U.S Futures red - Watch TSLA, KO, C, T, XOM, LUV

Later today, the U.S. Labor Department will release initial jobless claims in the week ending October 17 (0.87 million expected). The Conference Board will post its Leading Index for September (+0.6% on month expected). The National Association of Realtors will report September existing home sales (6.30 million units expected).

European indices are under pressure. Germany's GfK Consumer Confidence Index for November was released at -3.1 (vs -3.0 expected). France's INSEE has reported October indicators on business confidence at 90 (vs 92 expected) and manufacturing confidence at 93 (vs 96 expected).

Asian indices closed in the red except the Hong Kong HSI.

WTI Crude Oil futures remain under pressure. The U.S. Energy Information Administration (EIA) reported increased gasoline inventories last week, which indicated weak demand for fuel.

Gold is consolidating while the U.S dollar bounces after hitting a seven-week low amid U.S fiscal package uncertainty and soaring global COVID-19 cases.

Gold fell 9.22 dollars (-0.48%) to 1915.11 dollars.

The dollar index rose 0.26pt to 92.872.

U.S. Equity Snapshot

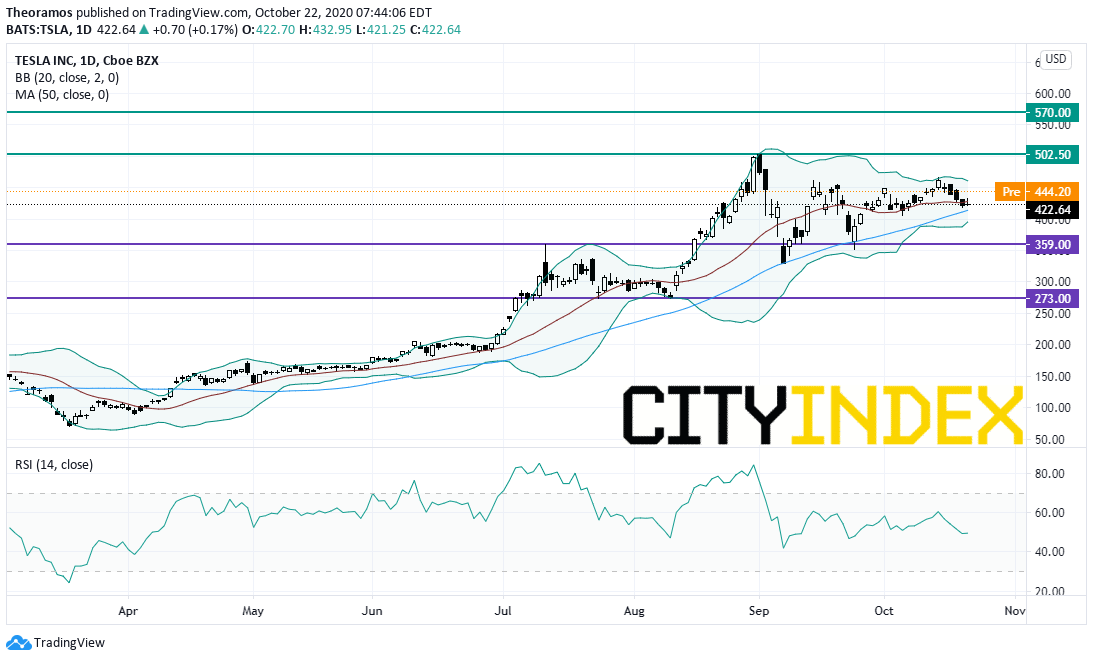

Tesla (TSLA), the electric-vehicle maker, reported third quarter adjusted EPS of 0.76 dollar, up from 0.37 dollar a year ago, on revenue of 8.8 billion dollars up from 6.3 billion dollars a year earlier. Those figures beat estimates.

Source :TradingView, GAIN Capital

Coca-Cola (KO), the soft drink giant, posted third quarter adjusted EPS of 0.55 dollar, exceeding estimates, vs 0.56 dollar a year earlier.

Citigroup (C), the banking group, was downgraded to "buy" from "conviction buy" at Goldman Sachs.

AT&T (T), one of the largest wireless communication carriers in the U.S., is gaining some ground before hours after posting quarterly earnings that slightly beat estimates.

Exxon Mobil (XOM), the oil and gas company, plans layoffs in the coming weeks, according to Bloomberg.

Southwest Airlines (LUV) is climbing in extended trading as quarterly earnings exceeded expectations. The company said it is in talks with Boeing (BA) to restructure order book.

Chipotle (CMG), the fast food restaurant chain, lost ground after hours as third quarter earnings were hurt by rising delivery costs.

Kinder Morgan (KMI), one of the largest midstream energy firms in North America, released third quarter adjusted EPS of 0.21 dollar, down from 0.22 dollar a year ago, on sales of 2.9 billion dollars, down from 3.2 billion dollars a year earlier. Those figures were broadly in line with estimates.

Xilinx (XLNX), a designer of field-programmable gate arrays (FPGAs), disclosed second quarter EPS of 0.79 dollar, down from 0.89 dollar last year on net revenue of 766.5 million dollars, down from 833.4 million dollars a year earlier. Those figures beat estimates.

Peloton Interactive (PTON), the interactive fitness platform, was downgraded to "neutral" from "buy" at Goldman Sachs.