U.S Futures flat - Watch CAN, SSP, NKLA, KMX, PENN, RAD

The S&P 500 Futures are flat following Wednesday sharp correction as the Dow Jones Industrial Average slumped 525 points (-1.92%) to 26763, the S&P 500 tumbled 78 points (-2.37%) to 3236, and the Nasdaq 100 plummeted 353 points (-3.16%) to 10833.

Later today, the U.S. Labor Department will release initial jobless claims in the week ending September 19 (0.84 million expected). The Commerce Department will report August new home sales (0.89 million units expected).

European indices are flat despites a lower opening. On the economic data front, German IFO business climate index was released at 93.4 in September, compared with 92.5 in August (revised from 92.6) and 93.8 expected. The current conditions sub-index rose from 87.9 to 89.2 but 89.5 expected. The outlook sub-index stood at 97.7, compared with 97.2 a month earlier (revised from 97.5) and 98 expected.

Asian indices declined around 1% on average, pushed lower by Wednesday Wall Street correction.

WTI Crude Oil futures are drawing a consolidation. The U.S. Energy Information Administration reported that crude stockpiles dropped 1.64 million barrels in the week ending September 18 (-2.47 million barrels expected) to 494 million barrels, the lowest total since early April.

Gold hit its lowest level in more than two months on surging dollars as equities retreat on coronavirus concern.

Gold fell 5.05$ (-0.27%) to 1858.29 dollars while the dollar index rose 0.05pt to 94.436.

U.S. Equity Snapshot

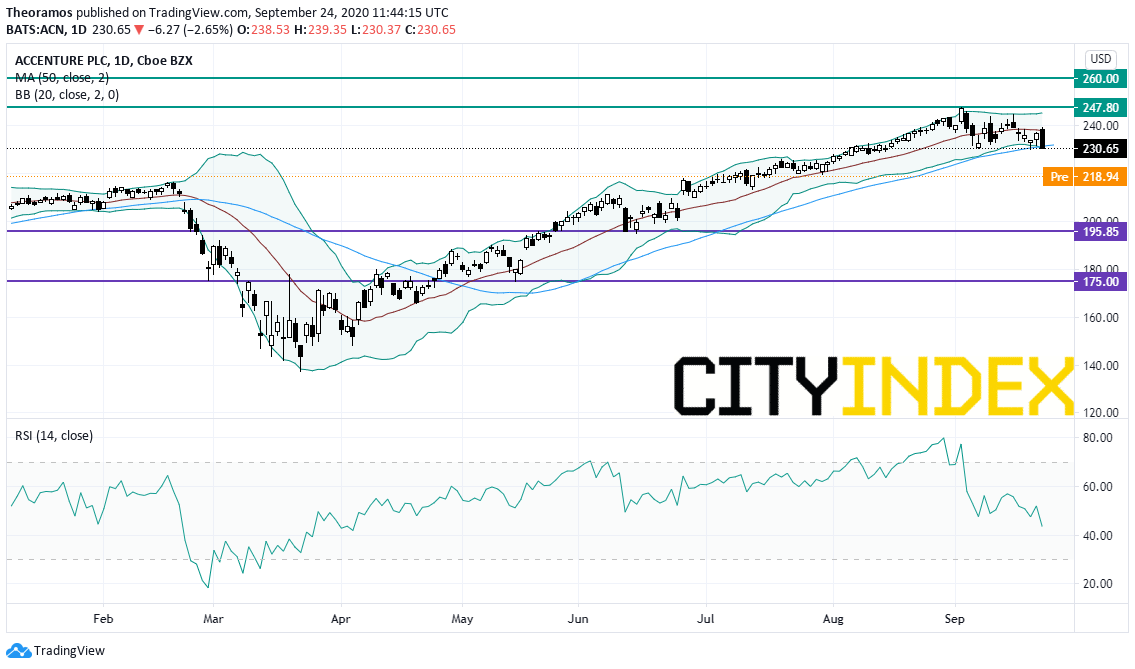

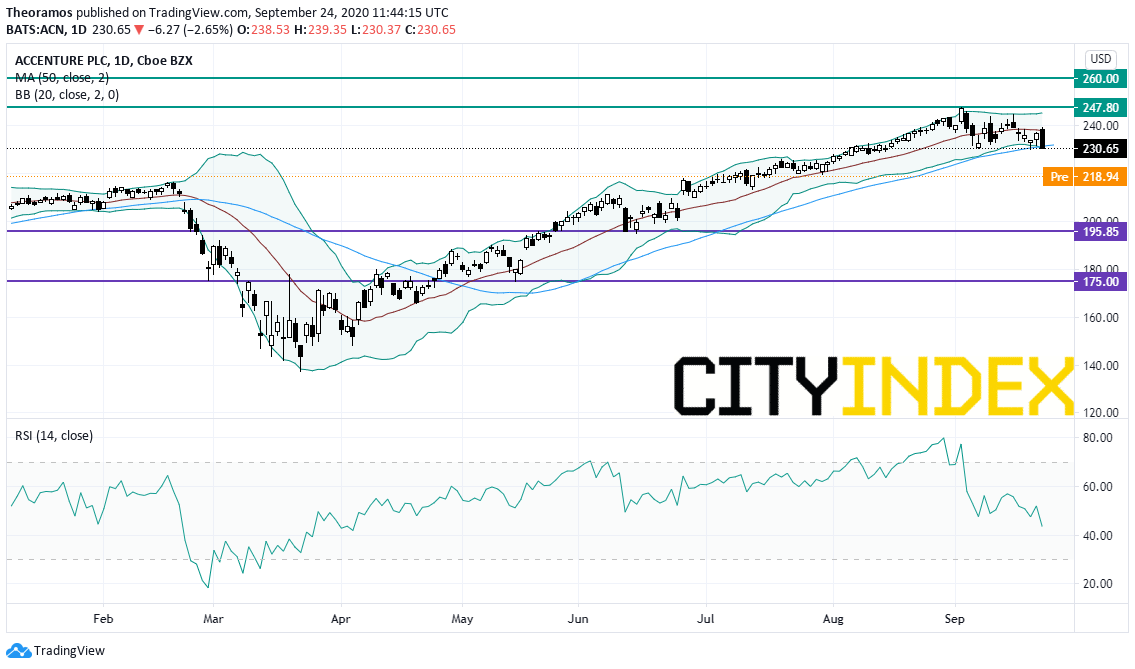

Accenture (ACN), a leading global professional services company, is losing ground before hours after posting fourth quarter adjusted EPS and full year EPS forecast that both missed estimates.

Source: TradingView, GAIN Capital

CarMax (KMX), a leading global professional services company, reported second quarter comparable sales up 1.2%, above estimates.

Penn National Gaming (PENN), an operator of casinos and racetracks, was downgraded to "neutral" from "outperform" at Macquarie.

Rite Aid (RAD), the drugstore chain, is surging before hours after unveiling second quarter adjusted EPS and sales that beat estimates.

Later today, the U.S. Labor Department will release initial jobless claims in the week ending September 19 (0.84 million expected). The Commerce Department will report August new home sales (0.89 million units expected).

European indices are flat despites a lower opening. On the economic data front, German IFO business climate index was released at 93.4 in September, compared with 92.5 in August (revised from 92.6) and 93.8 expected. The current conditions sub-index rose from 87.9 to 89.2 but 89.5 expected. The outlook sub-index stood at 97.7, compared with 97.2 a month earlier (revised from 97.5) and 98 expected.

Asian indices declined around 1% on average, pushed lower by Wednesday Wall Street correction.

WTI Crude Oil futures are drawing a consolidation. The U.S. Energy Information Administration reported that crude stockpiles dropped 1.64 million barrels in the week ending September 18 (-2.47 million barrels expected) to 494 million barrels, the lowest total since early April.

Gold hit its lowest level in more than two months on surging dollars as equities retreat on coronavirus concern.

Gold fell 5.05$ (-0.27%) to 1858.29 dollars while the dollar index rose 0.05pt to 94.436.

U.S. Equity Snapshot

Accenture (ACN), a leading global professional services company, is losing ground before hours after posting fourth quarter adjusted EPS and full year EPS forecast that both missed estimates.

Source: TradingView, GAIN Capital

E.W. Scripps (SSP), the media company, might be close to buy ION Media for 2.65 billion dollars, according to Dow Jones.

Nikola (NKLA), the hydrogen-electric vehicles maker, was downgraded to "underperform" from "neutral" at Wedbush.CarMax (KMX), a leading global professional services company, reported second quarter comparable sales up 1.2%, above estimates.

Penn National Gaming (PENN), an operator of casinos and racetracks, was downgraded to "neutral" from "outperform" at Macquarie.

Rite Aid (RAD), the drugstore chain, is surging before hours after unveiling second quarter adjusted EPS and sales that beat estimates.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM