US Futures rising, watch IBM, BABA, HPE, NVDA, DE, INTU

The S&P 500 Futures are calling for a flat to positive open after they closed lower yesterday, dragged by renewed tensions between the U.S. and China. While reiterating his disappointment with China's response to the coronavirus crisis, U.S. President Donald Trump claimed China was behind a disinformation and propaganda attack on the U.S. and Europe. Sentiment was also dampened by an official report that over two million Americans applied for unemployment benefits.

European indices are rebounding, after opening on the downside as China wants to impose new national security legislation on Hong Kong, threatening its status as a global financial center. The U.K. Office for National Statistics has reported April retail sales at -18.1% (vs -15.5% on month expected).

Asian indices closed in the red. This morning, the Bank of Japan announced plans to start a new 75 trillion yen lending program in June, to support coronavirus-hit businesses, while keeping its benchmark rate at -0.1% and 10-year government bond yield target at about 0% unchanged. Also, official data showed that Japan's core CPI dipped 0.2% on year in April (-0.1% expected), the first decline in more than three years.

WTI Crude Oil Futures are on the downside. IHS Markit projected that U.S. Crude Oil production would drop 1.75M b/d.

Gold rose 8.06$ (+0.47%) to 1735.06, rebounding on geopolitical tensions while the US dollar remains firm. EUR/USD fell 47pips to 1.0903 and GBP/USD declined 38pips to 1.2185.

US Equity Snapshot

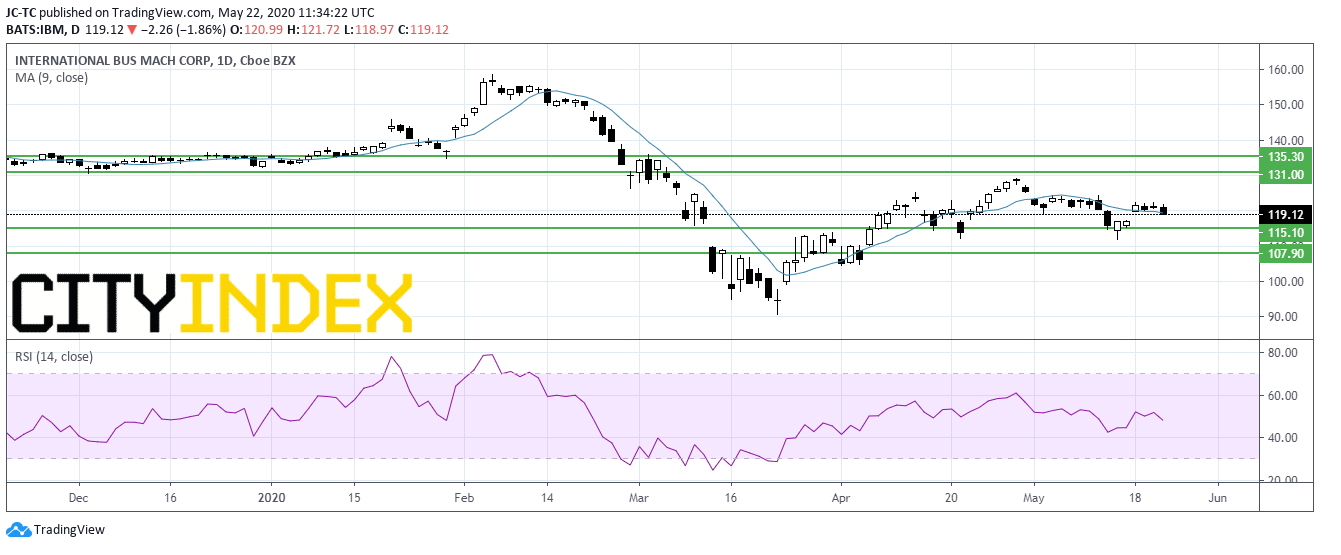

IBM (IBM), the tech company, announced job cuts, likely in the thousands according to different reports.

Alibaba (BABA), the e-commerce chines company, posted fourth quarter sales up 22% to 114.3 billion yuan (16 billion dollars), above estimates. Adjusted EPS also topped forecasts.

Hewlett Packard Enterprise (HPE), a supplier of information technology products and services, reported second quarter adjusted EPS of 0.22 dollar, below consensus, down from 0.42 dollar a year ago, on net sales of 6.0 billion dollars, less than forecast, down from 7.2 billion dollars in the previous year.

Nvidia (NVDA), a leading designer of graphics processors, posted first quarter adjusted EPS up to 1.80 dollar from 0.88 dollar a year earlier, on sales up to 3.08 billion dollars from 2.22 billion dollars a year ago. Both figures beat estimates. The company expects second quarter sales of 3.65 billion dollars, plus or minus 2%, in-line with forecasts.

Deere & Co (DE), a manufacturer of agricultural and construction equipment, unveiled second quarter EPS down to 2.11 dollars from 3.52 dollars a year earlier, on sales down 20% to 8.22 billion dollars. Both figures beat estimates. The company expects full year net income between 1.6 and 2 billion dollars, slightly below consensus.

Intuit (INTU), a developer and marketer of accounting software for small and medium sized businesses, announced third quarter adjusted EPS of 4.49 dollars, missing estimates, down from 5.55 dollars a year ago, on sales of 3.0 billion dollars, as expected, down from 3.3 billion dollars in the year before.

European indices are rebounding, after opening on the downside as China wants to impose new national security legislation on Hong Kong, threatening its status as a global financial center. The U.K. Office for National Statistics has reported April retail sales at -18.1% (vs -15.5% on month expected).

Asian indices closed in the red. This morning, the Bank of Japan announced plans to start a new 75 trillion yen lending program in June, to support coronavirus-hit businesses, while keeping its benchmark rate at -0.1% and 10-year government bond yield target at about 0% unchanged. Also, official data showed that Japan's core CPI dipped 0.2% on year in April (-0.1% expected), the first decline in more than three years.

WTI Crude Oil Futures are on the downside. IHS Markit projected that U.S. Crude Oil production would drop 1.75M b/d.

Gold rose 8.06$ (+0.47%) to 1735.06, rebounding on geopolitical tensions while the US dollar remains firm. EUR/USD fell 47pips to 1.0903 and GBP/USD declined 38pips to 1.2185.

US Equity Snapshot

IBM (IBM), the tech company, announced job cuts, likely in the thousands according to different reports.

Alibaba (BABA), the e-commerce chines company, posted fourth quarter sales up 22% to 114.3 billion yuan (16 billion dollars), above estimates. Adjusted EPS also topped forecasts.

Hewlett Packard Enterprise (HPE), a supplier of information technology products and services, reported second quarter adjusted EPS of 0.22 dollar, below consensus, down from 0.42 dollar a year ago, on net sales of 6.0 billion dollars, less than forecast, down from 7.2 billion dollars in the previous year.

Nvidia (NVDA), a leading designer of graphics processors, posted first quarter adjusted EPS up to 1.80 dollar from 0.88 dollar a year earlier, on sales up to 3.08 billion dollars from 2.22 billion dollars a year ago. Both figures beat estimates. The company expects second quarter sales of 3.65 billion dollars, plus or minus 2%, in-line with forecasts.

Deere & Co (DE), a manufacturer of agricultural and construction equipment, unveiled second quarter EPS down to 2.11 dollars from 3.52 dollars a year earlier, on sales down 20% to 8.22 billion dollars. Both figures beat estimates. The company expects full year net income between 1.6 and 2 billion dollars, slightly below consensus.

Intuit (INTU), a developer and marketer of accounting software for small and medium sized businesses, announced third quarter adjusted EPS of 4.49 dollars, missing estimates, down from 5.55 dollars a year ago, on sales of 3.0 billion dollars, as expected, down from 3.3 billion dollars in the year before.

Source : TradingVIEW, Gain Capital

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM