U.S Futures attempt to rebound - Watch TSLA, AMZN, CMSCA

The S&P 500 Futures are recovering from Monday decline when the Dow Jones Industrial Average once tumbled over 900 points before reducing its loss to 509 points (-1.84%) and closing at 27147. The S&P 500 sank 38 points (-1.16%) to 3281, while the Nasdaq 100 managed to close 43 points higher (+0.40%) at 10980. The market sell-off was triggered by growing concerns over further coronavirus-related shutdowns in Europe and uncertainty surrounding the U.S. election added to pressure on stocks.

Later today, the National Association of Realtors will release August existing home sales (6.01 million units expected). The Richmond Federal Reserve will post its Manufacturing Index for September (12 expected).

European indices are rebounding as the U.K government asked "If it is possible for people to work from home, then we’d encourage them to do so, adding: "No one underestimates the challenges the new measures will pose to many individuals and businesses (...) We know this won’t be easy, but we must take further action to control the resurgence in cases of the virus." Bank of England Governor Andrew Bailey said the central bank is considering cutting interest rates, while technical work on negative rates will need some more time.

Asian indices further extended Monday correction. Japan’s markets remain closed since last week as Tuesday was a bank holiday celebrating the Autumnal Equinox Day.

WTI Crude Oil futures are testing the $40 threshold as US API stock change will be released later today.

Gold still loses ground as US dollar consolidates after reaching a six-week high on tumbling stock markets.

Gold fell 7.66$ (-0.4%) to 1904.85 dollars while the dollar index declined 0.08pt to 93.575.

U.S. Equity Snapshot

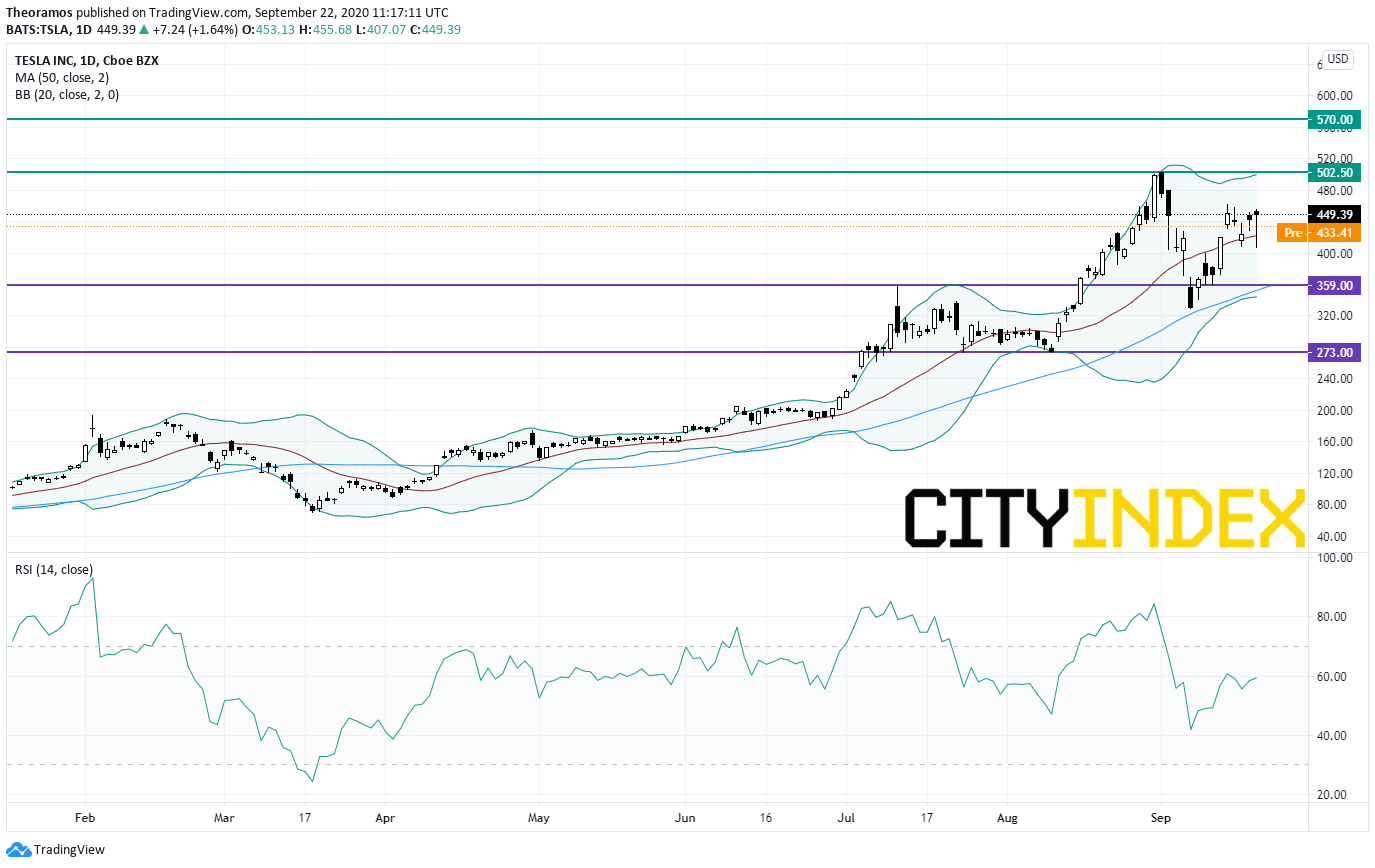

Tesla (TSLA), the electric-vehicle maker, lost ground in extended trading after CEO Elon Musk tweeted regarding battery day that "what we announce will not reach serious high-volume production until 2022."

Comcast's (CMCSA) shares might be active after Trian Fund Management said it bought a stake in the media company.

AutoZone (AZO), the leading retailer and distributor of automotive replacement parts and accessories in the U.S., reported fourth quarter comparable sales up 21.8%, above estimates.

Later today, the National Association of Realtors will release August existing home sales (6.01 million units expected). The Richmond Federal Reserve will post its Manufacturing Index for September (12 expected).

European indices are rebounding as the U.K government asked "If it is possible for people to work from home, then we’d encourage them to do so, adding: "No one underestimates the challenges the new measures will pose to many individuals and businesses (...) We know this won’t be easy, but we must take further action to control the resurgence in cases of the virus." Bank of England Governor Andrew Bailey said the central bank is considering cutting interest rates, while technical work on negative rates will need some more time.

Asian indices further extended Monday correction. Japan’s markets remain closed since last week as Tuesday was a bank holiday celebrating the Autumnal Equinox Day.

WTI Crude Oil futures are testing the $40 threshold as US API stock change will be released later today.

Gold still loses ground as US dollar consolidates after reaching a six-week high on tumbling stock markets.

Gold fell 7.66$ (-0.4%) to 1904.85 dollars while the dollar index declined 0.08pt to 93.575.

U.S. Equity Snapshot

Tesla (TSLA), the electric-vehicle maker, lost ground in extended trading after CEO Elon Musk tweeted regarding battery day that "what we announce will not reach serious high-volume production until 2022."

Source: TradingView, GAIN Capital

Comcast's (CMCSA) shares might be active after Trian Fund Management said it bought a stake in the media company.

AutoZone (AZO), the leading retailer and distributor of automotive replacement parts and accessories in the U.S., reported fourth quarter comparable sales up 21.8%, above estimates.

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM