EU indices under pressure | TA focus on Evraz

INDICES

Yesterday, European stocks were broadly higher. The Stoxx Europe 600 Index gained 0.55%, Germany's DAX 30 advanced 0.39%, the U.K.'s FTSE 100 jumped 1.20%, and France's CAC 40 was up 0.62%.

EUROPE ADVANCE/DECLINE

62% of STOXX 600 constituents traded higher yesterday.

34% of the shares trade above their 20D MA vs 29% Tuesday (below the 20D moving average).

53% of the shares trade above their 200D MA vs 51% Tuesday (below the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.94pt to 27.17, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Retail, Pers. & House. Goods

3mths relative low: Insurance, Banks, Energy

Europe Best 3 sectors

energy, automobiles & parts, technology

Europe worst 3 sectors

insurance, travel & leisure, basic resources

INTEREST RATE

The 10yr Bund yield rose 3bps to -0.51% (below its 20D MA). The 2yr-10yr yield spread rose 1bp to -20bps (above its 20D MA).

ECONOMIC DATA

FR 07:45: Sep Business Confidence, exp.: 93

FR 07:45: Sep Business Climate Indicator, exp.: 91

EC 09:00: ECB General Council Meeting

EC 09:00: ECB Economic Bulletin

GE 09:00: Sep Ifo Current Conditions, exp.: 87.9

GE 09:00: Sep Ifo expectations, exp.: 97.5

GE 09:00: Sep Ifo Business Climate, exp.: 92.6

UK 11:00: Sep CBI Distributive Trades, exp.: -6

UK 15:00: BoE Gov Bailey speech

GE 16:00: Bundesbank Wuermeling speech

UK 00:01: Sep Gfk Consumer Confidence, exp.: -27

MORNING TRADING

In Asian trading hours, the U.S. dollar remained firm, as EUR/USD was subdued at 1.1662 and GBP/USD stayed at 1.2718. USD/JPY edged up to 105.44.

Spot gold dropped to $1,859 an ounce.

#UK - IRELAND#

Smiths Group, a diversified engineering group, released full-year results: "The Group delivered a robust overall performance for the year. Underlying revenue for continuing operations was down (1)%, comprising +3% in the first half and (4)% in the second half. (...) Underlying headline operating profit was down (13)% driven by lower volumes in the second half as well as additional costs to support business continuity and uninterrupted customer service during the pandemic. (...) Statutory basic EPS was also up +18% to 66.9p (FY2019: 56.8p). (...) Guidance remains withdrawn, given the uncertain depth and duration of the COVID-19 pandemic. (...) We are seeing a stabilisation of recent trends, with Total Group underlying revenue of (5)% for the last four months to end of August (continuing operations (8)%)."

United Utilities, a water company, posted a 1H trading update: "Group revenue is expected to be lower than the first half of last year, largely reflecting our allowed regulatory revenue changes and lower consumption from businesses as a result of COVID-19, partly offset by higher consumption from households. Overall, the net reduction in revenue in the first half of the year is expected to be around 5 per cent. Underlying operating profit for the first half of 2020/21 is expected to be lower than the first half of 2019/20 largely reflecting the lower revenue and an anticipated moderate increase in infrastructure renewals expenditure (IRE)."

National Express Group, a public transport company, published a trading statement: "We traded slightly above our previously guided base case as we closely manage customer relationships, contract details and service requirements throughout the pandemic: Our previously guided base case assumed revenue to be around 50% of pre-Covid 19 expectations until the end of August; Tight cost controls remain in-place driving positive EBITDA and cash flow."

Pets At Home Group, a pet care business, issued a 1H trading update: "Although COVID-19 continues to create a number of material uncertainties around the trading environment, including the risk of a second lockdown, based on trading year to date, and as a consequence of the sustained strength in performance we have seen, we now expect full-year underlying pre-tax profit to be ahead of current market expectations (£73m)."

Antofagasta, a giant copper producer, was upgraded to "equalweight" from "underweight" at Morgan Stanley.

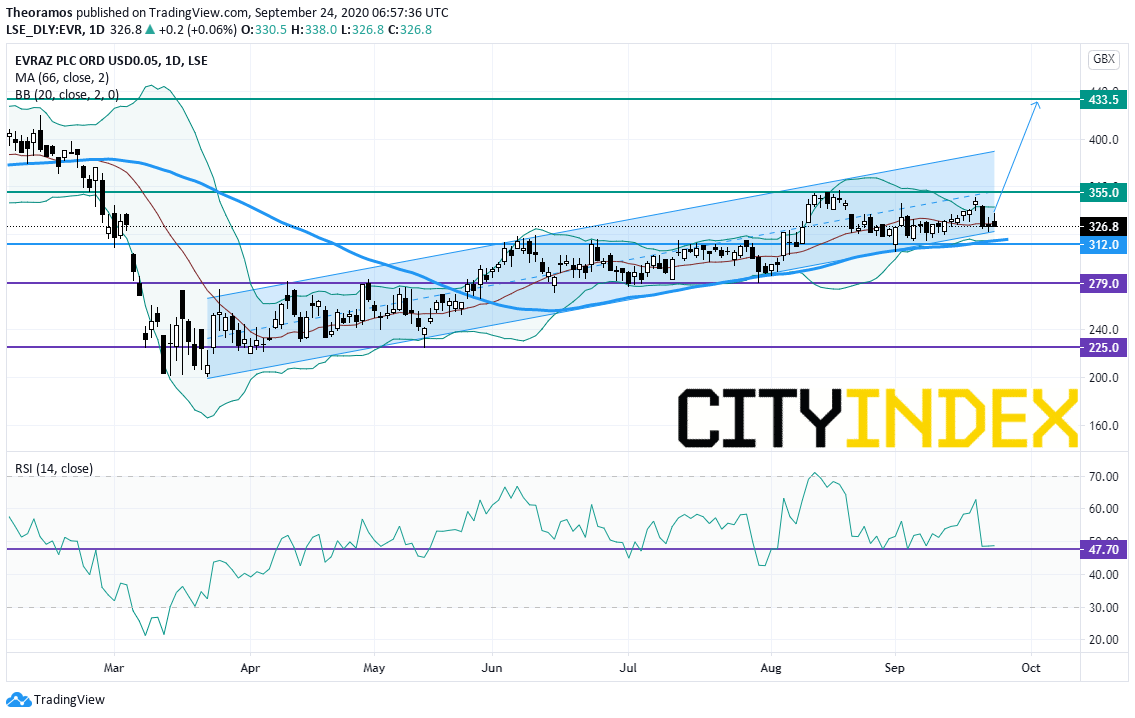

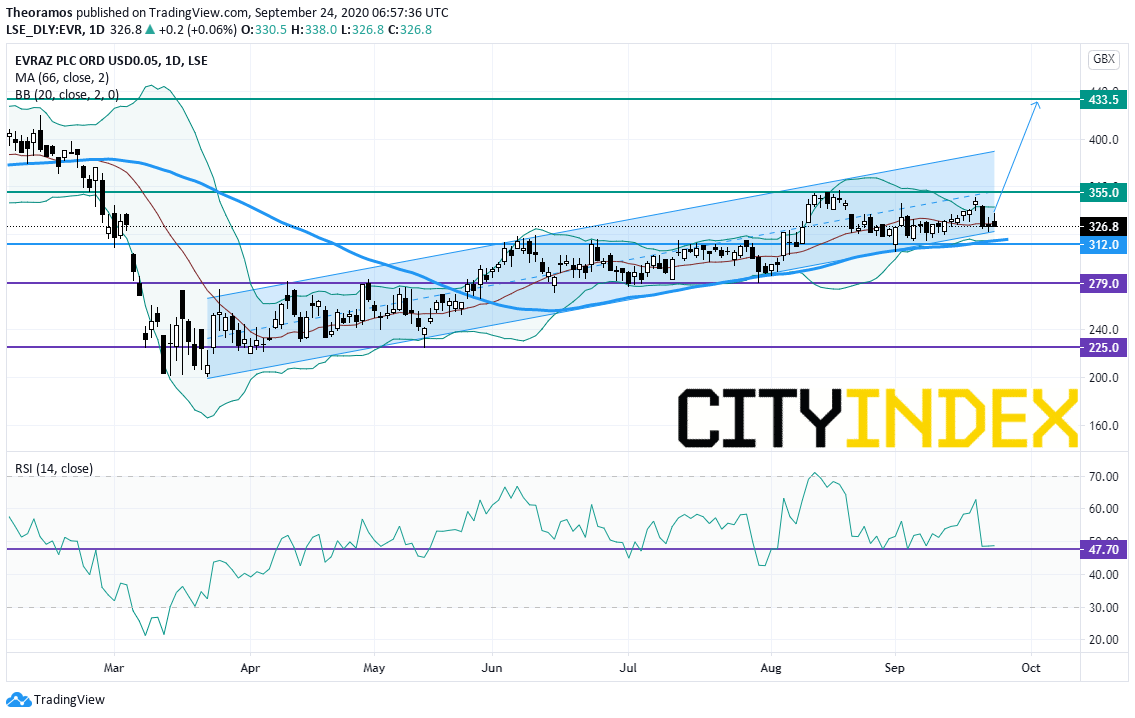

Evraz, a steel making and mining company, was upgraded to "equalweight" from "underweight" at Morgan Stanley.

Source: GAIN Capital, TradingView

#FRANCE#

Airbus, an aircraft manufacturer, has been asked by Delta Air Lines to delay deliveries of 40 aircraft scheduled this year, reported Bloomberg citing people familiar with the matter.

#ITALY#

STMicroelectronics, a semiconductor manufacturer, said it has decided to maintain the distribution of a cash dividend of 0.168 dollar per share, as approved by the Annual General Meeting of Shareholders on June 17, 2020.

Yesterday, European stocks were broadly higher. The Stoxx Europe 600 Index gained 0.55%, Germany's DAX 30 advanced 0.39%, the U.K.'s FTSE 100 jumped 1.20%, and France's CAC 40 was up 0.62%.

EUROPE ADVANCE/DECLINE

62% of STOXX 600 constituents traded higher yesterday.

34% of the shares trade above their 20D MA vs 29% Tuesday (below the 20D moving average).

53% of the shares trade above their 200D MA vs 51% Tuesday (below the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.94pt to 27.17, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Retail, Pers. & House. Goods

3mths relative low: Insurance, Banks, Energy

Europe Best 3 sectors

energy, automobiles & parts, technology

Europe worst 3 sectors

insurance, travel & leisure, basic resources

INTEREST RATE

The 10yr Bund yield rose 3bps to -0.51% (below its 20D MA). The 2yr-10yr yield spread rose 1bp to -20bps (above its 20D MA).

ECONOMIC DATA

FR 07:45: Sep Business Confidence, exp.: 93

FR 07:45: Sep Business Climate Indicator, exp.: 91

EC 09:00: ECB General Council Meeting

EC 09:00: ECB Economic Bulletin

GE 09:00: Sep Ifo Current Conditions, exp.: 87.9

GE 09:00: Sep Ifo expectations, exp.: 97.5

GE 09:00: Sep Ifo Business Climate, exp.: 92.6

UK 11:00: Sep CBI Distributive Trades, exp.: -6

UK 15:00: BoE Gov Bailey speech

GE 16:00: Bundesbank Wuermeling speech

UK 00:01: Sep Gfk Consumer Confidence, exp.: -27

MORNING TRADING

In Asian trading hours, the U.S. dollar remained firm, as EUR/USD was subdued at 1.1662 and GBP/USD stayed at 1.2718. USD/JPY edged up to 105.44.

Spot gold dropped to $1,859 an ounce.

#UK - IRELAND#

Smiths Group, a diversified engineering group, released full-year results: "The Group delivered a robust overall performance for the year. Underlying revenue for continuing operations was down (1)%, comprising +3% in the first half and (4)% in the second half. (...) Underlying headline operating profit was down (13)% driven by lower volumes in the second half as well as additional costs to support business continuity and uninterrupted customer service during the pandemic. (...) Statutory basic EPS was also up +18% to 66.9p (FY2019: 56.8p). (...) Guidance remains withdrawn, given the uncertain depth and duration of the COVID-19 pandemic. (...) We are seeing a stabilisation of recent trends, with Total Group underlying revenue of (5)% for the last four months to end of August (continuing operations (8)%)."

United Utilities, a water company, posted a 1H trading update: "Group revenue is expected to be lower than the first half of last year, largely reflecting our allowed regulatory revenue changes and lower consumption from businesses as a result of COVID-19, partly offset by higher consumption from households. Overall, the net reduction in revenue in the first half of the year is expected to be around 5 per cent. Underlying operating profit for the first half of 2020/21 is expected to be lower than the first half of 2019/20 largely reflecting the lower revenue and an anticipated moderate increase in infrastructure renewals expenditure (IRE)."

National Express Group, a public transport company, published a trading statement: "We traded slightly above our previously guided base case as we closely manage customer relationships, contract details and service requirements throughout the pandemic: Our previously guided base case assumed revenue to be around 50% of pre-Covid 19 expectations until the end of August; Tight cost controls remain in-place driving positive EBITDA and cash flow."

Pets At Home Group, a pet care business, issued a 1H trading update: "Although COVID-19 continues to create a number of material uncertainties around the trading environment, including the risk of a second lockdown, based on trading year to date, and as a consequence of the sustained strength in performance we have seen, we now expect full-year underlying pre-tax profit to be ahead of current market expectations (£73m)."

Antofagasta, a giant copper producer, was upgraded to "equalweight" from "underweight" at Morgan Stanley.

Evraz, a steel making and mining company, was upgraded to "equalweight" from "underweight" at Morgan Stanley.

From a daily point of view, the share is trading within a bullish channel drawn since March. In addition, the three-month moving average plays a support role, while the RSI is supported by a key support at 47.7%. Above 312p look for the horizontal resistance at 355p and the previous top of January 2020 at 435.5p in extension.

Source: GAIN Capital, TradingView

#FRANCE#

Airbus, an aircraft manufacturer, has been asked by Delta Air Lines to delay deliveries of 40 aircraft scheduled this year, reported Bloomberg citing people familiar with the matter.

#ITALY#

STMicroelectronics, a semiconductor manufacturer, said it has decided to maintain the distribution of a cash dividend of 0.168 dollar per share, as approved by the Annual General Meeting of Shareholders on June 17, 2020.

Latest market news

Today 07:55 AM

Today 04:47 AM

Yesterday 11:23 PM

Yesterday 10:19 PM