US Futures slightly rising, watch NFLX, FB, T, TXN

The S&P 500 Futures are rebounding after they fell for a second session in a row yesterday, as sentiment was still impacted by the dim economic outlook reflected by plunging oil prices.

European indices are posting a tentative rebound. The U.K. Office for National Statistics has released March CPI at +1.5% on year, as expected. The European Commission will release the eurozone's April Consumer Confidence Index (-20.0 expected).

Asian indices closed slightly on the upside except the Japanese Nikkei. Reserve Bank of Australia governor Philip Lowe said the Australian economy is expected to contract by 10% over the first half of the year and jobless rate might reach 10% by June.

WTI Crude Oil Futures remain under pressure and very volatile. The American Petroleum Institute (API) reported that U.S. crude oil stockpile built 13.2 million barrels for week ended April 17. Later today, The U.S. Energy Information Administration (EIA) will release crude oil inventories data for last week.

On the forex front, the US dollar consolidates its gains against its main peers as oil prices somewhat stabilized. EUR/USD rose 21pips to 1.0879 and GBP/USD gained 81pips to 1.237. AUD/USD jumped 63pips to 0.6343, the Australian currency benefited from strong retail sales figures.

US Equity Snapshot

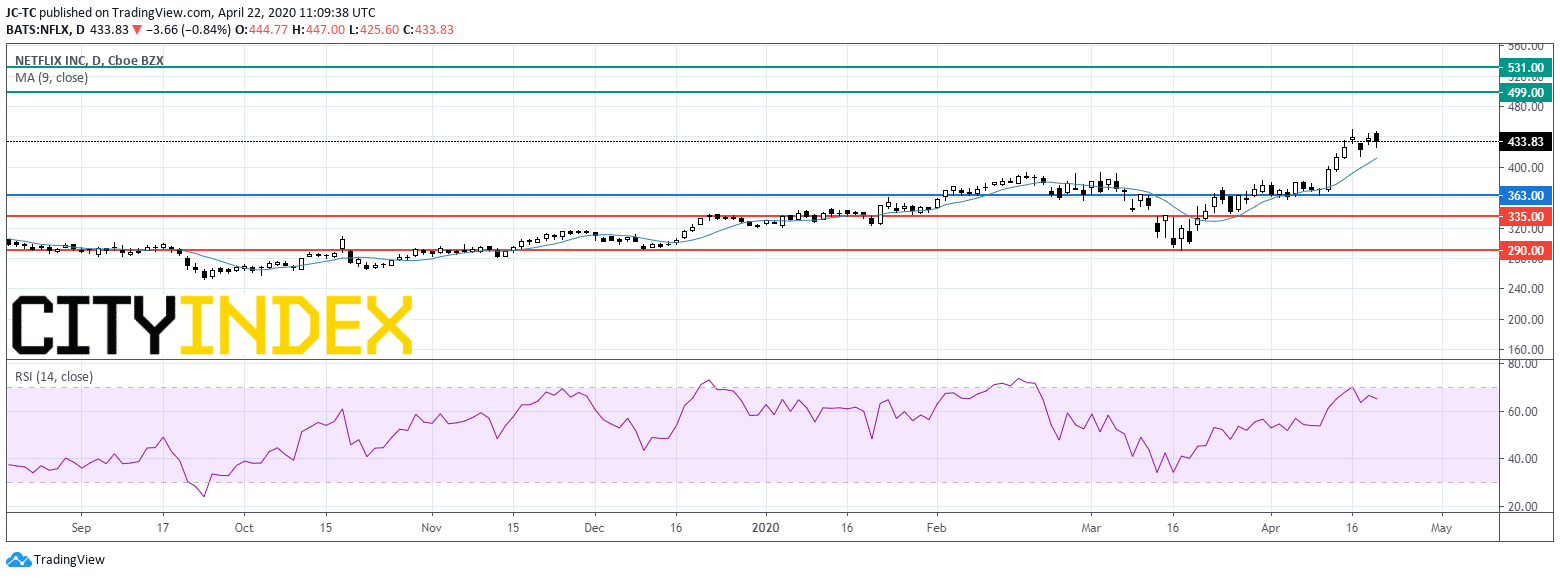

Netflix (NFLX), the video streaming service, reported first quarter EPS up to 1.57 dollar, missing estimates, from 0.76 dollar a year ago, on revenue up to of 5.8 billion dollars, better than expected, from 4.5 billion dollars last year. The company added a record 15.8 million net paid subscribers during the quarter but warned growth may be light in the third and fourth quarter.

Facebook (FB), the social network, disclosed a 5.7 billion dollar investment in Jio Platforms, a subsidiary of Reliance Industries, which houses the digital services of the Indian conglomerate.

AT&T (T), the communications company, unveiled first quarter adjusted EPS down to 0.84 dollar from 0.86 dollar a year earlier, in line with estimates. The company withdraws 2020 forecasts.

Texas Instruments (TXN), a designer of semiconductors, revealed first quarter EPS down to 1.24 dollar, above forecasts, from 1.26 dollar a year ago on revenue down to 3.3 billion dollars, just ahead of estimates, from 3.6 billion dollars in the previous year.

United Airlines (UAL), an airline group, announced plans to raise more than 1 billion dollars by offering 39.25 million shares with an option for underwriters to acquire 3.93 million addition shares. The company said: "The proceeds from the offering will be used for general corporate purposes."

Snap (SNAP), a camera and social media company, jumped in extended trading after saying that daily active user increased 20% to 229 million during first quarter. For the period, the company posted an adjusted LPS of 0.08 dollar vs a LPS of 0.10 dollar a year ago, on revenue up to 462 million dollars from 320 million dollars in the prior year.

Macy's (M), a department store chain, is seeking to raise 5 billion dollars in debt to counter the coronavirus impacts, according to CNBC.

European indices are posting a tentative rebound. The U.K. Office for National Statistics has released March CPI at +1.5% on year, as expected. The European Commission will release the eurozone's April Consumer Confidence Index (-20.0 expected).

Asian indices closed slightly on the upside except the Japanese Nikkei. Reserve Bank of Australia governor Philip Lowe said the Australian economy is expected to contract by 10% over the first half of the year and jobless rate might reach 10% by June.

WTI Crude Oil Futures remain under pressure and very volatile. The American Petroleum Institute (API) reported that U.S. crude oil stockpile built 13.2 million barrels for week ended April 17. Later today, The U.S. Energy Information Administration (EIA) will release crude oil inventories data for last week.

On the forex front, the US dollar consolidates its gains against its main peers as oil prices somewhat stabilized. EUR/USD rose 21pips to 1.0879 and GBP/USD gained 81pips to 1.237. AUD/USD jumped 63pips to 0.6343, the Australian currency benefited from strong retail sales figures.

US Equity Snapshot

Netflix (NFLX), the video streaming service, reported first quarter EPS up to 1.57 dollar, missing estimates, from 0.76 dollar a year ago, on revenue up to of 5.8 billion dollars, better than expected, from 4.5 billion dollars last year. The company added a record 15.8 million net paid subscribers during the quarter but warned growth may be light in the third and fourth quarter.

Facebook (FB), the social network, disclosed a 5.7 billion dollar investment in Jio Platforms, a subsidiary of Reliance Industries, which houses the digital services of the Indian conglomerate.

AT&T (T), the communications company, unveiled first quarter adjusted EPS down to 0.84 dollar from 0.86 dollar a year earlier, in line with estimates. The company withdraws 2020 forecasts.

Texas Instruments (TXN), a designer of semiconductors, revealed first quarter EPS down to 1.24 dollar, above forecasts, from 1.26 dollar a year ago on revenue down to 3.3 billion dollars, just ahead of estimates, from 3.6 billion dollars in the previous year.

United Airlines (UAL), an airline group, announced plans to raise more than 1 billion dollars by offering 39.25 million shares with an option for underwriters to acquire 3.93 million addition shares. The company said: "The proceeds from the offering will be used for general corporate purposes."

Snap (SNAP), a camera and social media company, jumped in extended trading after saying that daily active user increased 20% to 229 million during first quarter. For the period, the company posted an adjusted LPS of 0.08 dollar vs a LPS of 0.10 dollar a year ago, on revenue up to 462 million dollars from 320 million dollars in the prior year.

Macy's (M), a department store chain, is seeking to raise 5 billion dollars in debt to counter the coronavirus impacts, according to CNBC.

Source : TradingView, GAIN Capital

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM