U.S Futures rising - Watch INTC, AXP, GILD, WFC, MAT, COF

The S&P 500 Futures remain well directed after they closed higher yesterday. While the political tug-of-war on the fiscal stimulus package continued, investors were encouraged by upbeat jobs and housing reports.

Later today, October Manufacturing PMI will be expected at 53.5 while October Services PMI will be expected at 54.6.

European indices are on the upside. The U.K. Office for National Statistics has reported September retail sales at +1.5% (vs +0.2% on month expected). Research firm Markit has published preliminary readings of October Manufacturing PMI for the Eurozone at 54.4 (53.0 expected), for Germany at 58.0 (vs 55.0 expected), for France at 51.0 (vs 51.0 expected) and for the U.K. at 53.3 (vs 53.1 expected). Also, the preliminary readings of October Services PMI were published for the Eurozone at 46.2 (vs 47.0 expected), for Germany at 48.9 (vs 49.4 expected), for France at 46.5 (vs 47.0 expected) and for the U.K. at 52.3 (vs 53.9 expected).

Asian indices closed in dispersed order. This morning, official data showed that Japan's national CPI was flat on year in September (as expected).

WTI Crude Oil futures are under pressure. Later today, Baker Hughes will report the total number of rig counts for the U.S. and Canada.

Gold remains firm while the U.S dollar consolidates on U.S stimulus hopes.

Gold rose 5.64 dollars (+0.3%) to 1909.74 dollars.

The dollar index fell 0.16pt to 92.791.

U.S. Equity Snapshot

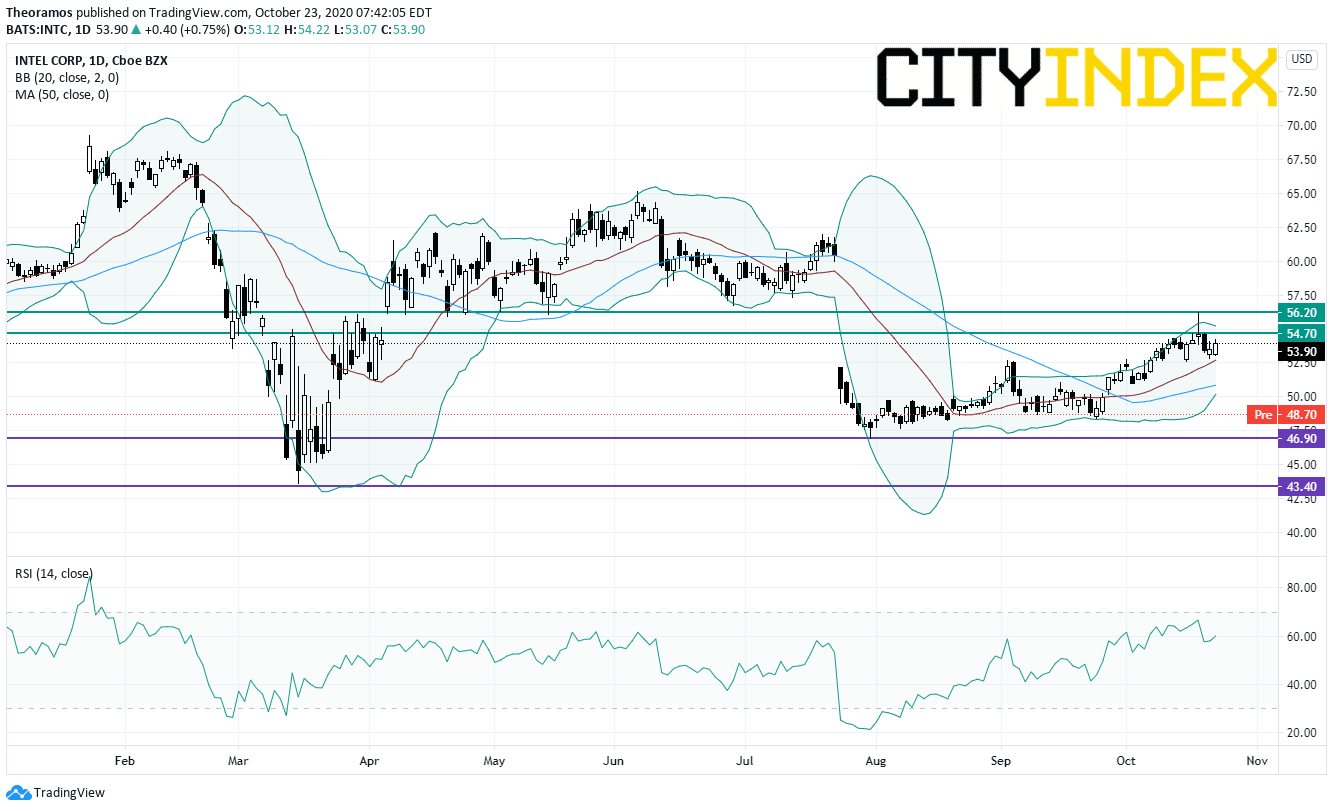

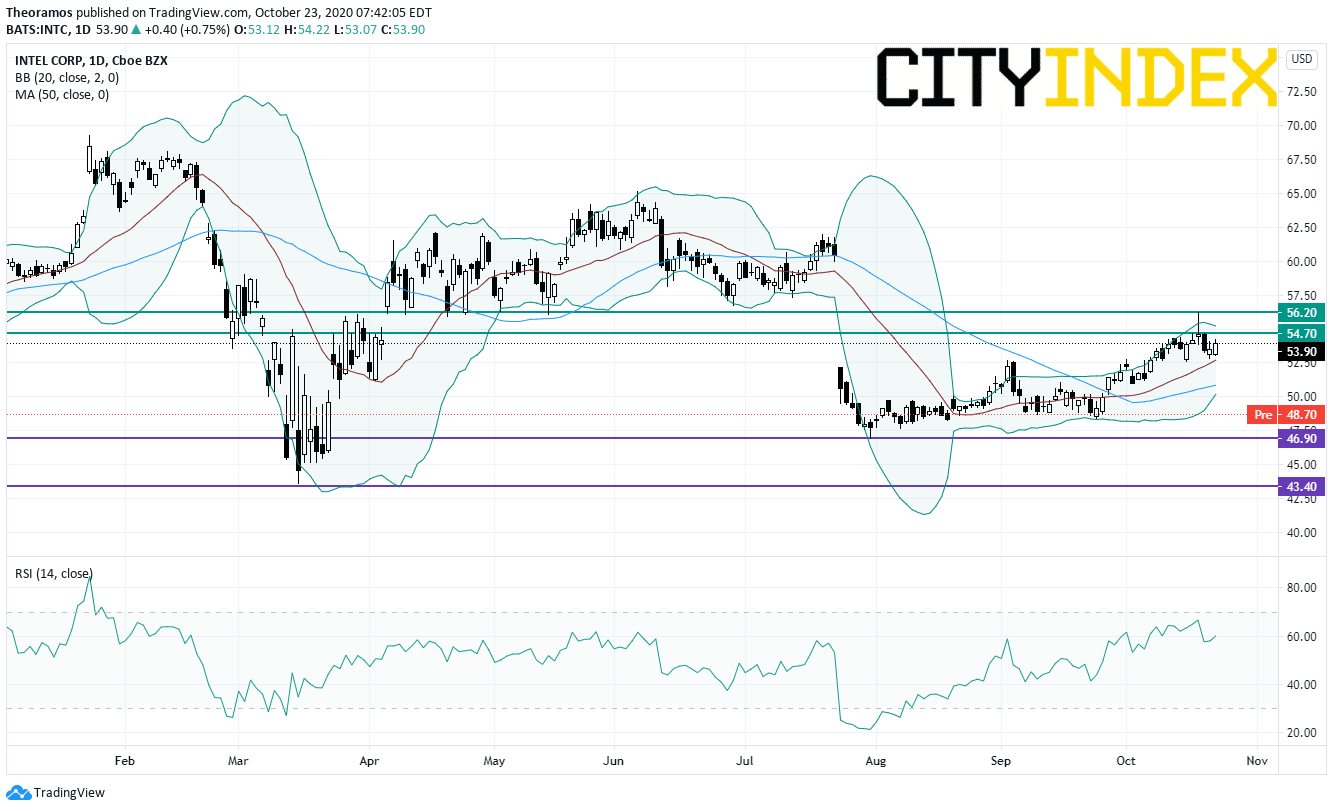

Intel (INTC), a designer and manufacturer of microprocessors, tanked after hours after reporting Data Center sales down 7% to 5.9 billion dollars, below estimates. The stock was downgraded to "underperform" from "neutral" at BofA.

Source: TradingView, GAIN Capital

Wells Fargo (WFC), a financial services company, is considering selling its asset management business, which may be valued at more than 3 billion dollars, reported Reuters.

Mattel (MAT), the toy maker, jumped in extended trading as quarterly earnings significantly beat estimates.

Capital One Financial (COF), a diversified banking services firm, announced third quarter adjusted EPS of 5.05 dollars, exceeding forecasts, up from 3.32 dollars a year ago.

Later today, October Manufacturing PMI will be expected at 53.5 while October Services PMI will be expected at 54.6.

European indices are on the upside. The U.K. Office for National Statistics has reported September retail sales at +1.5% (vs +0.2% on month expected). Research firm Markit has published preliminary readings of October Manufacturing PMI for the Eurozone at 54.4 (53.0 expected), for Germany at 58.0 (vs 55.0 expected), for France at 51.0 (vs 51.0 expected) and for the U.K. at 53.3 (vs 53.1 expected). Also, the preliminary readings of October Services PMI were published for the Eurozone at 46.2 (vs 47.0 expected), for Germany at 48.9 (vs 49.4 expected), for France at 46.5 (vs 47.0 expected) and for the U.K. at 52.3 (vs 53.9 expected).

Asian indices closed in dispersed order. This morning, official data showed that Japan's national CPI was flat on year in September (as expected).

WTI Crude Oil futures are under pressure. Later today, Baker Hughes will report the total number of rig counts for the U.S. and Canada.

Gold remains firm while the U.S dollar consolidates on U.S stimulus hopes.

Gold rose 5.64 dollars (+0.3%) to 1909.74 dollars.

The dollar index fell 0.16pt to 92.791.

U.S. Equity Snapshot

Intel (INTC), a designer and manufacturer of microprocessors, tanked after hours after reporting Data Center sales down 7% to 5.9 billion dollars, below estimates. The stock was downgraded to "underperform" from "neutral" at BofA.

Source: TradingView, GAIN Capital

American Express (AXP), a globally integrated payments company, loses ground premarket after posting third quarter adjusted EPS below estimates.

Gilead Sciences (GILD), a biopharmaceutical company focused on infectious diseases, popped in extended trading after the US FDA approved remdesivir for treatment of COVID-19.Wells Fargo (WFC), a financial services company, is considering selling its asset management business, which may be valued at more than 3 billion dollars, reported Reuters.

Mattel (MAT), the toy maker, jumped in extended trading as quarterly earnings significantly beat estimates.

Capital One Financial (COF), a diversified banking services firm, announced third quarter adjusted EPS of 5.05 dollars, exceeding forecasts, up from 3.32 dollars a year ago.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM