U.S Futures rising – Watch REGN, TSLA, NFLX

The S&P 500 Futures are rebounding after they closed in the red on Friday.

Later today, the Federal Reserve Bank of Chicago will post October National Activity Index (0.27 expected). Research firm Markit will publish preliminary readings of November Manufacturing PMI (52.5 expected) and November Services PMI (55.8 expected).

European indices are on the upside. AstraZeneca announced that its candidate vaccine developed with Oxford University is 70% effective on average. Research firm Markit has published preliminary readings of November Manufacturing PMI for the eurozone at 53.6 (vs 54.2 expected), for Germany at 57.9 (vs 57.3 expected), for France at 49.1 (vs 49.9 expected) and for the U.K. at 55.2 (vs 51.6 expected). Also, the preliminary readings of November Services PMI for the eurozone was published at 41.3 (vs 44.1 expected), at 46.2 for Germany (vs 47.5 expected), at 38.0 for France (vs 39.0 expected) and at 45.8 for the U.K. (vs 46.0 expected).

Asian indices closed slightly on the upside except the Hong Kong HSI. The Japanese Nikkei was closed for holiday.

WTI Crude Oil remains strong. The total number of rotary rigs in the U.S. slipped to 310 as of November 20 from 312 in the prior week, while rigs in Canada rose to 101 from 89, according to Baker Hughes.

U.S indices closed down on Friday, pressured by Banks (-1.15%), Consumer Services (-1.14%) and Software & Services (-1.13%) sectors.

Gold fell 3.86 dollars (-0.21%) to 1867.13 dollars.

The dollar index declined 0.34pt to 92.056.

U.S. Equity Snapshot

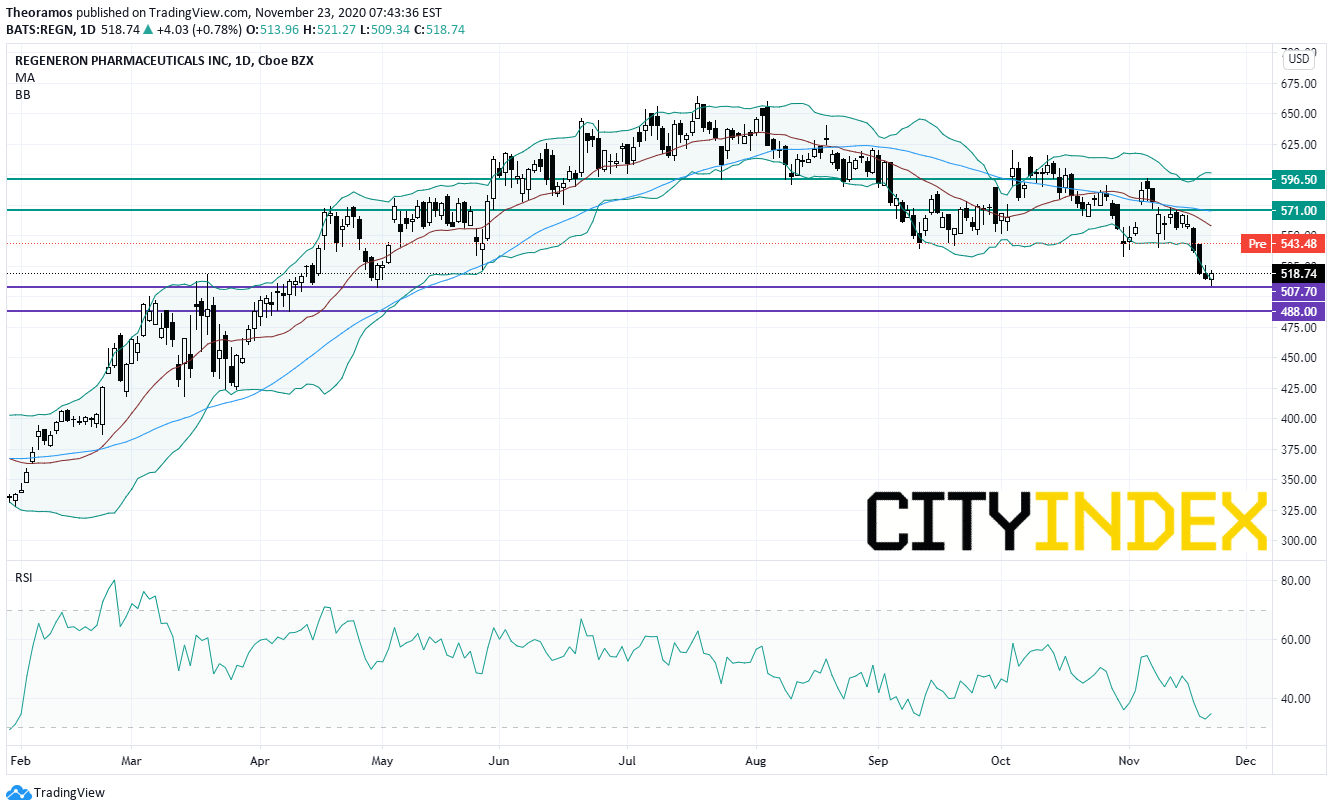

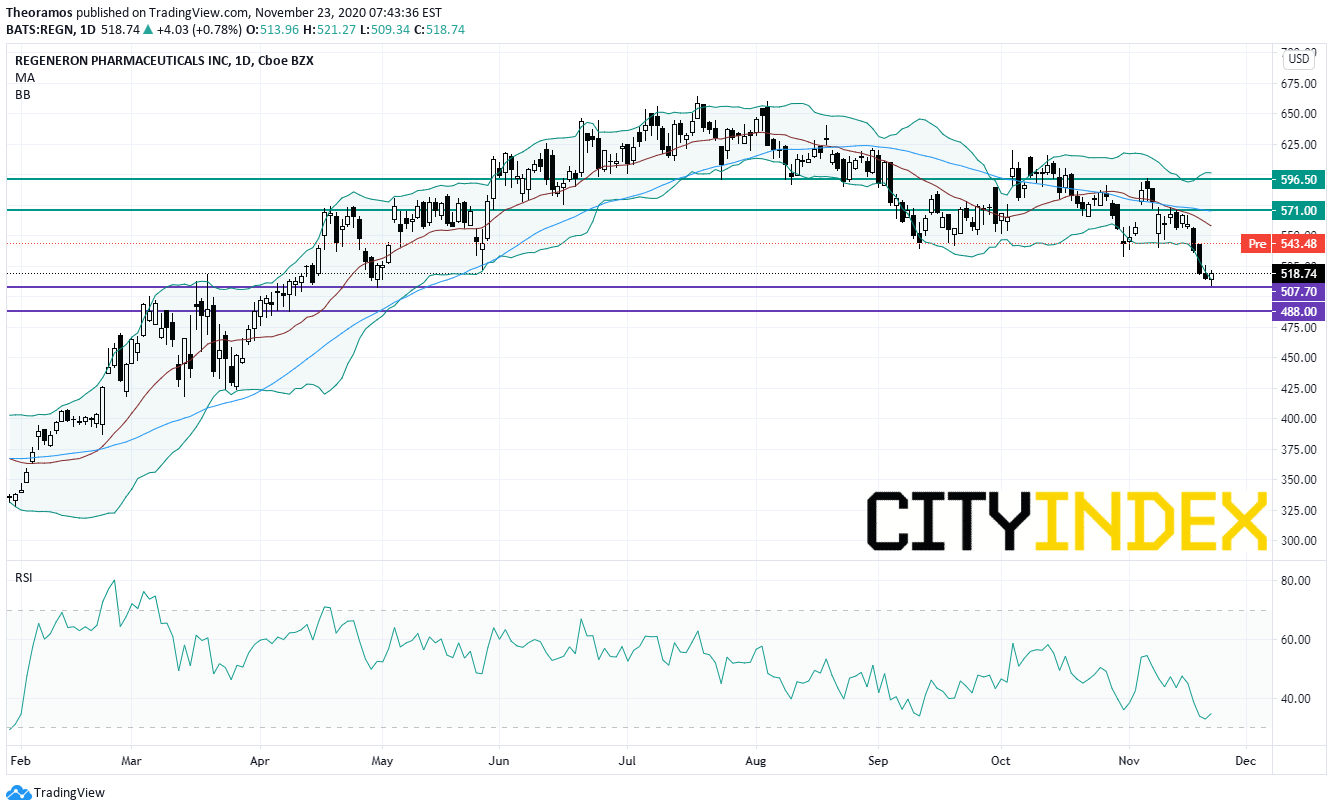

Regeneron Pharmaceuticals (REGN), a biotechnology company, reported that its REGEN-COV2, an antibody cocktail for Covid-19, has received Emergency Use Authorization from the U.S. Food and Drug Administration. The company said it "now expects to have REGEN-COV2 treatment doses ready for approximately 80,000 patients by the end of November, approximately 200,000 patients by the first week of January, and approximately 300,000 patients in total by the end of January 2021".

Netflix (NFLX)'s, the video streaming service, target price was raised to 628 dollars from 615 dollars at JPMorgan.

Later today, the Federal Reserve Bank of Chicago will post October National Activity Index (0.27 expected). Research firm Markit will publish preliminary readings of November Manufacturing PMI (52.5 expected) and November Services PMI (55.8 expected).

European indices are on the upside. AstraZeneca announced that its candidate vaccine developed with Oxford University is 70% effective on average. Research firm Markit has published preliminary readings of November Manufacturing PMI for the eurozone at 53.6 (vs 54.2 expected), for Germany at 57.9 (vs 57.3 expected), for France at 49.1 (vs 49.9 expected) and for the U.K. at 55.2 (vs 51.6 expected). Also, the preliminary readings of November Services PMI for the eurozone was published at 41.3 (vs 44.1 expected), at 46.2 for Germany (vs 47.5 expected), at 38.0 for France (vs 39.0 expected) and at 45.8 for the U.K. (vs 46.0 expected).

Asian indices closed slightly on the upside except the Hong Kong HSI. The Japanese Nikkei was closed for holiday.

WTI Crude Oil remains strong. The total number of rotary rigs in the U.S. slipped to 310 as of November 20 from 312 in the prior week, while rigs in Canada rose to 101 from 89, according to Baker Hughes.

U.S indices closed down on Friday, pressured by Banks (-1.15%), Consumer Services (-1.14%) and Software & Services (-1.13%) sectors.

Approximately 90% of stocks in the S&P 500 Index were trading above their 200-day moving average and 81% were trading above their 20-day moving average. The VIX Index rose 0.59pt (+2.55%) to 23.7 and WTI Crude Oil jumped $0.5 (+1.19%) to $42.4 at the close.

Gold and U.S dollar consolidate as investors favor riskier assets currently.Gold fell 3.86 dollars (-0.21%) to 1867.13 dollars.

The dollar index declined 0.34pt to 92.056.

U.S. Equity Snapshot

Regeneron Pharmaceuticals (REGN), a biotechnology company, reported that its REGEN-COV2, an antibody cocktail for Covid-19, has received Emergency Use Authorization from the U.S. Food and Drug Administration. The company said it "now expects to have REGEN-COV2 treatment doses ready for approximately 80,000 patients by the end of November, approximately 200,000 patients by the first week of January, and approximately 300,000 patients in total by the end of January 2021".

Source: TradingView, GAIN Capital

Tesla (TSLA)'s, the electric-vehicle maker, price target was raised to 560 dollars from 500 dollars at Wedbush.Netflix (NFLX)'s, the video streaming service, target price was raised to 628 dollars from 615 dollars at JPMorgan.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM