced the appointment of Lucio Genovese, currently non-executive director, as new Chairman with immediate effect.

From a monthly point of view, the share consolidates within a consolidation channel drawn since 2017. The RSI's behaviour, by breaking up above a declining trend line drawn from 2017, has given us an advanced signal. Above 94.9, look for the upper end of the consolidation channel set today around 270p. As soon as the upper boundary of the channel will be reached and bypassed, prices will look for 377p. Alternatively, a break below the pattern would set targets toward the previous all-time low at 12.5p.

Source: GAIN Capital, TradingView

#BENELUX#

GrandVision, an optical retailer, said a Dutch district court has in summary proceedings dismissed all claims made by EssilorLuxottica to receive additional documentation mainly in relation to its actions to mitigate the impact of COVID-19 on its business. The company added: "The arbitration proceedings initiated by GrandVision against EssilorLuxottica, as communicated on 30 July 2020, are proceeding as planned."

#SWEDEN#

Telia, a Swedish telecommunications group, was upgraded to "neutral" from "underweight" at JPMorgan.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM