EU indices mixed | TA focus on Renault

INDICES

Yesterday, European stocks were mixed. The Stoxx Europe 600 Index declined 0.14%, Germany's DAX 30 eased a further 0.12%, France's CAC 40 was little changed, while the U.K.'s FTSE 100 added 0.16%.

EUROPE ADVANCE/DECLINE

51% of STOXX 600 constituents traded lower or unchanged yesterday.

40% of the shares trade above their 20D MA vs 41% Wednesday (below the 20D moving average).

57% of the shares trade above their 200D MA vs 56% Wednesday (below the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.46pt to 28.99, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Retail, Autos, Media

3mths relative low: none

Europe Best 3 sectors

travel & leisure, automobiles & parts, banks

Europe worst 3 sectors

technology, basic resources, chemicals

INTEREST RATE

The 10yr Bund yield rose 2bps to -0.59% (below its 20D MA). The 2yr-10yr yield spread fell 1bp to -20bps (below its 20D MA).

ECONOMIC DATA

UK 07:00: Sep Retail Sales ex Fuel YoY, exp.: 4.3%

UK 07:00: Sep Retail Sales ex Fuel MoM, exp.: 0.6%

UK 07:00: Sep Retail Sales YoY, exp.: 2.8%

UK 07:00: Sep Retail Sales MoM, exp.: 0.8%

FR 08:15: Oct Markit Composite PMI Flash, exp.: 48.5

FR 08:15: Oct Markit Manufacturing PMI Flash, exp.: 51.2

FR 08:15: Oct Markit Services PMI Flash, exp.: 47.5

GE 08:30: Oct Markit Manufacturing PMI Flash, exp.: 56.4

GE 08:30: Oct Markit Services PMI Flash, exp.: 50.6

GE 08:30: Oct Markit Composite PMI Flash, exp.: 54.7

EC 09:00: Oct Markit Manufacturing PMI Flash, exp.: 53.7

EC 09:00: Oct Markit Services PMI Flash, exp.: 48

EC 09:00: Oct Markit Composite PMI Flash, exp.: 50.4

UK 09:30: Oct Markit/CIPS Composite PMI Flash, exp.: 56.5

UK 09:30: Oct Markit/CIPS UK Services PMI Flash, exp.: 56.1

UK 09:30: Oct Markit/CIPS Manufacturing PMI Flash, exp.: 54.1

GE 13:00: Bundesbank Mauderer speech

MORNING TRADING

In Asian trading hours, the ICE Dollar Index climbed above the 93.00 level, as EUR/USD fell to 1.1800 and GBP/USD slid to 1.3070. USD/JPY retreated to 104.73. This morning, official data showed that Japan's national CPI was flat on year in September (as expected). NZD/USD was broadly flat at 0.6676. Government data released earlier today showed that New Zealand's 3Q CPI grew 1.4% on year (+1.7% expected).

Spot gold edged up to $1,916 an ounce.

#UK - IRELAND#

Barclays, a banking group, post 3Q adjusted profit before tax declined 32.6% on year to 1.22 billion pounds and net operating income dropped 9.5% to 4.60 billion pounds on net interest income of 2.06 billion pounds, down 16.0%. CET1 ratio climbed to 14.6% from 13.4% in the prior-year period. The bank stated: "The Board recognises the importance of capital returns to shareholders and will provide an update on its policy and dividends at FY20 results."

London Stock Exchange, a stock market operator, reported that 3Q revenue grew 1% (+2% on an organic and constant currency basis) to 524 million pounds and 9-month revenue was up 3% (+3% on an organic and constant currency basis) to 1.58 billion pounds.

InterContinental Hotels Group, a hospitality company, issued a 3Q trading update: "Trading improved in the third quarter, although progress continues to vary by region. RevPAR declined 53%, compared to a 75% decline in the prior quarter, while occupancy was 44%, up from 25% in Q2."

#GERMANY#

Daimler, an automobile group, announced that 3Q net profit rose 19% on year to 2.16 billion euros and EBIT increased 14% to 3.07 billion euros on revenue of 40.28 billion euros, down 7%. The company said it expects full-year revenue to be significantly lower than in the previous year, while EBIT is now estimated to be at prior-year's level (previously lower than last year).

#FRANCE#

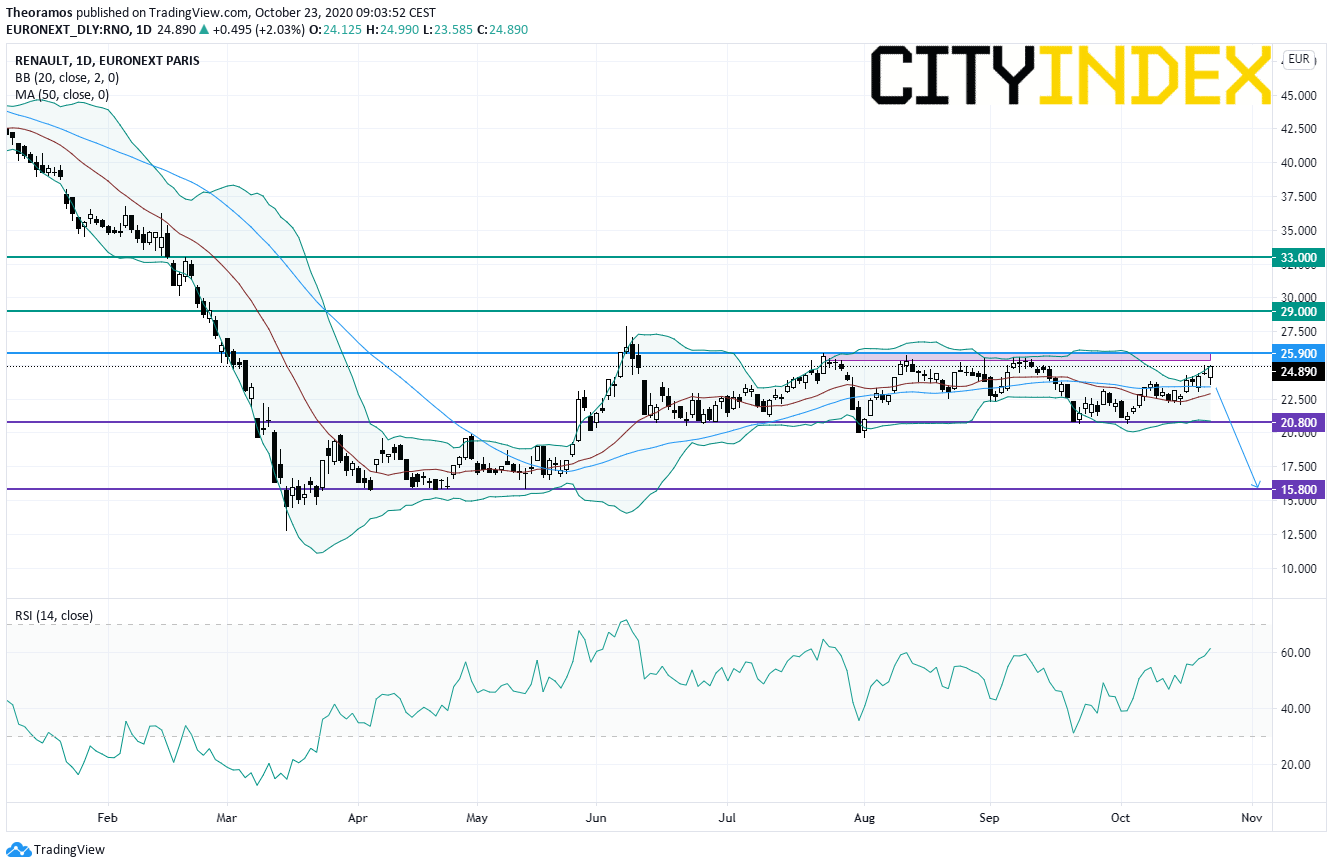

Renault, a vehicle manufacturer, announced that 3Q revenue dropped 8.2% on year (-3.2% at constant exchange rates and perimeter) to 10.37 billion euros and vehicle sales were down 6.1% to 806,320 units. The company added that "September showed a positive momentum, particularly marked in Europe, where Group's sales were up 8% in a market up 3%".

From a daily point of view, the stock is facing the key resistance in place since July at 25.9E. Below this key level, a new down leg is excepted with the horizontal support at 20.8E as first target and the support area of April and May at 15.8E in extension.

Iliad, a telecommunication services provider, said it has agreed to sell 60% of the company that will manage Play's mobile telecommunications passive infrastructure to Cellnex for 804 million euros.

LVMH, a luxury goods conglomerate, said it has decided to pay an interim dividend of 2 euros per share on December 3, and the last trading day with interim dividend rights is November 30.

#ITALY#

Moncler, a luxury fashion brand, posted 3Q revenue declined 15% on year to 362 million euros, down 14% at constant exchange rates.

#SWITZERLAND#

ABB, a power and automation company, reported that 3Q net income jumped to 4.53 billion dollars, citing a 5.3 billion dollars pre-tax book gain on the sale of Power Grids. Operational EPS was down 36% on year to 0.21 dollar and operational EBITA fell 2% to 787 million dollars on revenue of 6.58 billion dollars, down 4% (-4% on a comparable basis).

#FINLAND#

Nordea Bank, a financial services group, posted a 3Q net profit of 837 million euros, compared with a net loss of 332 million euros in the prior-year period, as net loan losses reduced to nearly zero from 331 million euros. Meanwhile, net interest income rose 6% on year (+8% in local currency) to 1.15 billion euros. The bank added that it intends to pay out a dividend for financial year 2019 and will review the situation in 4Q.

EX-DIVIDEND

Akzo Nobel: E0.43, Neste: E0.46

Yesterday, European stocks were mixed. The Stoxx Europe 600 Index declined 0.14%, Germany's DAX 30 eased a further 0.12%, France's CAC 40 was little changed, while the U.K.'s FTSE 100 added 0.16%.

EUROPE ADVANCE/DECLINE

51% of STOXX 600 constituents traded lower or unchanged yesterday.

40% of the shares trade above their 20D MA vs 41% Wednesday (below the 20D moving average).

57% of the shares trade above their 200D MA vs 56% Wednesday (below the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.46pt to 28.99, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Retail, Autos, Media

3mths relative low: none

Europe Best 3 sectors

travel & leisure, automobiles & parts, banks

Europe worst 3 sectors

technology, basic resources, chemicals

INTEREST RATE

The 10yr Bund yield rose 2bps to -0.59% (below its 20D MA). The 2yr-10yr yield spread fell 1bp to -20bps (below its 20D MA).

ECONOMIC DATA

UK 07:00: Sep Retail Sales ex Fuel YoY, exp.: 4.3%

UK 07:00: Sep Retail Sales ex Fuel MoM, exp.: 0.6%

UK 07:00: Sep Retail Sales YoY, exp.: 2.8%

UK 07:00: Sep Retail Sales MoM, exp.: 0.8%

FR 08:15: Oct Markit Composite PMI Flash, exp.: 48.5

FR 08:15: Oct Markit Manufacturing PMI Flash, exp.: 51.2

FR 08:15: Oct Markit Services PMI Flash, exp.: 47.5

GE 08:30: Oct Markit Manufacturing PMI Flash, exp.: 56.4

GE 08:30: Oct Markit Services PMI Flash, exp.: 50.6

GE 08:30: Oct Markit Composite PMI Flash, exp.: 54.7

EC 09:00: Oct Markit Manufacturing PMI Flash, exp.: 53.7

EC 09:00: Oct Markit Services PMI Flash, exp.: 48

EC 09:00: Oct Markit Composite PMI Flash, exp.: 50.4

UK 09:30: Oct Markit/CIPS Composite PMI Flash, exp.: 56.5

UK 09:30: Oct Markit/CIPS UK Services PMI Flash, exp.: 56.1

UK 09:30: Oct Markit/CIPS Manufacturing PMI Flash, exp.: 54.1

GE 13:00: Bundesbank Mauderer speech

MORNING TRADING

In Asian trading hours, the ICE Dollar Index climbed above the 93.00 level, as EUR/USD fell to 1.1800 and GBP/USD slid to 1.3070. USD/JPY retreated to 104.73. This morning, official data showed that Japan's national CPI was flat on year in September (as expected). NZD/USD was broadly flat at 0.6676. Government data released earlier today showed that New Zealand's 3Q CPI grew 1.4% on year (+1.7% expected).

Spot gold edged up to $1,916 an ounce.

#UK - IRELAND#

Barclays, a banking group, post 3Q adjusted profit before tax declined 32.6% on year to 1.22 billion pounds and net operating income dropped 9.5% to 4.60 billion pounds on net interest income of 2.06 billion pounds, down 16.0%. CET1 ratio climbed to 14.6% from 13.4% in the prior-year period. The bank stated: "The Board recognises the importance of capital returns to shareholders and will provide an update on its policy and dividends at FY20 results."

London Stock Exchange, a stock market operator, reported that 3Q revenue grew 1% (+2% on an organic and constant currency basis) to 524 million pounds and 9-month revenue was up 3% (+3% on an organic and constant currency basis) to 1.58 billion pounds.

InterContinental Hotels Group, a hospitality company, issued a 3Q trading update: "Trading improved in the third quarter, although progress continues to vary by region. RevPAR declined 53%, compared to a 75% decline in the prior quarter, while occupancy was 44%, up from 25% in Q2."

#GERMANY#

Daimler, an automobile group, announced that 3Q net profit rose 19% on year to 2.16 billion euros and EBIT increased 14% to 3.07 billion euros on revenue of 40.28 billion euros, down 7%. The company said it expects full-year revenue to be significantly lower than in the previous year, while EBIT is now estimated to be at prior-year's level (previously lower than last year).

#FRANCE#

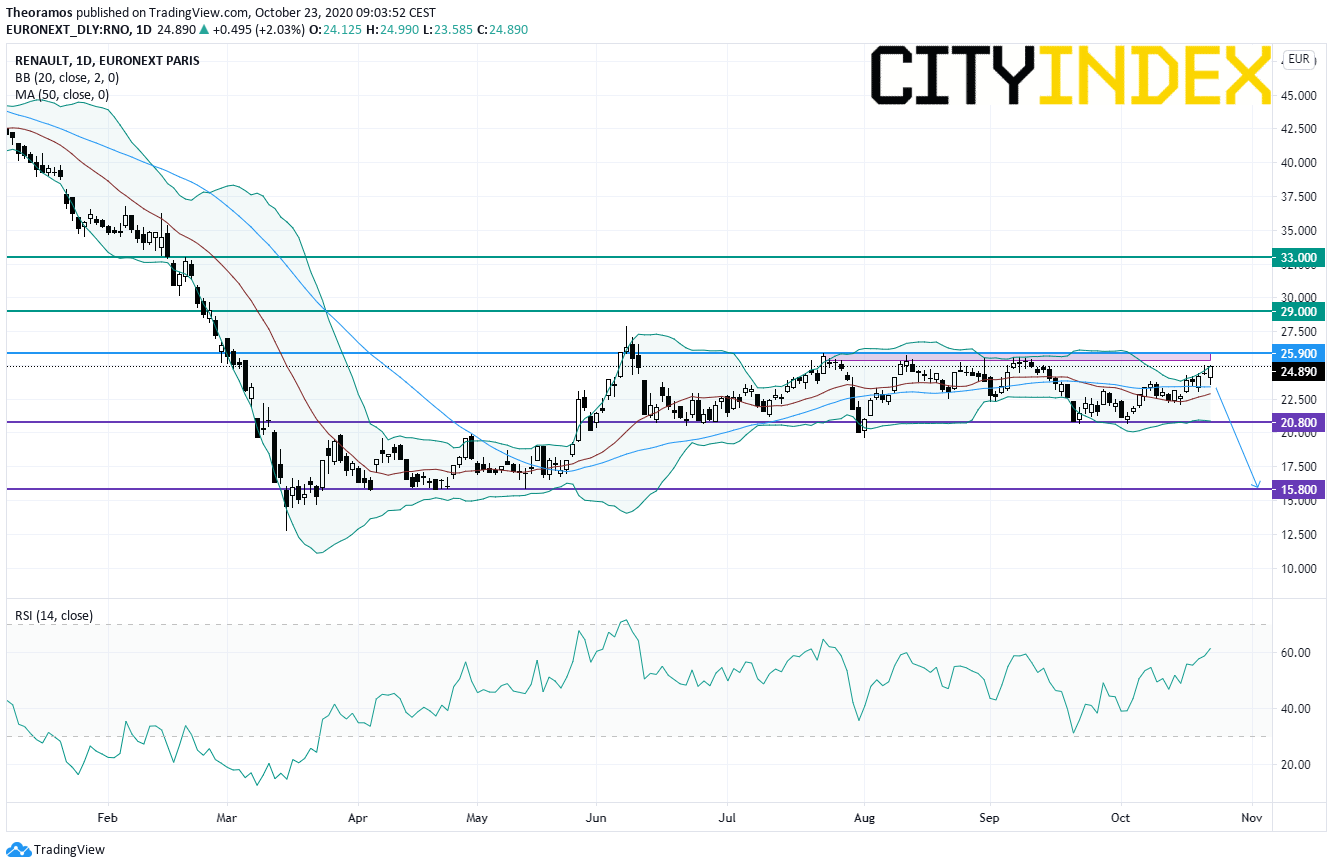

Renault, a vehicle manufacturer, announced that 3Q revenue dropped 8.2% on year (-3.2% at constant exchange rates and perimeter) to 10.37 billion euros and vehicle sales were down 6.1% to 806,320 units. The company added that "September showed a positive momentum, particularly marked in Europe, where Group's sales were up 8% in a market up 3%".

From a daily point of view, the stock is facing the key resistance in place since July at 25.9E. Below this key level, a new down leg is excepted with the horizontal support at 20.8E as first target and the support area of April and May at 15.8E in extension.

Source: TradingView, GAIN Capital

Kering, a luxury goods company, posted 3Q revenue dropped 4.3% on year (-1.2% comparable basis) to 3.72 billion euros and 9-month revenue was down 21.1% (-20.6% on a comparable basis) to 9.10 billion euros.Iliad, a telecommunication services provider, said it has agreed to sell 60% of the company that will manage Play's mobile telecommunications passive infrastructure to Cellnex for 804 million euros.

LVMH, a luxury goods conglomerate, said it has decided to pay an interim dividend of 2 euros per share on December 3, and the last trading day with interim dividend rights is November 30.

#ITALY#

Moncler, a luxury fashion brand, posted 3Q revenue declined 15% on year to 362 million euros, down 14% at constant exchange rates.

#SWITZERLAND#

ABB, a power and automation company, reported that 3Q net income jumped to 4.53 billion dollars, citing a 5.3 billion dollars pre-tax book gain on the sale of Power Grids. Operational EPS was down 36% on year to 0.21 dollar and operational EBITA fell 2% to 787 million dollars on revenue of 6.58 billion dollars, down 4% (-4% on a comparable basis).

#FINLAND#

Nordea Bank, a financial services group, posted a 3Q net profit of 837 million euros, compared with a net loss of 332 million euros in the prior-year period, as net loan losses reduced to nearly zero from 331 million euros. Meanwhile, net interest income rose 6% on year (+8% in local currency) to 1.15 billion euros. The bank added that it intends to pay out a dividend for financial year 2019 and will review the situation in 4Q.

EX-DIVIDEND

Akzo Nobel: E0.43, Neste: E0.46

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM