US Futures rising - Watch TSLA, BX, SPOT, PINS, DE, EL

The S&P 500 Futures remain on the upside after they charged higher on Friday, as both the S&P and the Nasdaq marked record closes. Market sentiment was supported by upbeat economic data.

Later today, the Federal Reserve Bank of Chicago will post July National Activity Index (3.7 expected).

European indices are bullish even if European Union's chief negotiator Michel Barnier said on Friday, about Brexit: "at this stage, an agreement between the U.K. and the E.U. seems unlikely".

Asian indices all closed in the green. Official data showed that New Zealand's 2Q retail sales declined 14.6% on quarter (-15.0% expected).Also, Japanese Prime Minister Shinzo Abe plans to go to hospital again today.

WTI Crude Oil futures are rebounding. The total number of rigs in the U.S. rose to 254 as of August 21 from 244 a week ago, and rigs in Canada increased to 56 from 54, according to Baker Hughes.

Gold rebounds on falling US dollar.

Gold rose 9.05 dollars (+0.47%) to 1949.52 dollars while the dollar index fell 0.32pt to 92.927 dollars.

U.S. Equity Snapshot

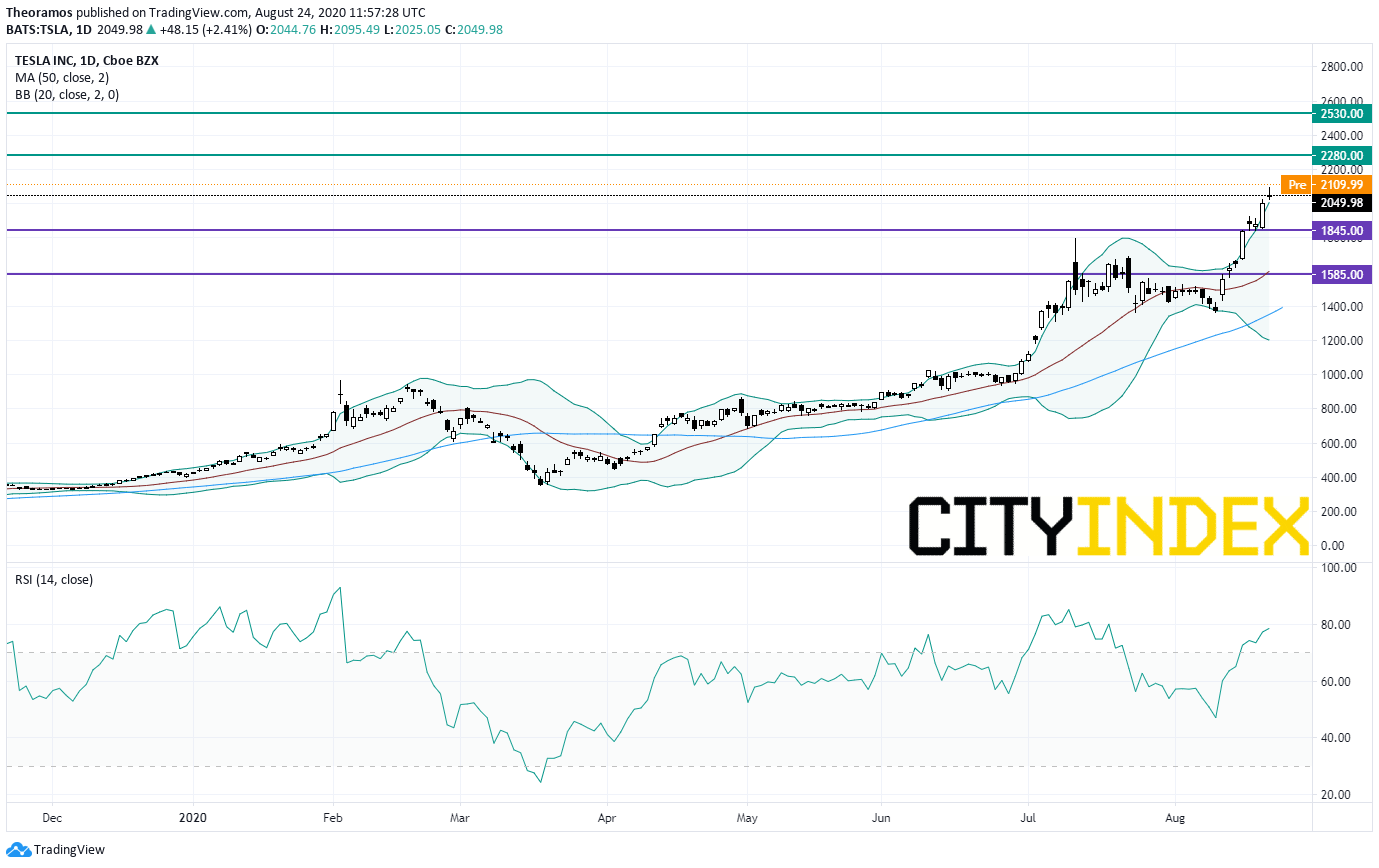

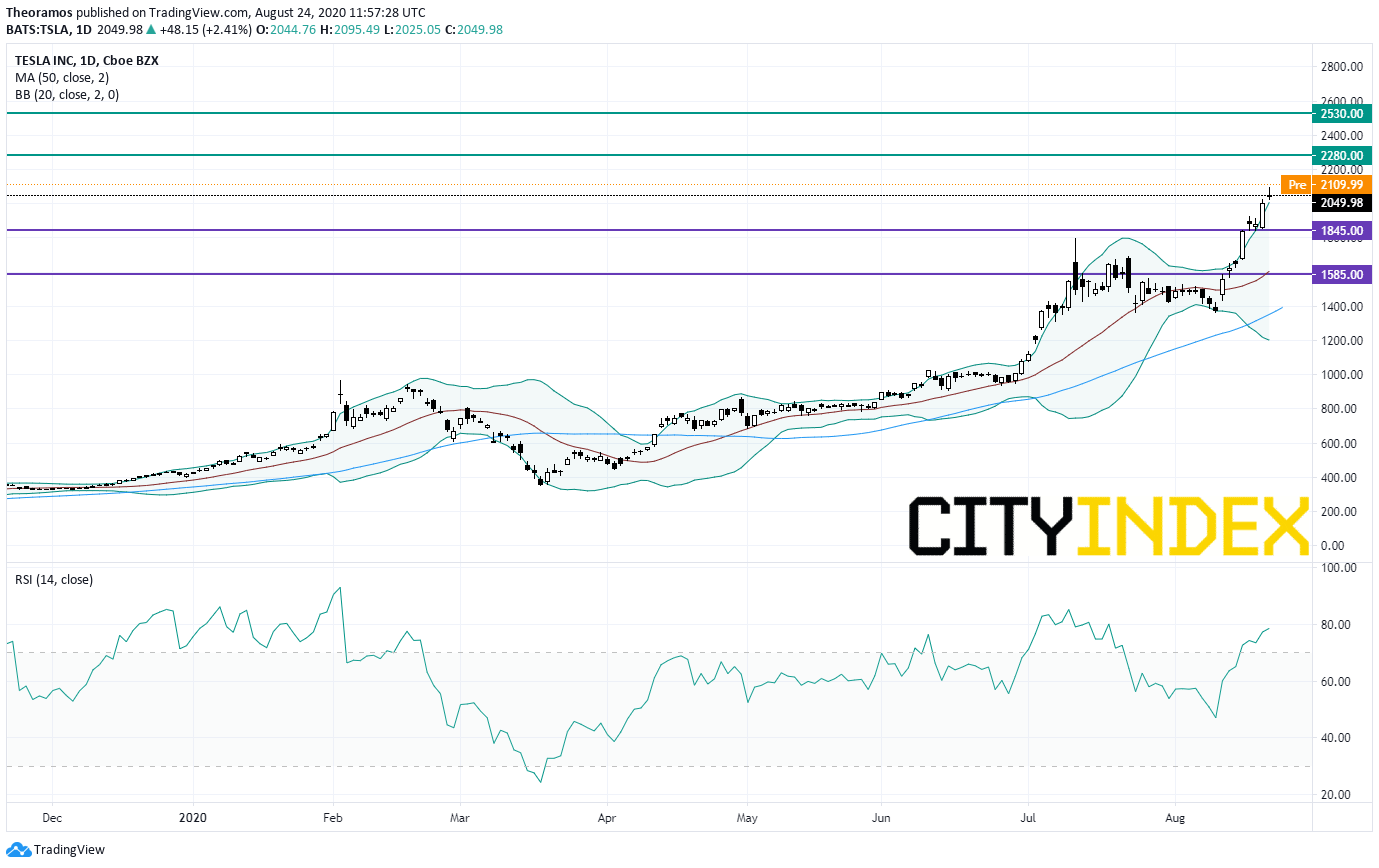

Tesla (TSLA)'s, the electric-vehicle maker, price target was raised to 3,500 dollars from 2,500 dollars at Wedbush.

Spotify (SPOT), the music streaming specialist, unveiled an Esports partnership with Riot Games.

Pinterest (PINS), the social network, was downgraded to "neutral" from "buy" at Citi.

Deere & Co (DE), a manufacturer of agricultural and construction equipment, was upgraded to "buy" from "neutral" at BofA Securities.

Estee Lauder (EL), the cosmetics company, was upgraded to "outperform" from "sector perform" at RBC Capital Markets.

Later today, the Federal Reserve Bank of Chicago will post July National Activity Index (3.7 expected).

European indices are bullish even if European Union's chief negotiator Michel Barnier said on Friday, about Brexit: "at this stage, an agreement between the U.K. and the E.U. seems unlikely".

Asian indices all closed in the green. Official data showed that New Zealand's 2Q retail sales declined 14.6% on quarter (-15.0% expected).Also, Japanese Prime Minister Shinzo Abe plans to go to hospital again today.

WTI Crude Oil futures are rebounding. The total number of rigs in the U.S. rose to 254 as of August 21 from 244 a week ago, and rigs in Canada increased to 56 from 54, according to Baker Hughes.

Gold rebounds on falling US dollar.

Gold rose 9.05 dollars (+0.47%) to 1949.52 dollars while the dollar index fell 0.32pt to 92.927 dollars.

U.S. Equity Snapshot

Tesla (TSLA)'s, the electric-vehicle maker, price target was raised to 3,500 dollars from 2,500 dollars at Wedbush.

Source: GAIN Capital, TradingView

Blackstone (BX), the investment firm, agreed to buy Takeda Pharmaceutical's Japan consumer health care business unit for 2.3 billion dollars.Spotify (SPOT), the music streaming specialist, unveiled an Esports partnership with Riot Games.

Pinterest (PINS), the social network, was downgraded to "neutral" from "buy" at Citi.

Deere & Co (DE), a manufacturer of agricultural and construction equipment, was upgraded to "buy" from "neutral" at BofA Securities.

Estee Lauder (EL), the cosmetics company, was upgraded to "outperform" from "sector perform" at RBC Capital Markets.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM