US Futures red, watch DELL, VMW, AMZN, GOOGL

Later today, the U.S. Federal Housing Finance Agency will post its house price index for April (-0.4% on month expected).

European indices are deeply in the red. On the statistical front, in Germany, the IFO business climate index came out at 86.2 in June, compared to 79.7 in May (revised from 79.5) and 85.0 expected. The Current Conditions sub-index came out at 81.3, compared to 78.9 in the previous month and 84.0 expected. The outlook sub-index stood at 91.4, compared to 80.5 a month earlier (revised from 80.1) and 87.0 expected. In France, the Business Climate Indicator for the manufacturing sector was 77 in June compared to 79 expected and 71 the previous month (revised from 70). For its part, the business climate index as a whole stood at 78 compared to 60 in May (revised from 59) and 72 expected.

Asian indices ended mixed. The Hong Kong HSI and the Japanese Nikkei indices ended lower while the Australian ASX 200 and the Mainland China Index CSI 300 both gained some ground.

WTI Crude Oil Futures are easing. The American Petroleum Institute (API) reported that U.S. crude oil stockpile built 1.7M barrels for week ended June 19. Later today, EIA will release crude oil inventories data for last week.

Gold gains ground, close from a 8-year high, on jumping COVID-19 global cases.

Gold rose 6.97 dollars (+0.39%) to 1775.39 dollars.

Risk currencies consolidate on reports that the US may target new tariffs on EU and UK goods.

EUR/USD fell 7pips to 1.1301 while GBP/USD declined 4pips to 1.2516.

US Equity Snapshot

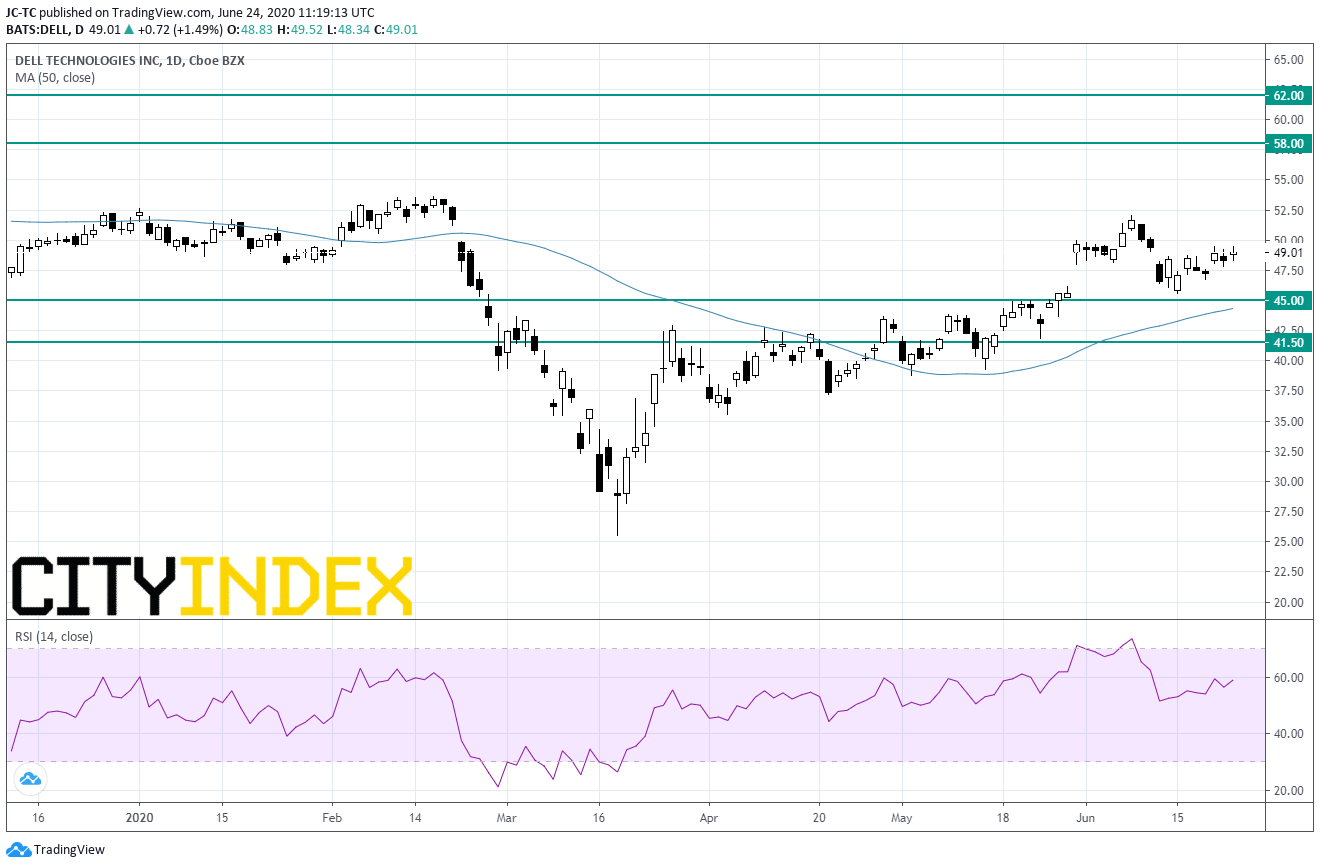

Dell Technologies (DELL), a technology company, is considering options for its 50 billion dollars stake in information technology company VMware (VMW), including a spinoff or a sale of the stake, or buying the minority stake of VMware that it doesn't already own, reported the Wall Street Journal citing people familiar with the matter.

Amazon.com's (AMZN), the e-commerce giant, price target was raised to 3050 dollars from 2750 dollars by Wedbush.

Alphabet's (GOOGl), Google parent company, price target was raised to 1775 dollars from 1425 dollars by Goldman Sachs.

T-Mobile US (TMUS) priced public offering shares at 103 dollars each, as part of Softbank's sale of its US mobile company shares.

Carnival's (CCL), an international cruise line, credit rating was downgraded to "BB-", a junk rating, from "BBB-" at S&P Global Ratings. The rating agency stated: "we believe the cruise industry may face an extended period of weak demand that will cause global cruise operator Carnival Corp.'s credit measures to remain very weak through at least 2021 as it implements a phased resumption of its cruises and given incremental debt raises to bolster its liquidity while its operations remain suspended."

Norwegian Cruise Line (NCLH), the cruise company, was downgraded to "equal-weight" from "overweight" at Barclays.

Source : TradingVIEW, Gain Capital